The Dangers Of Passive Investing

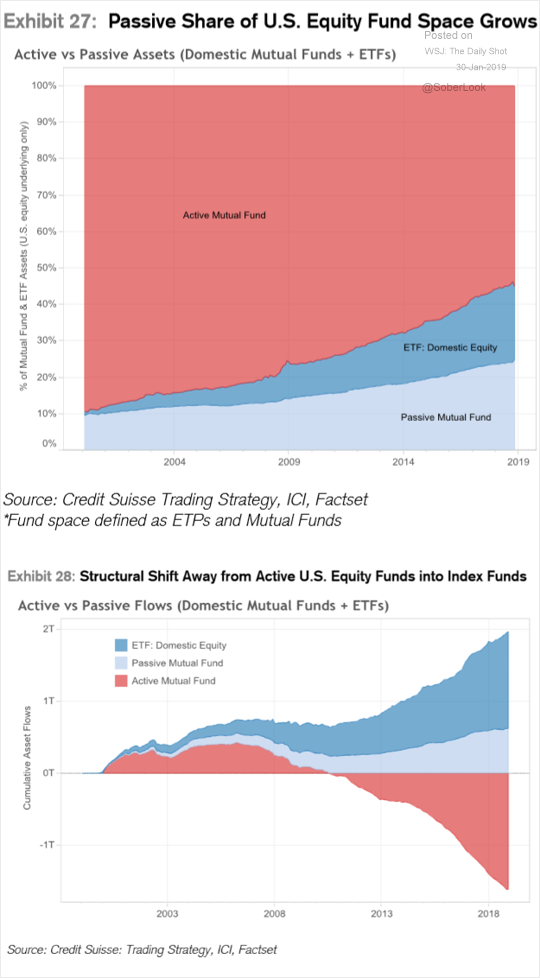

The popularity of passive investing has grown quickly in the early years of the 21st century. Passive investment vehicles now account for over 40% of total fund assets versus roughly 10% at the turn of the century. Passive investment vehicles have pre-determined fixed mandates, such as index funds or ETFs representing a sub-index such as technology or healthcare.

The benefits of passive investment vehicles are lower fees, the ability to quickly gain diversified exposure to a sector and ease of use. Lower fees have certainly attracted many people to passive investments and even more, have been lured by the prospect of dispensing with the time and effort required to manage their own investments or find a competent investment advisor. Add to that the fact that 80% of actively managed mutual funds do not perform as well as broad market indices, and passive investments vehicles would appear to be a logical choice.

But there are dangers…….

The bulk of the growth in passive investment ownership has occurred in a benign market environment. With the notable exception of the financial crisis of 2008, this growth has coincided with consistently positive market returns generated by unusually low market volatility. Thus, the experience of most owners of passive investment vehicles has been a steady march higher, with minimal volatility. As well, the nature of passive investment has not demanded much education in the investment process. How will these investors respond to a sharp bear market? Investors with modest experience with market volatility and negative returns may be more disposed to capitulation when faced with the psychological pain imposed by a significant bear market….and this creates greater danger for both the passive investor and markets in general.

Meaningful selling from holders of passive investments has the potential to amplify volatility, which would generate further selling in a feedback loop. The result could be a much sharper market decline because of the preponderance of passive investments than would otherwise be the case. Concerted sales of passive vehicles would put pressure on the entire market, but especially stocks with the highest weightings in the indices. This will serve to accelerate any decline. Index funds and other passive investment vehicles usually do not hold and rebalance literally every component of the underlying index. It is typically more efficient to manage the stocks with the highest weightings to replicate index returns and this tends to increase the influence of the largest companies.

A passive approach is almost never appropriate in anything in life. It is not appropriate in managing our health, our careers and certainly not our investments. Whatever the merits of passive investing, it has produced a large group of investors unprepared for a bear market and the volatility that accompanies it. More concerning, the nature of their exposure to the markets may generate even more volatility.

Active investing will continue to play an important role in the future. It is true that many money managers do not perform as well as the market. That’s because the task is very difficult. However, opportunities for active investors will continue to present themselves. Many, in fact, will be produced by the activities of passive investors. Capital flows in and out of passive investments will produce price extremes that can be profitably traded. The continued popularity of passive investing will also present opportunities in smaller capitalization stocks, which tend to be underrepresented in these funds.

In sum, the years ahead will be dramatic for investors, with significant threats and opportunities. The trend to passive investment will likely play a role in these events and create future opportunities for those that actively manage their investments.

(Click on image to enlarge)

Disclaimer:

This material is sourced from the Globalinvestmentletter.com website and is subject to the terms ...

more