TalkMarkets Tuesday Talk: Green Ahead, Look Out For Curves

Last week's burst of green made for a rosy Mother's Day and many Moms did receive flowers ordered online and not a traditional meal out due to continued restaurant closures and social distancing guidelines. The stock market continued its upward climb on Monday, though much slower than the trading days preceding it, what with the Dow down .45%, the Nasdaq up .78% and the S&P nearly unchanged at 2,930 up .02% from Friday. Today, Asian markets closed slightly lower, save for Hong Kong which closed down 1.45%. So far, markets in Europe are trading up and US market futures for today are also, up. Tech stocks are hot, maybe too, hot. Here's what some of our TalkMarkets contributors have to say.

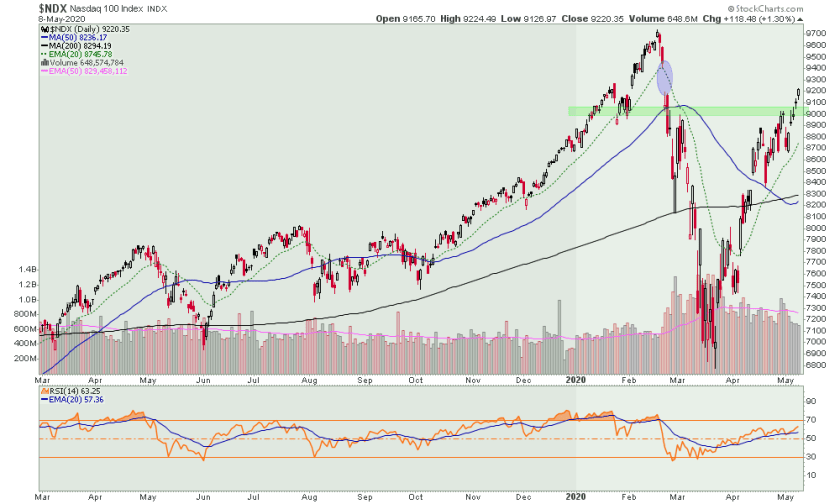

Michael J. Kramer in his article Warnings Signs Still Build As Overheating Technology Stock Rise Again Kramer charts the progressive rise of the S&P 500 since the beginning of April and looks at the Nasdaq, FB, PayPal, Salesforce and Amazon charts and shows some serious "V" shapes between mid-March and today. Here is the QQQ chart.

His view is that all these healthy rises suggest a bit of an overbought situation. Regarding FB, "Facebook rose to around resistance today and failed to push through meaningfully. Also, the stock still has an RSI that suggests it is overbought, and I think that means shares pullback to $191", Salesforce (CRM) "It is also back to resistance at $182 and has an RSI rising over 70. A pullback to $166 would be healthy."

Regarding PayPal (PYPL) "I don’t know. I get the whole digital transaction things, trust me, but still. There is a nice gap-fill still linger around $120." In mid-March the stock closed around $86 and yesterday closed at $124, where it was at the beginning of March, making the chart almost a perfect V. Hmm...indeed.

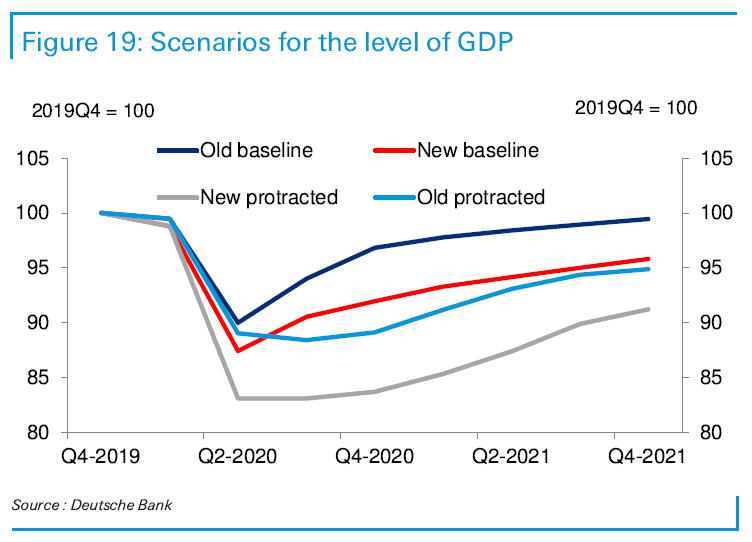

Contributor Menzie Chinn, writing in Who Is Predicting A “V” Shaped Recovery? looks at researchers and institutions that have been pursuing the V-shaped recovery, "Since April, sentiment has moved more toward the “swoosh” perspective (WSJ today). The debate over how to characterize the recovery is extensive..."

Menzie says he is inclined currently to go with the take of Deutsche Bank economists who expect the recovery to be more protracted. See the chart below.

It's a short but good round-up of some current research.

The Frugal Prof is concerned that many of those writing in the financial media, just don't get it. He says in Financial Media Is In Denial About The Real Economy that most are "young journalists who have little experience in real markets. The only Recession they’ve seen was followed by the longest Bull Market in history...".

He writes that the economy was in a fragile state before COVID-19 and that many colleges grads had been working in service sector jobs that have now dried up and that this is causing a drain on the whole economy whereby, "Parents that need to continue supporting children will force them to postpone retirement. All of this has a cascading effect. Most of this hasn’t even played out yet. We’re in the first inning in economic terms. The reality is no one knows.", and "For the financial media to be so bullish and confident speaks to their ignorance." The Frugal Prof finds this all "hard to watch", reminding us all to take some of what we read with a grain of salt.

In an exclusive for TalkMarkets, Sunil Tinani says that COVID-19 has upended some of our traditional ways of looking at investing. In his article, Post-COVID-19 Investment Themes , Tinani suggests eight sectors which will be investment magnets post-pandemic: Green Energy, Technology, Insurance, Healthcare, Food, Automation, Hygiene and Skill Institutes.

Some of these are not new, but Hygiene and Skills certainly are. Tinani expects that it will take longer for an effective vaccine to be developed and produced and therefore is of the mind that " we will have no option but to live with the virus longer than anticipated" and as such "...stocks in all the sectors listed above will outperform." Certainly we have seen shares in companies like Medtronic (MDT) and Clorox (CLX) gaining in activity.

Writing in "Notes from the Rabbit Hole", contributor Gary Tanashian, in his article ‘Sentiment Event’ Rally Grinds On finds that the market seems to be riding sentiment based on good news or bad news and less about value and fundamentals.

He takes readers through the charts but asks us to consider the following while doing so, "The bears will probably be right but here’s the thing, they have not been right for nearly 2 months now. When I write that the market is two things 1) bullish and 2) at high risk I trust you not to overreact to either of those statements. I ask you to consider and weigh them and to proceed using that information in a way that best suits your investment style."

Looking at the current Nasdaq 100 chart below, Tanashian says the following, "The media headlines are already talking about Nasdaq in positive territory for the year and a gap fill, which we’ve had on radar all along for this leading index, appears likely."

"It does not have to make sense. It just has to be what it is. What perma-bears don’t understand during a relief rally is the same thing perma-bulls don’t understand when things fall apart. The market is going to do what it is going to do anyway, informed by not only economic fundamentals (which COVID-19 ultimately is) but also by sentiment extremes..."

Tanashian concludes his article by reminding TalkMarkets readers that "The only logical response is to remain unbiased, open-minded, aligned with the probabilities, and ready for what the market delivers."

Good advice as we head toward today's market open in New York. Here is a "green" thought to consider from Albert Schweitzer:

"An optimist is a person who sees a green light everywhere, while a pessimist sees only the red stoplight... the truly wise person is colorblind."