TalkMarkets Tuesday Talk: Sideways Into July

No clear path emerged from last week’s trading and it appears that the markets are moving sideways into July. Here are some of the things some of TalkMarkets’ contributors found to say.

Brad Zigler takes a look at how alternative investments are faring year to date in Mid-Year Appraisal Of Alternative ETFs and finds that is SPDR Gold Shares Trust (GLD) that is the y-t-d winner. He has a chart of the top ten, ALT ETF investments showing performance over the last month and year to date.

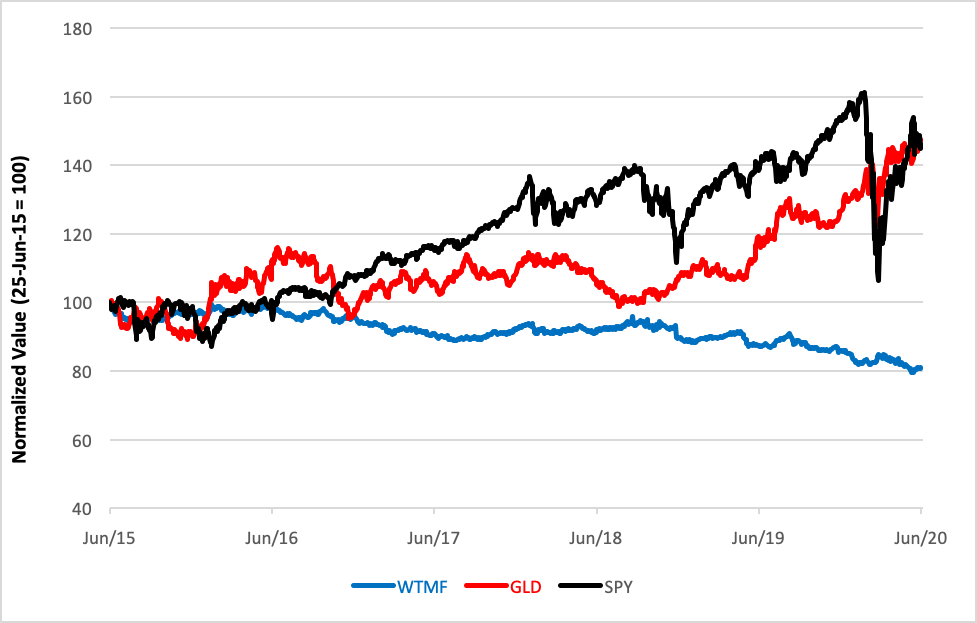

Of note is how the SPDR S&P 500 Trust (SPY) and GLD have performed similarly over the last five years:

“GLD and SPY have basically ended up in the same place after the past five years (see below). The bullion trust grew at a compound annual growth rate of 9.5 percent while the stock fund appreciated at an average rate of 9.3 percent. The two funds, however, attained their current levels with a significantly different degree of difficulty.”

Daily ETF Performance

As for the moment, the SPDR Gold Shares Trust is up 2.23% in the last month and year to date up 16.54%.

Zigler concludes that “In the meantime, investors can content themselves with a gold exposure. It could be worse.”

Arthur Donner and Peter Morici have two different takes on the Fed’s actions related to the COVID-19 pandemic.

Arthur Donner writes in, The Federal Reserve Massive Buying Of Government Debt, that “The current US Fed policy of quantitative easing is really in fact a version of monetizing the public debt.”

Donner further explains, “Monetizing debt is a simple process where the government issues bonds to cover its new spending. The central bank purchases the bonds from the secondary markets, and perpetually rolls them over. Thus, debt monetization leads to an increase in the money supply.”

The current increase to the money supply has been massive, larger than the Fed’s previous 3 periods of QE or quantitative easing.

The current amount of QE is a cause of concern for many economists but Donner notes that, “In the current weak global economic environment, massive fiscal policy injections supported by central bank debt monetization is entirely appropriate.”

Peter Morici, in The Fed Needs To Deploy Digital Dollars To Support Recovery, argues that the current measures taken by the Fed, are not enough, based in part on the Fed’s own estimate that the jobless rate is unlikely to fall to pre (current) – recession levels before 2023.

“Chairman Jerome Powell and his colleagues may be committed to doing “whatever we can” but even their much-expanded toolbox may prove not adequate—especially if a second wave of infections takes the economy down again.”

Morici then goes on to explain in much detail the pros and cons of what the Fed has done to date, as well as to disparage fears that the US Dollar will weaken significantly.

“With the future of the euro shaky and yuan carrying great political risk, the dollar remains the currency of choice for international commerce and a safe haven for foreign investors. Foreign holdings of Treasuries continue to grow, and the United States is in the happy position of printing the global currency.”

However, Morici believes the best way for the Fed to help the economy recover is to directly provide means to legal US residents, to increase consumer spending.

“It would be better to get the Fed, Treasury and SBA out of the business of propping up businesses and into boosting consumer demand. Let every legal resident open an electronic checking account at the Fed—folks could register with their social security numbers. Then deposit monthly payments into those accounts as long as the crisis persists—reducing that support as the unemployment rate falls to defined benchmarks to ensure payments phase out.

Consumer spending would pull capital and workers to their most productive uses via more efficient market forces, and the whole process would usher in an electronic currency that would make the economy run more efficiently than one supported by bank credit cards, paper checks and currency.”

A novel idea indeed.

This morning, Fiona Cincotta, who covers the markets from London, finds some cautious optimism as Tuesday trading gets underway around the globe. In, Stocks Point Lower As UK Q1 COVID Damage Worse Than Forecast she notes that the uptick in the US housing market and better than expected PMI data coming out of China are positives.

“The US pending home sales obliterated expectations, jumping 44.3% in May, well ahead of the 18.9% increase forecast”, and “Overnight Chinese PMI data added to the upbeat mood. The official manufacturing PMI showed that activity expanded faster than forecast, printing at 50.9, above estimates of 50.4. Level 50 separates expansion from contraction.”

However in the UK bad Q1 GDP data is dampening sentiment on the FTSE.

“Given that the first quarter only included a week of lockdown, the worst is yet to come in, with economic growth in Q2 expected to be significantly worse given that the economy was paralyzed for 2 of the three months. Today’s reading doesn’t bode well for Q2.

Following the release, the Pound has dropped back through $1.22 as it heads towards monthly lows.

Brexit talks are doing little to support sterling, with little progress on key issues and the UK insisting that an outline deal is ready by the end of July.

Attention will now turn to Boris Johnson and his plans to spend his way out of the pandemic crisis with huge infrastructure projects.”

In a surprising turn of events Facebook (FB) has become a victim of its own success. After repeatedly coming under fire for not doing enough to moderate “hate speech” on both their Facebook and Instagram platforms, several major corporate advertisers have suspended paid advertising campaigns with Facebook worth millions of dollars. There is writing about this everywhere in the press.

Media personality and TalkMarkets contributor Shelly Palmer writing in The Facebook Boycott Expands notes some of the major companies who have joined the boycott.

“Starbucks (SBUX) has joined Unilever (UN), Verizon (VZ), Honda (HMC), Levi Strauss (LEVI), Diageo (DEO), Coca-Cola (KO), Hershey's (HSY), Patagonia and other big advertisers who have paused their social media advertising. What started as a Facebook boycott is quickly evolving into a referendum on the state of social media.”

While Palmer quotes Facebook CEO, Mark Zuckerberg as saying that, “Facebook will label more controversial content and tighten advertising policies. The company will ban ads that scapegoat minorities, immigrants, racial or other groups as part of a wider crackdown on hate speech”, he wonders “is it too little, too late?”.

Regular folks and Facebook shareholders alike are wondering the same thing, too.

No doubt there will be a lot of action in the markets between now and market close on Thursday.

With a nod to the 4th of July, here is a quote from Dwight D. Eisenhower, 34th President of the United States.

“Independence Day: freedom has its life in the hearts, the actions, the spirit of men and so it must be daily earned and refreshed – else like a flower cut from its life-giving roots, it will wither and die.”