The Bizarre Data Continues

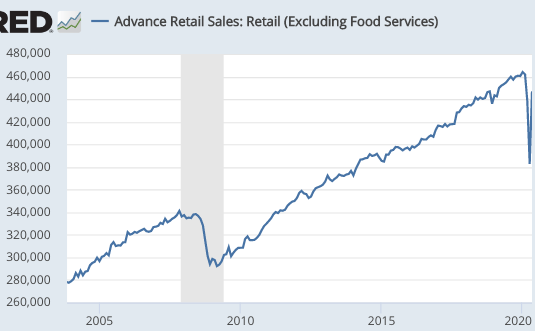

In May, retail sales regained about 80% of the losses from March and April. That’s in one month! In contrast, even a year after the trough in retail sales in March 2009, retail sales had recovered only about half the losses.

I understand that these are strange times, but I fail to understand how forecasts can be so far off:

Retail sales jumped by a record 17.7% in May over April, coming in at more than double the consensus estimate for a rise of 8.4%.

I don’t doubt that market forecasters are competent individuals. So I assume that these data points are intrinsically difficult to predict. But does anyone know why? Don’t we have real time daily data on credit card sales? And don’t most people use credit cards these days? So how can the forecast for May be 9.3% off course? We live in the computer age, but seem no more able to predict retail sales announcements than back in the 1920s. Why?

(With the earlier May labor report, it was partly definitional problems. That doesn’t seem to apply here.)

Buffett endured his worst performance vs. the S&P 500 index (SPX)in a decade last year, and 2020 is on track to be nearly as bad, the FT noted. CFRA Research analyst Cathy Siefert said Berkshire’s “chronic underperformance” needs to be answered for, especially considering some of Buffett’s decision-making in recent years, including the writing down of his stake in Kraft Heinz (KHC) by $3 billion and the “unmitigated disaster” that was his Occidental Petroleum (OXY)deal.

Wait, isn’t Warren Buffett the strongest argument for market inefficiency?