Stock Market And SPY: Mini Fed Taper And Second Half Demand Cliff

Video Length: 00:14:15

Today we're going to talk about some technical and fundamental divergence. Stocks are acting better. There's some more bullish action. But the Fed is right now in a mini-taper which could seep into trading at some point. Also, so far in tech land there's a recurring theme that current good results are helped by low-quality inventory builds and expectations that there's going to be resurgent back half demand.

Market's Listening To Me

The market doesn't always listen to me. It's way more important that I listen to markets.

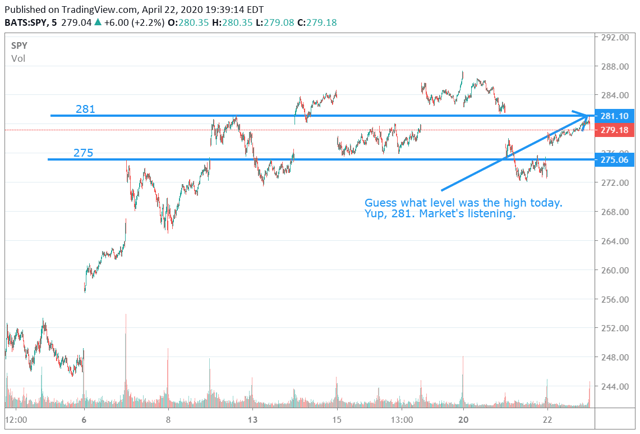

But I've been calling SPY 281-bullish and 275-bearish for a few days to subscribers and here.

The markets high today was spot-on 281 so the market's listening to me.

(Click on image to enlarge)

A slow rise through 281 and it's bullish. A sharp nasty break through 275 and it's bearish. A slow break through 275, however, would give me less conviction.

The market also slowed up today and volume dried up. That's a bullish sign. Slow is bullish. Whippy and crazy is bearish. So the market action has been changing.

But there's fundamental risks that keeps me disciplined to respecting these key levels.

Fed Mini-Taper

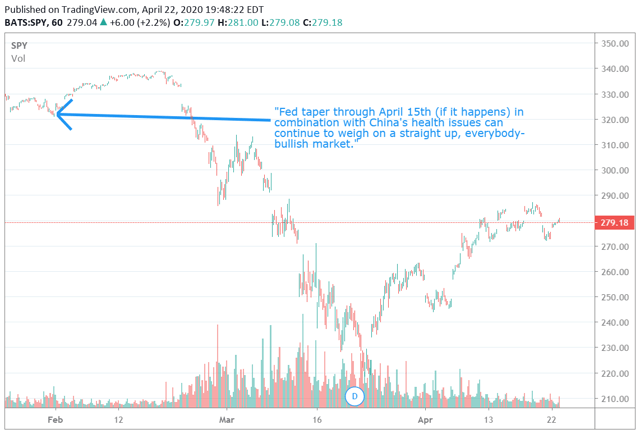

Back in January and February we had blog posts calling out the Repo taper (here and here).

Listen to what we said in early February.

"The Fed also last week talked about a taper at their Fed-day press conference. People didn't call it a taper but that's what it was. There's the risk that the Fed taper through April 15 (if it happens) in combination with China's health issues can continue to weigh on a straight up, everybody-bullish market."

We called out the Repo taper which preceded the market drop.

This current mini-Fed taper isn't actually so mini.

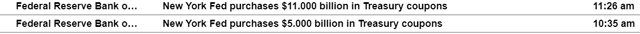

Yesterday I saw the Fed purchase about $16B in assets.

Today they purchased less; only about $7B in assets.

![]()

While that amount's shrinking, it's way down from buying $40-60B each day just a few weeks ago, even just last week.

|

I think that qualifies as a taper.

But One More Thing, Inventory Bulge, Demand Cliff Coming In The Back Half

Tech reporters are pretty pumped to report something better than a disaster.

But those numbers are somewhat dependent on demand picking up in the back half.

Teradyne (Nasdaq:TER) sells test equipment into smartphone makers like Apple (Nasdaq:AAPL). They are saying there's no slow down. Phone makers are expecting a big back half.

Lam Research (Nasdaq:LRCX) tonight said next quarter will actually be higher than this quarter. Memory demand is strong.

But Micron (Nasdaq:MU) said they are seeing OEM purchases to build up inventory, not necessarily to meet end demand.

Texas Instruments (NYSE:TXN) said the same thing yesterday.

So you have a recurring theme that revenues now are low quality and dependent on a back half pick up.

But the back half pickup needs something. You know what? Demand.

And with COVID-19 numbers not slowing, how are you going to get that demand?

|

There's been no slowdown in absolute cases. So when do we get back to normal? Tech companies are building product and inventory for a back half surge. But who's going to be buying?

If these COVID-19 numbers don't tumble, I don't see where that end demand comes from.

Conclusion

Technicals look a touch better but the market's still in limbo. But a not-so mini-Fed taper and a demand cliff coming in tech, things can go down too. So let's see where we break first, 281 or 275.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions.