Stocks Ignore European PMI Collapse, Rise On Tech Rally

European and Asian stocks rose and US equity futures were flat, as a rally in European tech shares lifted trader mood ahead of today's ECB meeting and the latest round of US-China trade talks, even as the latest round of collapsing European PMIs was roundly ignored. The dollar climbed and Treasury yields dropped.

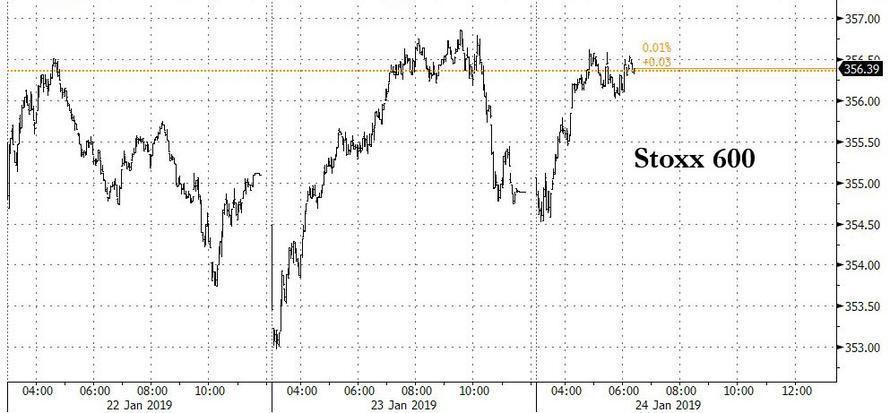

European tech giant STMicro rose as much as 8.4%, lifting the Stoxx 600 Technology Index to a 7-week high after investors brushed aside the chipmaker’s lower-than-expected quarterly sales forecast, focusing on better margins, expected recovery and positive indications from peers in U.S. and Asia. Increases in software and chipmaker shares pulled the Stoxx Europe 600 index higher, which shrugged off weaker euro area PMIs, trading 0.6% higher, and hovering near session peak. Technology, autos and banks lead the gains. The FTSE MIB (+1.2%) outperformed its peers bolstered by strong performance in banking names after Italian PM Conte said the Italian banking system is well capitalized and stable; with markets also looking out for any potential signals from the ECB on TLTROs.

European equity strength was somewhat puzzling as it came on the day the Germany Manufacturing PMI missed badly, printing 49.9, below the 51.3 expected, the lowest print since November 2014 and in contraction for the first time in 5 years...

... while French Service PMI tumbled to 47.5, far below the 50.5 expected, the lowest since February 2014.

The sudden plunge in Eurozone manufacturing and services sentiment suggests that the ECB will likely have to further trim its optimism for a rebound, if not turn outright dovish, a move which could send the Euro tumbling even more (it last traded at 1.1346, the lowest level since the start of the year).

Earlier in the session, Asia’s main stock markets all posted modest gains although trade was far from smooth sailing in Asia-Pac and upside in the other US majors were also capped amid ongoing shutdown concerns and trade uncertainty. ASX 200 (+0.4%) and Nikkei 225 (-0.1%) were mixed throughout the majority of the session as corporate updates dictated price action and in which energy names kept Australia afloat after Santos reported an increase in Q4 output and revenue, while Japanese exporters lacked unison amid an indecisive currency. Hang Seng (+0.4%) and Shanghai Comp (+0.4%) were initially lackluster amid ongoing trade uncertainty and following another substantial daily liquidity drain by the PBoC of CNY 250bln, but then gradually improved as money market rates declined ahead of the 2nd phase of the PBoC’s 100bps RRR taking effect tomorrow.

Meanwhile, in the US, S&P 500 index futures up 0.1%, Nasdaq +0.4% as investors continue to operate with few signals on China trade talks and in a drought of data on the U.S. economy thanks to the longest ever government shutdown. The tit-for-tat battle between President Donald Trump and Democrat leader Nancy Pelosi appears to be escalating. A vote on reopening agencies is set for Thursday.

At the same time, downbeat comments continue to emanate from the annual conclave of global movers and shakers in Davos: “Earnings expectations, particularly in the U.S., are too high,” said Bridgewater co-CIO Greg Jensen in an interview on Bloomberg TV Wednesday from Davos. “And generally the Fed and other policy makers are still expecting stronger growth than we see.”

In rates, European bonds bull flattened with peripherals leading the way. Ten-year BTPs and bonds outperform bunds by 5bps and 4bps respectively, while across the Atlantic, TSY yields were flat to 1bp lower across 2s through 10s, slight flattening bias.

In FX, the euro dropped before the ECB policy decision due out in less than an hour, weighed down by the abovementioned soft PMI data out of the euro area amid a broad recovery for the greenback during the London session. The Bloomberg dollar spot index recovered from an early loss as traders awaited fresh developments from U.S.-China trade talks; the greenback rallied against the euro in London hours to 1.1339, nearing a three-week high, after an expected rebound in French activity in January failed to materialize; composite PMI dropped to 47.9, the lowest in more than four years; Treasuries edged higher, underperforming European peers. The Aussie was the worst performing major, and hit a three-week low after National Bank of Australia, one of the big four banks, raised mortgage rates prompting concerns the central bank may have to ease policy; the AUD rallied earlier on better-than-expected employment data. Sterling dropped on profit-taking and the Norwegian krone rose after the central bank reiterated its outlook for gradual interest-rate increases.

In commodities, Brent (-0.4%) and WTI (-0.1%) pared back some of the downside seen after yesterday’s unexpected API crude stocks build of +6.55mln vs. Exp -0.4mln; with markets now looking to today’s EIA release. Separately, US President Trump has stated that oil sanctions could be imposed this week on Venezuela if the political situation deteriorates further.

Expected data include jobless claims and PMIs. American Airlines, Bristol-Myers, Union Pacific, Intel and Starbucks are among many companies reporting earnings.

Market Snapshot

- S&P 500 futures up 0.2% to 2,642.50

- STOXX Europe 600 up 0.4% to 356.24

- MXAP up 0.3% to 152.67

- MXAPJ up 0.4% to 496.32

- Nikkei down 0.09% to 20,574.63

- Topix up 0.4% to 1,552.60

- Hang Seng Index up 0.4% to 27,120.98

- Shanghai Composite up 0.4% to 2,591.69

- Sensex up 0.1% to 36,142.78

- Australia S&P/ASX 200 up 0.4% to 5,865.69

- Kospi up 0.8% to 2,145.03

- German 10Y yield fell 1.4 bps to 0.211%

- Euro down 0.3% to $1.1343

- Italian 10Y yield rose 1.1 bps to 2.394%

- Spanish 10Y yield fell 3.2 bps to 1.281%

- Brent futures little changed at $61.12/bbl

- Gold spot down 0.2% to $1,279.91

- U.S. Dollar Index up 0.3% to 96.38

Top Overnight News

- President Trump tweets that he will give State of the Union address when the partial government shutdown is over

- While headline oil futures barely moved on the back of a deepening crisis in Venezuela, the price of barrels that more closely mirror the Latin American country’s supplies surged to a fresh five-year high on Wednesday relative to WTI

- Venezuelan bond prices climbed for a fourth day as anti-government protests throughout the country spurred speculation that President Nicolas Maduro’s regime could be coming closer to an end

- The Swiss National Bank intends to keep interest rates at a record low and can even reduce them further if the political risks dominating the outlook explode into a bigger crisis, President Thomas Jordan said

- Malaysia’s central bank left its benchmark interest rate unchanged on Thursday, as expected, giving a little indication on whether it sees room to ease policy amid subdued inflation and weak economic growth

- Jardine Matheson Holdings Ltd., the flagship investment firm of a 186-year-old conglomerate, plunged 83 percent, wiping out as much as $41 billion in market value, before quickly recovering, with traders speculating that a fat finger error may have caused the dramatic drop

Most Asian bourses eventually followed suit to the gains stateside where the DJIA led the majors higher on better than expected earnings from several of its components, although trade was far from smooth sailing in the Asia-Pac region and upside in the other US majors were also capped amid ongoing shutdown concerns and trade uncertainty. ASX 200 (+0.4%) and Nikkei 225 (-0.1%) were mixed throughout the majority of the session as corporate updates dictated price action and in which energy names kept Australia afloat after Santos reported an increase in Q4 output and revenue, while Japanese exporters lacked unison amid an indecisive currency. Hang Seng (+0.4%) and Shanghai Comp (+0.4%) were initially lacklustre amid ongoing trade uncertainty and following another substantial daily liquidity drain by the PBoC of CNY 250bln, but then gradually improved as money market rates declined ahead of the 2nd phase of the PBoC’s 100bps RRR taking effect tomorrow. Finally, 10yr JGBs were flat with price moves contained by the indecision across riskier assets throughout the sessions and amid mixed results at this month’s 20yr JGB auction.

Top Asian News

- Bank Indonesia Governor Says Rate Near Peak, No Cut Seen Yet

- Anbang Is Said to Near First Domestic Disposal as Empire Unwinds

- Hainan Airlines Is Said to Signal Plans to Sell Dollar Bonds

- Kuwait Finance Said to Offer 35% Premium in $8 Billion Deal

Major European equities are in the green [Euro Stoxx 50 +0.7%]. The FTSE MIB (+1.2%) is outperforming its peers bolstered by strong performance in banking names after Italian PM Conte said the Italian banking system is well capitalised and stable; with markets also looking out for any potential signals from the ECB on TLTROs. Sectors are mixed, with outperformance in tech names following STMicroelectronics (+8.8%) earnings release; other tech names such as Infineon (+4.9%) are up in sympathy. Other notable movers include, Novozymes (-3.5%) who are at the bottom of the Stoxx 600 after missing on Q4 sales.

Top European News

- French Economy Stays on Downward Trend at Start of 2019

- Norway Flags Risk to Outlook as Tightening Plan Kept in Place

- SNB to Keep Negative Interest Rate for Some Time, Jordan Says

- STMicro Sees Past iPhone Jitters With Back-to-Growth Forecast

In FX, the DXY is back on an upward trajectory follow the prior session’s declines in which the index tested 96.000 to the downside at one point. In early EU trade, DXY gained more ground above psychological level and currently resides near intraday highs of 96.400 with upside exacerbated by the release of overall downbeat EZ PMIs. In terms of technicals, the index has breached its 100 DMA to the upside at 96.100 and sees its 200 DMA around 96.550.

- AUD – The marked underperformer amid the release of Australian jobs numbers, where the Aussie initial felt support as headline employment change and the unemployment rate were better-than-expected, thought gains were pared as the growth in employment was mostly fuelled by part-time jobs which coincided with the decline in participation rates. Additionally, reports of NAB hiking mortgage rates exacerbated downside in the AUD as some suggest this could aid the RBA to push back a rate hike, especially given the decline in house prices, subsequently, interest rate futures are pricing a 60% chance of a rate cut by December 2019. As such AUD/USD lost more ground below its 100 DMA at 0.7171 to levels below 0.7100 vs. a high of 0.7166. Furthermore, HSBC sees AUD/USD declining to 0.6600 this year and Rabobank sees the pair at 0.6800 citing 'doom loop' of debt which threatens to weigh heavily on the currency.

- NOK – A firmer Crown in the aftermath of a hawkish Norges interest rate decision in which the CB left its key policy rate unchanged as expected. Focus was more on whether a rate hike will be pushed further into H1 given the recent decline in oil, which the Central Bank left unchanged. Norges also noted that the domestic economic growth and labor market development appear to be broadly in-line with forecasts while inflation has been slightly above expectations. Subsequently, EUR/NOK fell through the 9.7500 to a low print of 9.7130 (vs high of 9.7600) and currency hovers closer to the bottom of the intraday band.

- EUR, GBP- The EUR is ultimately on the backfoot as dismal French PMIs triggered the decline in the single currency in which the composite output pointed to the quickest contraction in the French private sector output for over four years, according the IHS. Meanwhile, Germany’s manufacturing PMI fell into contractionary territory and to a 50-month low while the manufacturing output index slid to a 69-month low. In terms of the Eurozone, ING highlights that the below-forecast metrics indicates Q1 is off a disappointing start, heavily influence by France. Furthermore, IHS Markit’s Chief Economist notes “The disappointing survey data indicate that [Eurozone] GDP is rising at a quarterly rate of just 0.1%.” As such, EUR/USD fell further below its 200 DMA at 1.1384 to test the intraday low 1.1330 to the downside before stabilizing just above its LOD ahead of the ECB interest rate decision later where focus will be on the EZ growth outlook (full preview available in the Research Suite). In terms of option expiries, a sizeable EUR 2.2bln are scatter at strike 1.1395-1.1405. Meanwhile, Sterling is largely side-lined following days of gains as the ECB decision comes into focus, Cable is heavily dictated by dollar action as the pair resides near intraday lows below 1.3050 (vs high of 1.3094)

In commodities, Brent (-0.4%) and WTI (-0.1%) have pared back some of the downside seen after yesterday’s unexpected API crude stocks build of +6.55mln vs. Exp -0.4mln; with markets now looking to today’s EIA release. According to reports several Libyan oil ports are closed due to poor weather. Separately, US President Trump has stated that oil sanctions could be imposed this week on Venezuela if the political situation deteriorates further. Gold (-0.2%) has been subdued due to the improved risk tone following updates to the US-China trade front. Recent news flow has seen China’s commerce ministry stating that Vice Premier Lie He will travel to the US on January 30th; adding that the US and China are to have an in-depth negotiation on economic and trade issues. Elsewhere, Anglo America have reported Q4 copper production of 184Kt vs. Prev. 149KT, a 5-year high; Co’s CEO stating this is largely due to efficiency and productivity improvements.

In terms of the day ahead, the ECB meeting should be the main focus for markets today. We’ll also get the PMIs in the US alongside the latest weekly initial jobless claims print (expected to tick up modestly to 218k), December leading index (-0.1% mom expected) and the Kansas City Fed manufacturing activity index print for January (expected to hold at +3). Meanwhile, we’ll also get the EIA’s 2019 energy outlook while the earnings highlights today include Intel and Starbucks.

US Event Calendar

- 8:30am: Initial Jobless Claims, est. 218,000, prior 213,000; Continuing Claims, est. 1.73m, prior 1.74m

- 9:45am: Bloomberg Consumer Comfort, prior 58.1

- 9:45am: Markit US Manufacturing PMI, est. 53.5, prior 53.8

- 9:45am: Markit US Services PMI, est. 54, prior 54.4

- 9:45am: Markit US Composite PMI, prior 54.4

- 10am: Leading Index, est. -0.1%, prior 0.2%

- 11am: Kansas City Fed Manf. Activity, est. 2.5, prior 3

DB's Jim Reid concludes the overnight wrap

The main themes of Davos this year are the future of Globalisation and of work in a robotics age. I presented on the former yesterday and on the latter this morning. To be honest, globalization to me is being able to walk between sessions in the snow-draped highest city in Europe and still being able to listen to England play cricket in the blistering heat in Barbados using a cheap roaming 4G contract. I will fight hard to protect globalization in that form. Talking of roaming, I ventured around the whole conference area yesterday and the most scary thing was seeing various snipers on the roof between all the venues. Security is high but I suspect it would have been even higher if the likes of Trump hadn’t canceled.

It was a busy day in Davos around me, with speeches from German Chancellor Angela Merkel, Japanese Prime Minister Shinzo Abe, Chinese Vice President Wang Qishan, among many other public officials and private investors. Most speakers highlighted the need to defend globalization, free markets, and multi-lateral institutions, so the highlight might have been the voice of dissent from Italian Prime Minister Conte. He said that EU budget rules have resulted in higher public debt, by slowing economic growth, and predicted GDP growth of 1.5% this year. For context, DB economists and the private consensus both predict 0.7% GDP growth. My thoughts in my presentation was that globalization has been in aggregate a force for good, especially via a big drop in global poverty over the last 40 years. However, redistribution remains as big a problem as ever and unless policy makers act soon, a worse system in aggregate may win out via populism. The redistribution argument extents to intra-Europe as well. Can the European project survive with Germany running a near 2% budget surplus while the likes of Italy continue to be squeezed - notwithstanding the recent budget increases. Clearly, Germany has every right to be fiscally prudent but is it the best way of ensuring Europe’s long-term stability? Probably too big a question for 5am on a cold morning.

The Davos population will likely be tuned into their phones and screens this morning in what is a bit a blockbuster few hours ahead, with the January flash PMIs due out first of all, followed by the ECB at lunchtime. Just on the PMIs, they will be released at 8.15am GMT for France, 8.30am GMT for Germany and 9.00am GMT for the Euro Area this morning. As we discussed on Monday, the Eurozone and German manufacturing PMIs have both been sequentially down 11 months out of the last 12. European equity and credit markets remain cheap to PMIs but the problem over the last year is that PMIs haven’t stabilized, so equities haven’t yet found a decent base.

Consensus thinks we might see some stability today though, with the composite Euro Area reading actually expected to tick up slightly to 51.4 from 51.1 primarily due to the services reading edging up 0.3pts to 51.5. The manufacturing print is expected to hold steady at 51.4, which, as a reminder, was the lowest reading since February 2016. For France, the consensus is for a slight tick back up to 50.0 (from 49.7) for the manufacturing reading and a sharper move higher for the services reading to 50.5 (from 49.0). If the extent of the decline for France last month was related to the ‘yellow vests’ protests then the risk might be for a bigger bounce-back in the France data. In Germany, the consensus is for no change in the manufacturing reading at 51.5 and a 0.3pt increase in the services reading to 52.1.

As for the ECB at lunchtime, we noted in yesterday’s EMR that our economists believe that there are three key questions facing Draghi and the Council. The first is: have the balance of risks tilted to the downside? Our team believes they have. The second is: will the ECB commit to replacing TLTRO2? Our team believes that there will be a replacement to avoid a potentially disorderly deleveraging, with confirmation by the March meeting at the latest. The third question is: is there a consensus building around a technical or one-off depo rate hike to support the banking system? Although Draghi has hinted at such, the minutes lacked any evidence that the Council is discussing the idea. But that’s not to say that the topic won’t be brought up again in the Q&A. As a related stat, amazingly there’s still $8.3tn of negative yielding debt swimming around in the world, which is actually a 46% increase compared to October’s levels.

Negative yields and deposit rates don’t help banks and this has become a bigger and bigger talking point now that there’s doubt as to whether the ECB can even raise rates this cycle at all. Our economists have written two notes looking at the structural impact of negative rates on banks over the last week. The first looked at the cost of the interest rate cycle through the lens of net interest income across sectors of the economy and across countries. They found that in cash terms, the net interest income of financial corps was no worse at the end of the last monetary cycle in 2008 than at the start in 2002. However, the current cycle is very different with the net interest income of financial corps deteriorating by almost four times versus the previous cycle. The second note looked at the benefits of a sustainable banking system in the Euro Area and the drivers of profitability. The team conclude that the ECB has good reason to care about the structural profitability of the banking system and inability to reach such would come with significant economic and financial risks, and transmission of policy. They also find that it is full normalization of monetary policy rather than the removal of the negative depo rate that will benefit banks most, and this requires a sustained economic recovery. It’s also worth flagging the view from our rates strategists who believe that the ECB should consider a tiered reserves system, similar to that in Japan and Switzerland.

Plenty to consider then. Markets overnight are going into the meeting with modest gains for the most part in what’s been a fairly quiet session for newsflow. The Hang Seng (+0.14%), Shanghai Comp (+0.51%) and Kospi (+0.51%) are all up however the Nikkei (-0.26%) is still lagging behind after most markets started on the back foot. Japan’s flash manufacturing PMI for January didn’t help, dropping 2.6pts to 50.0 and to the lowest since August 2016. Futures in the US are broadly flat along with EM FX.

This follows a bit of a lackluster session yesterday where risk assets bounced between gains and losses before ultimately closing close to flat on the day. The S&P 500 opened as much as +0.76% higher, dropped to -0.75% around lunchtime, and closed +0.22%. The DOW and NASDAQ posted similar roundtrips, ultimately ending the session +0.70% and +0.08% respectively. The VIX also jumped above 22 for the first time in two weeks but subsequently fell to end the session -1.28pts lower at 19.52. US HY credit opened -4.3bps tighter but partially retraced to close -0.7bps.

Sentiment had been boosted by better-than-expected earnings reports from the likes of Procter & Gamble, United Technologies and IBM. Each company raised their guidance for Q1 or FY 2019, pointing to increased confidence in the economic backdrop. Overall, S&P 500 earnings are running +14.2% higher yoy so far. However, a turn in the oil price (WTI closing -2.29%) along with little sign of progress on the government shutdown saga appeared to be the catalyst to turn sentiment from the highs. Early in the day the Chairman of the White House Council of Economic Advisers Kevin Hassett had even said that the US economy could see growth in Q1 of “very close to zero” should the government shutdown extend for the whole quarter. He did, however, also add that growth could rebound to “4 or 5 percent” in Q2 if the government reopens.

Just on the shutdown, the Senate is set to vote on two bills today: a Republican proposal modelled on President Trump’s weekend offer, which would reopen the government and include wall funding, and a Democratic proposal, which would reopen the government with no wall funding. Neither bill appears likely to receive the requisite 60 votes. The House has already passed the Democrats’ bill and, while some senior Democrats expressed a willingness to raise border control spending, they still refuse to contemplate any wall funding. So the two sides are still entrenched, and acrimony is increasing after President Trump sent Speaker Pelosi a letter yesterday, insisting that he would still deliver his State of the Union address on January 29. Pelosi responded by insisting that he is not invited to speak to Congress until the government is reopened.

Meanwhile, here in the UK the prospect of Labour supporting a backbench plan for legislation to delay Article 50 should a deal not be agreed before February 26th (Cooper-Boles amendment) helped Sterling climb +0.89% yesterday and close above $1.30 for the first time since November 8th. Germany’s Economy Minister Altmaier also said he “would not mind” if the UK needed more time to clarify its position, though France’s EU Minister said that such an extension would be “technically feasible, although it is not simple”. Gilts were flat despite the bigger move for Sterling while the FTSE 100 (-0.85%) underperformed other European markets with the STOXX 600 closing -0.06%. Bond markets continue to be a relative sideshow for now with Treasuries just +0.2bps higher, which means that the range since January 8th, on an intraday basis, is still just 14bps.

The relatively benign moves for Treasuries partly reflects the data where the Richmond Fed manufacturing index for January printed in line at -2, and thus improving on the -8 level seen in December. Following notable deterioration in December, the regional Fed surveys so far in January have been a bit more mixed with the Richmond Fed and Philly Fed improving, but the Empire Fed dropping notably. We’ll get the manufacturing PMI today along with the Kansas Fed survey, which should help to further shape ISM expectations for this month. In Europe, France’s INSEE Manufacturing Sentiment Index fell 1 point to 103, which was as expected but nevertheless could point to some stabilization in conditions this month. For the Eurozone aggregate, January consumer confidence fell to -7.9 and December’s print was revised lower, though the results may been affected by a new methodology in the calculation.

In terms of the day ahead, as highlighted at the top the flash, January manufacturing PMIs and the ECB meeting around lunchtime should be the main focus for markets today. We’ll also get the PMIs in the US this afternoon, alongside the latest weekly initial jobless claims print (expected to tick up modestly to 218k), December leading index (-0.1% mom expected) and the Kansas City Fed manufacturing activity index print for January (expected to hold at +3). Meanwhile, we’ll also get the EIA’s 2019 energy outlook while the earnings highlights today include Intel and Starbucks.

Disclosure: Copyright ©2009-2018 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more