SPX: At An Interesting Crossroad

10:17 am

(Click on image to enlarge)

SPX is at an interesting crossroad. It may either go higher, with a possible target of 4680.00 (Short-term resistance) or the 61.8% retracement at 4683.00…

…or it may resume its decline from here. There are two different Elliott Wave structures that may be indicated simultaneously.

ZeroHedge poses the dilemma, “A lot of investors finally have what they wished for: a chance to buy the dip. The problem is uncertainty is much higher now.

Friday’s selloff, fueled by the emergence of a new Covid-19 variant, brought a firm halt to the market’s exuberance of recent weeks. The Stoxx 600 Index is now more than 5% below its record closing high of mid-November, opening a window for those who have been awaiting weakness to add positions.

“Many investors had been complaining about ever-rising markets that give little entry opportunities,” says Martin Moeller, co-head of Swiss and global portfolio management at Union Bancaire Privee in Geneva. “Here is the next one shaping up, given that in 2022, the easing of supply chains and delayed execution of very strong prior order intake should be supportive for economic growth.”

8:20 am

(Click on image to enlarge)

The expected bounce at mid-Cycle support came over the weekend with SPX futures rising to a high of 4646.00, just above the 50% retracement of Friday’s decline at 4644.00. Pundits blame the decline on the Omicron scare, ignoring the fact that the uptrend may be finished.

ZeroHedge reports, “As expected over the weekend, and as we first noted shortly after electronic markets reopened for trading on Sunday, S&P futures have maintained their overnight gains and have rebounded 0.7% while Nasdaq contracts jumped as much as 1.3% after risk sentiment stabilized following Friday’s carnage and as investors settled in for a few weeks of uncertainty on whether the Omicron variant would derail economic recoveries and the tightening plans of some central banks. Japan led declines in the Asian equity session (which was catching down to Friday’s US losses) after the government shut borders to visitors. The region’s reopening stocks such as restaurants, department stores, train operators and travel shares also suffered some losses. Oil prices bounced $3 a barrel to recoup some of Friday’s route, while the safe haven yen, Swiss franc and 10Y Treasury took a breather after its run higher.”

(Click on image to enlarge)

(Click on image to enlarge)

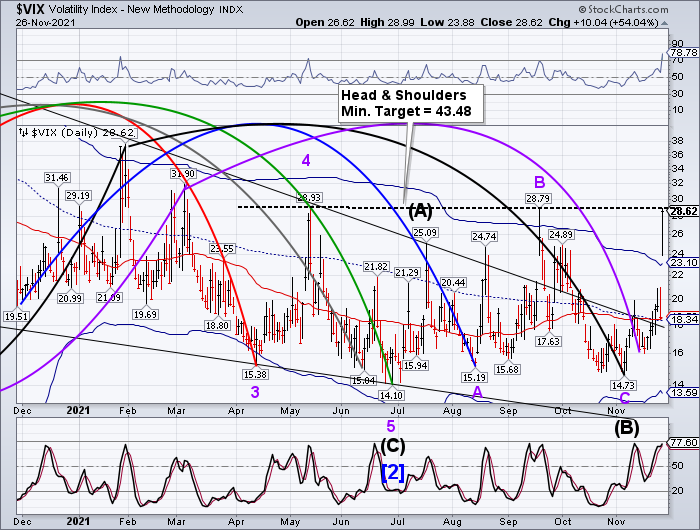

VIX futures declined to 24.45, well above the Cycle Top support at 23.10. VIX is behaving as it should in a new Master Cycle that may last another month. Pundits refer to this as a contrived “fearstorm.” However, from a Cycles perspective, it was overdue.

(Click on image to enlarge)

The NYSE Hi-Lo Index made an even deeper low on Friday. It is well into its sell signal. It is likely that there may be a bounce back. However, the Cycles Model suggests the decline in the Hi-Lo may last another two weeks, at a minimum.

(Click on image to enlarge)

TNX recovered from its Friday swoon, having completed an irregular correction and beginning its strongest move higher, Wave (C), in the series. We may see a breakout in the next few days, with a high degree of strength growing in the rally the week of December 6.

(Click on image to enlarge)

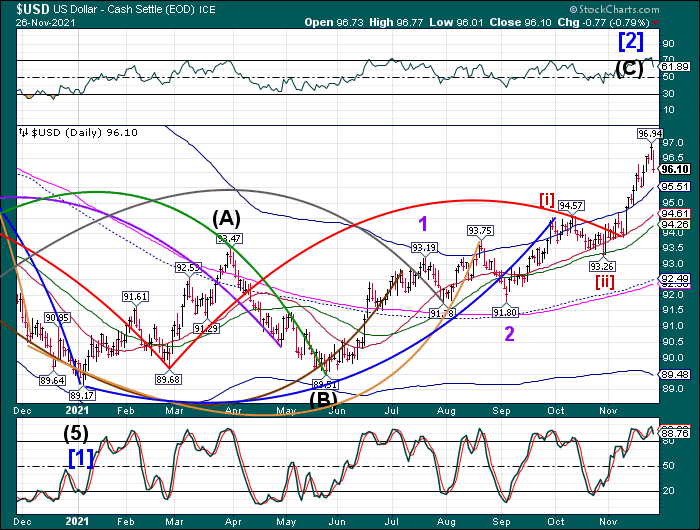

USD futures began a consolidation, rising to 96.39 over the weekend. It may rise out of the consolidation as early as this week. If not, trending strength may return the week of December 6.

(Click on image to enlarge)

BKX is likely to retest its 50-day Moving Average at 136.33. Wednesday may have been the last day of strength in the uptrend. Trending strength may return the week of December 6, but may accentuate the downtrend.

Nothing in this email or article should be construed as a personal recommendation to buy, hold or sell short any security. The Practical Investor, LLC (TPI) may provide a status report of ...

more