SPX, Gold, Oil And G6 Targets For The Week Of March 25th

The pause in momentum we were expecting last week arrived on cue, and the SPX registered its third negative weekly close in 2019. The weekly candles show that the SPX is starting to have difficulties keeping up with the 4 x 1 angle. And that’s to be expected since the year-end target for that angle is 4600. The 1 x 1 angle is where price and time are in balance, and that projects a more realistic target of 3075.

The SPY daily chart reveals that Friday’s close was within the support/resistance band stretching back to October ’18. The breadth oscillator has been declining all week long and is a couple of days away from hitting rock bottom.

Current signals*: Daily Flat, Weekly Flat

For Weekly Buy/Sell pivots check the TV page which gets updated on Monday.

The projected trading range for next week for SPX remains unchanged at 2750-2880.

Oil remained in its third wave up and came to within $0.20 of our upside weekly target.

Current signals: Daily Long, Weekly Long.

The projected trading range for Oil for next week is 56.5 – 61.5:

GOLD reached our upside target on Thursday and remains in an uptrend.

Current signals: Daily Long, Weekly long.

The projected trading range for Gold for next week is: 1295 – 1325:

USDCHF continued sliding after the double top reversal from last week, and dropped below the lower weekly target. More importantly, it dropped below parity which has been our bullish/bearish pivot for a long time.

The projected trading range for USDCHF for next week is 0.985– 1.00:

USDJPY came to life and broke below the 110 – 112 congestion zone. It reached our lower weekly target on Friday and continued sliding.

Current signals: Daily Short, Weekly Short.

The projected trading range for USDJPY for next week is 109 – 111.5:

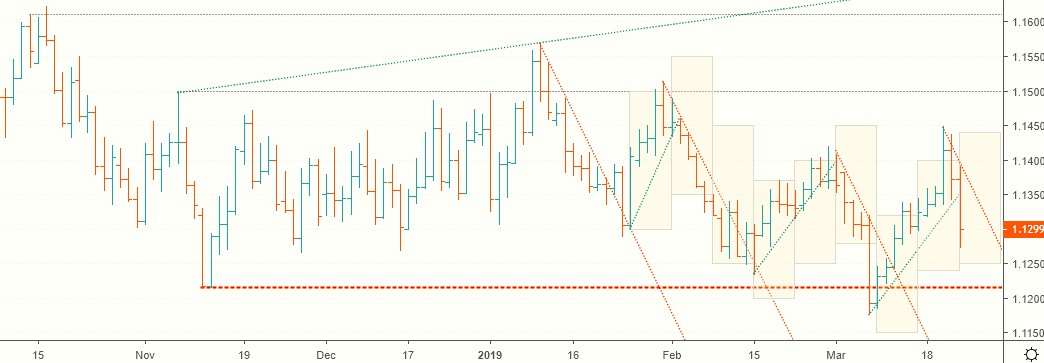

EURUSD tried to break above the upside weekly target but failed. EURUSD is showing a well-defined zig-zag pattern and, as mentioned before, a break below 1.12 could lead to a further 8% decline.

The projected trading range for EURUSD for next week is 1.125 – 1.144:

GBPUSD tested the lower weekly target twice, followed by a modest rebound. The Brexit saga continues to dominate the news flow but the question from the start has always been how much of a no-Brexit is priced in.

The projected trading range for GBPUSD for next week is 1.298 – 1.333:

USDCAD remains in the March trading range and keeps the same targets.

The projected trading range for USDCAD for next week is 1.325 – 1.35:

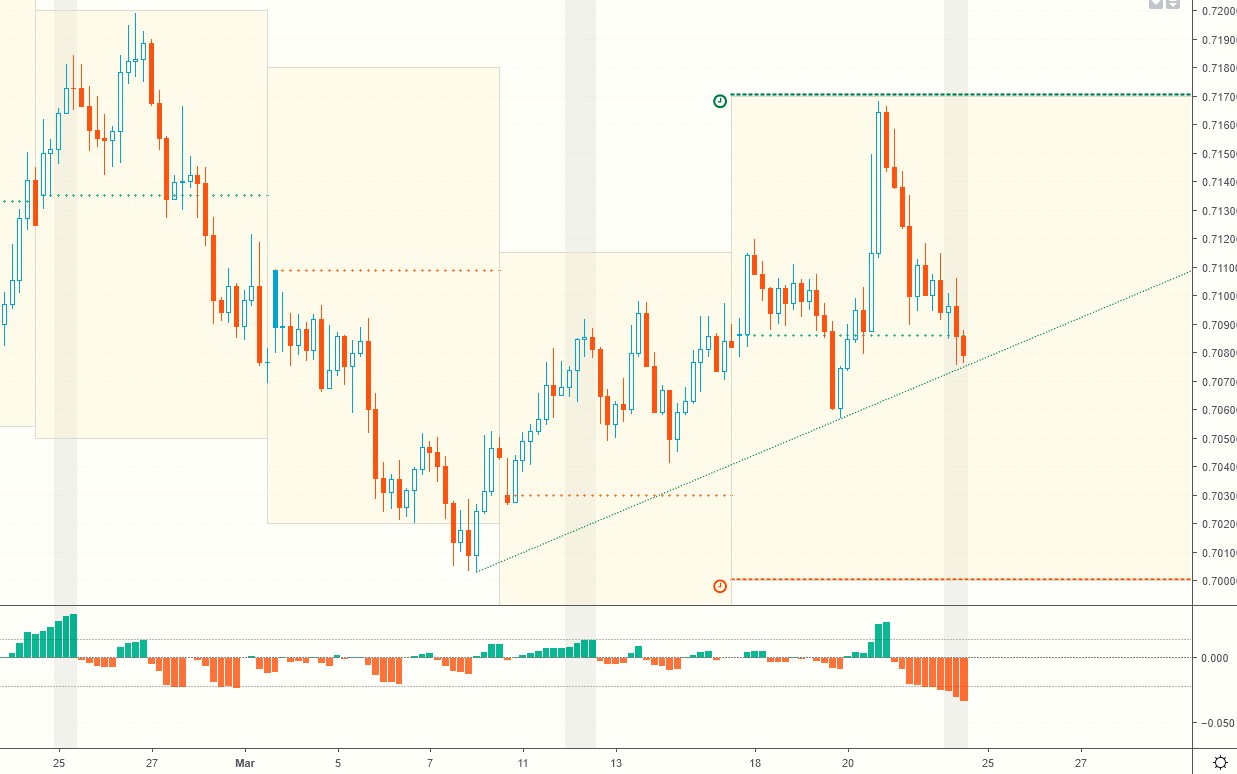

AUDUSD reached the upper weekly target and reversed, finishing the week flat. The sell-off at the end of the week is exhibiting signs of exhaustion and, if the trendline holds, it could provide a good long swing entry point.

Current signals: Daily Flat, Weekly Flat.

The projected trading range for AUDUSD for next week remains unchanged at 0.7 – 0.717:

*Please note that the signals are provided for informational purposes only. They are in effect as of the close on Friday and may change as soon as the markets re-open.

Charts, signals and data courtesy of OddsTrader, CIT for TradingView and NinjaTrader 8

For intraday charts and update follow us on TradingView

Disclaimer:Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that ...

more