TalkMarkets Tuesday Talk: Dow Days Of Summer

The ancient Greeks thought of the constellation Canis Major as a dog chasing Lepus, the hare. The star Sirius (which means scorching or glowing in Greek) is the dog’s nose. In the summer, Sirius rises and sets with the sun. They thought having another star in the summer sky made the days hotter, hence the phrase "Dog Days of Summer". Homer in the Iliad, says the dog star is "an evil portent, bringing heat, and fevers to suffering humanity".

On Wall Street, the phrase "dog days of summer" is used to define the historically slower trading months of July and August. But with the Dow "high in the sky" and the "earth moving" under its list, these "Dow Days of Summer" seem to be taking a few cues from the ancient Greeks.

This morning market futures are again in the green, the S&P is shining 3,442, the Dow 28,404 and the Nasdaq 11,626 (as I write). Biden is chasing Trump and there are hurricanes afoot. What do TalkMarkets contributors make of it all?

Simon Peters writing in Exxon To Exit Dow Jones Industrial Average After More Than A Century notes:

"One of the world’s major stock indices is set to undergo some significant changes, with Exxon Mobil (XOM), defense firm Raytheon Technologies (RTN) and drug maker Pfizer (PFE) on the way out of the 30-name index of US blue chip stocks. The trio will be replaced by cloud business software provider Salesforce (CRM), and conglomerate Honeywell (HON). Apple’s (AAPL) four-to-one stock split is one reason the changes are being made, as the index is constructed based on share price rather than market cap, so the change would have dramatically cut the Dow’s technology exposure. The news broke as the Dow (DIA) came within touching distance of breaking even in 2020, after adding 1.4% on Monday. Currently, the Dow is down just 0.8% year-to-date."

I don't know what these changes portend, but these certainly are epic moves for the Dow Jones Index.

Contributor Philippe Herlin asks What If The Debt Doesn't Matter? Is This Realistic?. Herlin postulates, "I mean, what if the debt wasn't serious? What if the explosion of its amount all over the world since the coronavirus crisis had no harmful consequences? What if we could even get rid of some of it without incurring any damage? This is the little tune we hear from those who want more and more public spending, who believe that only public spending can get us out of the rut, that we have to keep printing money." He is clearly at odds with the current thinking of the world's central bankers and is concerned that all the money circulating will result in inflation down the road and is concerned that the result in Europe and the U.S. may be akin to recent events in Venezuela, the former Yugoslavia and Zimbabwe. Mon dieu!

"Only work, innovation, and trade can create wealth, and money must be stable and independent of political power.", says Herlin. He believes that the excesses of "QE" have created political consequences that will be disastrous in the the near term. He ends with this: "... those who are far-sighted will return to gold, the currency that is nobody's debt."

For a consensus look of where the U.S. economy is headed, Arthur Donner in his TalkMarkets exclusive, An Unconventional US Recession, An Unconventional Recovery And The New Economic Normal?, looks at how the economy has performed so far in 2020 and what we can expect in 2021.

"Though the consensus expectation of economists continues to be that US economic growth would revive in the third and fourth quarters of this year, American GDP growth is also expected to be terribly slow in most of 2021."

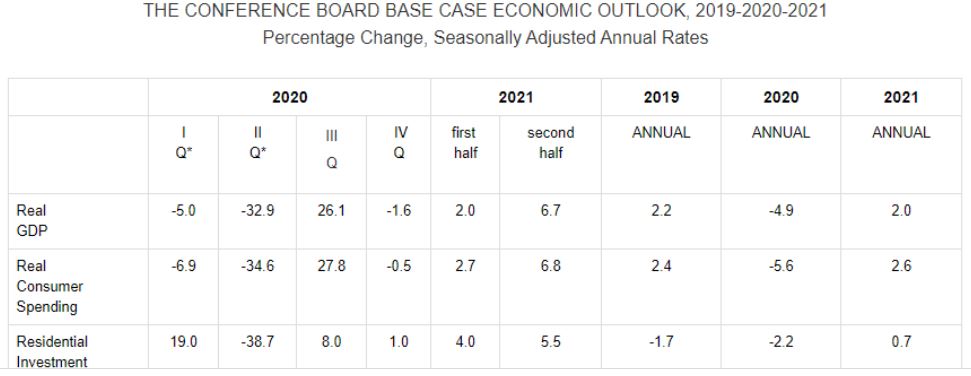

"The Conference Board expects a rebound of about 26% (SAAR) in Q3 and a fourth-quarter contraction of 1.6%. In the Conference Board view, the economy shrinks about 4.9% in 2020 and recovers about 2% in 2021. Other organizations also project the 2020 contraction to be in roughly the same range."

Below is a chart from The Conference Board that lays this all out in a fairly clear and concise manner.

Daniel Laboe in his article, Is The Stock Market Becoming A Safe-Haven For Returns? says The Fed's policies have made the stock market a safe bet.

"The Federal Reserve saved the US stock market: flooding the economy with liquidity and generating an indefinite easy money policy that made future earnings of publicly traded enterprises more valuable than ever (low-interest-rates = low discount rate)."

Laboe reasonably argues that the lower than low returns offered by US Treasury instruments have pushed institutional investors into significantly higher risk investments like equities, but the Fed's support of the stock market is lessening the risk. Laboe cites Apple (AAPL) as one example.

"Apple is a staple of the US stock market, and the public has been trading it as such. AAPL is viewed as about as safe as treasury note, with its fortress of a balance sheet, reliable yield that matches the treasury, and not to mention massive capital growth potential, already returning investors 145% in the past 52-weeks."

To his credit Zaboe does question the "safe-haveness" of the stock, "I question its continued ability to provide investors this type of outsized gains in the year to come. Over the past year, AAPL's 12-month forward P/E valuation doubled from a sensible 16x to a stretched 32x."

Zaboe says that Apple is only one example and that "You can see this rotation out of fixed-income and into equity demonstrated in the valuations of many blue chip stocks over the past 3 months, specifically those in tech."

So maybe this explains why the market is going up, but a safe-haven it makes it not. "Sinnerman where you gonna run to" (as the song goes), when the market goes down?

Julie Cheung gets practical in her article, Great Tips To Save Money During The Pandemic. I've got to say that some of her suggestions are right down obvious, but for those who have been so caught up in the pre-pandemic maelstrom, they may not have crossed your mind.

"Polish Up on Your Cooking Skills" means eat-in and save money.

"Sell Your Old Smart Gadgets" is an innovative one you might not have thought of, but Cheung writes, "it’s an excellent time to trade your old gadgets to some cash and upgrade to a new one. You’ll probably find lots of deals from which to choose. The time to buy probably won’t get any better than it is now."

"Start a Garden" means save money by "growing your own". Okay, this one is a little "Pollyanna (ish)". But growing some herbs in pots on the windowsill, will make you feel good (provided they don't die).

"Get Published". In the digital economy people have been known to pay for information or advice online, be it good or bad. I'm not sure about this suggestion but Finance Girl says if you're good, you can generate passive income. "Sites like Amazon’s Kindle Direct Publishing will walk you through the formatting process."

"Save Your Pocket Change". If your grandmother didn't teach you this one, now is certainly the time to learn. "Make it a point to check your wallet or pockets for extra coins. You’ll be surprised how much you can save."

As Cheung notes,"The pandemic has hit all of us hard and in many unexpected ways. However, that doesn’t mean we can’t make the best out of the situation and save some money. You may find that you’re better off without some of the things you used to do before." You get the idea.

Have a good week. See you in September.