Stock Records Were Made To Be Broken

Records were made to be broken. Thursday's (Mar. 11) session was the embodiment of that.

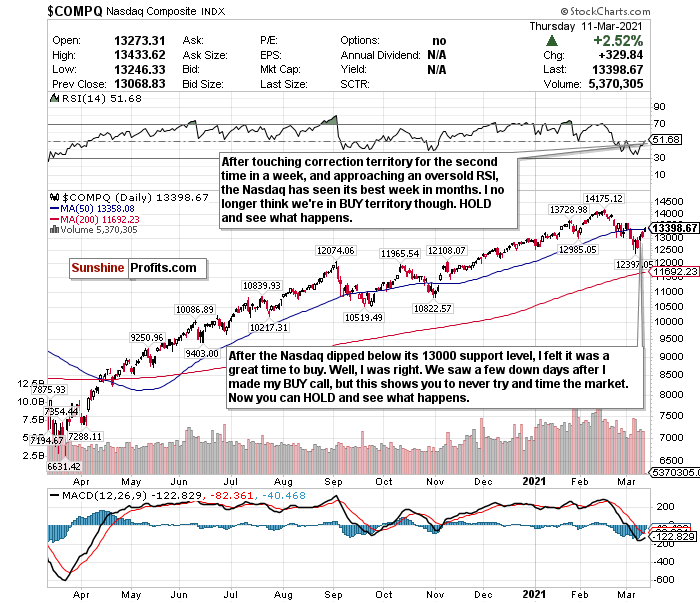

Every index closed in positive territory, and the Dow, S&P, and Russell all closed at record highs. Meanwhile, the Nasdaq led the way again with a 2.52% gain. After touching correction territory two times in the last week, the Nasdaq is up over 6.3% for the week. This is why you buy the dips, and why I said the second, the Nasdaq drops below 13000 support that you should buy.

Be bold, a little contrarian, block out the noise, and never try to time the market. Sure, when you buy a dip during uncertain times, you run the risk of encountering more pain. However, in the long-term, stocks trend upwards.

For example, do you also know what happened precisely a year ago, on March 11, 2020? The headline on CNBC read like so: Dow plunges 10% amid coronavirus fears for its worst day since the 1987 market. See for yourself.

You know what else happened? The market didn't bottom for another 2 weeks and declined another 21%. However, if you bought the Dow-tracking DIA ETF on March 11 and held it this entire time, you'd have gained 40.51%.

Imagine if you bought the dip as I recommended for tech.

I cautiously said to BUY the QQQ ETF, which tracks the Nasdaq, on February 24 but recommended doing it cautiously and selectively. I doubled down once it dropped below support at 13000 and tripled down once the Nasdaq hovered around 12600 on Monday (Mar. 8).

As I said before, the Nasdaq is up over 6.3% this week. If you followed my lead on this, you'd be pleased.

Inflation fears and the acceleration of bond yields are still a concern. But let's have a little perspective here. It appears as if things have stabilized for now. Bond yields are still at a historically low level, and the Fed Funds Rate remains 0%. Plus, jobless claims beat estimates again and came in at 712,000. This is nearly the lowest they've been in a whole year.

We will see how President Biden's newly signed $1.9 trillion stimulus package affects yields and inflation. But for now, with the Fed showing no signs of hiking rates shortly and inflation looking tamer than expected, we could see more firepower for stocks.

So is the downturn overblown and already finished?

Time will tell. I think that we could still see some volatile movements and consolidation to close the week out. That's just what happens with surges and swings like this. While I maintain that I do not foresee a crash like what we saw last March and feel that the wheels remain in motion for an excellent 2021, Mr. Market still has to figure itself out.

A broad-based correction of some sort is still very possible. I mean, the Nasdaq's already hit correction territory twice in the last week. Corrections are healthy and normal market behavior. Only twice in the previous 38 years have we had years WITHOUT a correction (1995 and 2017).

Most importantly, a correction right now would be an excellent buying opportunity. Once again- look at the Nasdaq since March 8.

It can be a very tricky time for investors right now. But never, ever, trade with emotion. There could be some more short-term pain, yes. But if you sat out last March when others bought, you are probably very disappointed in yourself.

You can never time the market.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

There is optimism but signs of concern. The market has to figure itself out. A further downturn is possible, but I don't think that a decline above ~20%, leading to a bear market, will happen any time soon.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

Nasdaq- That’s Why I Called BUY

Figure 1- Nasdaq Composite Index $COMP

Can I flex again, please?

Flexing.

The Nasdaq's performance this week is why I called BUY despite hitting two corrections in the last week. On Tuesday (Mar. 9), the Nasdaq saw its best day since November. The index's gains continued after that and is now sitting pretty up over 6.3% for the week.

If you bought the dip, good on you. It's an excellent time to be a little bit bold and fearless. Take Ark Funds guru Cathie Wood, for example. Many old school investors scoffed at her comments on Monday (Mar. 8) after she practically doubled down on her bullishness for her funds and the market as a whole. After crushing 2020, her Ark Innovation Fund (ARKK) tanked over 30%. Many called her the face of a bubble. Many laughed at her. Tuesday, March 9, ARKK saw its best day in history. Week-to-date, ARKK is up a staggering 16.71%.

I'm not saying that we're out of the woods with tech. But I am saying not to try and time the market, not get scared, and have some perspective.

The Nasdaq is once again positive for the year, but unfortunately, I no longer think we're at a BUY level. We could see some consolidation and profit-taking to end the week. Still, if we see a significant drop, especially below 13000, it could be a good buy again. It can't hurt to keep nibbling- we're still off the highs. I'm going to stick with the theme of "selectively buying" sub-sectors such as cloud computing, e-commerce, and fintech.

I think you should now HOLD and let the RSI guide your Nasdaq decisions. See what happens over subsequent sessions, research emerging tech sectors, and high-quality companies, and buy that next dip.

For an ETF that attempts to correlate with the performance of the NASDAQ directly, the Invesco QQQ ETF (QQQ) is a good option.

Disclaimer: All essays, research, and information found above represent analyses and opinions of Matthew Levy, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be ...

more