The Barry White, “Never Gonna Give You Up” Stock Market (And Sentiment Results)

This shortened Holiday Week, the song we chose to embody Stock Market sentiment is Barry White’s, “Never Gonna Give you Up.”

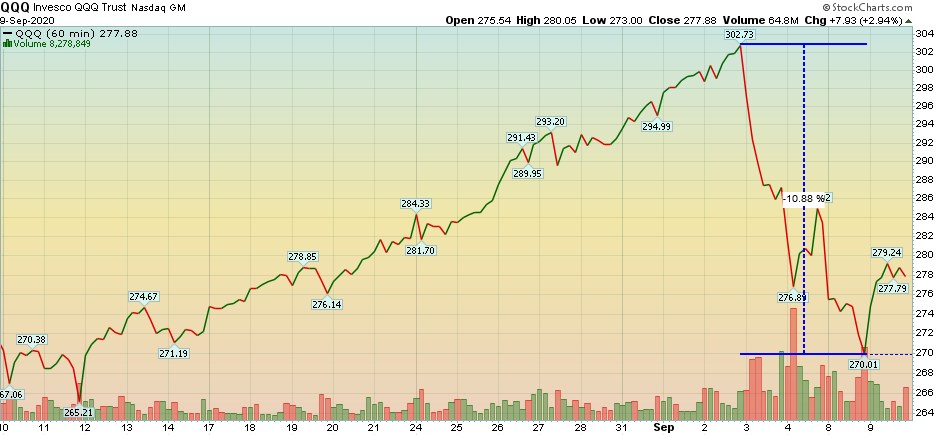

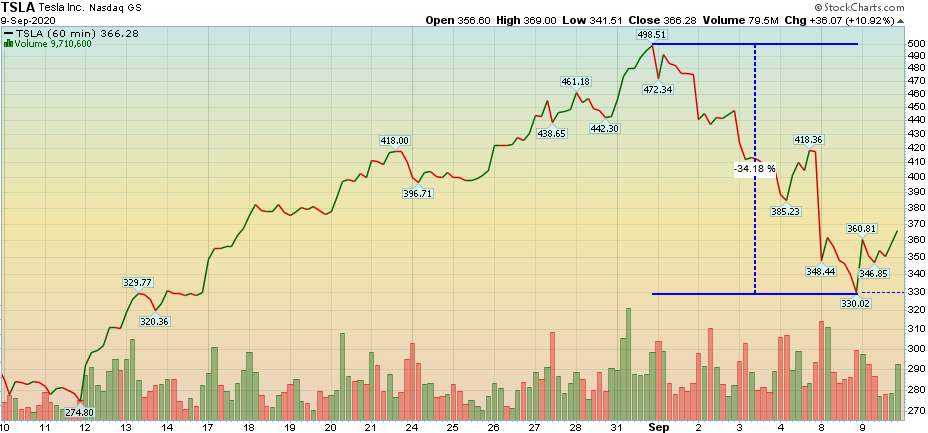

With the Nasdaq falling almost 11% in a few short trading days, AAPL dropping over 16%, TSLA down ~35%, and ZM off 23.86%…

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

Market Participants began behaving like a longing lover – as they eyed their favorite tech stocks trading a bit cheaper than a week ago:

Never, never gonna give you up

I’m never, ever gonna stop

Not the way I feel about you

Girl, I just can’t live without you

I’m never ever gonna quit ’cause

Quittin’ just ain’t my shtick

I’m gonna stay right here with you

And do all the things you want me to…

Were they Right?

To answer this question, we must first look at one of the catalysts – which was the pause of the AZN/Oxford vaccine trials due to one participant getting sick. Color on this was that the patient’s illness was something spinal – which may turn out to be unrelated – but we don’t know yet.

As discussed in the last 2 weeks’ notes – we made the case why these names were overdone in the short term (review below). It turned out to be right – but the other side of the thesis – (that cyclical would start to outperform on a relative basis) has not yet manifested in earnest.

The Run-DMC, It’s Tricky Stock Market And Sentiment Results

The Stevie Wonder, “Faith” Stock Market (And Sentiment Results)

So today (Wednesday), the delay of the front running vaccine pushed the money back into tech. If your bet is that the vaccine is now a way off and slow economic growth is the prognosis, re-buying into tech was a good bet.I’m more optimistic. My base case is that we’re two months behind China’s recovery (with or without a vaccine).

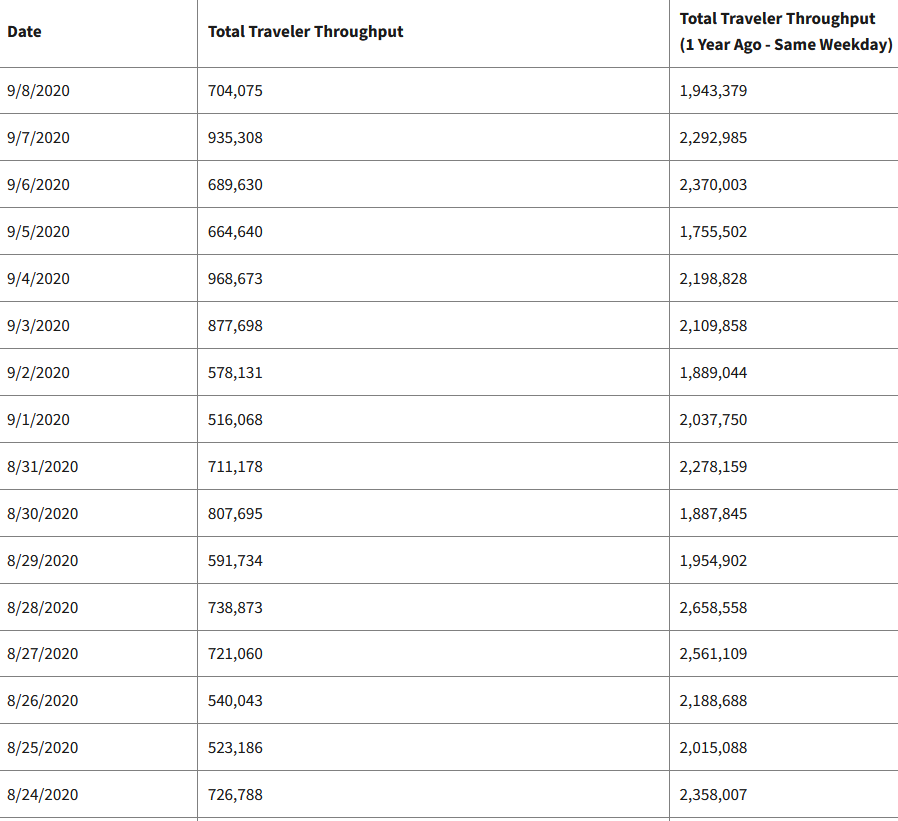

I discussed why this matters on CGTN Global Business tonight with Rachelle Akuffo.Thanks to Stephanie Savage for inviting me on. One of the key points I made was that the August Domestic Air Travel numbers last Month (August) were at 86% of pre-pandemic levels already (without a vaccine). They are projected to be at 100% in September:

Video Length: 00:05:35

China’s epicenter (Wuhan) cases peaked in mid-February. Our epicenter (NY, NJ, CT) peaked mid-April. The implication is that if we continue to track China’s numbers – we could very well see a resurgence in Travel by Christmas. Right now our “High Watermark” is ~40% of last year’s travel – a benchmark we hit just this week:

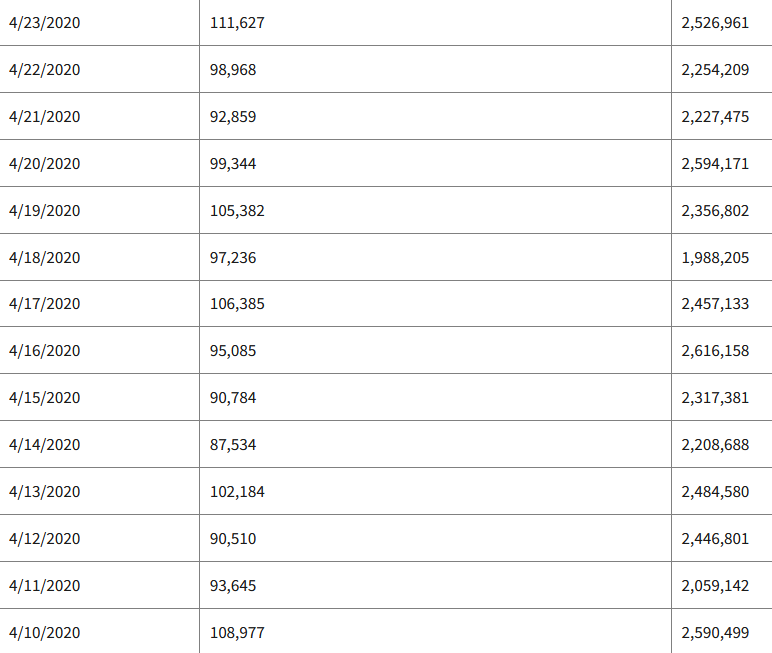

This (935,308 passengers) is a big improvement from what we saw in April – when the numbers dipped to less than 10% of our recent prints:

Governor Cuomo finally opened indoor dining (at 25% capacity) for NYC – starting at the end of this month. That decision is going to slowly restore a major center of GDP – from an empty wasteland – to a vital city once again. It will take leadership as well, but people coming back is a good start.

So the vaccine was delayed and cyclical got filleted! What else is new?!!! When the turn comes it will be abrupt, but for now, we wait…

Making Sense of it All

When volatility spikes this high in the short term, fundamentals take a back seat. I look at a number of indicators to see where we are in the short term – that you may find helpful in navigating this “Barry White” market. Here are a few of them:

(Click on image to enlarge)

This is elevated fear but not extreme (Learn more about how the Equity Put/Call Ratio 10 DMA works here)

(Click on image to enlarge)

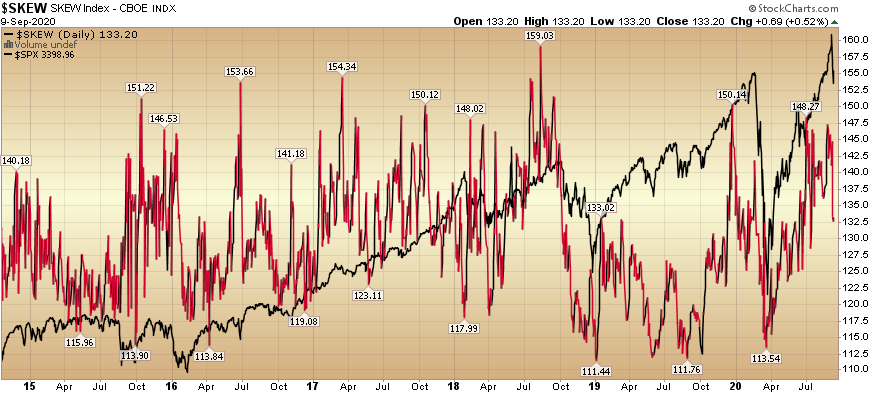

People are still betting on tail risk (Learn more about how SKEW works here)

(Click on image to enlarge)

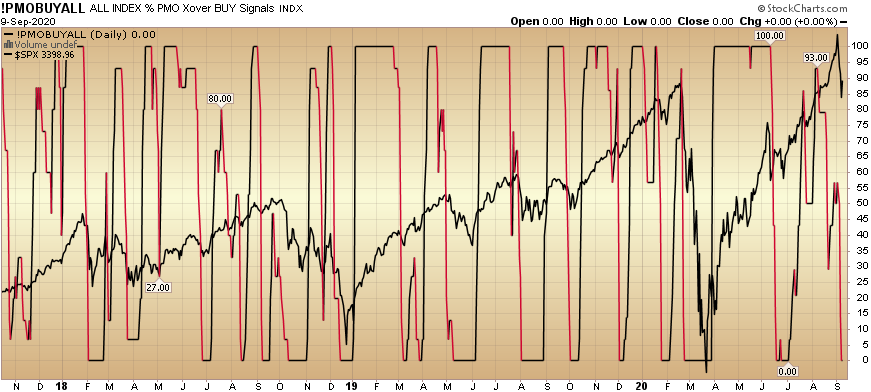

May need a little more time before bottoming and reversing (Learn more about how PMO Buy ALL works here)

(Click on image to enlarge)

High end of “No Man’s Land” (Learn more about how Bullish Percent S&P 500 works here)

(Click on image to enlarge)

Still in “No Man’s Land” (Learn more about how Nasdaq McClellan Summation Index works here)

Now onto the shorter-term view for General Market:

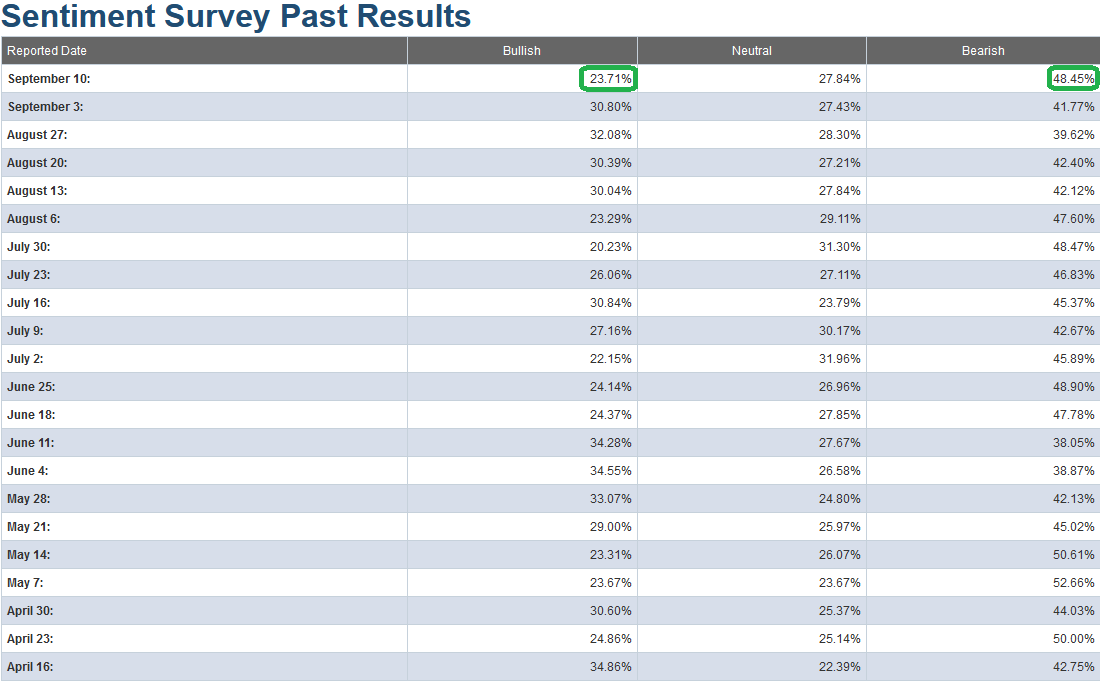

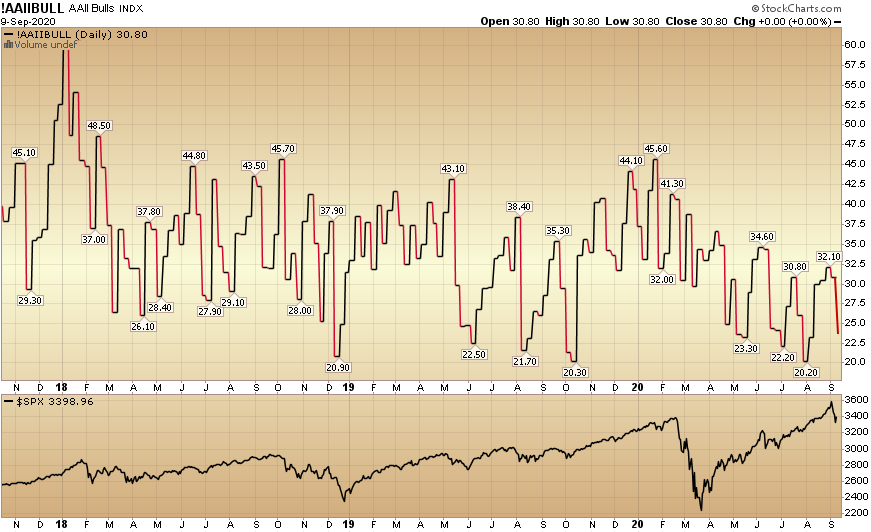

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) fell to 23.71% from 30.80% last week. Bearish Percent rose to 48.45% from 41.77% last week. These are levels of pessimism that historically favor being a buyer versus a seller.

(Click on image to enlarge)

(Click on image to enlarge)

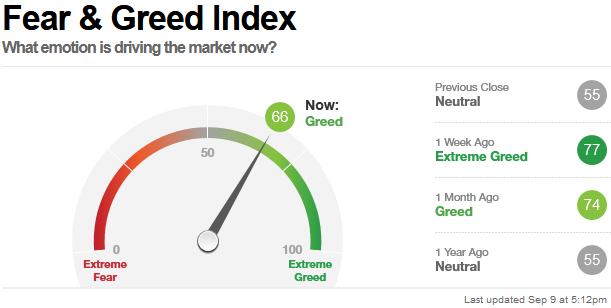

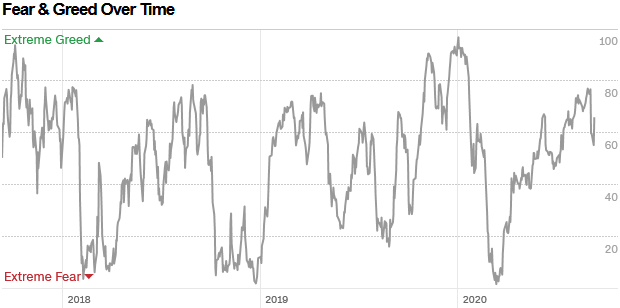

The CNN “Fear and Greed” Index slid from 78 last week to 66 this week. Fear has crept in, but not at an extreme level.You can learn how this indicator is calculated and how it works here: (Video Explanation)

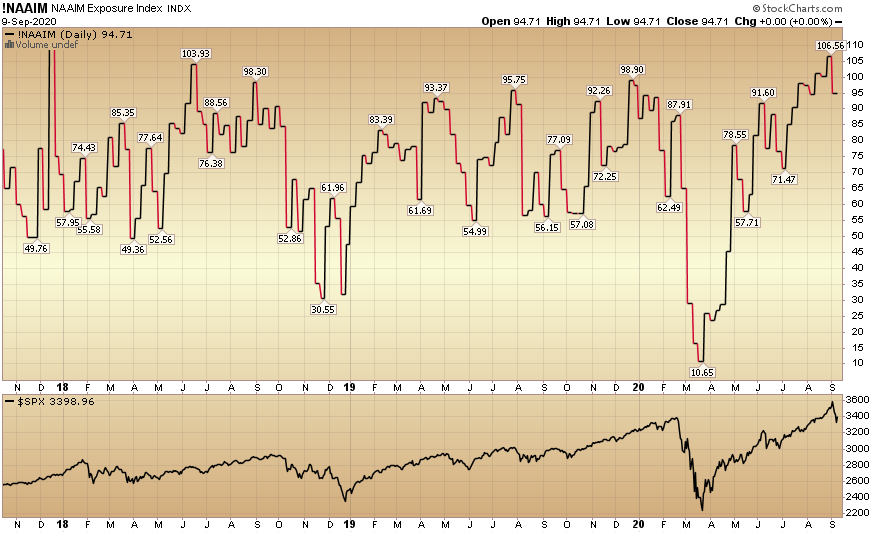

And finally, this week the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) moderated from 106.56% equity exposure last week, to 94.71% this week. This is still an extreme level, so we must remain on alert (particularly in overvalued sectors/stock).

(Click on image to enlarge)

Our message for this week:

As I have repeated for a couple of weeks, the catalyst for change (an abrupt move of money into Cyclicals) will likely come from science at this point. Don’t bet against science.

Despite mixed signals, my net takeaway this week – is that while we could bounce, the probabilities favor more work to do on the downside – particularly for the “overvalued” pockets of stocks that we covered in recent weeks’ notes above.

Where there is real long-term durable value, we are buyers. And for those of you holding the “highest flyers,” despite our warnings in the last two weeks, sometimes you gotta take the other side of Barry’s “Never Gonna Give You Up” and find another gal/guy to dance with. There are many lovely candidates – that are sitting on the sidelines – and haven’t even got out on the dance floor yet…

Disclaimer: Not investment advice. For educational purposes only: Learn more at HedgeFundTips.com.