Stocks And Precious Metals Charts - Who Could See It Coming? - Dead Reckoning The Minsky Moment

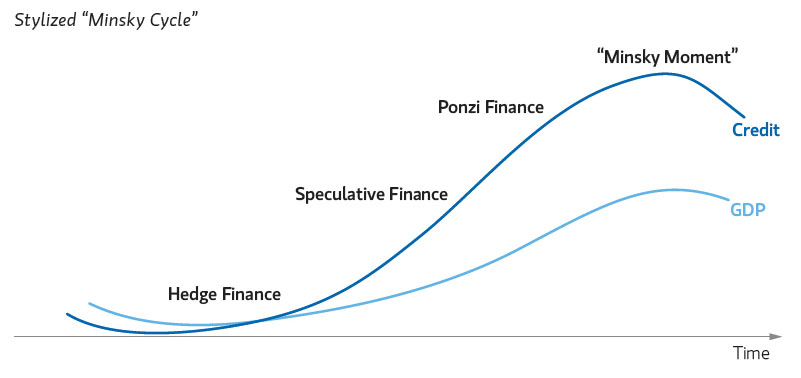

"In particular, over a protracted period of good times, capitalist economies tend to move from a financial structure dominated by hedge finance units to a structure in which there is large weight to units engaged in speculative and Ponzi finance".

Hyman Minsky, The Financial Instability Hypothesis

"Twenty-five years ago, when most economists were extolling the virtues of financial deregulation and innovation, a maverick named Hyman P. Minsky maintained a more negative view of Wall Street; in fact, he noted that bankers, traders, and other financiers periodically played the role of arsonists, setting the entire economy ablaze. Wall Street encouraged businesses and individuals to take on too much risk, he believed, generating ruinous boom-and-bust cycles. The only way to break this pattern was for the government to step in and regulate the moneymen.

Many of Minsky’s colleagues regarded his 'financial-instability hypothesis,' which he first developed in the nineteen-sixties, as radical, if not crackpot. Today, with the subprime crisis seemingly on the verge of metamorphosing into a recession, references to it have become commonplace on financial web sites and in the reports of Wall Street analysts. Minsky’s hypothesis is well worth revisiting".

John Cassidy, The Minsky Moment, The New Yorker, 4 February 2008.

"The period of financial distress is a gradual decline after the peak of a speculative bubble that precedes the final and massive panic and crash, driven by the insiders having exited but the sucker outsiders hanging on hoping for a revivial, but finally giving up in the final collapse".

Charles Kindelberger, Manias, Panics, and Crashes: A History of Financial Crises

Bubbles most often resolve their imbalances irresponsibly and jarringly, with a correction that is sharp and destructive. It is often triggered by some seemingly trivial event, especially if it's predatory mispricing of risk has been allowed to fester for an extended period of time...How can this be?

Credit cycles explain bubbles in modern finance, but the elite protect themselves and their banks from the effects. Hence, only the middle and working class loses. And this has been the case for many years now. Hence the growing unrest abroad, and the decisions by the electorate at home that seem to puzzle and provoke the very comfortable 'credentialed' class.

The reason for this is quite easy to understand. Those who benefit the most from the bubble both actively and passively help sustain it. They are reluctant to surrender any portion of their enormous advantage and personal gains, even if it might be better for them in the long term.

They do not consider the damage that may be done to the underlying social fabric that supports and protects their wealth. Contrary to all of the familiar assumptions, they are not acting rationally or prudently, even for themselves. Their focus is short term and short-sighted. They are drunk on their own success.

The interpreters and creators of the prevailing narrative are themselves beneficiaries of the bubble economy and will go to great lengths to misdirect the public discussion from any root causes, and often from its very existence. They will distract the public with inflammatory issues, economic fear,stage-managed spectacles, and manufactured complexity. And finally, in the extremes of their shamelessness, they will seek to blame the victims for their lack of sophistication and the government for its efforts to restrain their predatory frauds.

This enables the cycle of boom and bust to repeat and worsen beyond all reasonable expectations.

The lesson from history is that a system based on the ascendant greed of powerful insiders is rarely rational and self-correcting, and is often spectacularly self-destructive. And those with the most power, in their wonderful self-delusion, simply do not care until it is too late. They are blinded by the moment, in their competition with each other, and the insatiable nature of greed itself.'Enough' is not in their reckoning.

To this end, governments are fashioned, and people organize themselves from the damage that can be done to society as a whole by a few. Unfortunately, people forget, and it seems that at least once every generation or so the madness slips lose its restraints and this sad lesson from history repeats.

And so once again the world must face its rendezvous with destiny.

The box scores for today's market action are shown in the graphs below.

Have a pleasant evening.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

None.