TGI Friday The 13th – Bulls Are Feeling Lucky

We're still waiting on a few of bounce lines:

- Dow 23,800 (weak) and 24,200 (strong)

- S&P 2,640 (weak) and 2,684 (strong)

- Nasdaq 6,500 (weak) and 6,700 (strong)

- NYSE 12,450 (weak) and 12,600 (strong)

- Russell 1,520 (weak) and 1,540 (strong)

Even with this morning's pre-market rally, we still have to take the same 3 red levels we were looking for yesterday so we'll have to remain well-hedged into the weekend because we don't change our stance until at least 3 of five of the Strong Bounce levels are captured AND HELD – for at least one full day after a close above.

As you can see on the chart, 2,693 is the 50-day moving average on the S&P 500 so that's the real goal as it needs to be over that line to avoid (or at least put off) forming a "death cross" below the 200 dma into July earnings. Remember, we predicted strong bank earnings in our Big Bank Theory Report last Thursday and our Trade Idea for Citigroup (C) is looking very good as they have already jumped $4 since we made the play:

The markets are generally back to bullish as Trump walks back threats against Syria and, more importantly, says he may want to put us back in the Trans-Pacific Partnership (though the other partners may not want him now) and that then, makes it seem more likely NAFTA will be negotiated.

Oil (/CL) is back over $67 but a bit too dangerous to short again into the weekend. Gasoline (/RB) is just under $2.05 and we will short that again at $2.075 if we hit it and I guess we might take a stab at shorting /CL at $67.50 – because that is a ridiculous number, being propped up by OPEC and IEA statements that will likely fade away into the inventory rollover on the 19th.

There are still 223,636 fake, Fake, FAKE open contracts on the NYMEX representing a demand for delivery of 223.6 MILLION barrels of oil to Cushing, OK, by May 31st. If that actually happened, we would have a 50M WEEKLY build in crude oil and prices would drop to the low $20s. What's going to actually happen is that those FAKE orders will be rolled into longer months – to create more FAKE demand and keep the prices up. The only loser here is the American people – so don't worry about it!

|

Click for |

Current Session |

Prior Day |

Opt's |

||||||||

|

Open |

High |

Low |

Last |

Time |

Set |

Chg |

Vol |

Set |

Op Int |

||

|

67.18 |

67.76 |

66.70 |

67.13 |

08:44 |

|

0.06 |

201626 |

67.07 |

223636 |

||

|

67.11 |

67.63 |

66.59 |

67.04 |

08:44 |

- |

0.09 |

56569 |

66.95 |

482855 |

||

|

66.69 |

67.24 |

66.22 |

66.64 |

08:44 |

|

0.06 |

15967 |

66.58 |

216360 |

||

|

66.06 |

66.59 |

65.71 |

66.06 |

08:44 |

- |

0.05 |

8146 |

66.01 |

142162 |

||

|

65.31 |

65.96 |

65.02 |

65.46 |

08:44 |

- |

0.06 |

6702 |

65.40 |

214260 |

||

|

64.70 |

65.38 |

64.44 |

64.83 |

08:44 |

- |

0.03 |

2727 |

64.80 |

118845 |

||

|

64.19 |

64.76 |

63.99 |

64.25 |

08:44 |

- |

- |

1440 |

64.25 |

82734 |

||

|

63.65 |

64.23 |

63.35 |

63.75 |

08:44 |

- |

0.03 |

13198 |

63.72 |

262986 |

||

As you can see on the NYMEX chart, there are 1.065 BILLION barrels worth of contracts in the four front months (about to be the front 3 months) and we only import 50M barrels a week so that's a 20-week supply for the US being FAKELY ordered at one port (that can't possibly handle them) over a 90-day period. Complete and utter BS yet the price of oil and gasoline are determined by this scam! Remember, Cushing can only handle about 50M barrels a month and it's full so no more than 20M barrels worth of contracts (20,000) will actually be closed for delivery on the 19th – probably closer to 12M barrels. It's the biggest scam in World history (see: "Goldman's Global Oil Scam Passes the 50 Madoff Mark!") yet it goes on every month and no arrests are ever made.

For our trading purposes, what we care about is how many contracts the traders need to dump out of May between now and the last trading day (19th) and we can assume they'll want to get rid of about 210M of those barrels (effectively committing a crime against the US by damaging our energy security for profiteering purposes as those are valid contracts to replenish US stockpiles). There are 5 trading days left so they have to roll 42,000 contracts a day and, we'll keep a close eye on whether they are on or off track and, if they are off track (under), then there will be more last-minute pressure to dump May contracts at lower prices – and then we can be bearish on the /CL Futures.

You can see how we got a nice $4 ($4,000 per contract) drop at the end of March so, hopefully, we'll get something similar to close out this month as well. Otherwise, we're just waiting and seeing if the Strong Bounce levels hold and how the earnings are coming in over the next couple of weeks.

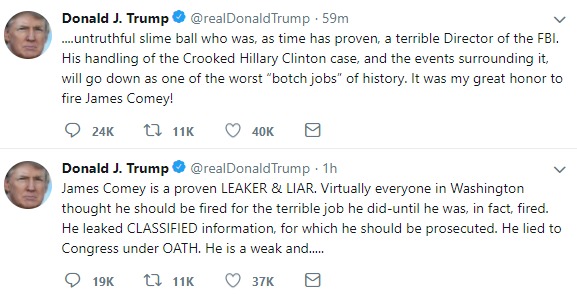

Meanwhile, Trump is at it again as James Comey's book came out and it did not paint a flattering view of the President. I think we will soon be seeing if this Teflon Market can shake off an indictment of a sitting President as Mueller is clearly closing in on Trump and, as we've already seen this week – ANYTHING can happen – and then it can be reversed a day later.

All in all, the S&P is now flat for the year and up or down next week can easily show us the direction the rest of the year will be taking.

Disclosure: Our teaching theme at Phil's Stock World is "Be the House, NOT the Gambler." Please see " more