Stall Speed

The more you turn the faster you have to move. This is the lesson for driving or flying and the physics maybe the best way to understand the risks for markets today as the ECB banks and the European economy nears stall speed. The flash PMI reports were worse than expected for Services and that matters given it is not just about US/China trade fears anymore but domestic political problems and protests. The power of fear over greed remains in play even as equities float on hopes of a kind ECB Draghi as he balances sounding positive on the soft-patch being temporary and yet promises to use more easy money if he is wrong. The risk mood is mixed to positive and disregards the economics. The warnings of the White House economist Hasset on the US economy potentially having zero GDP in 1Q spooked but didn’t hold much power on markets yesterday. The delay to Trump’s State of the Union address due to the government shutdown maybe more important as politics power economic sentiment. The news flows from overnight were negative – Australia flash PMI lower, Japan lower, Europe lower. Markets mostly ignored this and the gloomier outlooks from the Bank of Korea. The Norges Bank didn’t flinch either as it still plans a March hike. The risk for a bigger turnabout of mood seems clearly linked to what Draghi says today – and how the markets digest it. The EUR is still stuck in a 1.13-1.15 prison but the EUR/JPY maybe more obvious a chart with 125 capping rallies and risk for a retesting of the flash crash lows from earlier in the play still more likely.

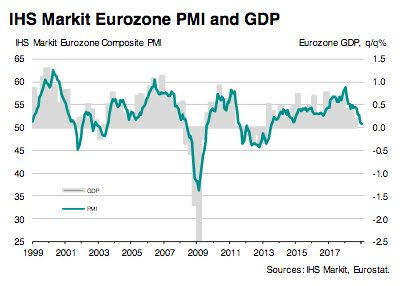

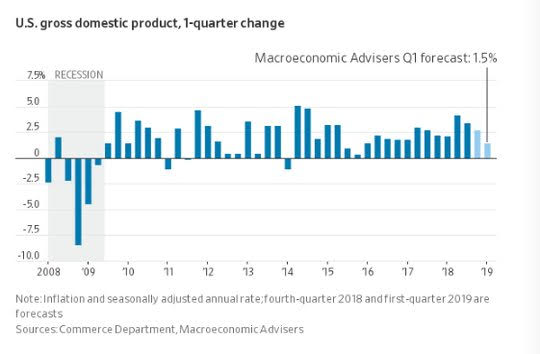

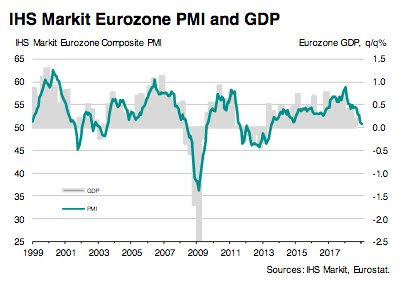

Question for the Day: Is the US or Europe worse off on growth for 1Q? The stall speed for the European economy seems to be more in play on the flash PMI reports but the warnings from economists on the pain from US government shutdown are rising. This is the balancing act and its captured in two charts with the 1Q forecasts in the US at 1.5% y/y while in Europe its down to 0.5% y/y – both are trouble for the rest of the world.

What Happened?

- Australia December Westpac LEI -0.27% after 0.43% - 6-month annualized – suggesting 2% 2H2018 growth. Westpac sees 2019 GDP slowing to 2.6% from 3.0% - well below the 3.5% RBA outlook. In December 4 of the 8 components to LEI fell.

- Australia January CBA flash composite PMI 51.5 from 52.9 – weakest in 33-months. Service sector weakness outweighed manufacturing gains. New orders and employment were both lower but confidence rose to 4-month highs.

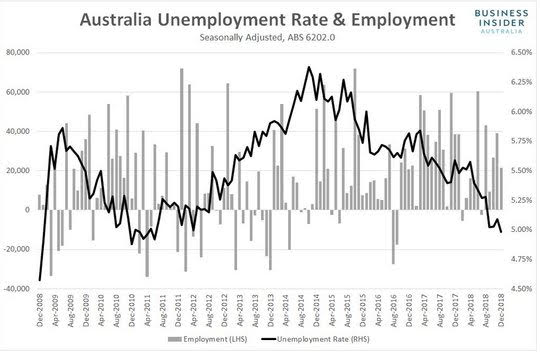

- Australia December employment up 21,600 after 39,000 – better than 18,000 expected. The unemployment rate drops to 5% from 5.1%p – also better than 5.1% expected and best since June 2011 - as the participation rate slips to 65.6% from 65.7%. Full-time jobs fell 3,000 after -7,300 while part-time rose 24,600 after a 46,300 gain. Over the year, full-time employment increased by 162,000, outpacing a 106,600 lift in part-time workers. Total hours worked inched higher over the month, lifting by 0.1% to 1.7589 billion hours.

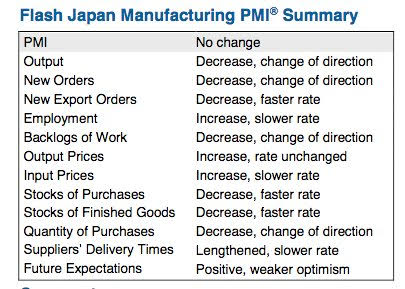

- Japan January flash manufacturing PMI 50.0 from 52.6 – weaker than 52.4 expected– with exports drop at 2 ½ year lows. Production fell for the first time since July 2016 and confidence dropped to 6-year lows.

- Japan November final LEI 99.1 from 99.7 – less than 99.3 preliminary report. The coincident index fell to 102.9 from 104.9 – also worse than the 103 expected.

- Bank of Korea left rates unchanged at 1.75%- as expected - but cuts GDP and CPI forecasts. GDP outlook cut to 2.6% from 2.7% and CPI from 1.7% to 1.4% for 2019. The BOK also said it also carefully monitor conditions related to trade, along with any changes in the monetary policies of major countries, financial and economic conditions in emerging market economies, the trend of increasing household debt in Korea and geopolitical risks.

- Norges Bank leaves rates unchanged at 0.75%- as expected – and keeps March rate hike outlook. The outlook and the balance of risks imply a gradual increase in the policy rate. Global growth is a little weaker than projected, and there continues to be considerable uncertainty surrounding developments ahead. In Norway, economic growth and labor market developments appear to be broadly as projected, while inflation has been slightly higher than expected.

- "Overall, new information indicates that the outlook for the policy rate for the period ahead is little changed since the December Report", says Governor Øystein Olsen.

- Sweden December unemployment rose to 6% from 5.5% - worse than 5.8% expected. The seasonally adjusted rate rose to 6.4% form 6.2%. The number of jobless rose 6,000 to 327,00 but employment rose 94,000 to 5.099mn.

- Eurozone flash composite PMI 50.7 from 51.1 – weaker than 51.4 expected – 5 ½ year lows. The manufacturing flash PMI 50.5 from 51.4 – weaker than 51.4 expected – 50-month lows with the output index at 50.4 from 51 touching 67-month lows. The services flash PMI 50.8 from 51.2 – also weaker than 51.5 expected – 65-month lows. Inflows for new work contracted for the first time since Nov 2014. New orders for goods were down for the 4thconsecutive month at the worst rate since Apr 2013 and for services the first decline since July 2013. However, the outlook stabilized near the four-year lows with focus on Brexit, political stress and the auto sector. The IHS Markit economist Chris Williamson noted: “The Eurozone economy slipped closer to stall speed in January, with companies reporting the first drop in demand for over four years. The disappointing survey data indicate that GDP is rising at a quarterly rate of just 0.1%.”

- France flash composite PMI 47.9 from 48.7 – worse than 50.9 expected – 50-month lows. The flash manufacturing PMI rose to 51.2 from 49.7 – better than 49.9 expected and 2-month highs – while the flash services PMI fell to 47.5 from 49 – worse than the 50.5 expected and 59-month lows.

- German flash composite PMI 52.1 from 51.6 – better than 51.9 expected. The flash manufacturing PMI 49.9 from 51.5 – weaker than 51.3 expected – 50-month lows while the flash services PMI bounced to 53.1 from 51.8 – better than 52 expected and 2-month highs. The manufacturing output PMI slowed to 50.2 from 51.5 at 69-month lows.

Market Recap:

Equities: The S&P500 futures are up 0.17% after 0.22% gain yesterday. The Stoxx Europe 600 is up 0.45% with earnings and ECB focus. The MSCI Asia Pacific bounced 0.2% with Apple suppliers gaining.

- Japan Nikkei off 0.09% to 20,574.63

- Korea Kospi up 0.81% to 2,145.03

- Hong Kong Hang Seng up 0.42% to 27,120.98

- China Shanghai Composite up 0.41% to 2,591.69

- Australia ASX up 0.37% to 5,930.50

- India NSE50 up 0.17% to 10,849.80

- UK FTSE so far off 0.25% to 6,827

- German DAX so far up 0.5% to 11,127

- French CAC40 so far up 0.7% to 4,876

- Italian FTSE so far up 1.25% to 19,641

Fixed Income: Lower flash PMI into ECB driving EU bonds – German 10-year Bund yield off 2bps to 0.21%, French OATS off 3bps to 0.61%, UK Gilts off 1bps to 1.32% while in periphery mixed with Italy off 6bps to 2.70%, Spain off 5bps to 1.27%, Portugal up 12bps to 1.71% and Greece up 3bps to 4.21%.

- France AFT sells 3Y 0% Feb 22 BTANat -0.35% after -0.42% and 5Y 0% BTAN at -0.06% after -0.18%

- US Bonds bid on growth fears, curve flatter– 2Y flat at 2.59%, 5Y off 2bps to 2.57%, 10Y off 2bps to 2.74%, 30Y off 2bps to 3.05%.

- Japan JGBs off even with weaker flash PMI –2Y up 1bps to -0.16%, 5Y up 1bps to -0.15%, 10Y up 1bps to 0.01% and 30Y flat at 0.67%.

- Australian bonds rally despite better jobs – focus on China and US rates– 3Y off 4bps to 1.76%, 10Y off 3bps to 2.26%.

- China bonds mixed, curve steeper– 2Y off 2bps to 2.64%, 5Y off 2bps to 2.94%, 10Y flat at 3.15%.

Foreign Exchange: The US dollar index is up 0.35% to 96.45. In EM, USD mixed – KRW off 0.4% to 1129.80, INR up 0.1% to 71.13, ZAR off 0.1% to 13.823, RUB up 0.2% to 65.932.

- EUR: 1.1335 off 0.4%. Range 1.1330-1.1391 with ECB key and weaker PMI driving 1.13-1.15 matters.

- JPY: 109.75 up 0.15%. Range 109.44-109.88 with EUR/JPY 124.50 off 0.15%. Focus is on 125 cap and 110 resistance in $.

- GBP: 1.3020 off 0.45%. Range 1.3020-1.3094 with EUR/GBP .8705 up 0.1%. Waiting for Jan 29 and more Brexit.

- AUD: .7095 off 0.6%. Range .7089-.7167 with NZD .6770 off 0.25%. Commodities and mixed jobs report with .7050 key.

- CAD: 1.3360 up 0.1%. Range 1.3329-1.3369 with 1.34 in play – commodities and crosses driving.

- CHF: .9955 up 0.1%. Range .9936-.9968 with EUR/CHF 1.1285 off 0.3%. All about ECB today with 1.00 key.

- CNY: 6.7920 flat. Range 6.7740-6.7960 with focus on rates, growth and trade talks still.

Commodities: Oil lower, Gold lower, Copper off 0.3% to $2.6810.

- Oil: $52.53 off 0.15%.Range $52.12-$52.88 with focus on EIA this morning. Brent off 0.45% to $60.87 with $60 pivot.

- Gold: $1278.20 off 0.45%.Range $1276.80-$1283.90 with USD bid driving and $1276 pivot for $1268. Silver off 0.5% to $15.30, Platinum off 0.25% to $794.30 and Palladium flat at $1307.50.

Economic Calendar:

- 0830 am US weekly jobless claims 213k p 220k e

- 0945 am US Jan flash composite PMI 54.4p 54.2e / manufacturing 53.8p 53.5e / services 54.4p 54.2e

- 1000 am US Dec conference board LEI 0.2%p

- 1100 am US weekly EIA oil inventories -2.683mb p

View TrackResearch.com, the global marketplace for stock, commodity and macro ideas here.