The Average Retirement Age In The US

Retirement is the end game for just about every investor. Indeed, the reason people invest their money is to grow it and use it at a later date, which for most people, coincides with their intent to leave the workforce.

But just saving and investing isn’t enough when it comes to retirement; investors must also figure out when they will retire.

The answer to this question varies from one person to another based on innumerable variables, but the point at which one leaves the workforce has immense implications for the retirement years.

If one wants to compare themselves to the average retirement age in the U.S., see below:

- The average retirement age in the U.S. is 61 according to Gallup.

- The average expected retirement age in the U.S. is 66 according to Gallup.

- More than 50% of U.S. retirees retired on or before age 62 according to DQYDJ.

If one retires too early, they risk running out of money. Conversely, retiring too late may cause the investor to miss out on planned experiences. Keep reading this article for more on the average expected and actual retirement ages in the United States.

Retirement: Expectations Versus Reality

Americans have historically made their decision to retire based upon their eligibility to receive Social Security payments or their ability to receive defined benefit plan payments from their employer. However, defined benefit plans, typically called pensions, are much rarer than they used to be and thus, investors must make up that income gap with prudent investing. This has caused expectations for retirement age to gradually increase in the past couple of decades, as seen below.

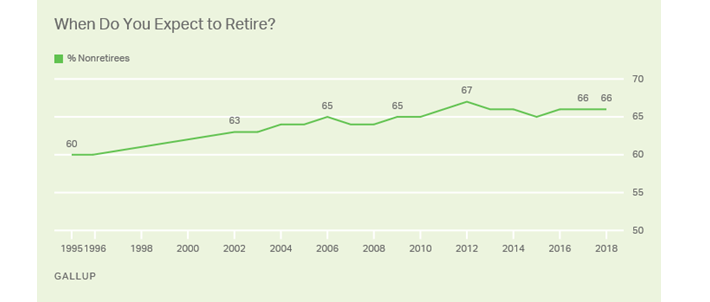

Source: Gallup

Polling giant Gallup regularly asks workforce participants in the US when they believe they’ll be able to retire. As we can see, the average response was 60 about 25 years ago, while the average is 66 today. There are many reasons why people would put off retirement, including taking care of aging parents, uncertainty around investment returns, and even the state one lives in. Indeed, states with lower cost of living tend to see earlier retirement ages, which makes a lot of sense considering most retirees are on a budget.

The good news is that while expectations for retirement age have been rising, the actual ages people retire in the US aren’t as high.

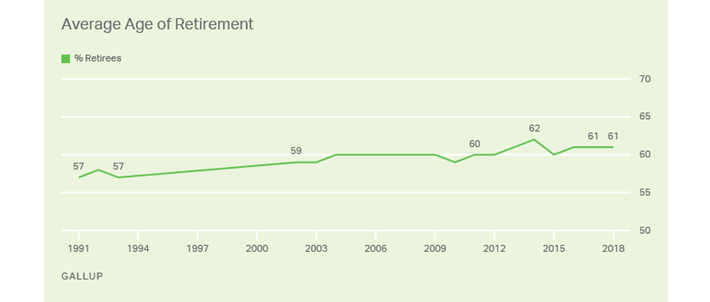

Source: Gallup

This chart from Gallup shows the average retirement age for those in the US by year and while the average has risen from 57 to 61 in the past 30 years or so, that is a full five years earlier than non-retirees today expect to retire. Indeed, it would appear the historical data suggest that people who aren’t retired are too pessimistic about when they will be able to retire, and tend to make the move around the age of 60.

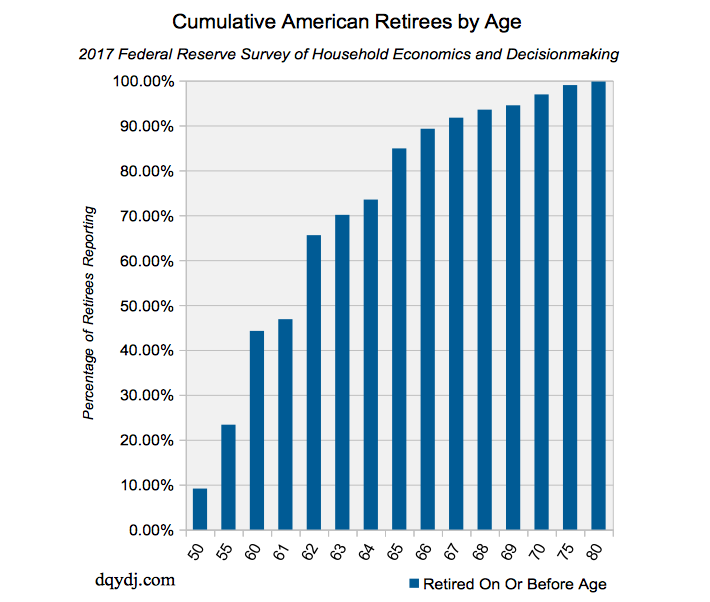

The data above is based on the average age of retirees, which can be skewed by those that retire very early, either because they’ve had some sort of financial windfall that allows them the ability to cease working, for health reasons, or some other cause to leave the workforce. The data below shows the cumulative number of people retired by each age, which is also instructive.

Source: DQYDJ

We can see that a very small portion of the population is retired by age 50, but that number more than doubles to ~25% of the population by age 55. That is still a very early retirement age, but roughly one-quarter of the US is reaching that milestone. By age 60, about 45% of the workforce is retired, and by age 65, the cumulative number of retirees is about 85% of the population. In other words, Americans tend to retire in a small range of ages and while there are some people that choose to work past 65 or are forced to for one reason or another, the overwhelming majority of people are out of the workforce by age 65.

Final Thoughts

The age at which one retires is a significant decision. It impacts the amount of time available to enjoy the activities one saved for during their working life, and whether or not each person has enough money to do so. There are many factors to consider, including how much money each person needs in retirement, as well as any benefits one is eligible for once they stop working. Social Security is available to most people that have worked during their lives and benefits can begin as early as age 62, although full benefits won’t be available until age 66 or higher, depending upon when the prospective retiree was born.

Investors can also prepare themselves for retirement by projecting how much income they’ll need, how much time they have before they want to retire, and the expected returns of their investments. Finding the best high-dividend stocks can help investors build wealth over the long term while ensuring the securities held in retirement are safe and generate high levels of income keep principal intact during retirement years. Saving for retirement can seem like a daunting or impossible task, but investing with discipline and a long-term view can make it a reality.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more