The 8 Best Dividend-Paying Oil Stocks For 2019 And Beyond

Oil stocks are very popular in the income-oriented investing community, primarily thanks to the generous dividends that many of these stocks offer. However, as the energy sector is highly cyclical, investors should be careful before purchasing energy dividend stocks.

Investing in this sector becomes even more complicated by the fact that the market always discounts the future prospects of these stocks to some extent. As a result, energy stocks will sometimes appear remarkably cheap or expensive on a valuation basis, when they are actually the opposite.

Nevertheless, while the energy sector requires special attention in the due diligence process, it includes some of the best opportunities in the stock market for high dividend yields and total expected returns.

Energy Transfer (ET)

Energy Transfer was formed in October-2018 by the acquisition of Energy Transfer Partners (previously ETP) by Energy Transfer Equity (previously ETE). The combined entity owns and operates one of the largest portfolios of energy assets in the U.S.

Its facilities gather and transport natural gas and crude oil while the company also has one of the largest planned LNG export facilities in the country.

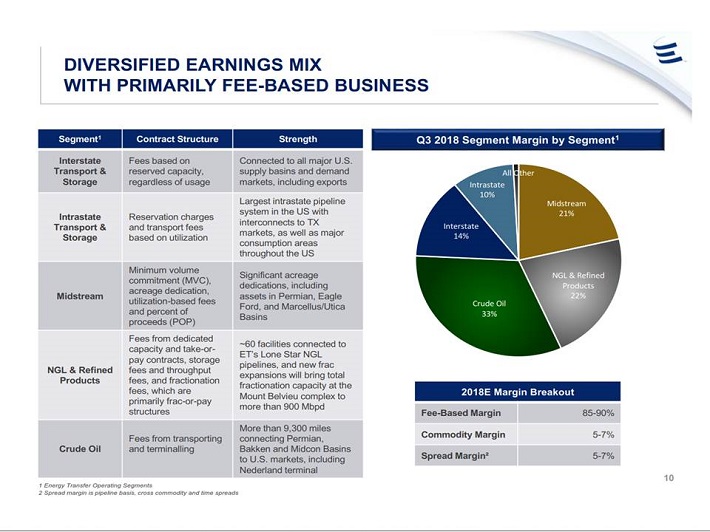

Energy Transfer has the advantage of operating with a fee-based model. It generates 85%-90% of its revenues from fees, which provide reliable cash flows, as the customers have to pay a minimum amount to Energy Transfer regardless of the actual quantities they transport and store.

(Click on image to enlarge)

Source: Investor Presentation

Moreover, after the merger of the aforementioned two entities, Moody’s has revised its credit rating to stable (Baa3 investment grade). Furthermore, the combined entity expects to achieve a distribution coverage ratio of 1.7-1.9, which is remarkably high for a master limited partnership.

Therefore, the 8.1% distribution yield of Energy Transfer is attractive. In the absence of a downturn in the energy sector, this exceptional yield seems to be safe.

Energy Transfer was only recently shaped in its current form, it does not have a reliable performance record. As a result, the distribution of Energy Transfer cannot be considered safe in the event of a recession or a downturn in the energy sector.

Energy Transfer is working to improve its distribution safety. It reported a distribution coverage ratio of 1.90x in the 2018 fourth quarter and 1.74x in 2018.

Both figures are adjusted for the impacts of the ETE-ETP merger. This means the company generated 74% more distributable cash flow than it paid out to investors last year.

Energy Transfer’s distribution payments appear sustainable for the foreseeable future. Those who have strong conviction in the continuing growth of the U.S. economy are likely to greatly benefit from the stock, mostly thanks to its exceptional distribution yield.

Canadian Natural Resources (CNQ)

Canadian Natural Resources operates in the exploration, production, marketing and sale of crude oil, natural gas liquids (NGLs) and natural gas. It is headquartered in Calgary, Alberta.

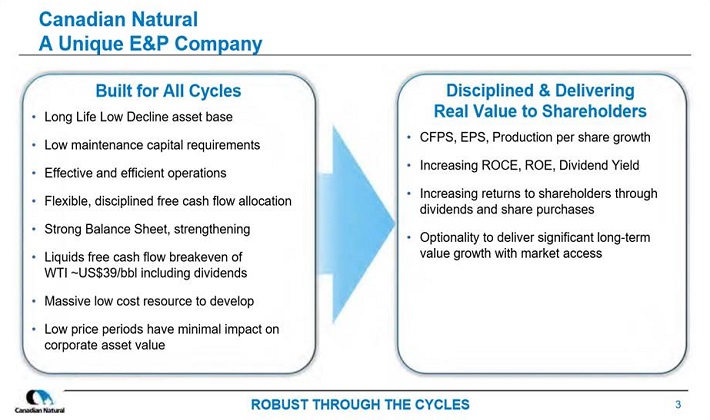

The company boasts of having high-quality reserves, with long life and low decline rates. This is evident from its remarkably low breakeven point of free cash flow (including dividends), which is an oil price of $39 per barrel.

(Click on image to enlarge)

Source: Investor Presentation

Canadian Natural Resources exhibits strong business momentum right now. In the most recent quarter, the company achieved record third-quarter funds flow from operations of $2.83 billion, which was 5% higher sequentially and 69% higher than prior year’s quarter.

The strong performance resulted from increased oil prices and growth in liquids production. Moreover, management expects to grow production per share by 7.5% per year on average until 2022. This growth rate for so many years is much higher than the growth rate of the well-known oil majors, such as Exxon Mobil and Chevron.

On the other hand, as Canadian Natural Resources is an almost pure upstream energy company, its results are greatly affected by the underlying commodity prices, which are beyond the control of the company.

This was evident in the downturn of the energy sector between 2014 and 2017, as the earnings of the company evaporated in 2015 and 2016.

Investors should keep the vulnerability of the company to low commodity prices in mind, as the company is less integrated and thus more vulnerable than the oil majors.

Overall, in the absence of a downturn, Canadian Natural Resources is likely to highly reward its shareholders thanks to strong production growth and its decent dividend yield, which currently stands at 3.5%. Nevertheless, the company is more sensitive to the gyrations of commodity prices than the integrated oil majors.

Imperial Oil (IMO)

Imperial Oil is one of Canada’s largest integrated oil companies and operates in three segments: Upstream, downstream and chemical. Exxon Mobil owns approximately 70% of Imperial Oil.

Imperial Oil is completely different from the well-known integrated oil majors, such as Exxon Mobil and Chevron, in one aspect. While the oil majors generate most of their earnings from their upstream segment, Imperial Oil generates most of its earnings from its downstream segment.

In 2018, the company generated essentially all its earnings (CAD$2.3 billion) from its downstream business (CAD$2.4 billion) while the earnings of the chemical segment (CAD$0.3 billion) offset the losses of the upstream segment.

The key behind this striking feature is the use of Canadian heavy crude oil in the refineries of the company. This type of crude is priced at a wide discount to WTI, which in turn is much cheaper than Brent.

As a result, Imperial Oil enjoys much higher refining margins than its international counterparts and many U.S. refiners. It thus enjoys a significant competitive advantage.

In the fourth quarter of 2018, the downstream segment of Imperial Oil almost quadrupled its earnings over prior year’s quarter. However, investors should not extrapolate these results to the future, as those impressive earnings resulted to a great extent from the excessive discount of Canadian crude to WTI.

The discount widened from $12 per barrel in Q4-2017 to about $40 per barrel in Q4-2018. Such a discount is unsustainable in the long run. Alberta has already enforced production cuts and thus the discount has plunged near $10 per barrel in this quarter.

Nevertheless, while last quarter’s results should not be extrapolated, Imperial Oil will continue to thrive thanks to the deep discount of Canadian crude to WTI and Brent for the foreseeable future.

Imperial Oil also has some strong growth drivers. Canada has the third-highest level of oil reserves in the world, behind only Venezuela and Saudi Arabia. Imperial Oil expects to grow its production by 15% from 2018 to 2020. In addition, its earnings per share will benefit from continuing share repurchases.

To conclude, Imperial Oil is one of the highest-quality oil companies in Canada. It has a credit rating of AA+ from S&P, which is the highest in its Canadian peer group.

Moreover, it has paid uninterrupted dividends for more than a century and has raised its dividend (in Canadian dollars) for 24 consecutive years.

(Click on image to enlarge)

Source: Investor Presentation

The company has grown its dividend at a 6.5% average annual rate in the last decade and has a payout ratio of 26% so it will easily extend this streak for several years.

Finally, it greatly benefits from leveraging the technological expertise of its major shareholder, Exxon Mobil. Overall, Imperial Oil is ideally positioned to offer double-digit average annual returns in the upcoming years.

Total SA (TOT)

Total is the fourth-largest oil and gas company in the world based on its market capitalization of $149 billion. Like the other oil majors, it is a fully integrated company. It operates in four segments: Upstream, downstream (mostly refining), marketing and gas, renewables and power.

Like most of its peers, Total failed to grow its production during 2010-2014. However, thanks to a strong pipeline of growth projects, the company has returned to an impressive growth trajectory. It grew its output by 8% last year, to an all-time high of 2.8 million barrels per day.

Moreover, it expects to grow its output by 9% this year thanks to a series of start-ups and ramp-ups of new projects. Management also expects to grow output by 5% per year for at least the next three years. This is one of the strongest growth profiles in its peer group.

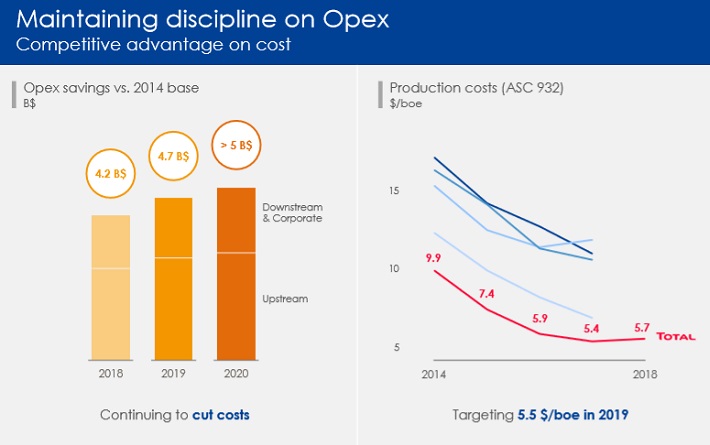

The most important feature of Total is its defensive nature. In the fierce downturn of the energy sector during 2014-2017, Total proved by far the most resilient oil major. Its earnings per share fell only 49% whereas those of Exxon Mobil plunged 75% and Chevron and BP posted losses in 2016.

The key behind the resilience of Total was its superior refining segment. During the rough years of refiners (2008-2013), all the oil majors were generating about 90% of their earnings from their upstream segment.

As a result, the other oil majors sold many refineries, failing to realize that their refineries were their hedges against a collapse of the oil price. Total maintained almost all its refineries and thus exhibited the most robust performance in the recent downturn.

Total also has another competitive advantage when compared to its American peers. It produces less than 10% of its natural gas in the U.S. and thus its average selling price of gas is much higher than the price of Henry Hub.

In 2018, Total sold its natural gas at an average price of $4.78, which was 51% higher than the average Henry Hub price of $3.17.

Moreover, Total has managed to reduce its production cost to $5.4 per barrel, which is approximately half of the production cost of its peers.

(Click on image to enlarge)

Source: Investor Presentation

Total is poised to continue growing its production in the upcoming years while it also offers a 5.2% dividend yield, which is higher than the 4.2% yield of Exxon Mobil and the 4.0% yield of Chevron.

Total is an ideal holding for income-oriented investors who want to gain exposure to the energy sector but remain highly protected from the cyclicality of the sector.

Vermilion Energy (VET)

Vermilion Energy is based in Canada and is engaged in exploration and production of oil and natural gas. It generates 60% of its total production in Canada while it also has operations in the U.S., Australia, France, Ireland, Germany, and the Netherlands.

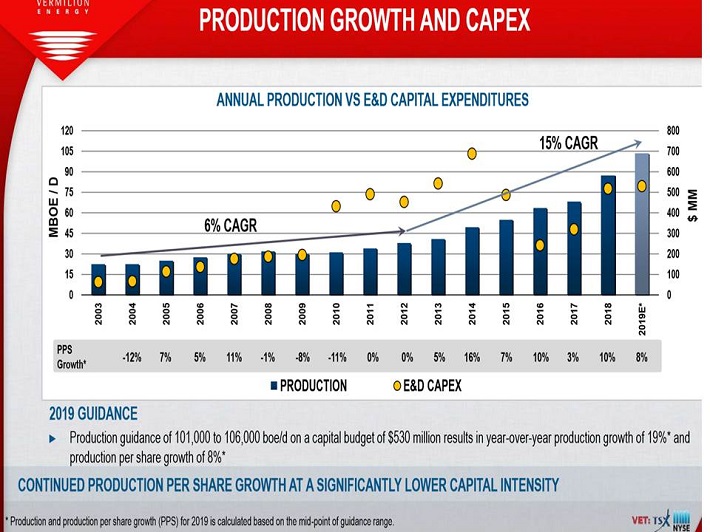

In contrast to the well-known oil majors, which are mature companies, Vermilion is growing its production at a double-digit annual rate. The company is also assisted by the high quality of its producing assets, which have a low decline rate.

Vermilion has grown its production at an approximate 15% average annual rate in the last five years.

(Click on image to enlarge)

Source: Investor Presentation

Even better, there are no signs of fatigue and management expects to grow the output by another 19% this year. As a result, the company is properly positioned to continue growing its cash flows even if oil prices remain stagnant in the upcoming years.

Another striking feature of Vermilion is its resilient performance even amid the most adverse business conditions. In the Great Recession, the company remained highly profitable.

Its performance was even more impressive in the fourth quarter of 2018 when the price of Canadian crude oil collapsed and the discount of WCS to WTI reached an unprecedented high of $40.

Although Vermilion generates 60% of its output in Canada, it remained highly profitable and managed to grow its annual fund flows from operations by 20% thanks to the nature of its Canadian output, as its Alberta condensate and Saskatchewan light proved more resilient than the heavy crude oil of Alberta.

As long as commodity prices remain at decent levels and Vermilion maintains its strong business performance, the stock offers higher return potential than the well-known oil majors.

On the other hand, investors should be well aware of its elevated risk level. Vermilion is a small producer, as its output is less than 3% of the output of Exxon Mobil.

As exploration and production is a risky business, which requires great diversification so that the profitable projects outweigh the failed projects by a wide margin, Vermilion is riskier than its well-established peers.

Chevron (CVX)

Chevron is the third-largest oil major in the world, behind only Royal Dutch Shell and Exxon Mobil. It has an important difference from the other oil majors. While Exxon Mobil, BP and Total produce crude oil and natural gas at approximately equal ratios, Chevron is more leveraged to the oil price, with a 57/43 production ratio.

Moreover, as a portion of its natural gas volume is priced based on the price of oil, approximately 75% of the total output of Chevron is priced based on the price of oil. As a result, the company is much more leveraged to the oil price than the other oil majors.

Thus, Chevron is an ideal holding for those who have a positive long-term outlook on the oil price and want to include an oil major in their portfolio.

On the other hand, as leverage is a double-edged sword, Chevron is the most vulnerable oil major to a plunge in the oil price, such as the collapse of the oil price between 2014 and 2016.

Chevron failed to grow its production for a whole decade despite its hefty capital expenses on growth projects. Especially in 2012-2014, the oil giant spent more than $30 billion per year on capital expenses but still failed to grow its output.

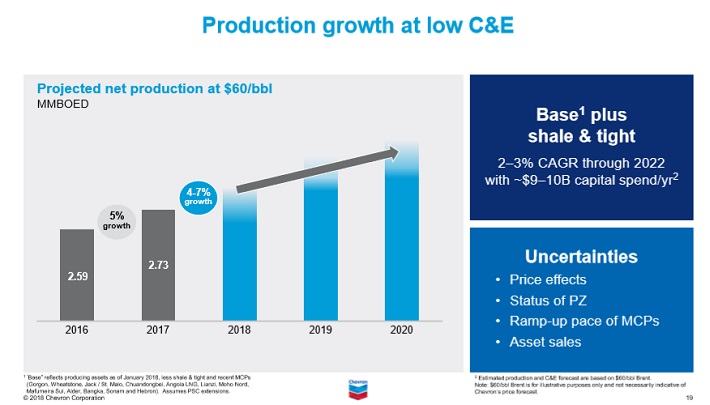

However, it is critical to note that growth projects in the oil industry take many years from inception to generation of cash flows. Chevron is currently in the positive phase of its cycle as its production has begun to grow in recent years despite the decreasing capital expenses of the company.

Chevron expects to grow its output by 4%-7% this year and by 2%-3% per year over the next five years.

(Click on image to enlarge)

Source: Investor Presentation

Chevron is a Dividend Aristocrat, which has raised its dividend for 32 consecutive years.

As the energy sector is highly cyclical, it is extremely hard to achieve such long dividend growth streaks. Thus, the streak of Chevron is a testament to the quality of its business execution.

Overall, thanks to its 3.9% dividend yield, its reasonable valuation, and its production growth, the stock is likely to offer attractive returns in the upcoming years, particularly if the oil price rises from its current suppressed level.

Enterprise Products Partners (EPD)

Enterprise Products Partners is a Master Limited Partnership that engages in oil and gas storage and transportation. It is one of the largest midstream energy companies, with about 50,000 miles of pipelines of natural gas, crude oil, petrochemicals, and refined products and storage capacity of 260 million barrels.

It also has a remarkably integrated structure, as its assets are connected to the major U.S. shale basins, every U.S. ethylene cracker and 90% of the refineries that are located east of Rockies.

Enterprise Products Partners has a credit rating of BBB+ from S&P and Baa1 from Moody’s. These ratings are much better than the ratings of most MLPs.

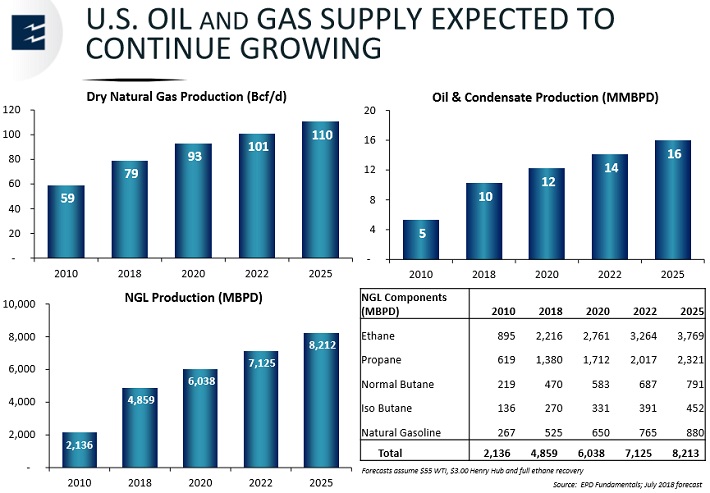

Moreover, thanks to the nature of its assets, the company enjoys reliable cash flows and thus boasts of an exceptional distribution growth record.

It has grown its distribution for 58 consecutive quarters. This impressive record is a testament to the strength of its business model.

As the company achieved a distribution coverage ratio of 1.5x in 2018, the company will continue to grow its dividend for the foreseeable future, in the absence of a major downturn. It currently offers a 6.3% distribution yield.

Enterprise Products Partners has $6.0 billion of growth projects underway so it is likely to remain in its growth trajectory in the upcoming years, particularly given the sustained boom in the U.S. production of oil and natural gas.

(Click on image to enlarge)

Source: Investor Presentation

Since its IPO in 1998, the MLP has invested approximately $38 billion on growth projects and has completed $26 billion of major acquisitions.

Overall, Enterprise Products Partners can offer double-digit annual returns in the upcoming years thanks to its 6.3% distribution yield and its promising growth prospects.

As it is a midstream company, it is much more resilient to suppressed commodity prices and thus enjoys more reliable cash flows than the well-known oil majors, which are overweight on the upstream business. It also has a much stronger balance sheet than the majority of the MLPs.

Exxon Mobil (XOM)

Exxon Mobil is an energy giant, with a market capitalization of almost $340 billion. It is the largest energy company in the world and has an integrated structure. It operates in three segments: Upstream, downstream (mostly refining) and chemicals.

Thanks to its integrated structure, Exxon Mobil is one of the most defensive oil stocks. This proved to be the case in the fierce downturn of the energy sector between 2014 and 2017.

While Chevron and BP incurred losses in 2016, the earnings per share of Exxon Mobil fell 75% in that downturn while its stock price fell only 35% from top to bottom.

Exxon Mobil has failed to grow its production for a whole decade. Its production fell from 4.2 million barrels per day in 2012 to 4.0 million barrels per day in 2014, it hovered around that level for four years and fell to 3.8 million barrels per day in 2018.

This is certainly disappointing performance, particularly compared to the other oil majors, which have returned to production growth in recent years.

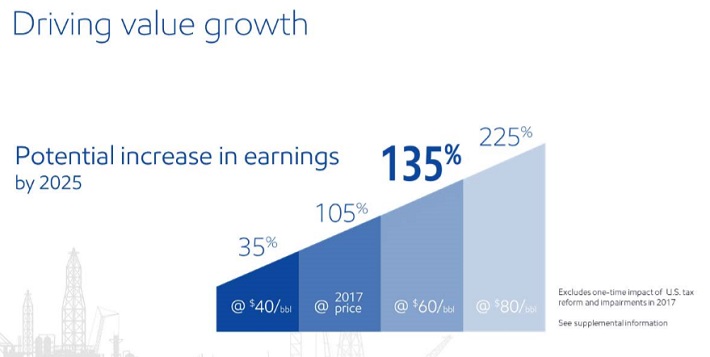

However, Exxon Mobil changed its strategy about a year ago and will now pursue production growth much more aggressively. It has already greatly boosted its capital expenses for growth projects and will keep them at about $30 billion per year until 2025.

Thanks to these growth projects, management expects to grow production by 32%, from 3.8 to 5.0 million barrels per day in 2025.

If the company achieves this goal, it expects to almost double its earnings per share, from $4.88 in 2018 to $8.44 in 2025, assuming an oil price around $60 in 2025.

(Click on image to enlarge)

Source: Investor Presentation

Exxon Mobil also offers an attractive 4.0% dividend yield. The oil giant has raised its dividend for 36 consecutive years and has raised its dividend at a 7.6% average annual rate in the last decade. Along with Chevron, Exxon Mobil is a Dividend Aristocrat.

Thanks to its rock-solid balance sheet and its promising growth prospects, the company will easily continue growing its dividend for many more years. It is expected to announce its next dividend hike in April.

The company easily kept growing its dividend in the recent downturn of the energy sector. Overall, Exxon Mobil currently offers significant growth potential, an attractive dividend yield, and resilience to potential downturns.

Final Thoughts

These eight oil stocks are likely to reward their shareholders in the upcoming years. Investors should keep in mind that the energy sector is highly cyclical.

Therefore, investors should be aware of the unique risks that are associated with purchasing individual stocks in a cyclical industry.

That said, long-term investors with a desire for dividend income can find many attractive stocks in the oil and gas industry. For example, these eight stocks have strong cash flow and durable competitive advantages.

These qualities should keep them paying higher dividends for years to come.

Disclaimer: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more

How do you always find such great picks?