SPX, Bitcoin, Gold, Oil, 10YT And G6 Targets For The Week Of April 20th

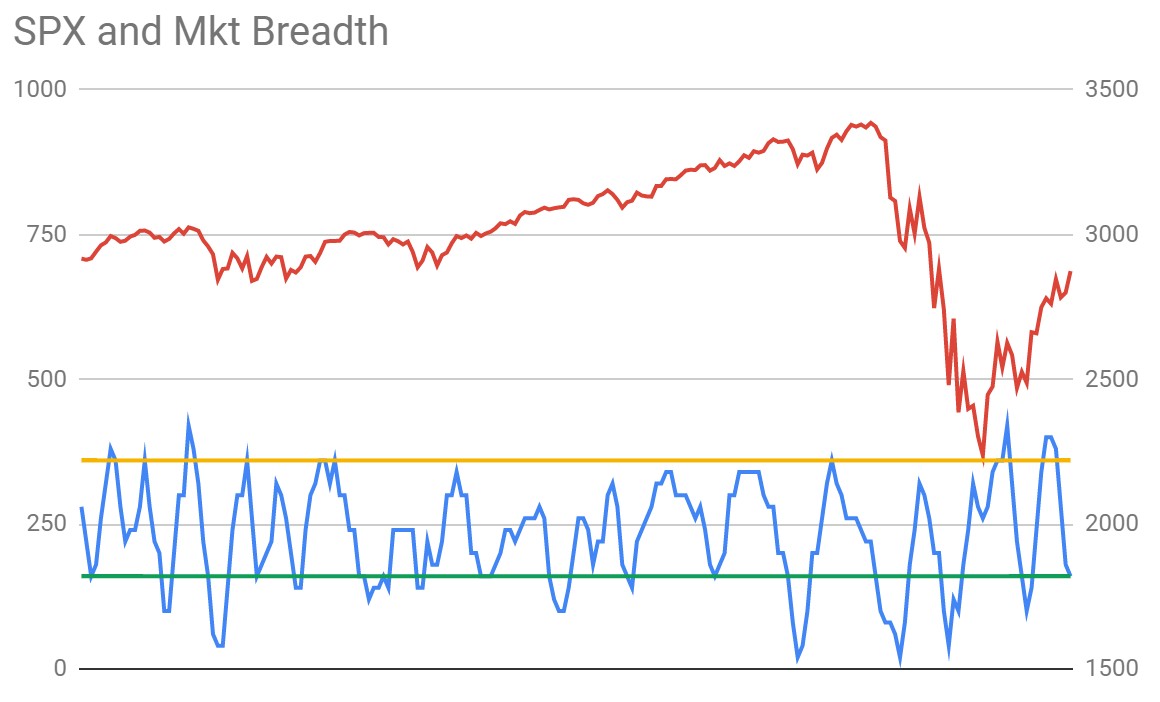

Last week the expectation was that the market will enter a sideways down phase. That phase ended on Thursday, and market breadth reached oversold levels once again:

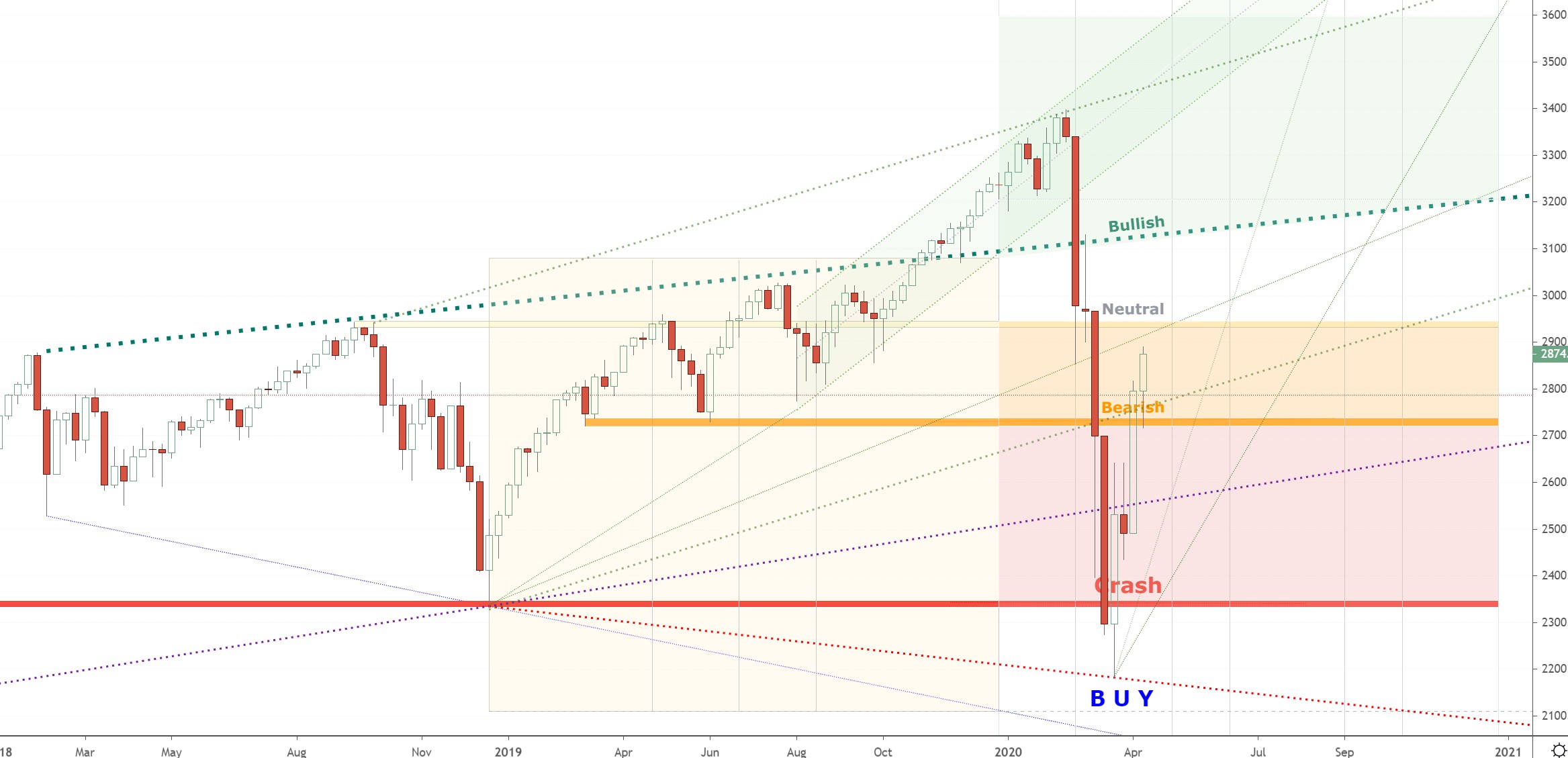

This should serve as a catalyst for the next up phase, which should lead to a test of the next important SPX technical level just above 2900. This also happens to be our upside weekly price target:

The 10 Year Treasury (TLT) turned bullish mid-week, but stalled at the upside weekly target. There’s a short-term double top just below 140 and continued failure to break above that level is likely to stimulate a stronger bearish reaction on a break below 138.28:

GOLD (GLD) met heavy resistance at the upside weekly target and reversed lower. Nevertheless, the weekly uptrend is not likely to get endangered just yet:

USDCAD has been trading in a narrow range since the end of March, and keeps the same weekly targets: (UUP/FXC)

For OIL, GOLD, BTC (BITCOMP) and G5 weekly targets and Buy/Sell pivots, check the TV page which gets updated on Monday.

*Please note that the signals are provided for informational purposes only. They are in effect as of the close on Friday and may change as soon as the markets re-open.

Charts, signals, targets and data courtesy of OddsTrader, CIT for TradingView and NinjaTrader 8

For intraday charts and update follow us on TradingView

Disclaimer: Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money ...

more