TGIF – Stocks Slide Into The Weekend – What’s Next?

Wheeeee!

I love a good sell-off – especially when we called it and we're well-prepared. We were skeptical of the market rally on Monday and, in our PSW Morning Report (which can be delivered to you pre-market for a small fee), I said:

"We'll see if the market is ablfe to get excited about more Trade Talks and we still haven't cracked 1,600 on the Russell (/RTY) but as long as the S&P (/ES) is over 2,800 – all is technically well in the markets… 7,200 on the Nasdaq (/NQ is a good shorting line for today as is 1,590 on /RTY, since that's the 200 dma – tight stops above!"

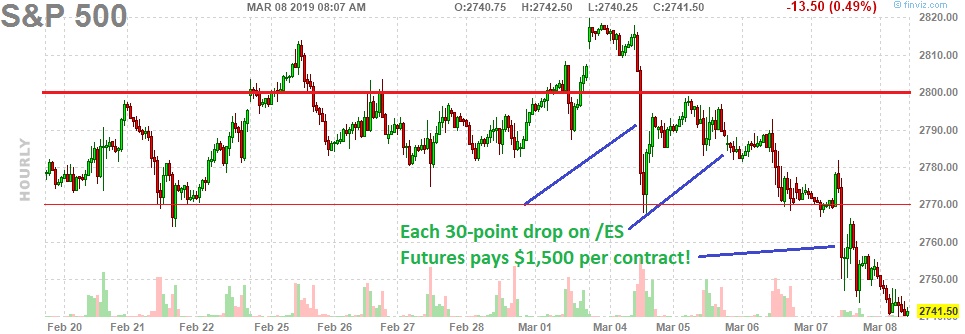

30 points is a 1% pullback on the S&P Futures (/ES) and, at $50 per point per contract, it pays $1,500 – making it an excellent portfolio hedge (using $6,600 of margin per contract). What makes Futures Trading such a valuable tool is that you don't have to wait for the market to open to make an adjustment. Also, there's very little friction cost (the cost of entering or exiting the trade, including fees) so you can use it to very quickly adjust your portfolio at a moment's notice.

Generally, at PSW, we don't like to enter a Futures trade unless there is a significant support or resistance line we can use as a stop because Futures contracts tend to move quickly and erratically EXCEPT when they run into significant support or resistance, where they slow down enough for you to catch your breath and see what's real. Since we are not technical traders but Fundamental ones – having the time to check the news flow is critical in deciding when to get in and out of a Futures trade. In fact, we took the quick $1,500 gain on Monday and we concentrated on the Russell (/RTY) shorts on Tuesday as I said in that Morning Report:

/RTY 1,568 should be support but, if not, could see 1,550. Tight stops in any case but I'm happy with these gains!

As you can see, almost all the rejections sent us down 100-200 points so let's not get too bullish as all we got yesterday was a bounce off the fall from 2,820 on Monday to 2,770 yesterday so that's 50 points and that means, per the Fabulous 5% Rule™, that we can expect 10-point bounces to 2,780 (weak) and 2,790 (strong) so now we're watching 2,790 as the fail line and, if we can't hold that, we'll be back to 2,770 and likely on the way to a full 1.25% pullback from 2,800 to 2,765 and, failing that, the next stop is the 2.5% line at 2,730, which we last tested on 2/15.

Notice how well the 5% Rule is being obeyed. That also tells us that 2,835 is the 1.25% line but we haven't made that and we are finding resistance at the 0.625% line, which is 2,817.50. We don't usually bother at that level but it is ineresting that that's exactly where we topped out yesteday, which indicates there is a LOT of technical resistance over 2,800 and it's going to take a lot more than promises of trade progress to get us over that hump.

Remember, this is not TA, this is Fundamental trading where we take TA into account – simply because so many people follow it but it's the NEWS that drives our decisions, not the charts! Read the full reports if you want to see the logic backing up the calls and remember, I can only tell you what is likely to happen and how to profit from it – the rest is up to you!

We are pretty much right where we're supposed to be on /ES and now we'll see if 2,735 holds up against the weak Payroll Report, which is no surprise to us but a shocker to Leading Economorons, who expected 185,000 jobs to be added by got just 20,000 additions in February, which is even worse than we expected with the Government Shutdown dragging things down.

Keep in mind, this is only the correction we expected. It's the one we discussed in Wednesday's Live Trading Webinar (replay here) and, if 2,735 holds, then it's a nice opportunity to go long as these are (as I keep saying) self-inflicted wounds and people are simply responding to data as it comes out whereas good Fundamental Investors know what the data is likely to say long before the official reports are issued – THAT'S HOW WE MAKE MONEY!!!

Panic may cause an overshoot but we can calculate that as well (20% of the drop from 2,800 to 2,730 is 14 points so 2,616 would be the lowest we are likely to see today). There's a lot of bad data out there as Trump's Government Shutdown had far-reaching repercussions, as did/do the Tariffs. Here's today's highlights:

- Draghi’s Goodbye Gift Taken With Disappointment by Markets

- ECB staff macroeconomic projections for the euro area, March 2019

- Oil prices drop as ECB warns on weaker economy, U.S. supply soars

- ‘Never-hike Draghi’ slams the euro

- China stocks tumble after ECB action spurs growth concerns | Financial Times

- China Stocks Slump Most This Year as Sell Rating Shocks Traders

- Carmakers Get No Relief in China as Auto Sales Keep Plunging

- China’s Amazing Collapsing Exports

- China’s Coal Imports Slump 42% as Australian Cargoes Delayed

- Chinese Buyers Helped Boost Australian Home Prices. Now They’re Leaving

- U.S.-China Trade Deal Isn’t Imminent, Envoy Says

- Japan stocks lower at close of trade; Nikkei 225 down 2.01%

- German industrial orders post strongest drop in seven months

- Norway to Dump Oil Producers From $1 Trillion Wealth Fund

- Venezuela Is Plunged Into Darkness by a Major Electrical Blackout

- Deadbeat Nation? 37 Million Credit Cards Were 90 Days Past Due In 4Q18

- US households see biggest decline in net worth since the financial crisis

- Amazon reportedly halts orders from wholesalers, prompting concern about major changes to seller platforms

- Fact check: How the Trump administration is spinning economic growth numbers

That's just TODAY and no, I'm not cherry-picking bad news. This is what we refer to as "Negative News Flow" and it means we're going to lean bearish in our betting so, unless something changes, we're only playing for the bounces (and probably weak ones) which would be the same 20% of the drop on /ES off 2,735 so +14 is 2,749 for a weak bounce and we'd call it 2,750 as we love round numbers (and big buts), call the unlikely strong bounce 2,765 but (another version) that's still good for a quick $700 per contract – not bad for a Friday!

It would take some good news to get to the strong bounce line but the weak bounce is simply a reflexive move as the news isn't bad enough that ALL the BuyBots will have turned off – so they simply kick in at levels that our 5% Rule™ predicts because the whole point of the rule is to predict the actions of automated trading programs – which are now over 80% of the market action.

While the news is terrible – it's nothing we(at PSW) didn't know about because WE PAY ATTENTION and don't buy into all the media hype and market cheerleading that drowns out the real news on a daily basis. The people who are panicking are the ones who listen to Leading Economorons or wait until AFTER a report is released to positions their portfolios. Sadly, that describes pretty much everybody…

In fact, last month, on Feb 1st in "Non-Farm Friday – Is America Working? The Liar-In-Chief Says Yes!", I said:

304,000 jobs is almost double the 180,000 expected by leading Economorons BUT, be careful as last month was revised down by 90,000 jobs – from 312,000 to 222,000 and one could imagine how a dishonest President who surrounds himself with a staff that already has 6 convictions with another half-dozen indictments in progress (that we know of) MIGHT have lied about last month and MIGHT be lying about this month too – in order to escape criticism over the shutdown.

Still, until we can prove it to Fox New's satisfaction, we can keep pretending that America is a magical land where you can furlough 800,000 workers and the economy IMPROVES! The Soviets used to say Russia was a "Workers Paradise" so often that people actually started to believe it and that is the GOP/Fox strategy – they endlessly repeat their talking points until you begin to forget what the truth actually is – even when you are the one suffering from their lies!

I know I come across as Anti-Trump (I am) but I was Anti-Nixon too and, I imagine if I lived in Germany in the 1930s, I would have been Anti-Hitler as well as I'm against anyone who is destroying my country and it's mainly for ECONOMIC reasons when I don't like politicians. I'm more of a Libertarian as far as policy goes though, Economically, I think Socialism is a better system than Capitalism just like I think it's bad to kill people with the jawbone of an ass and take their stuff – just because you are stronger than them. Capitalism, in it's pure form, is simply survival of the fittest with money instead of stone axes but the consequences of losing are just as dire for those who don't have the tools to compete.

Socialism is an Economic System that steers and economy to benefit SOCIETY over the individual but, unlike Communism, it doesn't extinguish or forbid individual accomplishments – it simply mandates a degree of sharing. We ARE a Socialist Society and pretending we're not and that Socialism is somehow evil or anti-American merely demonstrates how little people understand economics. We're supposed to have evolved, Socialism is the action of an evolved Society.

Meanwhile, if we are going to be bullish this morning, we need to play the S&P as it crosses back OVER the 2,735 line, with tight stops if it fails (risking less than $50 against a possible $700 gain) and we'll look for confirmation from the Nasdaq (/NQ) at the 6,975 line (and it will be hard to get back over 7,000) and 1,515 on the Russell (/RTY) and 25,250 on the Dow (/YM) – unless 2 of the 4 are green – I wouldn't play bullish and, if they stay red – we're going to have to add some more hedges – like the ones from 1/31's Report titled: "Following Up on our Apple Trade + 2 Hedges to Lock in the Gains."

Fortunately, I'll be reviewing the Short-Term Portfolio this morning and that is where we keep our main hedges!

Have a great weekend,

Disclosure: Our teaching theme at Phil's Stock World is "Be the House, NOT the Gambler." Please see " more