Stay Long Neck Braces And Equities

Don’t expect market volatility to subside anytime soon, according to a new report from Bank of America, U.S. Trust. Invest in a neck brace and in high quality, well-managed, world-class companies attractively valued after December’s market meltdown, says Joe Quinlan, Head of CIO Market Strategy.

The wholesale re-pricing of assets has afforded investors a propitious opportunity to re-energize/rebalance portfolios. Periods of steep market declines typically reset valuations and wash out investor sentiment, providing the base/bounce for upside moves in equities.

Quinlan says, think technological innovation (robotics, artificial intelligence), the global healthcare revolution and the incessant demand of emerging market consumers for travel and leisure, cosmetics, e-sports, and luxury brands goods. The world never as affluent as today, and the residual of wealth is waste—making waste management one of his favorite long-term plays.

There is nothing investors want more than to leave behind the market volatility of 2018 and walk on firmer ground in 2019. Owing to the toxic convergence of rising U.S. interest rates, simmering U.S.-Sino trade tensions and peak global earning expectations, among many other variables, volatility returned with a vengeance in 2018, notably down the home stretch.

Missing in action in 2017, the Chicago Board Options Exchange (CBOE) volatility index (VIX ) averaged 25.0 in December 2018, up from an average of 11.1 over the course of 2017. In December alone, the S&P 500 booked five days of losses exceeding -2%, after having experienced none throughout the entire year of 2017.

After the Fed raised rates for the fourth time of the year on December 19, and after reaffirming its commitment to continue raising rates and reducing its balance sheet, stocks sold off hard, with December 24 posting the largest-ever Christmas Eve decline for both the Dow and S&P 500. However, the major indices the day after Christmas posted one of the strongest single-day returns in over a decade. Then on December 27, the Dow rebounded from a more-than-600 point intraday loss to close up 260 points, the largest daily point recovery in the history of the index. The market swings capped one of the worst years for stocks since 2008 and left many whipsawed investors wishing they had unwrapped a neck brace for Christmas.

Barn Cats

Market volatility will remain the norm until Fed Chairman Jerome Powell and the Fed’s growth-cum-inflation expectations align with the markets. Miscommunication was a key part of the late-2018 market implosion, beginning with Powell’s October 3 comment that interest rates were “a long way from neutral.” The comment didn’t square with market sentiment worried about weaker U.S. growth and, more importantly, moderating inflationary expectations heading into 2019.

By the time the December Fed meeting rolled around, the markets were pining for the Fed to stand pat—or take a pass on raising rates. Ditto for the White House, with President Trump emerging as a key critic of Chairman Powell over 2018, further adding to negative market sentiment. Ignoring the markets and the president, however, the Fed raised rates again in December but pledged to move toward more “data dependency” in assessing the need for future hikes. The Fed also lowered its rate hike projections for 2019— from three to two. Stocks promptly sank following the Fed move but rebounded a few days later, on December 21, following comments from New York Federal Reserve President John Williams that the Fed is listening “very carefully” to the markets and that the Fed is open to reconsidering its views on rate hikes next year.

The soothing effect didn’t last long, though. The Fed’s verbal to-and-fro was too much for investors already more skittish than abused barn cats. December’s equity declines were among the worst since the Great Depression.

It's Not What They Do, It's What They Say

All of the above reminds us of Ben Bernanke’s critical declaration in his insightful book, The Courage to Act. According to the one-time head of the Fed, “monetary policy is 98 percent communication and 2 percent action.” As he notes in his book, communication from the Fed is notably important “when short-term rates hover close to zero and influencing expectations about future interest rates becomes critically important.” Communication is also highly important the longer the rate cycle progresses since each rate hike begets expectations as to the end of the cycle. Misfire on communications, according to Mr. Bernanke, and “any wrong or unintended policy signal could roil markets.”

How true-just ask Jay Powell and company, taken to task by the capital markets and the president over the past few months for largely muffing the “98%” Bernanke warned about.

To help clear the air, the Fed chairman has pledged to hold news conferences after every monetary policy meeting this year—a stance that could conceivably add clarity to Fed expectations or create more fog or ambiguity for the markets. Calming the barn cats, the Fed Chairman hit the right notes on Friday, claiming that at the Fed, “we will be prepared to adjust policy quickly and flexible and use all of our tools to support the economy should that be appropriate.”

Not helping matters is a host of other variables outside the control and domain of the Fed. Think sloppy and uncertain signals over Brexit; mounting alarm over Italian finances; weaker-than-expected growth figures from Germany and Japan; and the rolling over of global inflationary expectations. Slumping oil prices, meanwhile, are fueling fears that the global economy has slowed markedly, that reflationary efforts of the central banks have been all for naught, and that earnings expectations for 2019 are too high and needed to be adjusted lower.

Add to this volatile pot the U.S. government shutdown and simmering trade tensions between the U.S. and China—the world’s two largest economies—and it is little wonder the global capital markets remain fragile early in 2019.

Stay Long Neck Braces and Stocks

We don’t expect market volatility to subside anytime soon given the multiple crosscurrents buffeting the capital markets. So invest in a neck brace—more market swings and volatility lie ahead.

We ask investors to consider investing in high-quality, well-managed, globally positioned, world-class companies attractively valued after December’s market meltdown. The wholesale re-pricing of assets has afforded investors a unique opportunity to re-engage/rebalance portfolios.

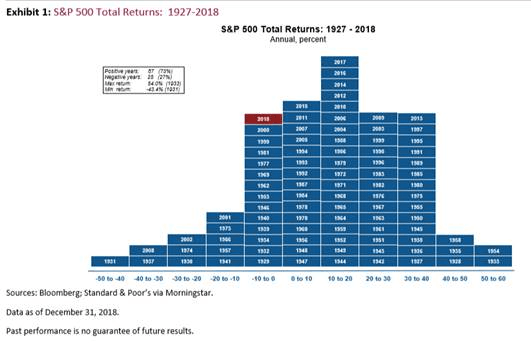

While strapping on that neck brace, keep in mind that periods of steep market declines typically reset valuations and wash out investor sentiment, providing the base/bounce for upside moves in equities. With the forward P/E of the S&P 500 at roughly 14x versus the 18x at the beginning of 2018, equities are attractively valued. Also, think long term: As Exhibit 1 depicts, 2018 was the exception, not the rule, with the S&P 500 posting positive annual returns 73% of the time since 1927. And amid all the negative headlines, don’t forget about market fundamentals and long-term secular global trends.

Per the former-fundamentals-U.S. economic growth, led by the consumer, remains on firm ground, backed by strong employment levels and moderately rising wages. Friday’s jobs number was nothing less than a blowout, with 312k jobs added in December. Countering the myth that America is not in the business of manufacturing, some 284,000 manufacturing jobs were created last year, the most gains in two decades. Global growth, meanwhile, is slowing, but the world economy is still expected to expand by better than 3% this year. We expect more reflationary measures from Europe, Japan and, most notably, from China. Global earnings have peaked but are expected to remain positive this year; 5%–6% earnings growth is the consensus in the United States—hardly stellar, but solid.

Helping matters, we suspect that in year two, Chairman Powell will become better at communicating with the markets, and despite jawboning from the White House, the Fed, in our opinion, will remain the credible, independent institution it has always been.

On a secular basis, think technological innovation (robotics, artificial intelligence), the global healthcare revolution and the incessant demand of emerging market consumers for travel and leisure, cosmetics, e-sports, and luxury brands goods. Also, with the world never as affluent as today, think trash or waste management. The residual of wealth is waste-making waste management and related activities one of our favorite long-term plays.

The named research analysts in these materials certify that: the views expressed in these materials accurately reflect the analysts’ personal opinions about the securities, investments and/or economic subjects discussed and that no part of the analysts’ compensation was is or will be related to any specific views contained in these materials. This publication is designed to provide general information about economics, asset classes, and strategies. It is for discussion purposes only since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Always consult with your independent attorney, tax advisor, and investment manager for final recommendations and before changing or implementing any financial strategy.

Disclaimer: This article is NOT an investment recommendation, please see our disclaimer - Get ...

more