Strong Chinese Agriculture Purchases Likely To Continue In 2021

China has increased agricultural imports this year for several reasons, and it appears as though these strong purchases are set to continue into 2021, which should mean the agri complex remains well supported next year.

Why has China boosted agri imports?

Agricultural markets have received a boost in 2020, and one of the key drivers behind this has been a significant pickup in Chinese demand over the year.

Whether it is soybeans, corn, wheat or sugar - all have seen a significant increase in Chinese buying over the year. Soybean imports over the first 10 months of the year are up almost 18% YoY, inflows of corn are up 97%, sugar imports have increased by 28% YoY, and wheat imports have grown by 163% YoY (WEAT).

So why are we seeing this pickup in Chinese buying? While the 'phase-one' trade deal is probably playing a role in more imports of certain agricultural commodities, it is certainly not the only reason. There is likely an element of China ensuring food security amid the pandemic, given the potential disruptions to global supply chains.

Meanwhile, further support for agricultural purchases has come from the fact that pig herds in China are starting to recover following the African swine fever outbreak over 2018 and 2019. The government has made it a priority to increase pork production in the country, after the outbreak saw pig herd in the country fall to its lowest levels in 16 years in 2019, pushing up pork prices. According to government data, China’s pig herds in October was 26.9% higher YoY, and with this strong growth, demand for animal feed has grown, which has been supportive for corn and soybeans (CORN, SOYB).

Over the years we have seen China draw down inventories in certain commodities. The domestic corn balance has tightened, with flat production, and continued demand growth, and so there is a need to rebuild stocks. The outlook for corn demand remains constructive in the longer term, particularly given China’s aim of implementing a nationwide 10% ethanol mandate, which was meant to be implemented in 2020, however, it was suspended due to tightening corn stocks and limited production capacity for ethanol.

Given China’s environmental/ carbon reduction targets, the mandate will likely be implemented at a later stage, which should be supportive for corn demand.

US-China trade deal continues to support strong purchases

A large chunk of the buying we have seen this year comes from the 'phase-one' trade deal between China and the US, with China trying to hit its target under the agreement. Although trade data suggests that the target will still be difficult to reach this year.

According to the Peterson Institute for International Economics, up until October, China had only reached a little over 52% of its full-year target of US$36.6bn. Given that the phase-one trade deal is a two-year deal, with the value of exports set to pick up over the second year to US$43.6bn, Chinese buying could very well continue to support a number of agricultural markets. If imports fall short of the target this year, there is the potential that this will need to be made up for next year.

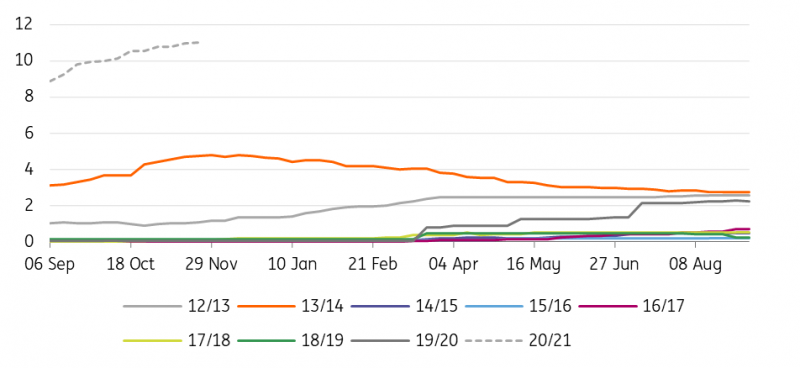

If we look at export sales from the US to China, total commitments so far in the current marketing year (starting in September) total a little over 11mt, up from just 60kt at the same stage last year, and is the largest amount of US corn sales we have seen to China by this time of the year going as far back as the 2012/13 season. While some of these sales may be cancelled in the months ahead, almost 2.9mt of corn has already been exported to China since September, and that already exceeds the full amount exported in the 2013/14 marketing year. In fact, these sales have already exceeded China’s total annual import quota of around 7mt, and so we will need to see the government issue further quota allowances. There have already been reports that the government has increased this quota by 5mt.

Meanwhile, for US soybean sales to China, total commitments stand at a record 29.2mt so far this marketing year, well above the 9.3mt sold by the same time last year, and above the record 24.7mt seen by the same stage in the 2016/17 season. Meanwhile, actual exports so far in the season stand at around 17.7mt, up from 5.6mt last year.

Given there is still a large portion of outstanding sales, and assuming we do not see significant cancellations, strong export volumes from the US to China will continue in 2021.

Total US corn export commitments to China (mt)

Source: USDA, ING Research

Others also benefiting from the stronger buying

It is not just the US benefiting from China’s increased appetite for agricultural imports.

Brazil has also seen strong soybean flows to China over the course of the year, which has seen Brazilian cash values move higher. Brazilian cash values traded to almost a record US$3/bu premium over CBOT soybeans, highlighting the strong Chinese buying. Meanwhile, the broad weakness that we have seen in the BRL has also helped to make Brazilian soybeans more competitive. Chinese imports of Brazilian beans have remained stronger YoY despite the increased purchases we are seeing from the US. Brazilian farmers will be hoping that this continues into 2021, given that the country is set to harvest a record soybean crop in their 2020/21 season.

ING forecasts

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information ...

more