SPX, Gold, Oil And G6 Targets For The Week Of February 11th

There were two themes in last week’s forecast. The first focused on market breadth, which continues to be supportive of higher prices. The focus of the second was the bearish 1 x 1 angle from the ’18 high. The SPX closed on that angle, meaning that price and time are in balance. The notion of balance was reinforced by the weekly doji candle which represents balance between buyers and sellers:

Therefore, a break above the angle is critical for continuation of the 2019 rally. The next bullish target is just above 2800, while support starts at the 2630 level.

Current signals*: Daily Flat, Weekly Long

For Weekly Buy/Sell pivots check the TV page which gets updated on Monday.

The projected trading range for next week for SPX is 2600-2800:

Oil found support at the lower weekly target and staged a modest rebound at the end of the week. The technical outlook hasn’t changed, since it continues making higher highs and higher lows.

Current signals: Daily Flat, Weekly Long.

The projected trading range for Oil for next week is 50 – 56:

GOLD continues trading above the breakout 1300 level and remains in an uptrend.

Current signals: Daily Long, Weekly Long

The projected trading range for Gold for next week remains unchanged: 1295 – 1330:

USDCHF finally broke above parity but met resistance at the upper weekly target and retreated to just below $1.00.

The projected trading range for USDCHF for next week is 0.993 – 1.0085:

USDJPY remains in an uptrend but needs to break above 110 to keep the bullish momentum alive.

Current signals: Daily Flat, Weekly Flat.

The projected trading range for USDJPY for next week is 108.5 – 111:

EURUSD sold off to the downside weekly target on Wednesday and, after testing that level several times, broke below it on Friday.

The projected trading range for EURUSD for next week is 1.125 – 1.145:

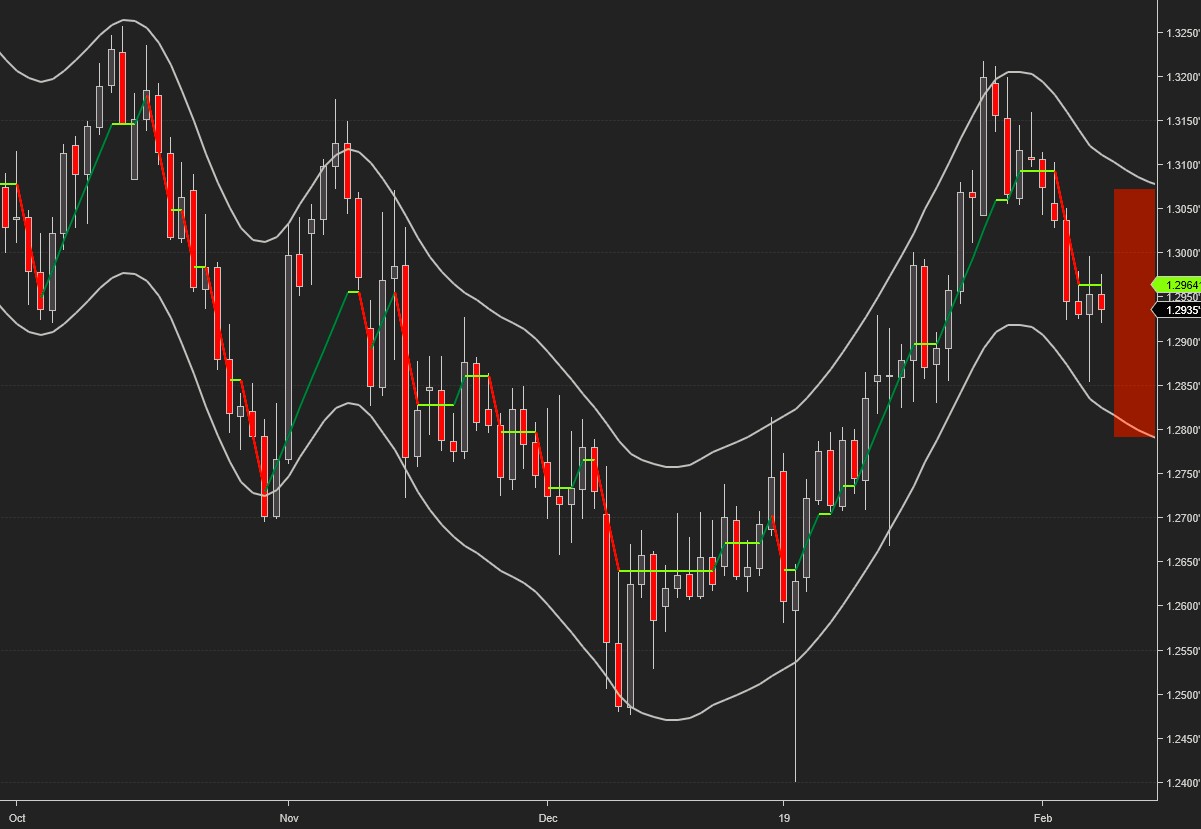

GBPUSD started retreating from the open on Sunday and traded most of the week at the lower weekly target.

Current signals: Daily Flat, Weekly Flat.

The projected trading range for GBPUSD for next week is 1.28 – 1.3075:

USDCAD reversed trend shortly after the open, then proceeded to breach the upper weekly target, only to retreat and retest it on Friday.

Current signals: Daily Long, Weekly Flat.

The projected trading range for USDCAD for next week is 1.315 – 1.3375:

AUDUSD lost its bullish momentum on Tuesday and sold off for the remainder of the week, dropping below the weekly downside target. There’s a strong area of support between 0.705 and 0.707.

Current signals: Daily Short, Weekly Short.

The projected trading range for AUDUSD for next week is 0.7 – 0.718:

*Please note that the trading signals are in effect as of the close on Friday and may change as soon as the markets re-open. When the current signal is flat/hold, we may also include the preceding buy or sell signal (e.g. Buy/Hold or Sell/Hold). Hold signals followed by a buy/sell signal in the direction of the preceding buy/sell signal can be considered for pyramiding the position.

Charts, signals and data courtesy of OddsTrader, CIT for TradingView and NinjaTrader 8

For intraday charts and update follow us on TradingView

Disclaimer:Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that ...

more