The Best Seasonal Investments For Q3

The third quarter seasonality report provides insight into historical seasonal trends that can be exploited for determining appropriate over- and under-weights on a sector, industry, and individual stock basis. Many of our clients also use it successfully as an additional idea generation tool. As a refresher, seasonality is calculated over rolling 10 year periods.

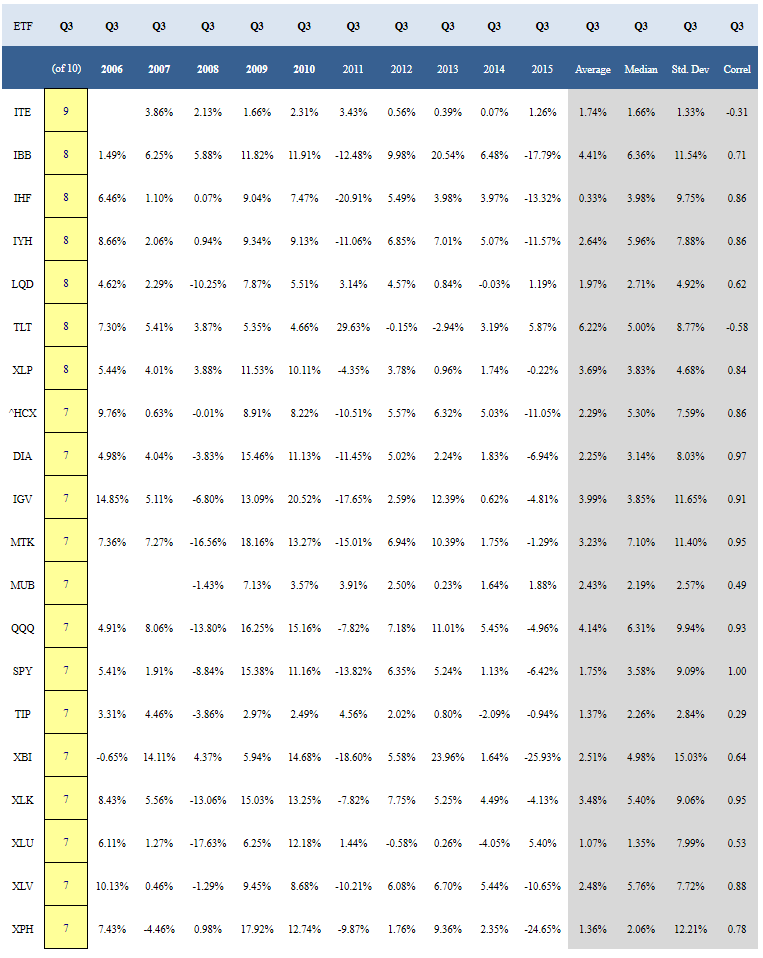

In the third quarter, the best sectors for seasonal tailwinds in our seasonality database (as measured by ETFs) are healthcare and consumer staples. Historically, biotechnology has been the strongest performing industry, gaining ground in nine of the past 10 years and returning a median 6.36% in the quarter. It is also, however, among the most volatile industries with a standard deviation of 11.54%. Technology (software in particular) and utilities deserve honorable mentions for solid seasonality too. You'll also notice that bond ETFs are very strong (in keeping with the sell in May adage).

The following table highlights those ETFs within our coverage that have posted gains in at least seven of the past 10 Q3s.

(Click on image to enlarge)

Source: seasonalinvestor.blogspot.com

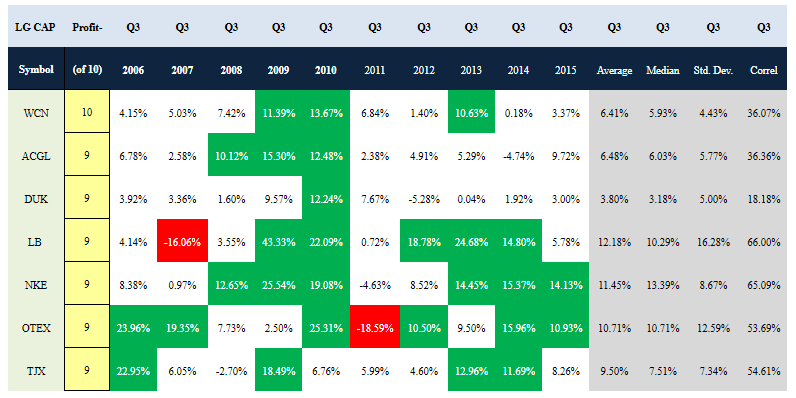

Source: seasonalinvestor.blogspot.com

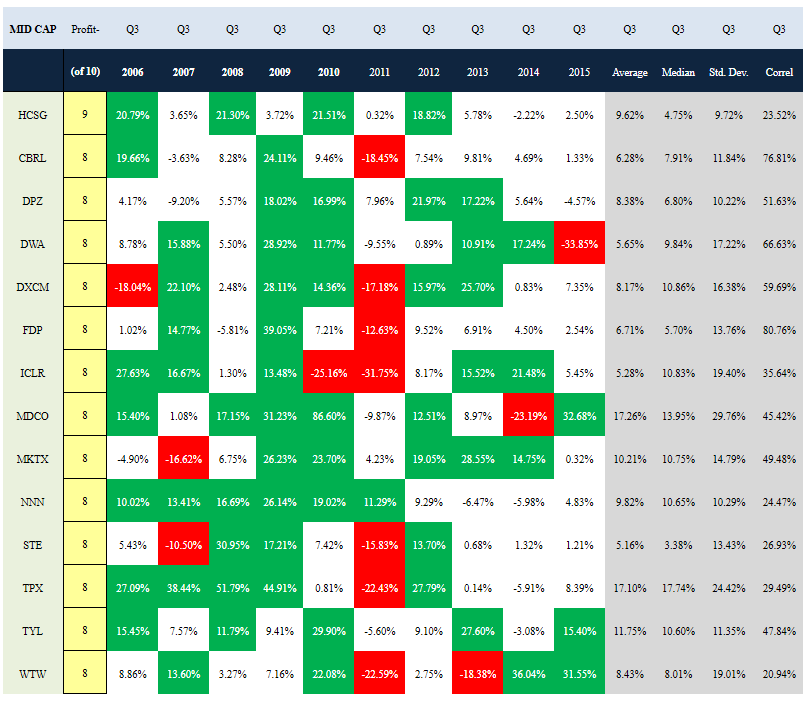

Source: seasonalinvestor.blogspot.com

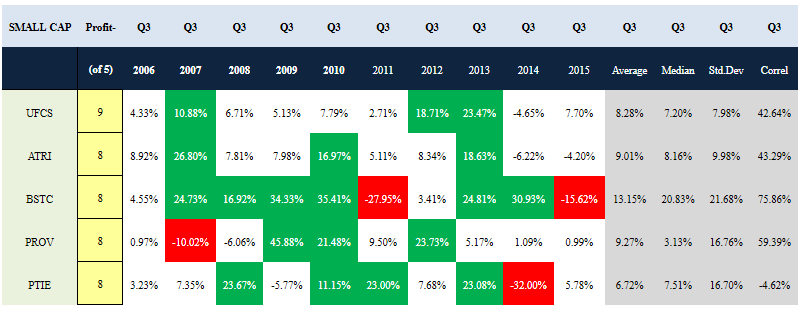

Source: seasonalinvestor.blogspot.com

Disclosure: None.