Stocks Stumble After Retail Rout, Coke Collapse, Bezos Bombshell, & Trade Turmoil

The algos were in charge today as headline after headline spooked stocks and sparked buying panics...

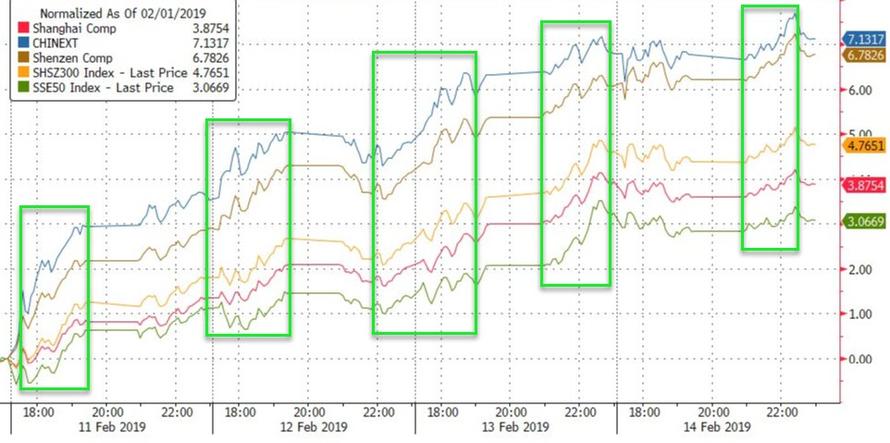

China continues to extend post-new year gains...

(Click on image to enlarge)

European markets dropped today (hurt by US retail sales sentiment)...

(Click on image to enlarge)

And before we get to US markets, let's just ponder this shitshow...

(Click on image to enlarge)

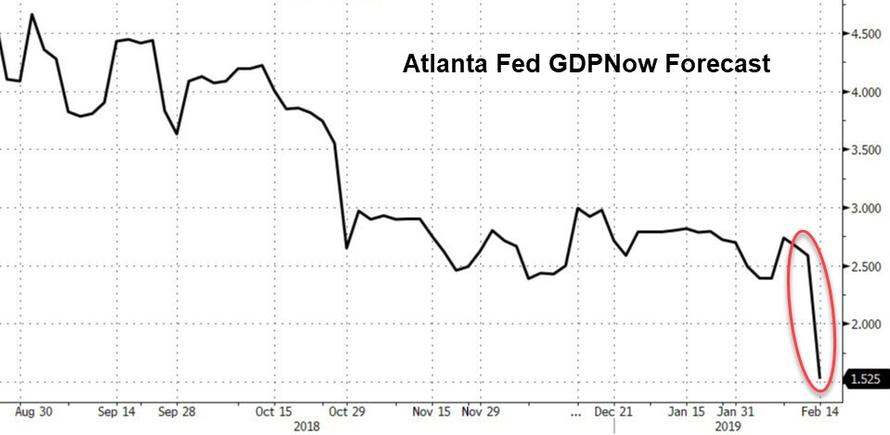

And GDP expectations are cratering...

(Click on image to enlarge)

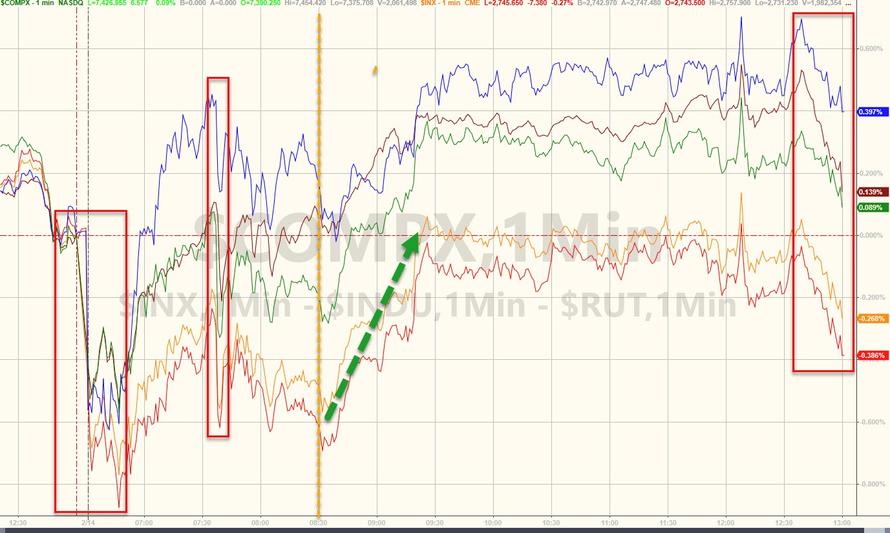

US Futures show the day's chaos - standard overnight drift higher (positive China trade data which is only good due to new year timing), then a punch in the face by US retail sales, followed by headlines on China trade being "deadlocked", stocks puked into the open only to be rescued by Larry Kudlow proclaiming everything is awesome. Stocks were steady then knee-jerked up on headlines from McConnell that Trump will sign border deal but were unsure as Trump is said to use emergency powers to fund his wall...and then we dumped into the close...

(Click on image to enlarge)

Small Caps, Trannies, and Nasdaq outperformed...

(Click on image to enlarge)

Another short-squeeze saves the day...

(Click on image to enlarge)

The Buyback index is up 30 days this year (only 3 down days)...

(Click on image to enlarge)

Coke was not "it" today...

(Click on image to enlarge)

Bezos abandoned NY and the stock surged back to unchanged before fading back...

(Click on image to enlarge)

But SL Green Realty stumbled...

(Click on image to enlarge)

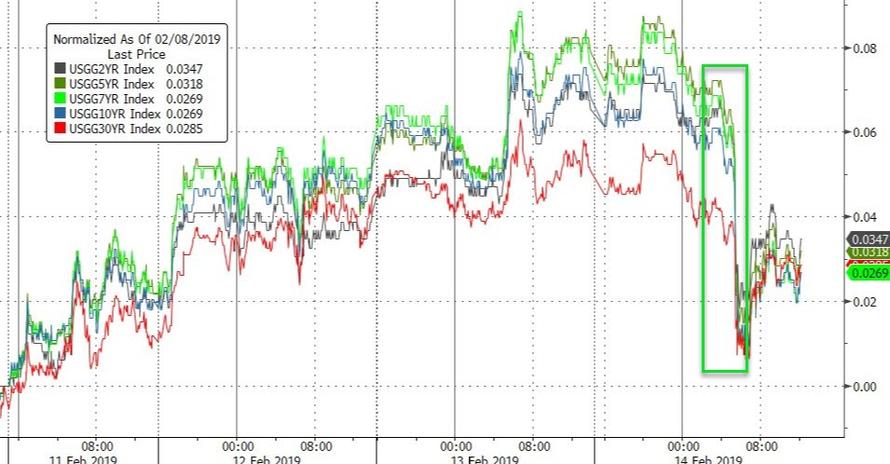

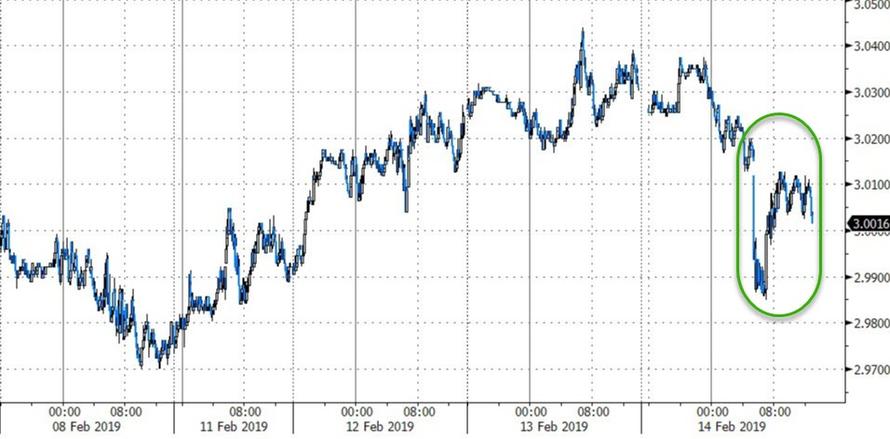

Treasury yields tumbled after the retail sales collapse...also perhaps helped by the fact that the IG calendar slowed...

(Click on image to enlarge)

30Y Yields tumbled back below 3.00% on the retail sales print...

(Click on image to enlarge)

The dollar swung around like a penny stocks today on the back of weak data and trade headlines...

(Click on image to enlarge)

Cable drifted lower after several more failed Brexit votes...

(Click on image to enlarge)

Cryptos flatlined despite headlines about JPMCoin...

(Click on image to enlarge)

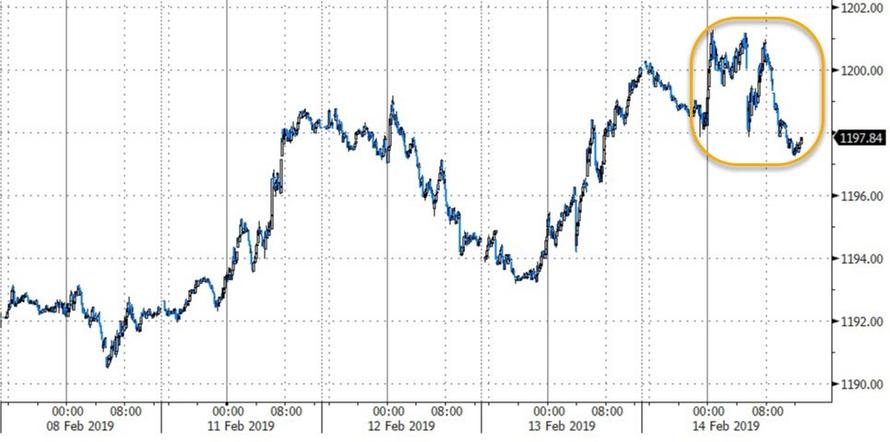

Copper and silver lagged today as oil and gold gained (as the former performed another miracle)...

(Click on image to enlarge)

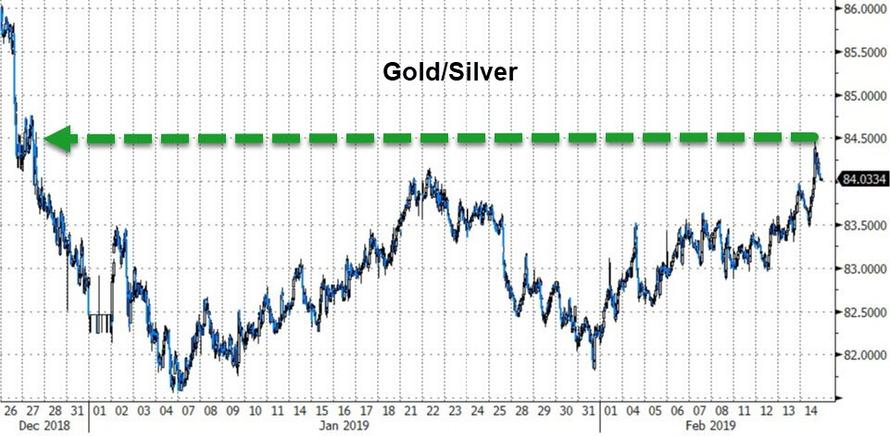

Gold pushed up to its strongest relative to silver since late December...

(Click on image to enlarge)

Finally, we ask "did stocks just ring the bell?"

(Click on image to enlarge)

BMO's Brad Wishak points out that the largest stock market in the world is suggesting perhaps so, as we again stall out on a test of the 200-day-moving-average (as we did in Nov and Dec as well). The NYSE ($30 trillion market cap) continues to be my most reliable guidepost despite getting little attention from the mainstream overall. DING DING.

"Something Changed" again also... for the 4th day in a row - the last 30 minutes of the day have seen notable selling pressure...

(Click on image to enlarge)