Specter Of Long Term US Unemployment

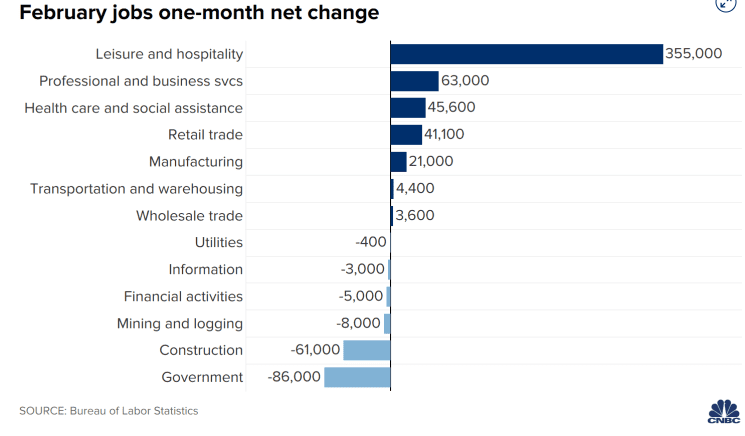

In February nonfarm payrolls increased by a hefty 379,000, more than double the 166,000 gain in the previous month. Not surprisingly, most of the rebound hiring in February was centered in the hospitality sector, which reported a gain of 355,000.

In contrast, the education, construction, and mining sectors all posted job declines in February. And underscoring the need for the federal government to help state and local governments, public sector jobs declined by 86,000 in February, largely reflecting cutbacks in the education sector.

Elsewhere, manufacturing added 21,000 jobs and retail posted a gain of 41,100 jobs. Health care and social assistance employment increased by 45,600 in February, while professional and business services rose 63,000.

Reinforcing the observation that the jobs recovery still has a long way to go, there were 9.5 million fewer Americans holding jobs in February 2021 compared to a year earlier. The unemployment rate in February was 6.2%, lower than the 6.3% level in January, but hardly a number to cheer about.

It is widely recognized that the benchmark unemployment figures severely underestimate the true harm the pandemic recession has afflicted on the job market.

This understatement is often described as the discouraged worker effect. For example, while the labor force participation rate was unchanged at 61.4% in February, it was considerably lower than the 63.3% participation rate a year earlier.

In other words, about four million people have dropped out of the labor force since last year. If the labor force participation rate was back at last year’s level, the unemployment rate would measure closer to 10%.

The broader U6 unemployment rate is a more accurate measure of joblessness since it accounts for both unemployed and underemployed workers. In February, the U6 unemployment rate was still extremely high at 11.1%.

The real public sector worry should focus on whether the US job market will post-pandemic have a significant long-term unemployment problem.

The accepted measure of identifying hardcore or long-term unemployed are those who unemployed for 27 weeks or longer. In February, 41.5% of the recorded unemployed fell into this category.

Looking ahead, the recent employment data indicate that the US job market has a long way to go before reaching the same level of employment that existed before the pandemic hit.

That is, the US economy would need to add almost 1 million jobs a month for the rest of 2021 to simply return to pre-crisis levels by the end of the year.

In other words, while the February employment increase would normally be considered far above average in a pre-pandemic world, nonetheless there is still the deep chasm of 9.5 million jobs that have been lost over the past twelve months.

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)

(Click on image to enlarge)