Stock Market Didn't Notice COVID-19 Cases Accelerated - Bearish

Video Length: 00:16:18

In this video I discuss the consequences of the most important and most under-reported datapoint globally, the number of new coronavirus cases. They picked up in the latest data yesterday. I'm surprised markets aren't watching that.

That makes me look for more signs of risk in stocks. Stocks are stuck in "my" range of 275-281, trying to decide their next move. Respecting that next move I think is so important right now.

Here's The Data That's So Under-Reported

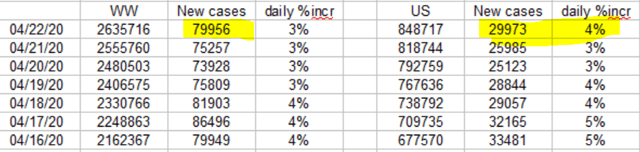

Above you see that the number of new coronavirus cases re-accelerated after slowing for many weeks. Obviously we all hope it's only one day but this needs watching.

For the economy to reopen these numbers of course need to slow. Yesterday's numbers went the wrong way.

Stocks and the market are trading on hopes that we can get back to normal in some sort of reasonable timeframe. Stocks typically discount out 9-12 months.

Stocks are not far from their highs which means they are hoping for some sort of "normal" by Q4 or Q1.

That's why this real-time data is so critical and going the wrong way today matters. If we get follow through I have to believe that investors at some point start to look past Fed stimulus and start to worry about a second dip back to the stock market lows.

Based on these coronavirus numbers my fundamental bias gets more bearish but still I want to wait for SPY to break a key level of 275 to get more bearish.

The reason I want to wait is because nobody has any experience to assess this amount of immense Fed support, so we have to respect what the market wants to do.

The Fed keeping rates at near zero elevates the value of future cash flows, or said simply, valuations. That's the Fed's intention by playing with interest rates across the curve. They hope that up-markets feed into psychology and the economy and an upcycle starts back up.

So while fundamentals appear terrible and the latest data of coronavirus new cases is not good, the Fed is messing with markets. It makes sense at this stock market fork in the road to wait to see which way the market wants to go.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.