Tech Talk: Financials Redux

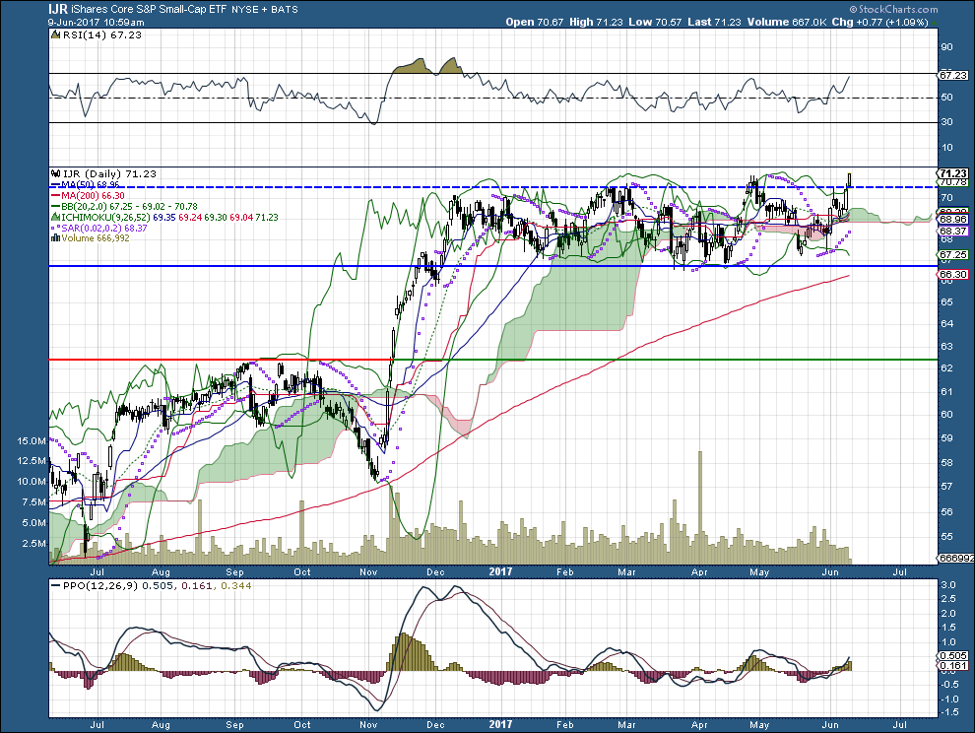

Before I comment on the resurgence in the financials, here’s a bonus: at ETF focused on small cap stocks. After showing strength yesterday, today it strongly surged up over the resistance indicated by the broken blue line.

(Click on image to enlarge)

Taking a quick look at the fund’s fundamentals, its net income grew by 9.61%, year over year, to (U.S.) $12.46 per share, and it had a net profit margin of more than 60 per cent. I bought some about the time of the Trump Jump, and I intend to hold on.

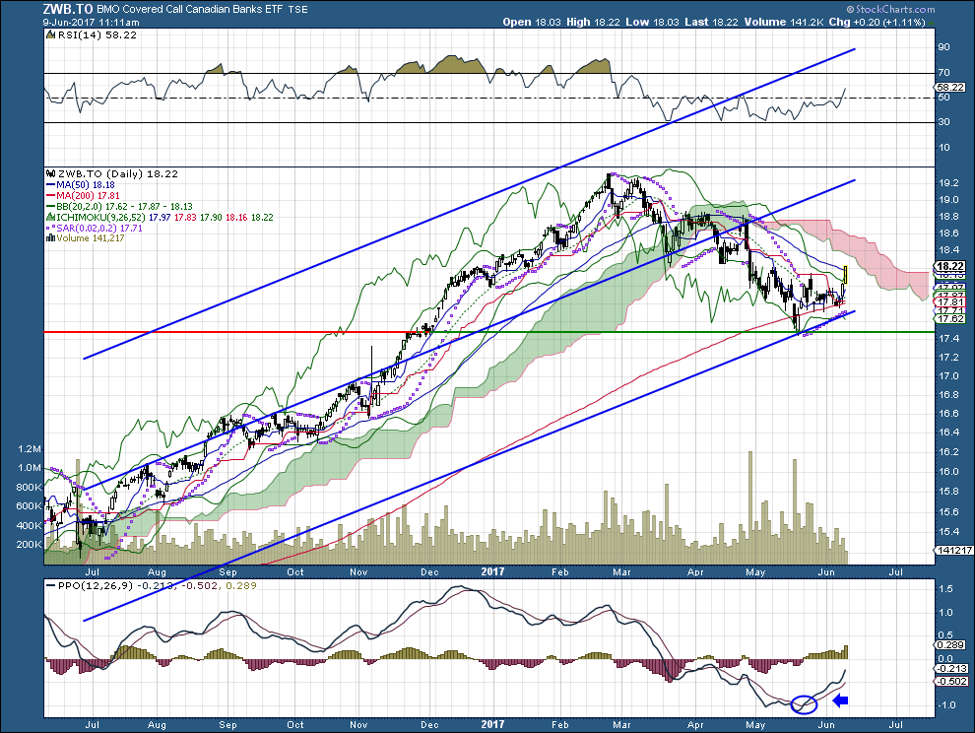

The following fund is another ETF I own, and which have discussed before.

A covered call of Canadian banks issued by the Bank of Montréal, the charting system I’ve used is the Raff regression channel which, as you can see, is a linear regression with evenly spaced trend lines above and below. The width of the channel is based on the high or low furthest from the linear regression. The trend is up as long as prices rise within this channel. An uptrend reverses when price breaks below the channel extension. The trend is down as long as prices decline within the channel. Similarly, a downtrend reverses when price breaks above the channel extension.

(Click on image to enlarge)

As the chart bounced off the bottom of the channel, a signal on the PPO panel suggested that the recovery is real. To my mind, this suggests that the upward march is ready to resume.

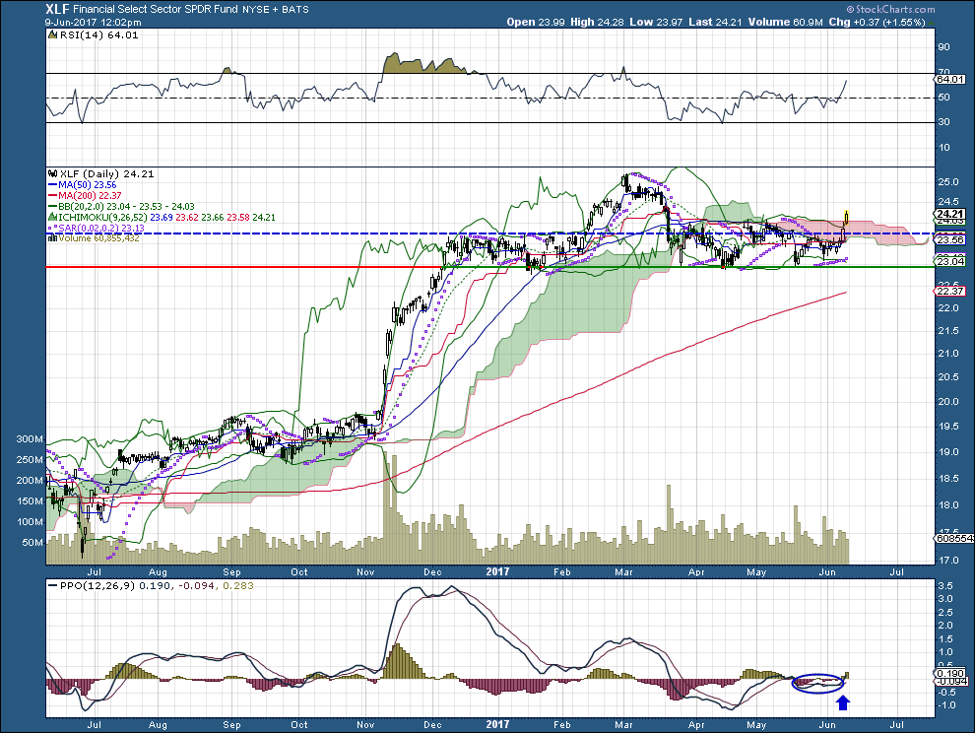

The following chart is the same, but different.

(Click on image to enlarge

XLF is an ETF based on 55 financial entities traded in New York; you can review and study them here. As you do, please bear in mind that this fund’s net income declined year over year last quarter from a gain of US $1.07 per share to a loss of US $0.28. That’s a statistic to give you pause, perhaps, but the chart seems okay with it: The investment has been consolidating since the end of last year, and now seems to have recovered its oomph; note the PPO buy signal I’ve marked with an arrow.

I hope it’s beginning another big upturn. I’ve been patiently waiting for that to happen.

Disclaimer: The analysis and ideas presented here should never be seen as a buy or sell recommendation. I am an active trader, but I discuss stocks for informational purposes only. By reading my ...

more