Stock Market & Economy Recap - Saturday, June 12

S&P 500 Earnings Update

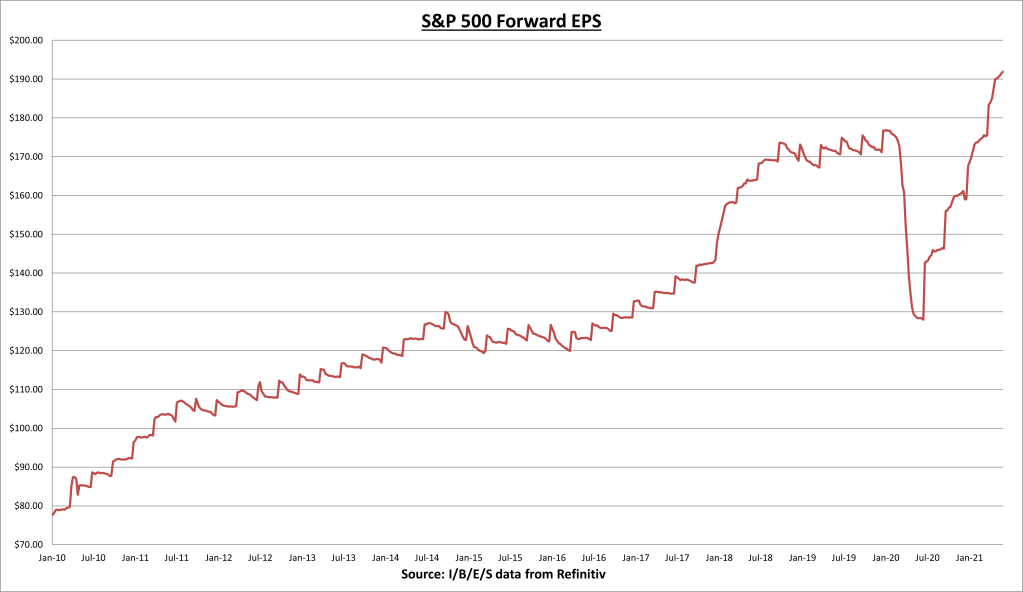

The S&P 500 earnings per share (EPS) increased to $191.93 this week. The forward EPS is now +20.7% year-to-date. All but three S&P 500 companies have now reported Q1 earnings. Q1 was another record quarter, with +52% earnings growth, an 87% beat rate, and results coming in a combined +22% above expectations.

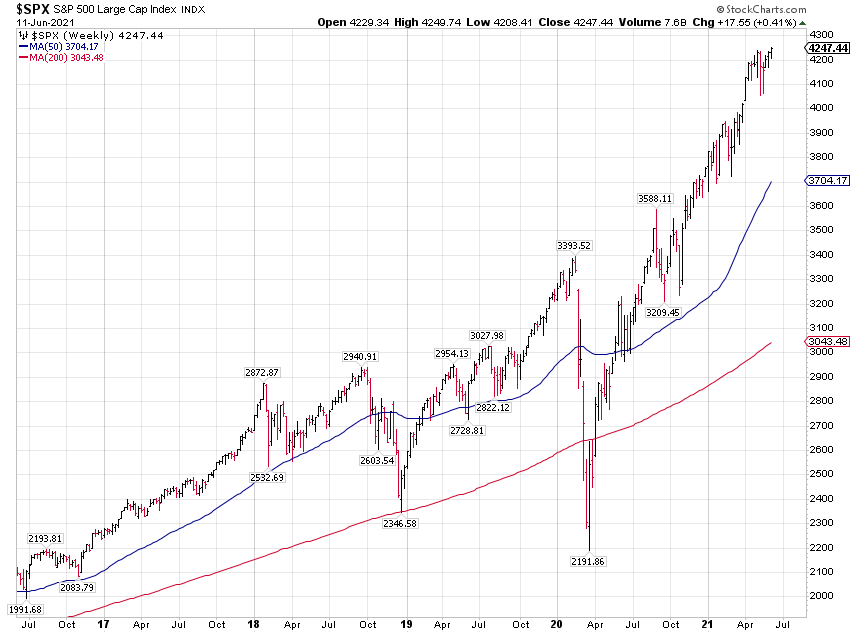

The S&P 500 index finished +0.41% higher for the week, another record high.

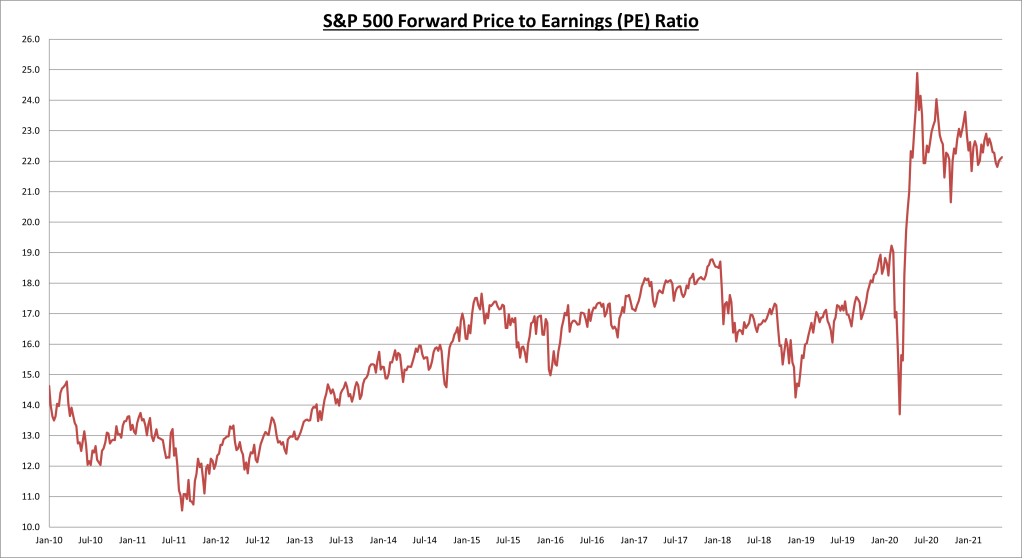

The S&P 500 price to earnings (PE) ratio remains at 22.1.

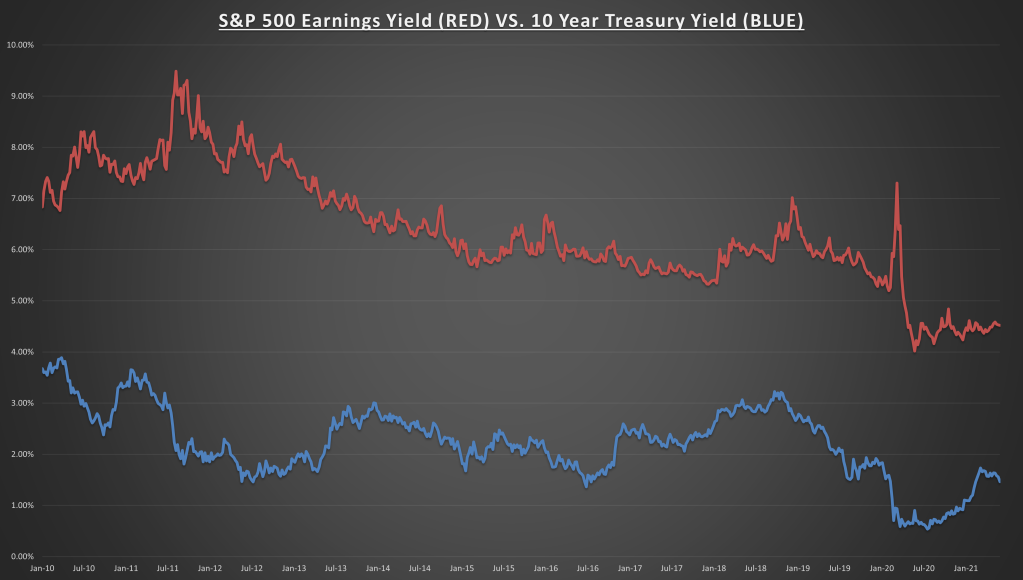

The S&P 500 earnings yield is now 4.52% (along with a dividend yield of 1.36%), which still looks great against the backdrop of a 10-year treasury bond rate that declined to 1.46%.

Economic Data Review

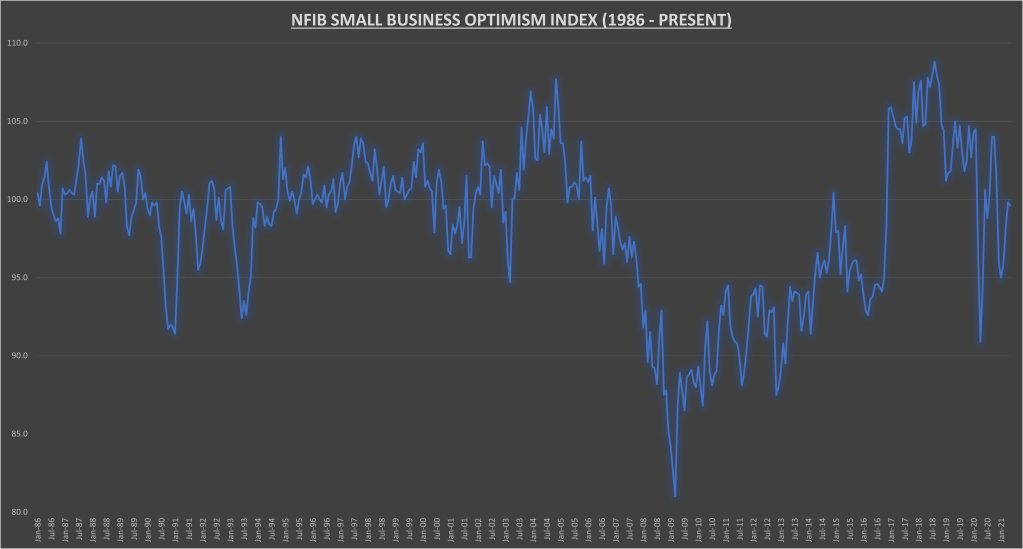

The NFIB small business optimism index came in at 99.6 for May, slightly below last month (99.8) and +5.5% over the last 12 months. The historical average since the data set began reporting monthly on January 1986 is 98.4.

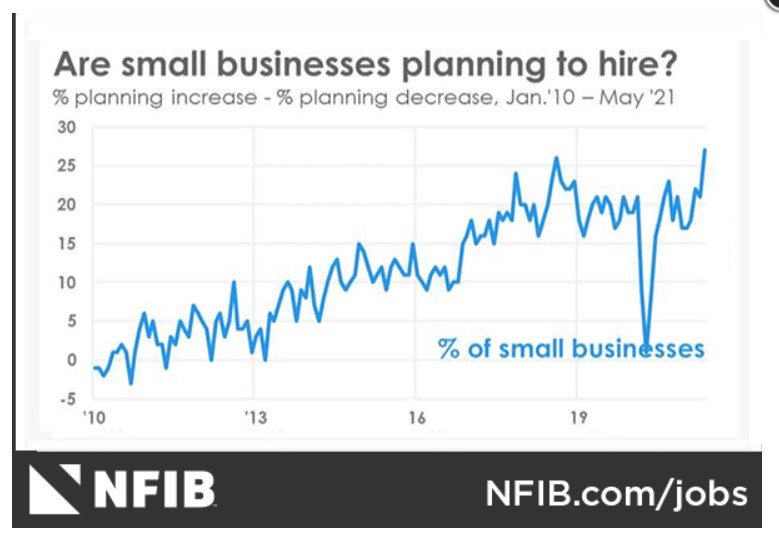

Small business owners continue to report having issues finding qualified workers, along with inflation concerns. 48% of small business owners reported unfilled job openings in May, a record high.

Small business owners want to increase their workforce (61% of owners reported hiring or trying to hire in May, and 34% of owners reported raising compensation). But for a variety of reasons, eligible workers are either unable or unwilling to reenter the work force.

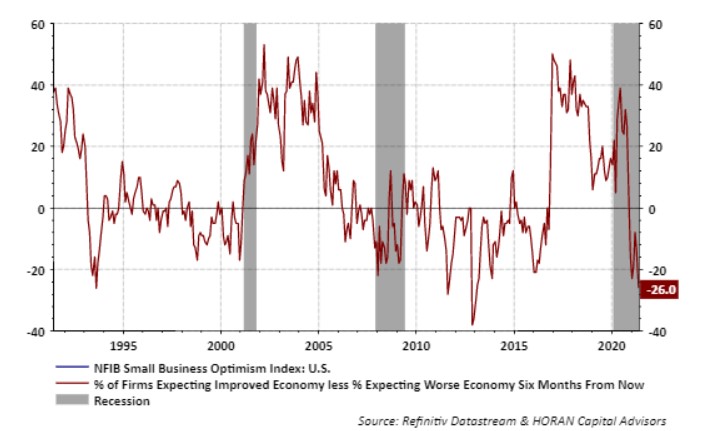

On the negative side, the outlook for general business conditions over the next six months continues to decline. And on the inflation front, 40% of owners reported raising average selling prices, which is the highest since April 1981.

So while the index components that track current business conditions remain in good shape, the components that track future expectations are showing a decline in confidence.

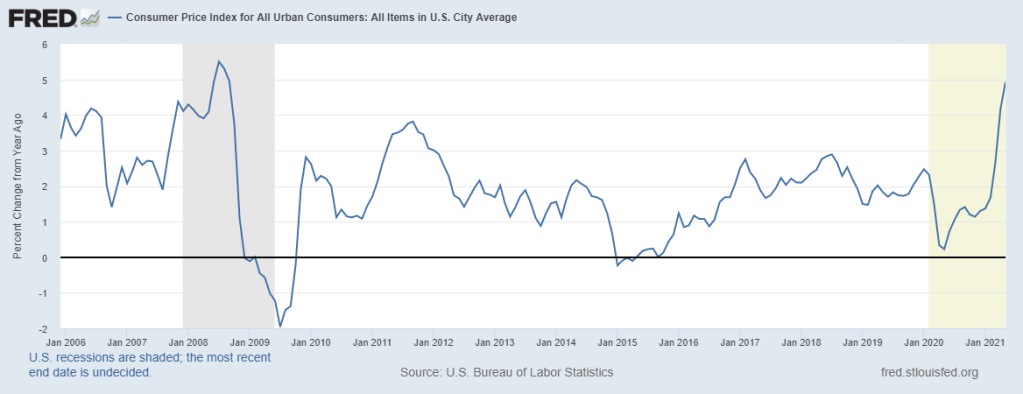

The Consumer Price Index (CPI) increased +0.6% in May, +5.0% annualized (up from +4.2% annualized last month). You have to go back to August 2008 to find a time when the CPI was running this hot. Used cars and trucks, transportation services, and fuel, oil, & gas services were the biggest contributors to the monthly increase.

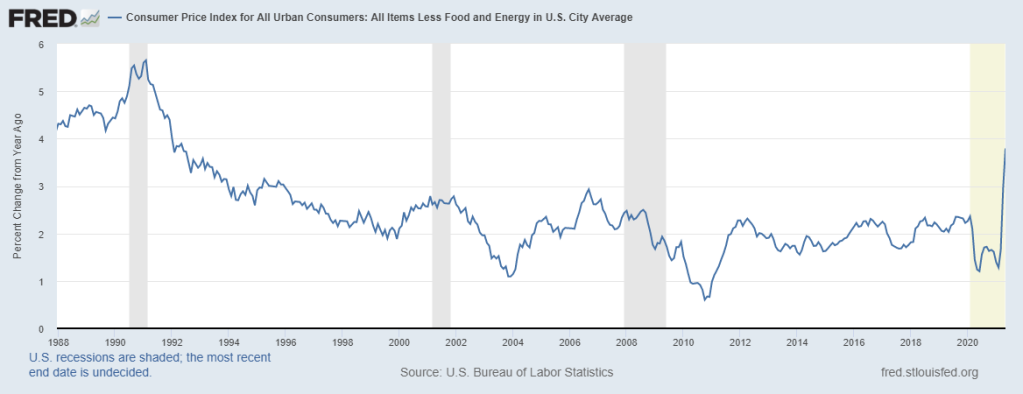

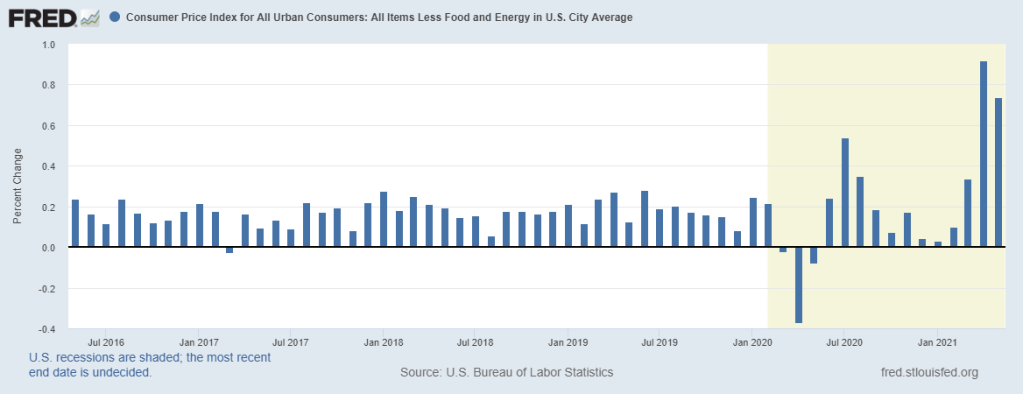

The Consumer Price Index minus food and energy prices (Core CPI) rose +0.7% in May, +3.8% annualized (up from +3.0% annualized last month). You’d have to go back to June 1992 to find a higher annualized Core CPI. Both measures of inflation came in higher (worse) than expected.

Chart of the Week

This month's Job Openings and Labor Turnover (JOLTS) report showed a record 9.29 million job openings. This is an increase of 12% over last month, and a whopping +86% higher than this time last year. Job openings are now close to exceeding the number of individuals unemployed.

Summary

Last week, the consumer confidence report showed consumers expectations over the next six months deteriorated, and this week, the small business optimism index showed owners are also feeling pessimistic about the future. This will need to be monitored closely since the consumer makes up about 75% of the US economy and small businesses employ roughly half the nation's work force.

Sentiment is very hard to predict and can change on a dime, but it can become a “self-fulfilling prophecy” if it begins to affect decision making. So far, that is not the case.

As for inflation, the good news is that the bond market took it all in stride. Interest rates actually declined for the week. This shows the strong demand for US dollar denominated assets. The other potential reason why the bond market isn’t reacting to the CPI report is that year-over-year comparisons get a lot tougher going forward.

Here is what I mean by this: The chart above shows the change in Core CPI from month to month. In 2020, the March, April, May period consisted of month-to-month declines that were well above average. April 2020 Core CPI declined -0.37% for the month, which was the worst monthly percentage decline on record. So the 2021 comparisons are against some historically bad results, which is making these recent results look higher (in the case of inflation, higher is worse).

We are now through the worst of it. So its quite possible future CPI reports will moderate from here on out. I think that is what the bond market is telling us. This doesn’t mean they will be right. No matter which way you measure it, inflation is running hotter than its been in awhile.

I think a 1970’s style inflation scare is a low probability outcome, but 3-4% inflation could be with us for some time. Which may seem like a lot given that inflation failed to stay above 2% for most of the 2010’s decade.

Wednesday, the Federal Reserve Open Market Committee will give their economic projections and statement. Chairman Powell will hold a press conference. It will be interesting to see what comes out of it, and how the markets react. I don’t expect any significant changes. The projections will likely be adjusted a bit higher. That’s about it. But I expect the media to twist and parse every word.

Next week will be the last week for Q1 earnings. Four companies will report, I’ll be paying attention to Adobe (ADBE) on Thursday. For economic data we have retail sales and industrial production, a Federal Reserve policy statement, a press conference on Wednesday, and the CB leading economic indicators index on Thursday.

I/B/E/S data from Refinitiv.

Disclaimer: None.