Stocks Slide On India-Pakistan Hostilities As Traders Brace For Day Of Fireworks

After two days of surprising weakness in US cash stocks in the last hour of trading, and following an overnight session in which S&P futures were offline for two hours following a "glitch" at the CME Globex exchange, world markets are a sea of red as stocks fell in Europe alongside US equity futures pressured by disappointing corporate earnings and a dramatic escalation in India-Pakistan hostilities after Pakistan reportedly shot down two Indian fighter jets even as traders brace for a barrage of news including the latest Trump-Kim summit, the Congressional testimony by Trump's former lawyer Michael Cohen, and the second day of Powell's testimony on the hill this time before Maxine Waters and AOC. Treasuries yields dropped, as did the dollar.

The European Stoxx 600 index was down about 0.5%, with all the main regional indexes were in the red as Air France-KLM dropped the most ever and Nivea hand-cream maker Beiersdorf cut guidance, sparking a selloff in consumer stocks.

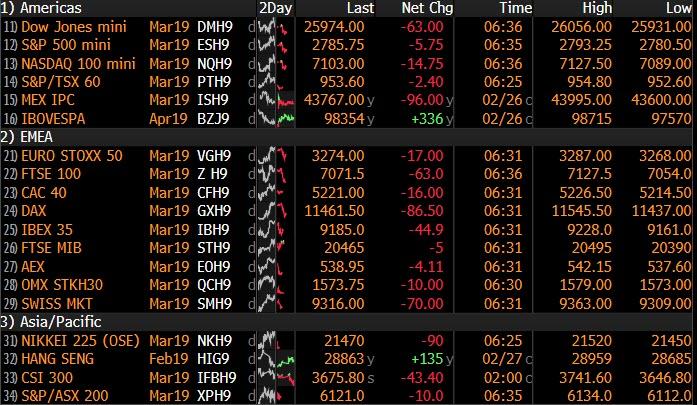

Earlier, all eyes were on the latest Asian geopolitical conflict: S&P futures fell, Japan equities came off their highs, Hong Kong faded an advance after Pakistan said it had downed two Indian jets, sending Indian and Pakistan bonds and currencies lower and MSCI’s index of Asia-Pacific shares ex-Japan sliding 0.1% as the threat of conflict between the nuclear-armed neighbors grew. Australia's ASX 200 (+0.4%) gains were led by energy names following the rebound in the complex after sources stated that OPEC are to stick to their output curb agreement coupled with bullish API inventory data, while Nikkei 225 (+0.5%) benefitted from the strength in the healthcare sector. Elsewhere, Shanghai Comp (+0.4%) benefited from gains in IT names whilst the latter profited from the strong performance in heavyweight energy and financial names.

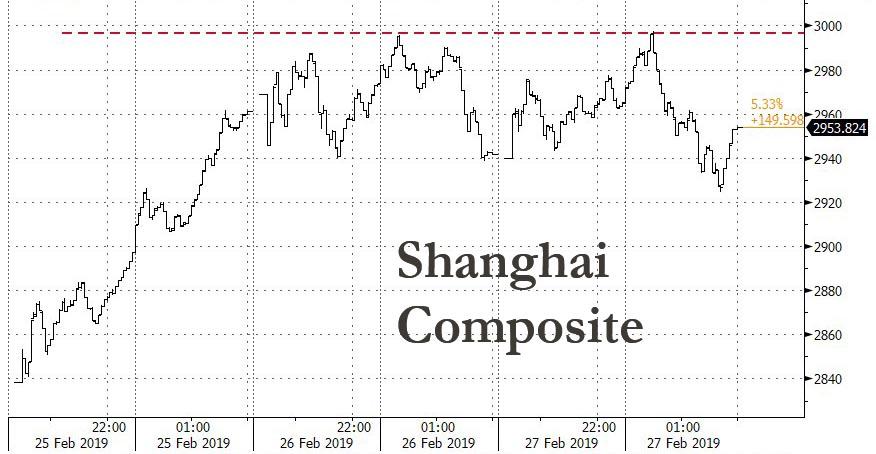

Meanwhile, just as 2800 has emerged as an uncrossable resistance line for the S&P, China is having the same issue with the 3000 level on the Shanghai Composite as Chinese stocks erased a gain in the afternoon, with the Composite again failing to cross the 3,000-point level after climbing into the bull market earlier in week. The Shanghai benchmark climbed as much as 1.9% earlier in the day before seeing much of its gains fade and close up just 0.4%.

"It was purely a liquidity-driven rebound without the support of fundamentals, so nobody expected the market to embark on another bull run to hit 5,000 points," said Yin Ming, vice president of Shanghai-based investment firm Baptized Capital. "When the index nears the technically important 3,000-point level, investors will choose to exit first and wait for bargains after the correction. With gains in recent sessions, shareholders of firms are finally able to close out their share-pledge positions to repay loans."

India’s rupee reversed gains and Pakistan’s benchmark stock index plunged more than 3 percent in Karachi before recovering after the latest escalation in tensions. The Pakistani action came a day after India’s Air Force jets bombed what it said was a terrorist training camp inside Pakistan.

"This adds another layer of risks for investors”, said Charles St-Arnaud, a strategist at Lombard Odier, although he noted the market moves remained limited for now.

US Secretary of State Pompeo spoke to the Indian and Pakistani Foreign Minister separately according to the US State Department. The Secretary of State urged Pakistan to avoid military action against India following the previously reported Indian air strike on a terrorist camp on Pakistan. Furthermore, at least three Pakistan fighter jets have entered the Indian side of Kashmir, Indian Air Forces intercepted the Pakistani planes; according to an Indian Official. It was later reported that an Indian Air Force jet has crashed in Jammu & Kashmir, according to PTI. Pakistan Foreign Ministry confirms they have shot down two Indian planes and arrested a pilot, states that we have no intention of escalation, but are prepared to do so if forced into that situation.

As Bloomberg notes, investors have added the India-Pakistan conflict to a host of other uncertainties from China trade talks to Brexit, that could rein in a recovery in global equities from December lows. U.S. President Donald Trump is in Hanoi for a second summit with North Korean leader Kim Jong Un, with the outcome uncertain. Powell’s testimony on Tuesday helped steady the ship, though, as he gave no indication that the Fed is ready to alter policy any time soon.

S&P500 futures were down 0.2%, after earlier a Globex malfunction around 740pm ET halted trading in ES, Treasury and commodity futures, prompting trader anguish for nearly two hours before the "glitch" was eventually resolved.

Markets are also watching the U.S.-North Korean summit, which began shortly after 6 am ET in Hanoi. President Trump is meeting North Korean leader Kim Jong Un for their second summit, with the United States pushing North Korea to dismantle its nuclear weapons program.

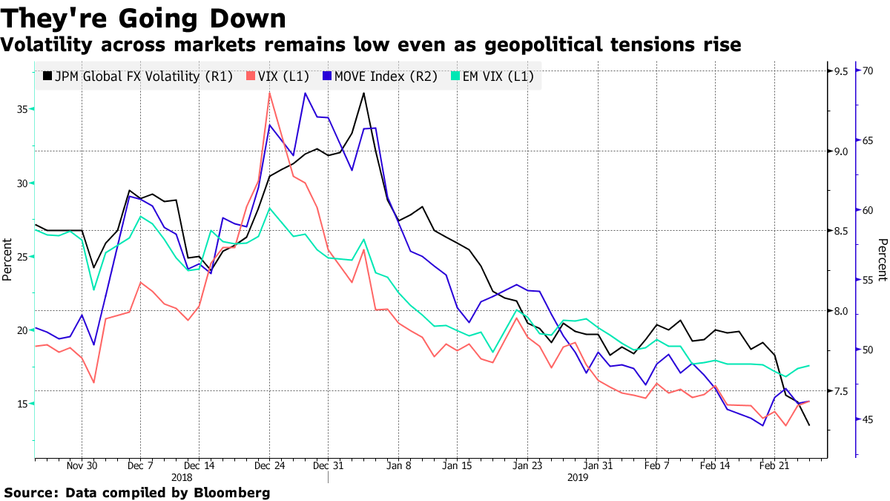

The heightened geopolitical risks helped assets considered safer than stocks, such as the Japanese yen, which gained against the dollar. Paradoxically, while news of the worst escalation between the two nations since the 1971 war moved the yen higher and India’s rupee lower, volatility across currencies continued on its downward trend as traders continue to sell vol in droves.

In political news, overnight the US House voted to block President Trump's national emergency declaration regarding a Mexican border wall, as expected. The bill will now be passed onto Senate before eventually being vetoed by the president.

Of note, also today Trumps's former lawyer Michael Cohen will testify publicly that Trump is a racist, conman & cheat, and that Trump knew ahead of time that Wikileaks were to release Democratic Committee emails hurting Hilary Clinton's election campaign; draft statement.

In the latest Brexit news, UK PM May said she is close to winning concessions from the EU that could persuade Eurosceptic MPs to back her deal. More notably, Brexiteer Jacob Rees-Mogg has softened his stance on PM May's Brexit deal; he is no longer insisting the Irish backstop be scrapped and he is prepared to consider other legal fixes to make sure it does not become permanent. Cabinet Ministers warned PM May that Brexit could be delayed by up to two years after she announced a series of votes on her deal, no deal and a Brexit delay to be held in a fortnight. Meanwhile, the newly-formed Independent Group has tabled an amendment demanding the government to commence preparations for a second EU referendum. The amendment reportedly has support from the SNP, LibDems, and Plaid Cymru and is said to be aimed at provoking a fresh split in the Labour party by tempting MPs who are seeking a new vote.

In FX, the dollar hovered around a three-week low after Federal Reserve Chairman Jerome Powell reiterated on Tuesday the Fed had shifted to a more “patient” policy approach regarding changes to interest rates. “We didn’t learn much new,” St-Arnaud said. The new dovish stance of U.S. monetary policy had not weakened the dollar much, notably against the euro.

Elsewhere, the British pound continued to rise after Prime Minister Theresa May offered lawmakers a chance to vote on delaying Brexit. The pound approached $1.3300 as leveraged accounts bought the currency as it dipped earlier in the day, while gilts declined. The euro recovered from a loss as the dollar erased an Asian session advance; the pound was up a fourth day, its longest winning streak since September amid continued Brexit optimism after Prime Minister Theresa May bought herself more time to secure a Brexit agreement. Scandinavian currencies led the advance after better-than-forecast data; unemployment unexpectedly fell in Norway and retail sales beat estimates, while a Swedish economic tendency survey rose. Australia’s dollar surrendered early gains on disappointing building data.

In rates, bunds were little changed, Treasuries were steady after earlier whipsawing and U.S. equity futures drifted lower; the previously noted technical error at CME Group Inc. disrupted trading of contracts tied to Treasuries and commodities.

Today's Data include factory orders, pending home sales and mortgage applications. Lowe’s, Square and American Tower are due to report earnings

Market Snapshot

- S&P 500 futures down 0.3% to 2,782.50

- STOXX Europe 600 down 0.5% to 371.76

- MXAP up 0.1% to 160.43

- MXAPJ down 0.1% to 526.18

- Nikkei up 0.5% to 21,556.51

- Topix up 0.2% to 1,620.42

- Hang Seng Index down 0.05% to 28,757.44

- Shanghai Composite up 0.4% to 2,953.82

- Sensex down 0.1% to 35,927.20

- Australia S&P/ASX 200 up 0.4% to 6,150.27

- Kospi up 0.4% to 2,234.79

- German 10Y yield rose 0.4 bps to 0.122%

- Euro up 0.02% to $1.1391

- Brent Futures up 0.8% to $65.70/bbl

- Italian 10Y yield fell 6.8 bps to 2.346%

- Spanish 10Y yield rose 0.5 bps to 1.143%

- Brent Futures up 0.8% to $65.70/bbl

- Gold spot down 0.2% to $1,326.29

- U.S. Dollar Index down 0.01% to 96.00

Top Overnight News from Bloomberg

- U.S. President Donald Trump plans to hold a one-on-one meeting with North Korean leader Kim Jong Un on Wednesday before the two leaders dine together with aides as they kick off their second summit aimed at a deal for Pyongyang to surrender its nuclear arsenal

- Donald Trump’s administration regularly denounces Nicolas Maduro as an autocratic Cuban puppet and may hit the Caribbean island with new sanctions over its support for the Venezuelan leader

- Leading Brexit purist Jacob Rees-Mogg, who has opposed Theresa May’s exit deal, appears to be softening his stance, making it more likely that the divorce agreement could win Parliamentary approval next month

- The European Union is unlikely to offer concessions to the U.K. on its Brexit deal until just before the British Parliament votes on it, triggering a frantic two-week period that culminates in a critical summit of leaders

- U.K. financial firms were dealt a blow after EU policy makers agreed to tighten the rules governing the City of London’s access to the bloc after Brexit

- Bank of Japan board member Goushi Kataoka says the central bank should try to widen the gap between supply and demand by ramping up its easing measures in pursuit of 2% inflation. BOJ may resort to more QE if yen jumps, according to Takahide Kiuchi, a former policy board member

- A Bloomberg Economics gauge indicates that China’s economy is showing the first signs of recovery after months of slowdown, as stock and commodity rallies lift confidence

- A technical error at CME Group Inc. prompted a lengthy trading halt at the world’s largest exchange operator, preventing the buying and selling of contracts tied to U.S. Treasuries, stock-futures and commodities

- The House voted to block President Donald Trump’s declaration of a national emergency on the U.S.-Mexico border, sending the measure to the Senate where the GOP majority will be forced to take a stand on whether to defy their president

- Greece’s foot-dragging on some key economic reforms is raising creditor concern, putting at risk a planned debt relief measure next month and a rebound in its stock and bond markets

- Italian business and economic confidence fell, signaling a possible continuation of the recession that started late last year

Asian equities were higher across the board following a subdued lead from Wall Street where the Dow dipped into the red following disappointing earnings from Home Depot and the S&P retreated further below the 2800 level. ASX 200 (+0.4%) gains were led by energy names following the rebound in the complex after sources stated that OPEC are to stick to their output curb agreement coupled with bullish API inventory data, while Nikkei 225 (+0.5%) benefitted from the strength in the healthcare sector. Elsewhere, Shanghai Comp (+0.4%) and Hang Seng (U/C) extended on gains from the open with the former supported by IT names whilst the latter profited from the strong performance in heavyweight energy and financial names. Furthermore, Morgan Stanley raised its targets for Chinese equities, citing policy stimulus alongside positive trade developments. BoJ Governor Kuroda said the chance of Japanese inflation to hit the 2% target during FY 2020 is low and any exit from the BoJ's ultra-easy policy will be very gradual. BoJ Board Member Kataoka disagrees with the BoJ's view of persistently easing policy to reach price goal and added that longer monetary easing will bring more side effects. Kataoka also added that the BoJ is still far from ending its ultra-easy policy. He expects any sales-tax hike driven pickup in Japan's economy to be moderate and said Japan's inflation expectations remain weak whilst also acknowledging that global growth has slowed compared to the prior year.

Top Asian News

- China Is Studying Plan to Restructure Vaccine Sector: CSJ

- H.K. Govt ‘Gravely Concerned’ Over Claims Against H.K. Airlines

- Here’s What You Need to Know About Asia’s Stock Markets Today

Major European equities are in the red [Euro Stoxx 50 -0.5%], following a subdued lead from Wall Street and modest gains in Asia overnight, as traders are mindful of growing tensions between India and Pakistan. There is some mild underperformance in the Dax (-0.7%) where only 3 companies are in the green; although losses are limited by strong performance in Bayer (+4.5%) after the Co. posted a beat on their Q4 sales. Sectors are similarly broadly in the red, with underperformance seen in consumer staples. Other notable movers include Marks & Spencer (-9.5%) who are at the bottom of the Stoxx 600 after the Co. are considering a rights offering to fund their joint venture with Ocado (+4.7%). Air France (-11.7%) are down as the Dutch government has taken a 12.7% shareholding in the Co. in an attempt to protect their interests; which may lead to tensions with France who hold a 14.3% stake in the Co. Rio Tinto (+0.4%) are in the green after posting a significant increase in FY net earnings of USD 13.64bln vs. Prev. USD 8.76bln alongside the announcement of a special dividend.

Top European News

- Air France-KLM Tumbles After Dutch State Builds Surprise Stake

- Britain’s Winter Heat Wave Means Wildfires and Chronic Pollution

- Ted Baker Plunges After Profit Warning Adds to Clothier’s Woes

- Brexiteer Rees-Mogg Softens Stance on May’s Deal: Brexit Update

In FX, the Dollar continues to sag in wake of Fed chair Powell’s reinforcement of the new patient policy stance and on portfolio rebalancing for the turn of the month. The DXY has retreated below 96.000 as a result, and with additional downside pressure coming from the escalation in tensions between India and Pakistan that has prompted greater demand for safer currency havens relative to the Greenback.

- CHF/GBP The Franc and Pound are vying for pole position within the G10 ranks, as the former benefits from defensive positioning amidst the aforementioned rise in Indian-Pakistani hostilities, with Usd/Chf reversing more definitively from par-plus levels to around 0.9970. Meanwhile, Sterling has extended gains on the back of Tuesday’s marked turnaround on Brexit from UK PM May that raises the prospect of a delay to Article 50 and odds on a no deal or cliff edge conclusion to the already protracted withdrawal process. Cable is now probing 1.3300 after eclipsing resistance just shy of the big figure (1.3298 high from September 2018), while Eur/Gbp is hovering around 0.8570 and eyeing chart support a few pips below, like a Fib at 0.8548.

- CAD/JPY The next best majors, with the Loonie drawing comfort/support from a rebound in crude prices and the more pronounced downturn in the Usd, to rebound firmly over 1.3200 again and pivot 1.3150, while Usd/Jpy has now breached its 100 DMA more convincingly to trade under 110.40. Note, 110.00 should be well supported given the 30 DMA at 110.02, and with hefty expiries looming at the strike on Thursday (2 bn), and next up for the CAD top-tier Canadian CPI data and avg. earnings.

- AUD/NZD/NOK/SEK Contrasting fortunes for the more high-beta and risk-sensitive Antipodean Dollars and Scandi Crowns, as the Aussie and Kiwi underperform in wake of disappointing data overnight (Q4 construction and January trade respectively), but the Nok and Sek glean protection from the overall risk-averse environment with the aid of upbeat macro releases (retail sales, manufacturing and overall industry sentiment, plus trade). Aud/Usd is currently near the bottom of a 0.7198-65 range, Nzd/Usd close to 0.6874 vs 0.6901 at one stage, while Eur/Nok is under 9.7200 and Eur/Sek around 10.5500.

- EUR The single currency is also gaining at the expense of the Greenback, with one prominent bank flagging strongest month end Usd sell signals against the Eur. However, technical obstacles around 1.1400 are proving tough to overcome and the decline in Eur/Gbp noted above is also hampering the single currency to a degree

In commodities, Brent (+1.3%) and WTI (+1.6%) prices are higher and trading towards the top of the sessions range, after yesterday’s unexpected -4.2mln draw in API Weekly Crude Inventories compared with the expectations for a +2.8mln build. Recent newsflow has seen comments from Saudi Energy Minister Al Falih saying that he sees a likelihood of an output cuts extension in H2 and are aiming for March oil exports of 7mln BPD. Separately, the Russian Energy ministry is reportedly planning to meet with Russian oil companies on March 1st in order to discuss the OPEC+ deal. Elsewhere, Nigerian President Buhari has won the re-election, which is to be contested in court and oil prices were little affected by the CME group’s technical issues which resulted in WTI live prices being unavailable for a time. Gold is flat as it follows the dollar after the first testimony by Fed’s Chair Powell yesterday to the Senate and ahead of his testimony to the house today at GMT 15:00. Elsewhere, Freeport’s CEO has instructed his employees to immediately report any safety concerns regarding dams the Co. operate; following January’s Vale mine disaster. Separately, Copper has slipped slightly from it’s 7-month high which was spurred by falling supply and dollar weakness.

In terms of the day ahead, we’re due to get the December advance goods trade balance, and final revisions to December wholesale inventories, durable goods, and capital goods orders. Away from that, Powell will speak again, this time testifying to the House Financial Services Committee Panel, while the ECB’s Coeure and Weidmann are due to speak. In the UK the House of Commons will be voting today however it’s unlikely to be significant in light of yesterday’s developments, The other potentially important event to watch is US Trade Representative Lighthizer testifying to the House Ways and Mean Committee’s hearing on the US-China trade talks.

US Event Calendar

- 8:30am: Advance Goods Trade Balance, est. $73.9b deficit, prior $70.5b deficit

- 8:30am: Retail Inventories MoM, est. 0.2%, prior -0.4%; Wholesale Inventories MoM, est. 0.4%, prior 1.1%

- 10am: Pending Home Sales MoM, est. 1.0%, prior -2.2%; Pending Home Sales NSA YoY, est. -4.55%, prior -9.5%

- 10am: Factory Orders, est. 0.6%, prior -0.6%; Factory Orders Ex Trans, prior -1.3%

- 10am: Durable Goods Orders, prior 1.2%; Durables Ex Transportation, prior 0.1%

- 10am: Cap Goods Orders Nondef Ex Air, prior -0.7%; Cap Goods Ship Nondef Ex Air, prior 0.5%

DB's Jim Reid concludes the overnight wrap

If you’re looking for the next box set to binge on and are happy to suspend any semblance of belief then I can give a wholehearted recommendation to watch Ozark (Netflix). It’s in the mould of Breaking Bad for the uninitiated. Over the last month, we have watched the two available series back to back and are now at a loss as to what to do with our evenings again. More time for stressing about kitchens, bathrooms, carpets, new windows, boilers, guttering and the like.

After watching last night’s tense finale, markets seem positively mundane at the moment. Mr. Powell might have ignited the flame for positive sentiment at the start of the year but 8 weeks on markets weren’t particularly fussed by the first of his semi-annual testimonies yesterday in front of the Senate. We’ll touch on what he said shortly however 10y Treasuries traded in a range of just a few of basis points as Powell spoke, before ending the day down -2.5bps at 2.638%. We went back and looked at the range since Powell spoke in early January and found that on a closing basis, the range has been just 15.5bps which is the smallest since June last year, and the second smallest since October 2017. The MOVE index (implied vol of 1-month treasury options) is back down slightly above all time lows (data back to 1988) so central banks have killed vol again for now. As for the response in equites yesterday, reaction to the testimony was mixed as US stocks oscillated between losses and gains with the S&P 500 and NASDAQ indexes retreating -0.08% and -0.09%, respectively, at the close. They do remain +14.13% and +16.80% off their Jan 3 levels before Powell’s initial policy U-turn sparked a rebound in markets. US HY spreads are -122bps tighter over the same period, having tightened -3bps yesterday.

So the change in message has worked for markets in 2019 but there wasn't much more to give yesterday as it was mostly a repeat of the recent mantra in favor of patience before any further rate hikes are seen. Powell repeated that “our policy decisions will continue to be data dependent” and that “we’re in no rush to make a judgment about changes in policy.” So the Fed continues to be on the sidelines for now. Powell justified his position by citing “muted” inflation pressures and the fact that “growth has slowed in some major foreign economies, particularly China and Europe.” Finally, he also noted that “uncertainty is elevated around several unresolved government policy issues, including Brexit and ongoing trade negotiations.”

Before that, European markets had closed mostly higher, with the STOXX 600 gaining +0.39%, and indexes across the continent advancing as well. The main exception was the FTSE 100, which retreated -0.45% amid a large rally in the pound on positive Brexit developments (details below). Bund yields rose +0.8bps, while peripheral spreads tightened with Italian BTPs yields -6.9bps lower. European HY credit spreads tightened -4.9bps to their tightest level since November.

The other main piece of news yesterday surrounded Brexit with a few more dates for your diaries. PM May confirmed that should her deal be rejected by March 12, then the PM will put forward the choice to MPs of a no-deal Brexit vote on March 13 and should that be rejected, then a vote on extending Article 50 will be put forward on March 14. We know that May would ask for a short and one-off extension (not beyond June) but we don’t know what the EU will agree to and we won’t know for sure until the EU engage on the issue. Bloomberg has previously reported some EU officials as saying they would back an extension of as much as 21 months but the truth is we won’t really know until closer to the above dates. GBP/USD rallied throughout the session yesterday, ending +1.21% stronger, its best performance since last November. We’re reading at $1.3248 overnight which is the highest since last July. EUR/GBP is now at 0.857 and the strongest since May 2017. We should add that our FX strategists yesterday reinstated their Sterling long trade in light of recent developments and target 0.84 in EUR/GBP. More in their note here. Overnight the FT has carried interesting quotes from the de facto leader of the eurosceptic Tory wing Jacob Rees-Mogg. He is suggesting that he is no longer looking to scrap the Irish backstop and will instead consider other legal fixes to it. So the mood music continues to move in favor of Mrs. May’s deal albeit without yet having the necessary legal concessions from the EU.

Overnight markets are heading higher with the Nikkei (+0.49%), Hang Seng (+0.60%), Shanghai Comp (+0.79%) and Kospi (+0.24%) all up. Elsewhere, futures on the S&P 500 are trading flat (-0.02%). President Trump and North Korea leader Kim Jong Un are meeting today and tomorrow, with President Trump set to meet North Korea’s Kim at 11:40am GMT. In the meantime, S&P has said that even if the US and North Korea make a formal declaration of an end to the Korean War, it is unlikely to impact South Korea’s rating as the security posed by North Korea will continue to weigh on South Korea’s ratings for the foreseeable future.

In other news, after Italy’s ruling coalition partner M5S lost c. 75% of its vote share in Sardinia (11.18% in 2019 down from 42.5% previously), it’s leader Luigi Di Maio is facing fresh dissent from party members with majority of them calling on him to return the party to its roots and give more power back to the rank-and-file members. M5S trails its other coalition partner League by more than 10% in the most recent polls as the two leaders gear up for May’s European parliamentary elections. In the meantime, Di Maio appeared to recognize the internal dissent yesterday by signaling that he is ready to give some concessions to the party dissenters but added that “we need to have better structure, but my political leadership will only be up for discussion four years from now" (per Bloomberg). This could lead to renewed turbulence in Italian politics but Italian PM Conte and both the ruling coalition leaders have played down the risk of regional and European parliament elections impacting the sustainability of the Italian government by saying that Italy’s current coalition government will govern for its complete term. 91 governments in around the last 117 years might suggest otherwise. One to continue to watch.

Also, interesting yesterday was the US data. The most headline-grabbing were the February surveys where the Richmond Fed manufacturing index rose 18pts to +16 (vs. +5 expected) – and included a big jump in new orders – and the Conference Board consumer confidence reading jumped 9.7pts to 131.4 (vs. 124.9 expected) and the highest since November last year. Both the expectations and present situations components ticked up and it was noticeable again that the chart highlighting the gap between the two (expectations minus present situations) did the rounds again yesterday- albeit with the gap narrowing slightly to -70 from -82. A negative numbers has been billed as a leading indicator of recessions in the past and the only time it’s been more negative than now was in 2001 when it hit -96 just before the recession. Given that the thought was the government shutdown may have impacted the data the fact that there hasn’t been a huge change in the latest reading is certainly noteworthy.

As for the other data, December housing starts surprisingly fell -200k to 1.08m, versus expectations for 1.26m, reaching their lowest level since September 2016. That figure may have been affected by wildfires in the western US, as new permits were strong at 1.33m, close to flat on the month but beating consensus expectations. Overall, the print suggests that the US housing market may indeed be turning a corner after a tepid 2018. The -45bps drop in mortgage rates over the last four months should help too. The FHFA house price index rose 0.3% mom for December and the S&P CoreLogic 20-city house price index rose +0.19% mom, both a touch softer than expected.

In terms of the day ahead, this morning it’s quiet with the January M3 money supply print due for the Euro Area followed by February confidence indicators. In the US we’re due to get the December advance goods trade balance, and final revisions to December wholesale inventories, durable goods, and capital goods orders. Away from that, Powell will speak again, this time testifying to the House Financial Services Committee Panel, while the ECB’s Coeure and Weidmann are due to speak. In the UK the House of Commons will be voting today however it’s unlikely to be significant in light of yesterday’s developments, The other potentially important event to watch is US Trade Representative Lighthizer testifying to the House Ways and Mean Committee’s hearing on the US-China trade talks.