Stock Market’s Optimism Vs. Worrisome Economic Data

Judging by the US stock market, the economic outlook is optimistic in no trivial degree. The S&P 500 Index rose for a fifth straight day on Monday (Nov. 18), ticking up to another record high. Taking a cue from the party atmosphere on Wall Street, Goldman Sachs’ chief equity strategist expects the sluggish US economy will improve in 2020.

“The equity market is anticipating an acceleration in US economic growth during the coming months,” predicts David Kostin in a research note on Friday. He explained that “our economists believe that tariffs have peaked and that the drag on US GDP attributable to the US-China trade war is now abating. Their base case is that tariff levels on imports from China remain flat in 2020.”

The future may look sunny by some accounts, but the positive spin contrasts with a gloomy rear-view mirror. The Philly Fed’s ADS Index, a real-time business-cycle benchmark, fell sharply in Friday’s revision (thanks to weak industrial production data for October), settling at just above a level that’s considered a recession signal. The current -0.68 print for ADS is modestly above the -0.80 threshold that a San Francisco Fed research paper identified as a signal that a US recession has started. We’ve been here before in recent years and a rebound in growth pulled the economy back from the brink. Is this time different? Unclear, but we’ll know the answer soon.

Meantime, a fresh set of GDP nowcasts for the fourth quarter from the Atlanta and New York Fed banks paint a worrisome economic profile. On Friday (Nov. 15), the Atlanta Fed’s GDPNow model downgraded its real-time growth estimate to a weak 0.3% — a dramatic slowdown from the 1.9% increase in Q3. The New York Fed’s nowcast isn’t much better at a 0.4% gain (Nov. 15).

To be fair, other nowcasting models offer a more encouraging profile… sort of. Now-casting.com’s latest Q4 estimate is a relatively upbeat 1.1% (Nov. 15). But the model’s weekly revisions have been falling since late-September and so even here there’s plenty of room for caution.

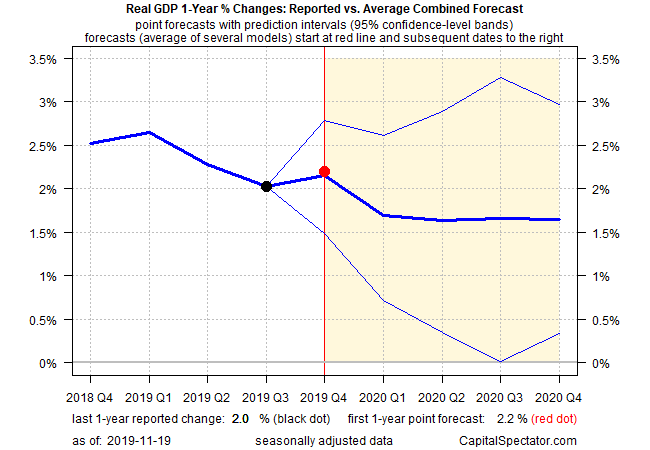

For another perspective, the Q4 outlook for the year-over-year change in GDP looks more encouraging, Output is currently expected to edge up to a moderate 2.2% annual pace in the final three months of 2019, slightly faster than Q3’s 2.0%, based on the average point forecast via The Capital Spectator’s combination-forecasting model. Note, however, that this spin on the outlook shows that the modest uptick in growth will fade in 2020.

It’s still early in Q4 for data and so it’s possible, perhaps even likely, that the economic profile will change, perhaps for the better. But for now the outlook appears biased to the downside for 2019’s final profile.

Keep in mind that the Philly Fed’s ADS Index is volatile and so the current warning sign in this index could easily fade in the next round of economic updates, starting with today’s October numbers on housing starts.

Later in the week we’ll see new data on weekly jobless claims (Thursday, Nov. 21) and November survey data via PMIs (Friday, Nov. 22). Perhaps the most important number will be Friday’s preliminary estimate of consumer sentiment for November. Econoday.com’s consensus point forecast sees the index holding at a healthy level.

With the manufacturing sector in recession, consumer spending is increasingly critical for keeping the expansion alive. On that note, the rebound in retail sales in October is helpful.

Nonetheless, the optimists are counting on a conspicuous improvement in hard data to bolster the case for a 2020 rebound. At the moment, supporting evidence is a bit thin.

Perhaps the critical data point to watch in the days ahead is Monday’s October update (Nov. 25) of the Chicago Fed National Activity Index, arguably the gold standard for monitoring the US business cycle through a robust econometric lens. The September reading for the three-month average is -0.24, indicating below-trend growth. That’s still moderately above the -0.70 mark that signals recession. If this falls further, optimism will take another hit.

Disclosure: None.