Stocks, Bond Yields Tumble On Global Growth, China Talks Anxiety

European economies are collapsing along with global sovereign bond yields... but stocks seem to have found something to love (hint rhymes with Schmentral Schmank Schmiquidty)... how long are they willing to let this decoupling from reality last?

(Click on image to enlarge)

Total desperation to ensure the world thinks...

When in fact it's circling the drain.

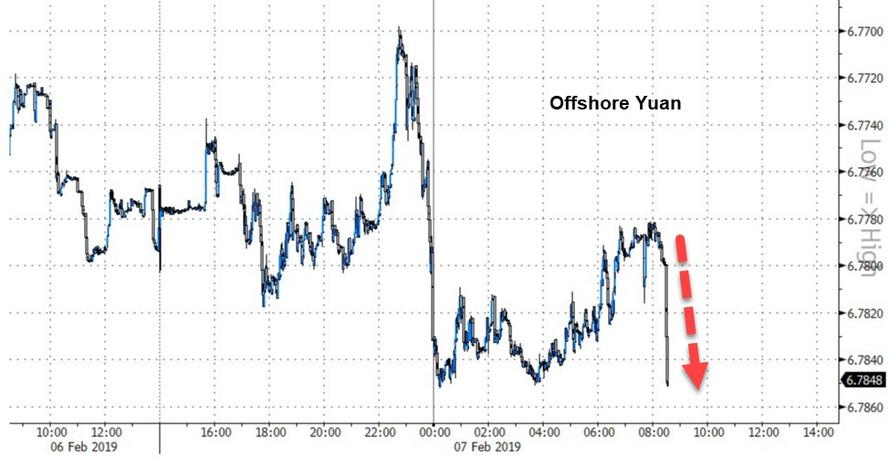

China remains closed for the lunar new year celebrations but Yuan tumbled on the Kudlow comments...

(Click on image to enlarge)

Worst day of the year for German and Italian stocks as the parade of terrible economic data finally breaks the bad news is good news meme...

(Click on image to enlarge)

Larry Kudlow spoiled the party early on after stocks rebounded magically at the cash open...

(Click on image to enlarge)

But we did see dip-buying after Europe closed - Nasdaq was worst, Trannies best...

(Click on image to enlarge)

S&P failed to break its 200DMA for the second day and broke down below its 100DMA...

(Click on image to enlarge)

Nasdaq and S&P ended the day giving up all their February gains...

(Click on image to enlarge)

US equities also started to play catch down to crude's recent demise...

(Click on image to enlarge)

Equity and Credit protection costs spiked... IG spreads spiked the most since mid-December...

(Click on image to enlarge)

And stocks started top catch down to bond yields' reality...

(Click on image to enlarge)

Treasury Yields tumbled across the curve...

(Click on image to enlarge)

30Y broke back below 3.00%...

(Click on image to enlarge)

And the market is repricing the uber-dovish Fed (expecting rates to drop 10bps in 2019!)...

(Click on image to enlarge)

The dollar is up for the 6th day in a row - the longest win streak since Dec 2017...but note that it rolled over at what looks like key resistance...

(Click on image to enlarge)

We wonder what happens when the Chinese come back from their lunar new year celebrations.

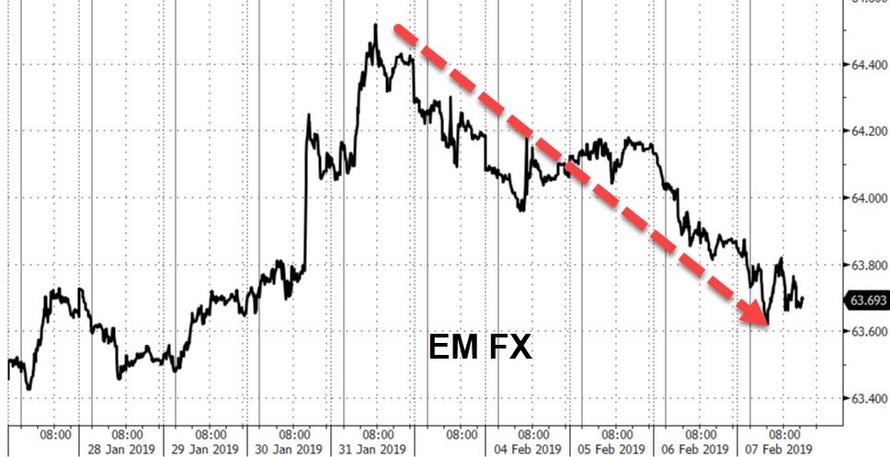

Notably, EM FX has been tumbling as the USD surged and EM sovereign debt was hit today...

(Click on image to enlarge)

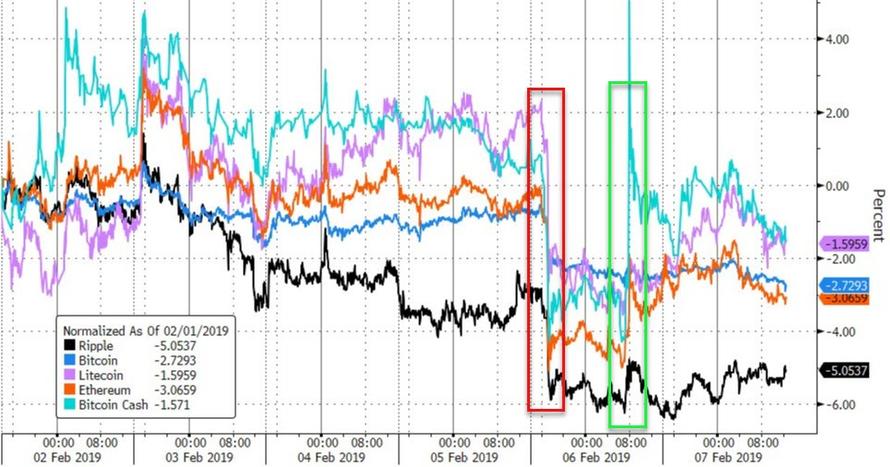

Cryptos were quiet again after yesterday's chaos...

(Click on image to enlarge)

Despite dollar gains, PMs managed to rally (safe haven), copper was flat, and crude tumbled...

(Click on image to enlarge)

Gold dipped and ripped back to unchanged...

(Click on image to enlarge)

WTI tested $51 handle intraday...

(Click on image to enlarge)

Finally, we note that, while it's surely just a coincidence but, US equity markets suffered their biggest drop since the start of the year on the day when AOC unveiled her full-socialist-utopia "Green New Deal"...

(Click on image to enlarge)