The 8 Best Dividend Stocks In May 2019: What To Buy Now

The recent spike in volatility in the stock markets means investors should refocus on quality dividend stocks. Companies with durable competitive advantages and growth potential could outperform in a bear market, while strong dividends help provide a buffer against falling stock prices.

Investors looking for high-quality dividend stocks should consider companies with high profitability and dividends that are sufficiently covered.

With that in mind, we have compiled a list of the 8 best dividend stocks with a combination of an A rating for dividend risk in the Sure Analysis Research Database and an expected annual return of at least 10% over the next five years.

The 8 best dividend stocks for May 2019 are listed in order of 5-year expected total returns, from lowest to highest.

Best Dividend Stock #8: T. Rowe Price (TROW)

- Dividend Yield: 3.0%

T. Rowe Price is a major asset management firm, with total Assets Under Management (AUM) of just over $1 trillion. T. Rowe Price is an attractive dividend growth company. T. Rowe Price is a member of the exclusive Dividend Aristocrats list.

You can view a further discussion of T. Rowe Price’s dividend in the video below.

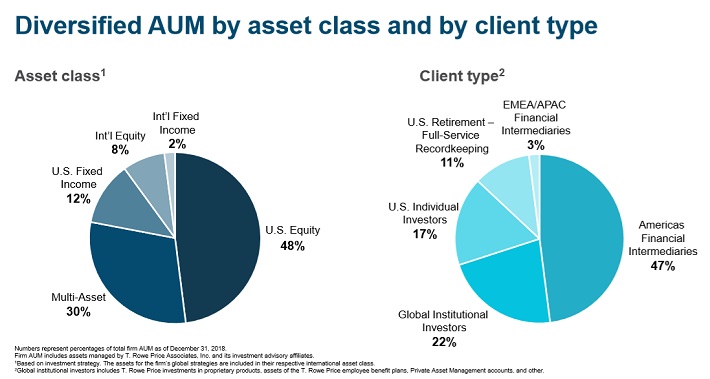

T. Rowe Price has a huge level of assets under management, and its AUM is diversified by asset class and client type:

Source: Investor Presentation

T. Rowe reported its first-quarter earnings results on April 25. The company managed to generate revenues of $1.3 billion during the quarter, which was down 2.2% from the same quarter last year. Still, revenue beat analyst estimates for the quarter.

The recovery in global stock markets during the first quarter helped grow AUM to $1.082 trillion. This represents an increase of $119 billion versus the fourth quarter of fiscal 2018. T. Rowe’s funds continued to perform well, as 86% of multi-asset funds outperformed their Morningstar median over the last year.

Strong fund performance is T. Rowe Price’s biggest competitive advantage, as it gives the company a high reputation within the asset management industry. This provides T. Rowe Price with the ability to bring in new client assets.

The company also beat analyst expectations on earnings-per-share, which increased 7.5% last quarter to $1.87. Share repurchases meaningfully helped boost EPS, as the company bought back 2.5 million (roughly 1%) of its own shares in the first quarter.

AUM has continued to rise in recent months. April AUM increased to $1.11 trillion, which bodes well for T. Rowe Price’s second-quarter results. As the stock market steadily recovered in the first quarter of 2019, this should fuel stronger AUM results in the months ahead.

We expect total annual returns above 10% for T. Rowe Price, comprised mainly of the 3% dividend yield, 6% expected annual EPS growth, and a small ~1% tailwind from an expanding price-to-earnings ratio. T. Rowe Price stock trades for a price-to-earnings multiple of 14.5x, compared with our fair value estimate of 16.0x.

Best Dividend Stock #7: Federal Realty Investment Trust (FRT)

- Dividend Yield: 3.2%

Federal Realty Investment Trust is a Real Estate Investment Trust, or REIT, which means its business model is to own and lease real estate properties. Cash flow received from rents allows Federal Realty to acquire new properties, which then generate additional cash flow, and the process repeats itself over time.

Federal Realty primarily owns shopping centers. It also redevelops multi-purpose properties including retail, apartments, and condominiums. Its major markets are Washington, D.C., New York, Philadelphia, Boston, San Francisco, and Los Angeles. It also has also expanded into Miami and Chicago more recently.

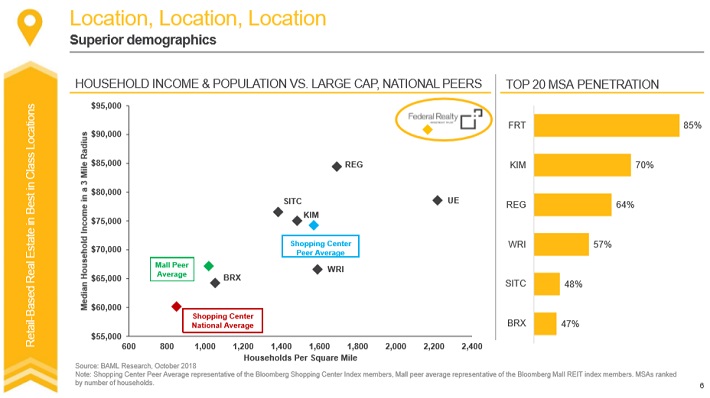

The company’s investments focus on densely-populated, affluent communities, with high demand for commercial and residential real estate. These higher-quality locations allow Federal Realty to charge more per square foot than many other REITs.

Source: Investor Presentation

Federal Realty’s property portfolio is also heavily insulated against the threat of e-commerce, as it focuses on retail properties that offer unique experiences that still appeal to consumers. The company’s e-commerce resistant properties provide it with steady growth.

In the most recent quarter, Federal Realty generated comparable property operating income growth of 3.5%. Thanks to new properties, funds from operation (FFO) on a per-share basis increased 2.6% for the quarter. Occupancy remained strong at 94.6%.

Federal Realty has a 3.2% dividend yield, which is relatively low for a REIT. But Federal Realty more than makes up for this, with dividend growth. The company has increased its dividend each year since 1967. Over the course of its 51-year streak of annual dividend increases, the company raised its dividend by 7% per year, on average.

Because of this, Federal Realty has the longest streak of annual dividend increases of any REIT. It is on the exclusive list of Dividend Kings, which have increased their dividends for 50+ years in a row. Federal Realty has continued to grow its dividend through many recessions and other challenging environments over the past several decades. This makes it a very attractive stock for dividend growth investors.

Federal Realty’s dividend appears to be secure.

Based on company guidance for FFO-per-share of $6.30 to $6.46 per share, Federal Realty has an expected dividend payout ratio of 63% to 65% for 2019. Federal Realty also has a healthy balance sheet, with a credit rating of A- from Standard & Poor’s and Fitch Ratings. A high credit rating lowers the company’s cost of capital, an added measure of safety for the dividend.

With expected FFO growth of 5.5% annually, the 3.2% dividend yield, and valuation changes of 1.7% per year, we expect total returns of 10.4% per year for Federal Realty.

Best Dividend Stock #6: Target (TGT)

- Dividend Yield: 3.4%

Target is a giant U.S. retailer with over 1,800 stores. Target reported strong financial results for fiscal 2018. In the fourth quarter, the company grew its comparable sales by 5.3%, more than the expected 5.0% growth rate. Comparable sales from stores increased 2.9% in the fourth quarter.

Traffic growth of 4.5% fueled Target’s comparable sales growth in the fourth quarter. For the full year, comparable sales grew 5.0%. This was the strongest comparable sales performance for Target since 2005.

Reported and adjusted earnings-per-share were $5.50 and $5.39, respectively. Both figures set new all-time highs for the retailer.

2019 is expected to be another good year for Target. Company management expects comparable sales to grow at a low-to-mid single digit rate for the year, while earnings-per-share are expected in a range of $5.75-$6.05 for 2019. At the midpoint of guidance, Target expects to generate 9.5% earnings growth in fiscal 2019.

Target’s future growth is focused on renovating existing stores, opening new stores, and e-commerce. In recent years, the brick-and-mortar retail industry has come under great pressure from online retail competitors like Amazon (AMZN). Target has successfully driven its own traffic growth by modernizing its stores, emphasizing its own brands, and investing in new concepts like small stores.

Target has rapidly built its own e-commerce platform to compete directly with Amazon. Comparable digital sales soared 31% in the fourth quarter. And, 2018 marked the fifth-consecutive year of digital sales growth above 25%.

Target has a solid dividend yield of 3.4%, and a long history of dividend growth. Target has increased its dividend for 47 consecutive years, making it a member of the, a group of 57 companies in the S&P 500 Index with 25+ years of annual dividend increases.

Target’s current annual dividend payout of $2.56 per share equals an expected dividend payout ratio of 43% in 2019, based on the midpoint of company guidance. Target has a secure dividend and should continue to increase its dividend each year, as it has done for nearly five decades.

Target’s dividend safety is discussed in the following video.

Due to a combination of dividends (3.4%), expected EPS growth (4%), and valuation changes (4.1%), we expect total returns of roughly 11.5% per year for Target over the next five years.

Best Dividend Stock #5: Bank OZK (OZK)

- Dividend Yield: 2.9%

Bank OZK, previously called Bank of the Ozarks, is a regional bank operating in multiple states including Arkansas, Florida, North Carolina, Texas, Alabama, South Carolina, New York and California. Bank OZK offers traditional banking services including checking, business banking, commercial loans, and mortgages. The stock has a market capitalization of $4 billion.

On April 17th, 2019 Bank OZK reported operating results for its 2019 first quarter. For the quarter, total interest income increased 15% from the same quarter last year. However, net income fell 2.2% to $110.7 million, as expenses grew faster than revenue.

Earnings-per-share came in at $0.86, a 2.3% decline compared to $0.88 in the year-ago period. Returns on average assets, stockholders’ equity and tangible equity all declined modestly in the 2019 first quarter. Still, total loans increased 5.2% while tangible book value increased 22% to $24.73 per share.

We expect 8% annual earnings growth for the company over the next five years, comprised mainly of loan growth. Rising interest rates would be an added catalyst, although the Federal Reserve has suspended rate hikes for the time being. Still, the steady GDP growth of the U.S. economy is a broad tailwind for regional banks such as Bank OZK.

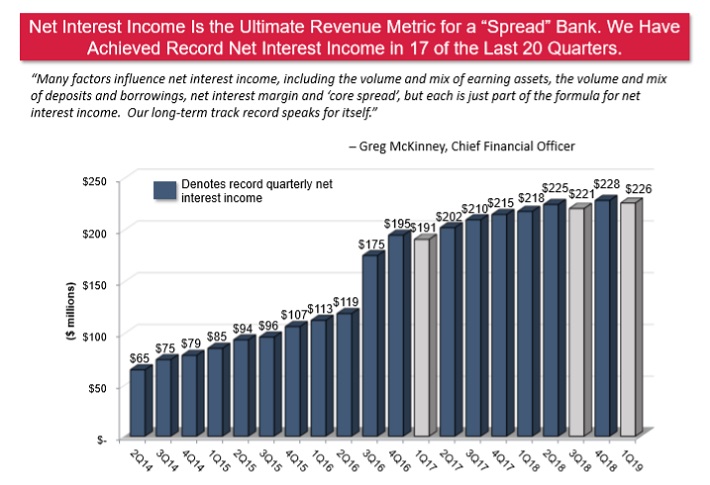

Bank OZK has generated consistent net interest income growth over the past five years. In fact, Bank OZK reported record net interest income in 17 of the past 20 quarters.

Source: Investor Presentation

Bank OZK is an attractive stock for value and income. First, shares appear to be undervalued today. We expect Bank OZK to generate earnings-per-share of $3.50 for 2019. Based on this, the stock has a price-to-earnings ratio of just 9.0x. Our fair value estimate is a price-to-earnings ratio of 12.0x. This means an expanding valuation multiple could boost shareholder returns by approximately 5.9% per year, over the next five years.

In addition, the stock is appealing for dividend growth. Bank OZK stock has a 2.7% current dividend yield, which beats the average yield in the S&P 500 Index, currently near 2%. And, Bank OZK has a strong dividend growth history. The company has increased its dividend for 35 consecutive quarters, including a recent 4.6% increase.

The combination of projected 5-year EPS growth (8%), the current dividend yield (2.7%), and expansion of the price-to-earnings multiple (5.9%) adds up to total expected returns of 16.6% per year through 2024.

Best Dividend Stock #4: Caterpillar (CAT)

- Dividend Yield: 2.7%

Caterpillar manufactures heavy machinery used in the construction and mining industries. The company also manufactures ancillary industrial products such as diesel engines and gas turbines. Caterpillar generates annual revenue of $58 billion.

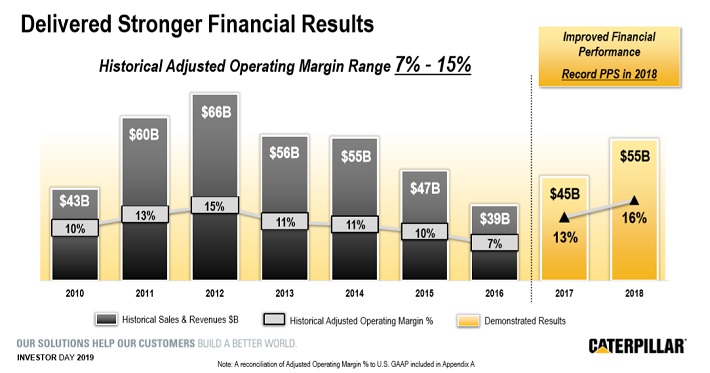

Caterpillar performed very well in 2018. For the fourth quarter, revenue increased 11% to $14.3 billion. Construction product sales rose 8%, while resource segment revenue increased 21% for the quarter. For 2018, revenue increased 20% while adjusted earnings-per-share soared 63%. Earnings-per-share of $11.22 set an annual record for 2018.

Source: Investor Day

This year should be another good one for Caterpillar. In the 2019 first quarter, revenue increased 5%, while earnings-per-share increased 19% to $3.25. Earnings-per-share hit a first-quarter record for the company. Sales in Energy & Transportation were flat for the quarter, while Construction Industries reported 3% segment sales growth, and Resource Industries sales increased 18%.

Going forward, Caterpillar will continue to benefit from positive economic trends, including steady GDP growth, supportive commodity prices, and a strong construction and housing market. The company also intends to pursue growth in services. Caterpillar expects to double its Machine, Energy & Transportation services sales to about $28 billion by 2026, from about $14 billion in 2016.

Caterpillar has accelerated its cash returns to shareholders. On May 2, Caterpillar raised its quarterly dividend by 20%. The company also stated its intention to raise the dividend over the next four years by at least a high-single-digit percentage rate. We further analyze Caterpillar’s dividend in the following video.

With a forecasted dividend payout ratio of 29% for 2019, Caterpillar’s dividend is secure barring a deep and protracted recession. Absent a significant economic downturn, Caterpillar stock could generate impressive returns, due to a combination of the 2.7% dividend yield, 5% annual earnings growth, and a significant boost from valuation expansion.

Caterpillar stock trades for a price-to-earnings ratio just above 10x. Our fair value estimate is a price-to-earnings ratio of 15x, meaning expansion of the price-to-earnings ratio could add over 8% to Caterpillar’s total returns. This results in total expected returns slightly above 17% per year for Caterpillar over the next five years.

Best Dividend Stock #3: Eaton Vance (EV)

- Dividend Yield: 3.7%

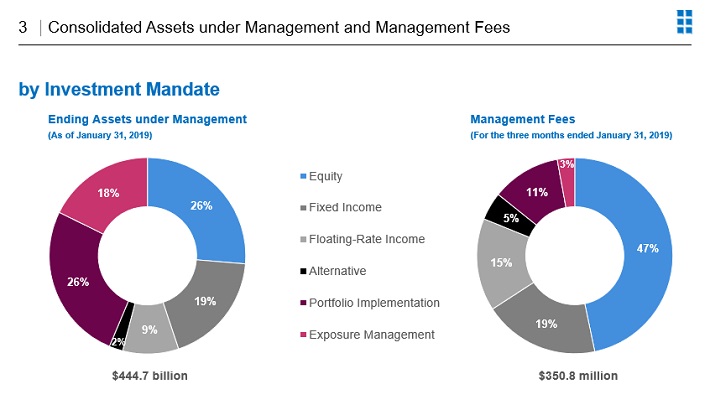

Eaton Vance is an asset management firm with a $4.4 billion market cap. Eaton Vance offers closed-end funds, mutual funds, term trusts, and exchange-traded funds under the NextShares brand. The company ended the most recent quarter with assets under management (AUM) of $445 billion.

The company’s AUM is diversified across various asset classes.

Source: Investor Presentation

In the 2019 first quarter, revenue of $406 million fell 3.3% from the same quarter a year ago. This revenue decline was partially due to declining assets, as consolidated AUM declined by 1%, primarily a reflection of stock market declines in the 2018 fourth quarter. The company also reported lower average management fees. Adjusted earnings-per-share of $0.73 also declined last quarter, by 6% from the $0.78 reported in the same period a year ago.

Eaton Vance’s competitive advantage lies in its appealing product offerings and low fees, which are allowing it to compete in an asset management industry experiencing significant fee compression. While most asset managers are experiencing net outflows due to the trend towards low-cost ETFs, Eaton Vance actually saw net inflows of $11.7 billion through the last four quarters.

Eaton Vance has a long history of dividend growth. The company has increased its dividend for 38 consecutive years, including a 13% increase in October 2018. Over that 38-year period, the company increased its dividend by 17% per year on average.

Eaton Vance stock is attractive valued, with a high dividend yield as well. The company is expected to generate earnings-per-share of ~$3.36 in fiscal 2019. Using this estimate, the company is trading at a price-to-earnings ratio of 11.4x. Eaton Vance traded at an average price-to-earnings ratio of 16x over the last decade.

If the company’s valuation can revert to a price-to-earnings ratio of 16x in five years, this will boost its returns by about 7.0% annually. Eaton Vance is expected to generate 6.8% annualized earnings growth and pays a dividend that yields 3.7%. Overall, we believe that Eaton Vance could deliver total returns of 17.5% per year over the next 5 years.

Best Dividend Stock #2: Walgreens Boots Alliance (WBA)

- Dividend Yield: 3.3%

Walgreens Boots Alliance is a large pharmacy retailer, with over 18,500 stores in 11 countries around the world. It also operates one of the largest global pharmaceutical wholesale and distribution networks in the world, with more than 390 centers that deliver to nearly 230,000 pharmacies, doctors, health centers and hospitals each year. With 43 years of consecutive dividend increases, Walgreens is a member of the Dividend Aristocrats Index.

Walgreens has a secure dividend, which is elaborated on further in the video below.

In early April, Walgreens reported (4/2/19) fiscal 2019 second-quarter results. Revenue of $34.5 billion increased 4.6% year-over-year, but adjusted EPS declined 5.4% for the quarter. Walgreens attributed the weak quarterly results to significant reimbursement pressure and worsening generic deflation. It also reduced its full-year outlook. The company now expects adjusted EPS to be roughly flat in 2019, versus previous expectations of 7% to 12% EPS growth.

Despite its weak fiscal second quarter, Walgreens has a positive long-term growth outlook. Even in a difficult period, Walgreens grew its retail pharmacy sales by 7.3% last quarter. Prescriptions and pharmacy retail will benefit from the aging U.S. population and a corresponding need for more healthcare services.

Walgreens also has a plan to revitalize performance in its core retail pharmacy operation, through investments in digital capabilities and a renewed focus on cost efficiency.

Source: Investor Presentation

Despite the challenge posed by online retail competition, Walgreens should navigate the difficult operating climate thanks largely to its competitive advantages. Primarily, Walgreens’ competitive advantage is its leading market share. Its robust retail presence and convenient locations encourage consumers to use Walgreens instead of its competitors. This brand strength means customers keep coming back to Walgreens, providing the company with stable sales and growth.

Another appealing aspect of Walgreen’s business model is that it is resistant to recessions. Consumers are unlikely to cut spending on prescriptions and other healthcare products. Walgreens’ adjusted earnings-per-share declined by just 7% during 2009 – the worst of the global financial crisis – and the company actually grew its adjusted earnings-per-share from 2007 through 2010, following this up with over 20% earnings growth in 2011.

Based on the company’s revised guidance, Walgreens is expected to generate earnings-per-share of $6.02 in fiscal 2019. The stock has a price-to-earnings ratio of 8.7x, well below our fair value estimate of 13x. Expansion of the price-to-earnings ratio to 13x over five years could add 8.4% to Walgreens’ annual returns. In addition, we expect Walgreens to grow earnings by 6% per year, and the stock has a 3.3% dividend yield. Overall, Walgreens stock has expected returns of 17.7% per year over the next five years.

Best Dividend Stock #1: AbbVie (ABBV)

- Dividend Yield: 5.6%

AbbVie is a global pharmaceutical company with annual revenue in excess of $32 billion. AbbVie’s most important product by far is Humira, which by itself represents ~60% of the company’s annual revenue.

AbbVie has a long history of dividend growth. Going back to its pre-spinoff days as a subsidiary of Abbott Laboratories (ABT), AbbVie is a Dividend Aristocrat. AbbVie has a highly secure dividend payout. We gave an update on AbbVie’s dividend safety after the company reported 2018 financial results, which is discussed in greater detail in the following video:

In late April, AbbVie reported (4/25/19) its 2019 first-quarter earnings results. Revenue of $7.8 billion increased 0.4% on an operational basis (excluding currency). Humira dragged AbbVie down last quarter, with a 5.6% sales decline. Revenue growth and share repurchases contributed to another quarter of double-digit earnings growth. AbbVie’s adjusted earnings-per-share increased 14% for the quarter, to $2.14.

AbbVie’s biggest near-term risk is patent loss of Humira, which is facing biosimilar competition in Europe. Sales of Humira in the international markets declined 23% on an operational basis last quarter, due to significant price discounting. Humira will face biosimilar competition in the U.S. in 2023.

Fortunately, AbbVie continues to perform well overall and has a plan to pursue growth outside Humira.

Source: Investor Presentation

For example, Imbruvica is another potential blockbuster drug for the company. Imbruvica grossed sales of $1.02 billion, up 34% from the same quarter last year. AbbVie’s hematologic oncology portfolio grew revenue by 43% last quarter. In all, AbbVie expects non-Humira product sales to exceed $35 billion by 2025.

For 2019, AbbVie expects earnings-per-share in a range of $8.73 to $8.83, representing 11% year-over-year growth at the midpoint of guidance.

AbbVie operates with strong safety metrics. It has an expected dividend payout ratio of 49% for 2019, which indicates a secure dividend with room for continued increases even if earnings stall temporarily.

Based on expected earnings-per-share of ~$8.78, AbbVie stock trades for a price-to-earnings ratio of 8.8. Our fair value estimate for AbbVie is a price-to-earnings ratio of 13.0, indicating the stock is undervalued. An expanding P/E multiple could boost shareholder returns by approximately 8.1% per year if the stock valuation expands to our fair value estimate over the next 5 years.

In addition, we expect annual earnings growth of 9%-10% through 2024. Lastly, the stock has a current dividend yield of 5.6%, a very high yield resulting from both a declining share price and the company’s high rate of dividend growth. In total, we expect annual returns above 23% per year over the next five years, making AbbVie our best dividend stock for May 2019 in terms of dividend risk and expected returns.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more