Stock Exchange: Do You Know When To Fold Your Trades?

Review:

Our previous Stock Exchange asked if the current momentum trend is really your friend, and then pointed out the benefits of blending multiple trading approaches. If you missed it, a glance at your news feed will show that the key points remain relevant.

This Week: Do You Know When To Fold Your Trades?

One of the worst mistakes you can make as a trader is to be stubborn. For example, a common mistake among new traders is refusing to cut your losses when the market is moving significantly against you. Convincing yourself that the market will eventually move in your direction if you just hold on to your position a little longer can often lead to disaster. According to professional trader, Nial Fuller, “one of the most challenging decisions that [traders] are faced with on a day to day basis is…knowing when to hold on to a trade and when to close it.” In his recent article “Know When to Hold ‘em…” Nial explains how to manage your trades in various market conditions. His advice includes using stop loses, and also trailing those stop loses in a rising market.

Another interesting read appeared in the Wall Street Journal this week regarding the large amount of short interest (i.e. people betting against) on RH (RH) (formerly Restoration Hardware) this year. Of course RH is a stock we’ve written about often in this weekly Stock Exchange series (for example, here, here and here) and it’s also a trade that our trading models have had a lot of success with by being long. The Wall Street Journal article suggests as much as $1 billion dollars may have recently been lost by short sellers betting against this stock (which is a lot considering the market cap of RH is still less than $2 billion even after the shares have risen more than 195% this year). Despite the big gains (which have been fueled in part by massive share buybacks), plenty of short sellers remain unconvinced considering about 35% of the company’s shares are still currently sold short. Several of our models are on the other side of that trade, however our models have stop loss orders in place to prevent us from giving back our big gains.

Model Performance:

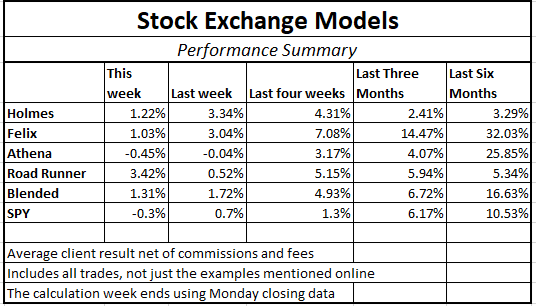

Per reader feedback, we’re continuing to share the performance of our trading models, as shown in the following table.

Importantly, we find that blending a trend-following / momentum model (Athena) with a mean reversion / dip-buying model (Holmes) provides two strategies, effective in their own right, that are not correlated with each other or with the overall market. By combining the two, we can get more diversity, lower risk, and a smoother string of returns.

Expert Picks From The Models:

This week’s Stock Exchange is being edited by Blue Harbinger (Blue Harbinger is a source for independent investment ideas).

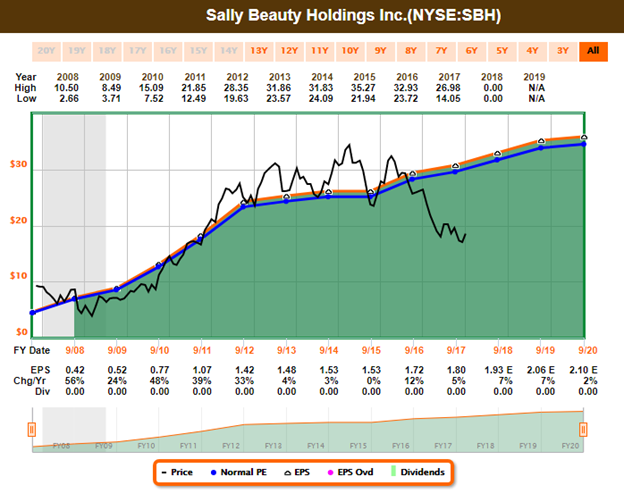

Holmes: I have no new purchases this week, however I did exit my position in Sally Beauty (SBH) on 12/22 after entering the trade back on 10/24.

Blue Harbinger: Interesting, Holmes. I do recall discussing your purchase of Sally Beauty during the week of 10/24 in this Stock Exchange. And I think it’s nice to review sells once in a while. Why exactly did you finally decide to “fold” this trade?

Holmes: I typically only hold for around six weeks, so this was a longer hold for me. I had a stop loss in place and macro conditions were changing. It was finally time to exit this trade, and I did so at a profit.

BH: Glad you made a little money on this one. I realize your dip buying strategy has been good, but it hasn’t been as “hot” as some of the momentum models lately. How about you RoadRunner—what have you got for us this week?

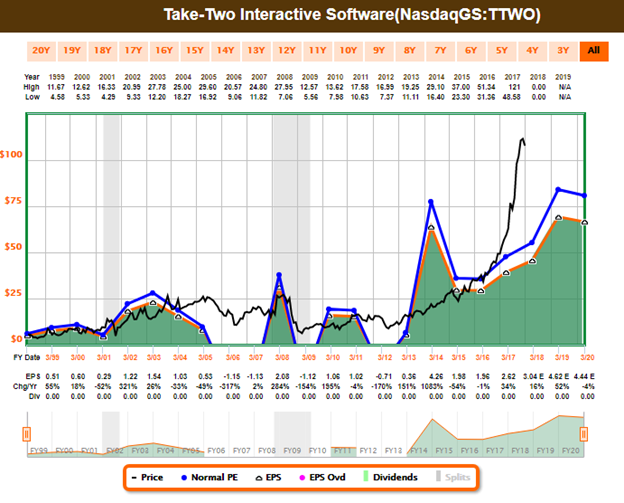

Road Runner: This week I like Take Two Interactive (TTWO). Are you familiar with this stock, Blue Harbinger?

BH: Yes, Road Runner. This is your fourth Take Two trade since May. The company makes interactive entertainment (i.e. “video games”).

RR: Well then as you also know, I like to buy stocks that are at the bottom of a rising channel, and if you look at the chart below, you can see why I like TTWO again this week.

BH: Yes, Road Runner—I can see why you bought it, and I can also see this stock has been in a rising channel for most of this year, which helps explain your success on your earlier Take Two trades. Remind us, how long do you typically hold your positions, and how do you know when it’s time to exit?

RR: My typical holding period is about 4-weeks. I give my trades time to work, and if they aren’t working in my time period then I exit my position.

BH: Well—you have a decent track-record over the last six-months. Thanks for sharing this idea. How about you, Felix—do you have any trades this week?

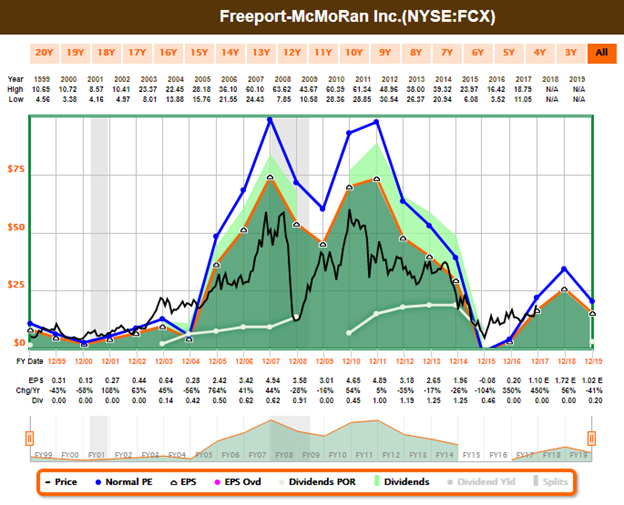

Felix: No new trades this week, but I did exit my position in Freeport-McMoRan on Wednesday 12/27.

BH: Interesting Felix. Based on the above price chart, I think I know why you sold (i.e. the shares are up big this month), but why don’t you tell us—why did you sell this copper and gold mining company, Felix?

Felix: I typically hold my positions for about 66 weeks—which is much longer than the other models. I exit when my price target is hit, and I use stops and macro considerations to control risks.

BH: That makes sense.

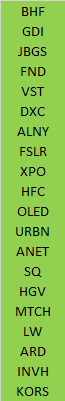

Felix: Also, this week I ran the entire Russell 1000 index (large cap stocks) through my model, and you can see the top 20 rankings in the following list.

BH: Thanks Felix. I know you are a momentum trader, so that list is interesting. How about you Oscar—what have you got for us this week?

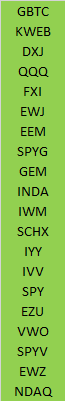

Oscar: This week I’m sharing my top ranked global ETFs. The following list includes my top 20.

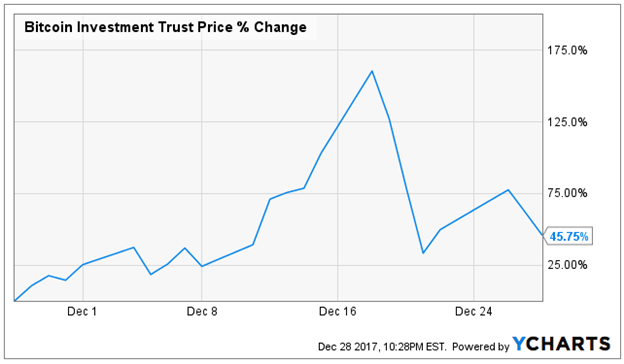

BH: Thanks Oscar. That is a very diverse group of ETFs on your list. I recall from our previous conversations that you are a momentum trader, you hold for about 6-weeks, and you control risks with stops and by rotating into a new sector. I suppose I am not surprised to see the Bitcoin Investment Trust (GBTC) at the top of a momentum list. We discussed Bitcoin in more detail a few weeks ago in this article: Do Not Invest In Bitcoin, Trade It! Bitcoin’s price has pulled back in the last week, but it has been on a wild ride over the last month, as shown in the following chart.

Conclusion:

Trading is not only about buying—that’s only half the story. Knowing when to sell your trades can be just as important. We use a combination of stops, macro factors and timeframes to determine when to exit our positions and to control risks across our varying model-based trading approaches. As Kenny Rogers says in the following video: “you’ve got to know when to hold ’em, know when to fold ’em.”

Overall, we find that a blended approach, between momentum and dip-buying, works well to deliver strong returns while also providing more diversity, lower risk, and a smoother string of returns.

The Stock Exchange does not have all the answers, but it provides good ideas and a stimulus for your own trading.

Getting Updates

We have a new (free) service to subscribers to our ...

more