Tesla Coin

One of the biggest innovations of bitcoin is the invention of a blockchain that allows us to transfer something of value across the internet, without the possibility of being duplicated and without the need of a trusted third party to verify the transaction.

Though the practical applications for this are virtually unlimited, one of the most obvious is the ability to revolutionize the financial markets. At the moment, just about all global markets rely on a central authority.

The ability to create a digital token that represents a financial asset is just around the corner. In fact, an exchange called DX has just announced that they will be the first to deliver tokenized stocks starting next week.

As a regulated broker, DX plans to hold onto the shares and issue the tokens. The tokens can then be traded freely and cheaply by anyone in the world 24/7.

This is only the beginning though. Over the next decade, we could very well see the tokenization of the entire financial markets. Essentially, anything that has value and can be traded can also be represented as a digital token and traded on a blockchain.

Today's Highlights

- Shutdown: Day 14

- Jobs Report Today

- Crypto Correlations

Traditional Markets

Stocks remain under pressure but are seeing a bit of a rebound today. Going into the 14th day of the partial US government shutdown, stocks are at a critical juncture.

They've managed to push off the lows last Wednesday, but so far this year have mostly been seeing modest declines. It would take a lot of gusto to muster a rally back to the highs at this point but on the other hand if we start testing the lows again it would certainly make a lot of investors nervous.

(Click on image to enlarge)

Today we'll get the monthly jobs report from the United States, which is expected to bring a solid announcement of 179,000 jobs added in December and a wage growth of 0.3%.

The closer we get to those numbers the more comfortable Wall Street will be. Weak job growth numbers could start to show cracks in the economy but stronger than expected numbers could be even worse as they could entice the Fed to tighten their monetary policy even quicker.

Bitcoin Lining up with Stocks?

With the recent turbulence in the traditional markets, it seems like a fitting time to check how crypto is lining up with traditional assets.

Here we can see bitcoin in black, the S&P500 stock index in blue, the USD in green, and Gold in orange.

(Click on image to enlarge)

I think the trends are pretty clear from this graph above, but if we want to analyze the correlations of these markets over time, we can use something like the graph below.

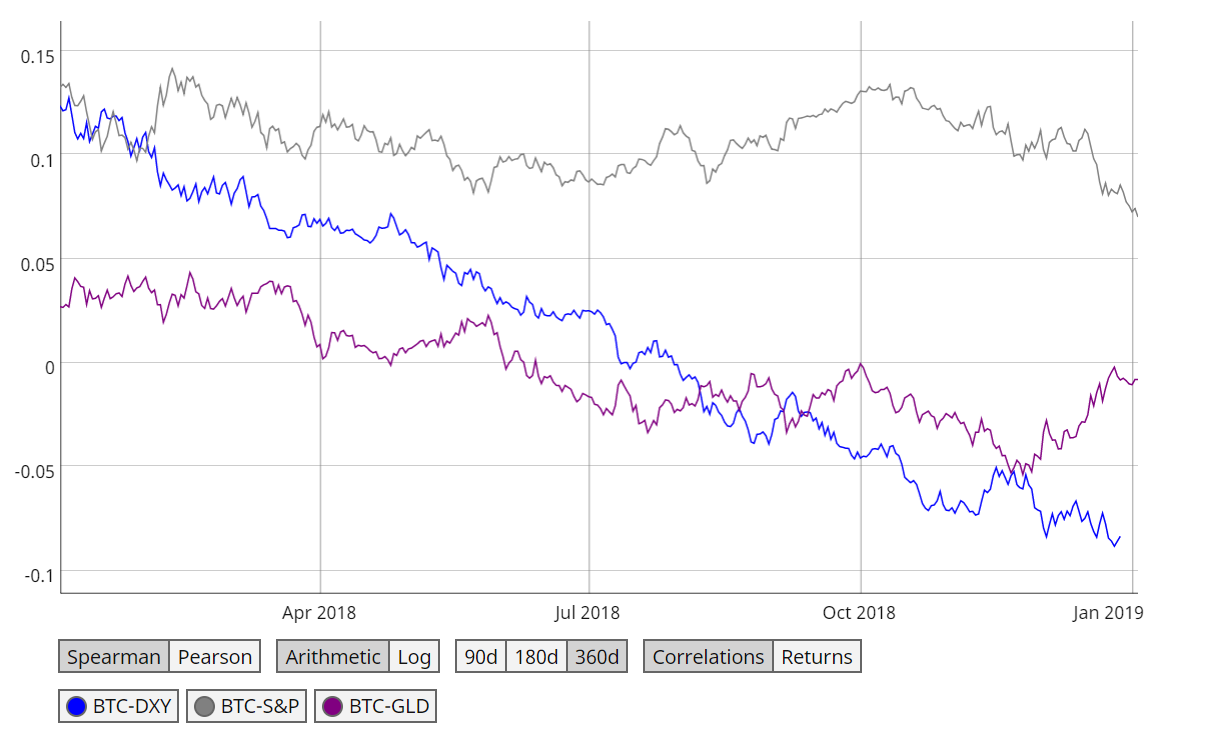

This shows bitcoin's correlation to the USD (Blue), the US stock market (grey), and gold (purple).

The numbers here are very small. A high of 0.15 and a low of negative 0.1 shows that there's virtually no correlation. However, I think that we can start to look at direction as an indicator of market sentiment.

Notice how the correlation between bitcoin and gold (purple line) has risen sharply over the last month as both gold and bitcoin rise together.

If we do continue to see the stocks sliding and bitcoin rising, that grey line would plummet. Maybe then bitcoin might be seen by some as a safe hedge against stock declines, but we're still far away from that.

Disclaimer: This content is for information and educational purposes only and should not be considered investment advice or an investment recommendation. Past performance is not an indication of ...

more