S&P/Case-Shiller Home Price Index: Home Price Increases Slow

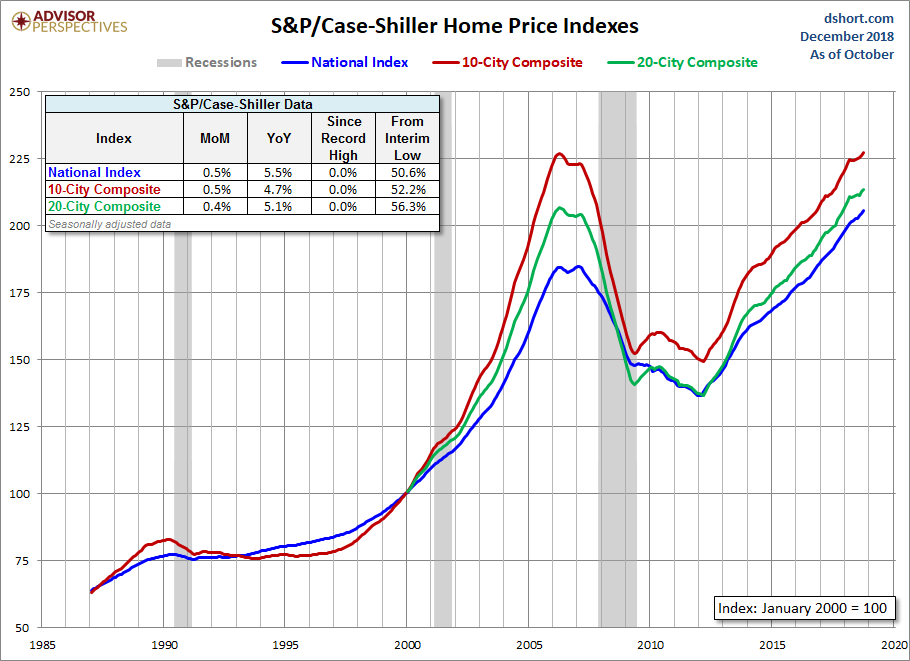

With today's release of the October S&P/Case-Shiller Home Price Index, we learned that seasonally adjusted home prices for the benchmark 20-city index were up 0.41% month over month. The seasonally adjusted national index year-over-year change has hovered between 4.2% and 6.7% for the last two-plus years. Today's S&P/Case-Shiller National Home Price Index (nominal) reached another new high.

(Click on image to enlarge)

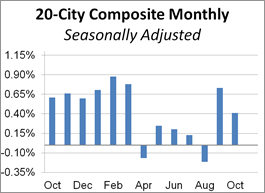

The adjacent column chart illustrates the month-over-month change in the seasonally adjusted 20-city index, which tends to be the most closely watched of the Case-Shiller series. It was up 0.41% from the previous month. The nonseasonally adjusted index was up 5.1% year-over-year.

Investing.com had forecast a 0.2% MoM seasonally adjusted increase and 5.0% YoY nonseasonally adjusted for the 20-city series.

Here is an excerpt from the analysis in today's Standard & Poor's press release.

“Home prices in most parts of the U.S. rose in October from September and from a year earlier,” says David M. Blitzer, Managing Director and Chairman of the Index Committee at S&P Dow Jones Indices. “The combination of higher mortgage rates and higher home prices rising faster than incomes and wages means fewer people can afford to buy a house. Fixed rate 30-year mortgages are currently 4.75%, up from 4% one year earlier. Home prices are up 54%, or 40% excluding inflation, since they bottomed in 2012. Reduced affordability is slowing sales of both new and existing single family homes. Sales peaked in November 2017 and have drifted down since then.

“The largest gains were seen in Las Vegas where home prices rose 12.8% in the last 12 months, compared to an average of 5.3% across the other 19 cities. This is a marked change from the housing collapse in 2006-12 when Las Vegas was the hardest hit city with prices down 62%. After the last recession, Las Vegas diversified its economy by adding a medical school, becoming a regional center for health care, and attracting high technology employers. Employment is increasing 3% annually, twice as fast as the national rate.” [Link to source]

The chart below is an overlay of the Case-Shiller 10- and 20-City Composite Indexes along with the national index since 1987, the first year that the 10-City Composite was tracked. Note that the 20-City, which is probably the most closely watched of the three, dates from 2000. We've used the seasonally adjusted data for this illustration.

The next chart shows the year-over-year Case-Shiller series, again using the seasonally adjusted data.

Here is the same year-over-year overlay adjusted for inflation with the Consumer Price Index owners' equivalent rent of residences.

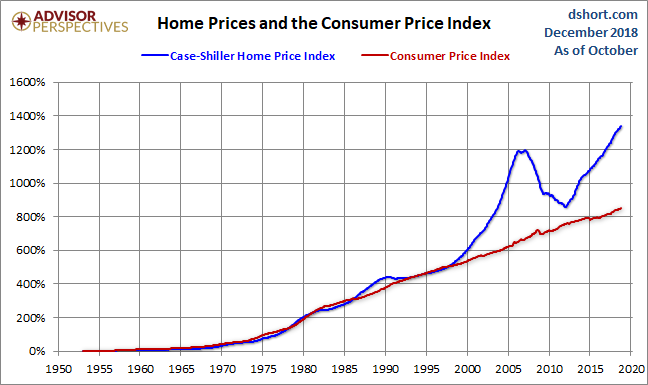

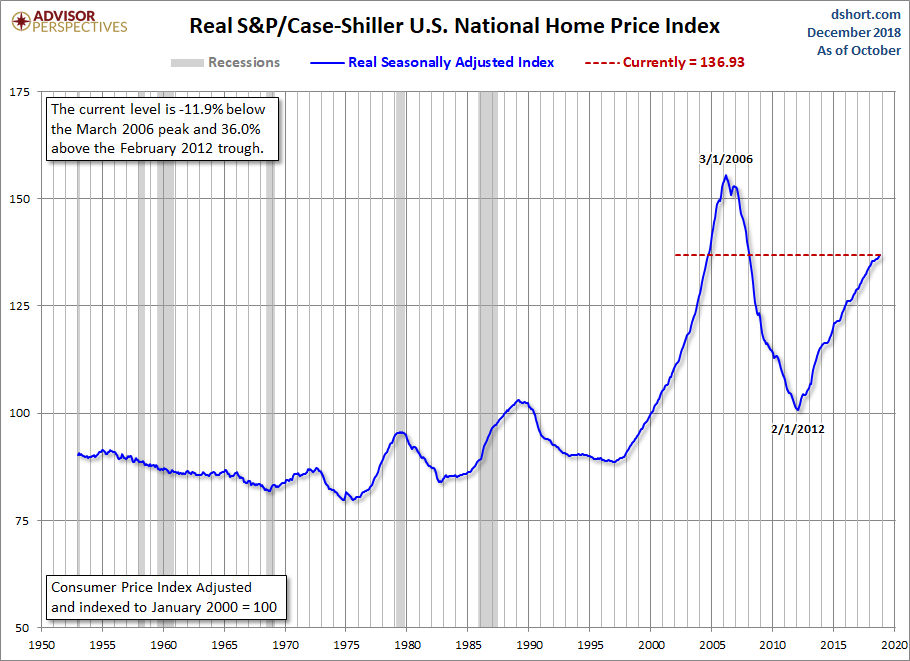

For a long-term perspective on home prices, here is a look at the seasonally and inflation-adjusted Case-Shiller price index from 1953, the first year that monthly data is available. Because the CPI owners' equivalent rent of residences didn't start until 1983, we've used the broader seasonally adjusted Consumer Price Index.

To get an even better idea of the trend in housing prices over long time periods, we compare the change in the seasonally-adjusted Case-Shiller Home Price Index and the Consumer Price Index since 1953.