S&P Futures Storm Higher Ignoring Riots, Chinese Halt Of Some US Imports

The honey-badger market is back.

After initially dropping more than 1% at the start of trading on Sunday in a kneejerk response to the worst US riots in decades, stocks recovered all losses by the time Europe opened for trading, then just after 4am ET reports hit that that state-owned traders Cofco and Sinograin were ordered to suspend purchases of some American farm goods including soybeans. At the same time, China also accused the US of undermining bilateral relations and said its comments regarding Hong Kong “disregarded facts,” days after President Donald Trump moved to rescind the city’s special trading status.

Futures dropped quickly on this news, but then once again quickly recovered and erased most of the loss as the market is fully in "ignore all negative news" mode. As a result, the Emini was just up from the Friday close, trading at 3,044 last, after dropping as low as 3,008 overnight.

And so, once again hope and optimism over the global reopening prevailed, helping push world stocks near three-month highs despite some wild moves in the dollar amid boosted risk appetite, despite worries over riots in the United States and unease over Washington’s standoff with Beijing. Traders also ignored the reality that if indeed the virus is poised for a second wave, then the weekend riots which clearly ignored social-distancing rules, will only accelerate it.

Having risen a whopping 35% from a late March trough, stocks looked set to kick off June with more gains. The MSCI world stocks index has recovered two-thirds of the losses it incurred in the aftermath of the coronavirus outbreak. Investors were also relieved that President Donald Trump left a trade deal with China intact despite moving to end Washington’s special treatment for Hong Kong in retaliation for Beijing seeking to impose new security legislation on the city.

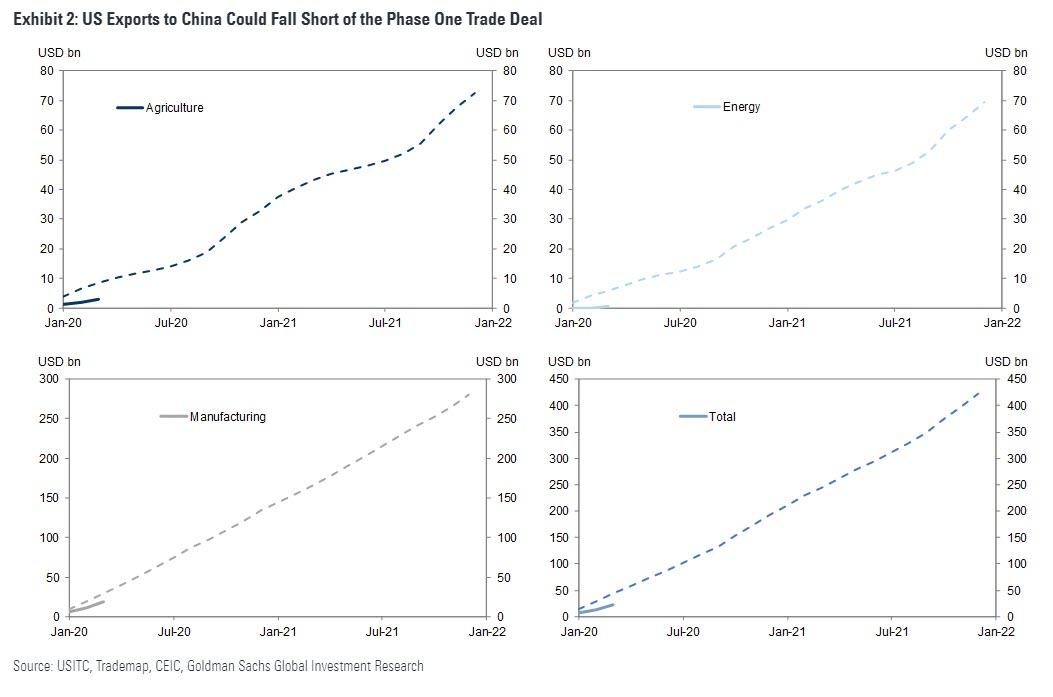

Incidentally, just last night we cautioned that "there is a clear risk—if not a likelihood—that US exports to China will fall short of the Phase 1 deal." So far, the administration appears to be taking a wait-and-see approach to this and could continue to do so for a while, since the export targets were intended to be met over a 1-2 year timeframe, and the deal was only signed four months ago. But if Trump decides that China has not met its commitments under the Phase 1 trade deal - which it clearly hasn't - he would take the initial step of taking the tariff rate on Tranche 4A back to 15%, according to Goldman." It didn't take long for China to acknowledge that there is no way the Phase 1 deal would ever happen and did so by making a clear political statement.

In Europe, stock markets were up 0.8% led by virus-hit sectors such as travel & leisure, banks, and miners but volumes were subdued as Germany, Switzerland, and Austria were closed for holidays.

"The Trump rhetoric against China and trade impediments against Hong Kong could have been a lot worse, hence the performance of those markets this morning, which has helped the risk backdrop for the European open," said Chris Bailey, European strategist at wealth manager Raymond James.

In Asia, stocks closed higher, led by China on signs that parts of the domestic economy were picking up. Hong Kong managed to rally 3.4%, while Chinese blue chips rose 2.7%. India's S&P BSE Sensex Index rose 2.7%. Trading volume for MSCI Asia Pacific Index members was 44% above the monthly average for this time of the day. Japan's Nikkei added 0.8% to also reach a three-month peak as the Topix gained 0.3%, with Akebono Brake and I'rom Group rising the most. The Shanghai Composite Index rose 2.2%, with Zhejiang China Commodities City and Markor Intl posting the biggest advances.

In FX, the safe-haven dollar meanwhile, hit an 11-week low dented by risk-on mood among investors and riots in major U.S. cities over race and policing; the dollar pared losses after news China will halt some U.S. soy imports, adding to tensions between the two countries, which however were roundly ignored by equities. Commodity currencies rallied as the greenback’s haven appeal waned. The euro rose a fifth consecutive day against the dollar, the longest streak since March.

Much of the dollar’s recent decline has come against the euro which has been boosted by plans for an EU stimulus package. The European Central Bank is also widely expected to say on Thursday that it will raise its asset-buying by around 500 billion euros to 1.25 trillion.

The pound reached a three-week high against a weaker dollar, with some traders positioning for a positive surprise from this week’s Brexit negotiations. The Australian dollar rallied by more than 1% against the greenback and the New Zealand dollar advanced amid short-covering in high-beta currencies and a rally in commodity prices and Asian equity markets.

"I agree the riots are not good but the perception is that this is a local issue...and the uncertainty has spilled over into a lower dollar."

In rates, yields on 10-year Treasuries were trading steady at 0.66% having recovered from a blip up to 0.74% last month when the market absorbed a tidal wave of new issuance. Bailey added. German bund yields DE10YT=RR were stuck near minus 0.42%.

The turmoil in the U.S. was a fresh setback for the economy which was only just emerging from a downturn akin to the Great Depression. Following poor data on spending and trade out on Friday, the Atlanta Federal Reserve estimated economic output could drop a staggering 51% annualized in the second quarter.

Looking ahead, the May jobs report due out on Friday is forecast to show the unemployment rate surged to 19.8%, smashing April’s record 14.7%. Payrolls are expected to drop by 7.4 million, on top of the 20.5 million jobs lost the previous month. “Current unemployment numbers go far beyond what has been experienced in any post-war recession,” Barclays economist Christian Keller wrote in a note. “To the extent that some sectors may never return to pre-pandemic business-as-usual.”

In commodity markets, gold added 0.5% to $1,735. Brent crude futures were off 8 cents at $37.76 a barrel, while U.S. crude fell 35 cents to $35.14.

Looking at today's US economic data, we have Markit and ISM manufacturing PMIs.

Market Snapshot

- S&P 500 futures down 0.4% to 3,028.50

- STOXX Europe 600 up 0.6% to 352.33

- MXAP up 1.7% to 153.12

- MXAPJ up 2.3% to 487.07

- Nikkei up 0.8% to 22,062.39

- Topix up 0.3% to 1,568.75

- Hang Seng Index up 3.4% to 23,732.52

- Shanghai Composite up 2.2% to 2,915.43

- Sensex up 3% to 33,386.32

- Australia S&P/ASX 200 up 1.1% to 5,819.15

- Kospi up 1.8% to 2,065.08

- German 10Y yield rose 1.7 bps to -0.43%

- Euro up 0.3% to $1.1130

- Brent Futures down 0.08% to $37.81/bbl

- Italian 10Y yield rose 5.0 bps to 1.305%

- Spanish 10Y yield fell 0.3 bps to 0.559%

- Brent Futures down 0.08% to $37.81/bbl

- Gold spot up 0.5% to $1,738.74

- U.S. Dollar Index down 0.3% to 98.02

Top Overnight News

- China accused the U.S. of undermining bilateral relations and said its comments regarding Hong Kong “disregarded facts,” days after President Donald Trump moved to rescind the city’s special trading status

- The U.K. allowed some schools, outdoor markets, and car showrooms to open their doors on Monday under social- distancing guidelines, along with some competitive sports, including horse racing

- Measures of manufacturing activity across the euro-are pointed to a noticeable easing in the pandemic- induced downturn in May, even though output and orders continued to decline, according to a survey by IHS Markit. Italy recorded the smallest contraction, while Germany fared worst

- OPEC+ is set to discuss a short extension of its current output cuts, according to a delegate, as the cartel considers bringing forward its next meeting a few days to June 4

Asian equity markets began the new month higher across the board as the region sustained the late relief seen last Friday on Wall Street where the S&P 500 capped off its strongest 2-month performance in over a decade after US President Trump’s press conference, where he announced to revoke Hong Kong’s special status but refrained from any ‘nuclear’ action on China which could have derailed the Phase One trade deal. This underpinned sentiment in Asia and helped US equity futures recoup the initial losses that were triggered by nationwide violent protests and mixed Chinese PMI data over the weekend. ASX 200 (+1.1%) declined at the open led by real estate stocks after the latest data showed a contraction in home prices, although the index later recovered in tandem with the overall constructive risk tone and as various states in Australia further eased lockdown restrictions, while Nikkei 225 (+0.8%) was underpinned as exporters welcomed the recent favourable currency moves. Hang Seng (+3.4%) and Shanghai Comp. (+2.2%) were also higher after US President Trump’s slap on the wrist retaliation to China and with the outperformance in Hong Kong fuelled by dip-buying, while participants also digest the latest varied Chinese PMI data which showed Official Manufacturing PMI missed expectations but remained in expansionary territory and both Non-Manufacturing PMI and Caixin Manufacturing PMI topped estimates. Finally, 10yr JGBs were lower with demand subdued by gains in riskier assets and amid a similar lacklustre tone in T-notes, as well as a reserved BoJ Rinban announcement with the central bank in the market for a total of just JPY 400bln of JGBs mostly concentrated in 1yr-3yr maturities.

Top Asian News

- Asahi Registers to Sell 200b Yen in Shares for AB InBev Deal

- South Korea Unveils $62 Bln Post-Virus Plan to Reshape Economy

- Luckin Chairman’s Car Unit to Sell Stake to Automaker BAIC

- Bodies Left on Hospital Beds as Virus Overwhelms Mumbai

Stocks in Europe kicked the week off on a firmer footing before reports that China is to halt some imports of US soy and pork knocked the bourses off-course, albeit the region still ekes mild gains. US equity futures immediately gave up overnight gains and now reside in negative territory – with rising social unrest State-side also afflicting sentiment across the pond. Back to European cash – Euro Stoxx 50, DAX, ATX are all closed in observance of Whit Monday, while other core bouses post gains between 0.5-1.0%. Sectors all reside in positive territory with cyclicals outpacing defensives – reflecting risk appetite, and with energy outperforming the bunch. In terms of the breakdown, Travel & Leisure tops the charts, closely followed by Banks and Oil & Gas. The other end of the spectrum sees Health Care and Chemicals lagging. Looking at individual movers and shakers – AB Foods (+7.0%) holds onto gains after noting that early trading indicators from recently reopened stores have been encouraging and reassuring, but it remains too early to provide guidance. Mediobanca (+7.0%) also resides among the top gainers amid reports Del Vecchio’s Delfin is reportedly looking to boost stake in Co. to 20% from around the current 10%. Hong Kong exposed HSBC (+1.7%), and Standard Chartered (+6.0%) benefit from President Trump refraining from announcing more stringent measures against Mainland China and Hong Kong.

Top European News

- Beekeeper’s Plight Points to $109 Billion Remittances Problem

- Billionaire Del Vecchio Asks OK To Buy 20% of Mediobanca

- U.K. Travel Firms Urge Air Bridges Instead of Quarantine Plan

- U.K. Manufacturing Contraction Eases in Sign of Slow Recovery

In FX, the Greenback remains under pressure amidst George Floyd related US riots, but the DXY has pared some losses from sub-98.000 lows on the back of reports that the Chinese Government has instructed firms to halt the purchase of certain US agricultural goods including soybeans and pork. The index has bounced within 97.849-98.242 parameters, while Usd-CNH has retested 7.1500+ from the low 7.1230s in wake of a firmer than forecast and back above 50.0 Caixin manufacturing PMI that seemed to overshadow mixed official surveys overnight. Moreover, risk sentiment has soured across the board to the detriment of high-beta currencies that were outperforming to the detriment of safer havens, naturally.

- AUD/NZD - The Aussie is still comfortably above 0.6700 and markedly outperforming G10 rivals ahead of tomorrow’s RBA policy meeting, albeit off 0.6770+ peaks and just under 1.0800 vs the Kiwi on the aforementioned China news that will no doubt prompt some further US retaliation after President Trump’s rather reserved response to Hong Kong national security legislation last Friday than many were anticipating or feared. Meanwhile, Nzd/Usd is holding relatively firm on the 0.6200 handle in holiday-thinned volumes awaiting NZ trade data for Q1 and April building consents after a hefty decline in the previous month.

- GBP/CAD/EUR/JPY/CHF - All firmer vs the Buck, but also off best levels as Cable hit some resistance around 1.2425 following a breach of the 50 DMA (1.2350) and largely shrugged off an essentially in line final UK manufacturing PMI. Elsewhere, the Loonie continues to glean impetus from firm oil prices and probed 1.3700 at one stage amidst more headlines suggesting OPEC+ will meet this week to discuss an extension to the May-June production pact, while the Euro briefly extended gains to 1.1150+ following Eurozone manufacturing PMIs revealing an especially encouraging recovery in Italy, but waned before key upside chart levels at 1.1163 and 1.1167 (March 30 high and a Fib retracement respectively). Similarly, the Yen is struggling to maintain momentum on a break of 107.50 and Franc beyond 0.9600 on Whit Monday in Switzerland, though Eur/Chf has also faded within a 1.0705-1.0670 range.

- SCANDI/EM - Crude is also keeping the Norwegian Crown afloat vs the single currency over 10.8000, but the Swedish Krona is marginally lagging around 10.4500 even though the manufacturing PMI improved slightly in keeping with the broader trend extending from Turkey through the Czech Republic to Russia. However, the Rouble is gleaning extra traction from Brent and positive results from an anti-viral drug, while the Rand is digesting supportive SARB commentary and a SAA rescue package including a minimum Zar2 bn for restructuring and additional working capital. Usd/Try is pivoting 6.8000, Eur/Czk is towards the bottom of a 26.900-8200 band, Usd/Rub is sub-70.0000 and Usd/Zar is either side of 17.5000.

In commodities, choppy trade in WTI and Brent futures early doors with initial downside exacerbated by reports of China halting some US pork and soy imports in what marks an escalation, while upside thereafter emanated from source reports that OPEC and Russia are heading closer towards striking a compromise on the duration of an extension to the oil output cut pact, with 1-2 months is being discussed. On that front, a date still has not been officially cemented as the cartel touts bringing forward the scheduled June 9/10 meeting closer to June 4th – with a date to be decided on later today according to EnergyIntel. The above source reports follow reports week that Russia could support an extension of current oil cuts for another two months, according to Energy Intel's Bakr citing Russian press but some oil majors, notably Rosneft, reportedly told the Russian Energy Ministry that it would be hard to maintain oil output cuts to the end of the year as it does not have enough crude to ship to customers as part of long-term supply deals, sources state. The energy contracts have since pared back a bulk of the move with the WTI July trading with losses under USD 35.50/bbl vs. a sub-35/bbl overnight low, whilst Brent August remains below USD 38/bbl. Meanwhile, spot gold saw pressure amid the US-Sino headline given investors piling into the yellow metal for a better part of last week in anticipation for an escalation. Furthermore, the firming USD also weighed on prices which receded from a 1744/oz high to below USD 1740/oz ahead of session lows around USD 1730/oz. Copper prices initially mimicked the optimistic tone seen in equities before waning off highs on the US-China headlines amid the prospect of lower demand for the red metal – which prices still holding ground above USD 24/lb.

US Event Calendar

- 9:45am: Markit US Manufacturing PMI, est. 40, prior 39.8

- 10am: Construction Spending MoM, est. -6.0%, prior 0.9%

- 10am: ISM Manufacturing, est. 43.7, prior 41.5

DB's Jim Reid concludes the overnight wrap

In the great post covid-19 deflation / inflation debate we’re having at DB (outlined in Konzept here and a podcast here) it is clear to most of us that disinflation will be the initial path. However one thing that is bucking the trend as I’m finding to my horror is antique desks. When I bought one for my old house a decade ago the dealers I spoke to said you couldn’t give them away these days. No one wanted them so I got a cheap one which I left behind in the old house. However in my new house we moved into last year the one room that hasn’t been refurbished is my study area. As such I need a decent desk, especially with the new WFH era. Given the style of the room it has to be an old desk or a fake old desk. I’ve been stunned that in the last two weeks I’ve been outbid for three on eBay as demand has suddenly increased. I also agreed to buy one from a dealer before getting a call back to say someone had paid more for it. As such I’ve spent a fair bit of time over the weekend securing a new one and will find out today if I’ve been successful. I’m pretty sure these desks don’t go into the inflation numbers but if they did we’d be in the Weimar Republic now.

It’ll be a reasonably busy week ahead as I sit at my old kitchen table while I await the new arrival, with the US jobs report on Friday the highlight. Also of interest will be the ECB’s latest decision on Thursday and whether they’ll announce more policy action, along with the release of PMIs (today - manufacturing and Weds/Thurs - services) from around the world. Finally, Brexit will return to the headlines as another negotiating round between the UK and the EU takes place.

Speaking of the PMIs, in China the official May manufacturing print came in at 50.6 (vs. 50.8 a month earlier) which was weaker than the 51.1 expected while in contrast the non-manufacturing PMI rose to 53.6 (vs. 53.2 last month and 53.5 expected). That being said, the Caixin manufacturing PMI released overnight printed at 50.7 which was up on the month prior and ahead of consensus (vs. 49.6 expected and 49.4 last month). Away from China, Australia’s manufacturing PMI printed at 44.0 vs. 44.1 in April, Japan was unrevised at 38.4 and South Korea at 41.3 versus 41.6 in April.

As for how markets are doing, the late bounce on Wall Street late Friday after Trump stopped short of any executive actions seems to have propelled bourses in Asia. Most notable is the +3.22% gain for the Hang Seng, while the Nikkei (+1.11%), Shanghai Comp (+1.97%), Kospi (+1.22%) and Asx (+0.67%) are also higher. Bucking the trend however are S&P 500 futures which have been flirting in negative territory for most of the session while the Dollar index is down -0.33% in response to the weekend riots.

In other news, it’s worth highlighting a couple of FT stories from the weekend. The first is a report that the UK government is preparing an economic stimulus package to be unveiled in July. The report added that Chancellor of the Exchequer Rishi Sunak is working on proposals to invest in training programs, infrastructure and help for technology firms. Elsewhere, in an interview with the FT, EU budget commissioner Johannes Hahn said that he wants member states to back new taxes, including a levy on big companies for access to the single market, to help fund the recovery from the economic effects of the coronavirus.

Turning to late Friday now, when President Trump held a press conference where he announced that Hong Kong would no longer be given special trade status and promised sanctions against Chinese and Hong Kong officials “directly or indirectly involved” in eroding Hong Kong’s autonomy. The president also announced that he would be ending the country’s relationship with the WHO. With the topic of the US-China trade deal largely absent and maximum escalation avoided, as mentioned above markets rose slightly into the close following the conclusion of the press conference.

Looking ahead to the likely key market moving events this week now. For payrolls the consensus on Bloomberg is currently expecting -8000k job losses and the unemployment rate to rise to 19.6%, its highest level since the Great Depression in the 1930s, and up from the 14.7% reading in April. Within this it’ll be worth looking at the sectoral breakdowns for an idea of which industries are being hit the hardest. For example, in April the level of employment in leisure and hospitality fell by 47%. Meanwhile young people are being hit especially hard, and the teenage unemployment rate (for 16 to 19 year olds) rose to an astonishing 31.9% in April. Elsewhere PMIs (and the ISMs) will be important but the diffusion nature makes it incredibly difficult to calibrate to growth at extreme turning points. For the Fed, they meet next week so we’re now in blackout period so don’t expect to hear much from the committee members.

On the ECB meeting on Thursday DB expects large downward economic revisions to the staff forecasts more towards our house view. This will support our call for a doubling of the PEPP to €1.5tn and an extension to mid-2021. The risk is a soft commitment to increase but no firm numbers until the next meeting on July 16th. There is also a clash between the PEPP being temporary policy and for it to be permanent enough to allow reinvestment. However, we believe a lengthening of the “crisis” period means reinvestment until at least the end of 2022 would be appropriate to avoid a premature tightening of financial conditions. Expect all to be announced on Thursday. Also expect lots of press conference questions on the German Constitutional Court hearing. Full the full preview see our economists’ piece here.

Over in the political sphere, Brexit negotiations between the EU and the UK on their future partnership will continue via videoconference from tomorrow to Friday. This is the fourth round now, and thus far there hasn’t been a great deal of progress. Indeed, at the end of the third round in May, the UK’s chief negotiator, David Frost, said that “we made very little progress towards agreement on the most significant outstanding issues between us”. This is the last negotiating round before a high level meeting in June where the two sides will be taking stock of progress. It’s also important as if the two sides want to extend the transition period that concludes at the end of 2020, they only have until the end of June to agree.

Looking back to last week now. Global equities continued to rise last week as economic data continues to slowly improve, economies reopen and the possibility of further stimulus is firmly on the table. Risk assets rose despite further confrontations between the US and China, potentially putting their trade deal at risk. The S&P 500 climbed +3.01% on a shortened 4-day week (+0.48% Friday after a late day rally as Trump’s end week China press conference wasn’t as aggressive as feared), closing at its highest level since March 4th. The index is now +36.06% off the March lows and is just -5.77% down year-to-date. US equity markets saw a rotation midweek as large-cap technology stocks lagged, while value-oriented stocks like US banks outperformed on the week. So the tech-focused Nasdaq underperformed, up +1.77% (+1.29% Friday). European equities rallied strongly on the week as the European Commission considered a proposal for a €750bn EU recovery instrument. The Stoxx 600 rallied +3.00% (-1.44% Friday pre Trump presser) over the five days. The DAX rallied +4.63% (-1.65% Friday), while the Italian FTSE MIB rose +5.09% (-0.84% Friday), and the CAC gained +5.64% (-1.59% Friday). Asian indices rose like their European and American counterparts. The Nikkei was up +7.31% over the week (-0.18% Friday) while the CSI 300 was up just +1.12% (+0.27% Friday), with the Kospi +3.02% (+0.05% Friday). In other risk assets, oil continued its recovery, with WTI futures up +6.74% (+5.28% Friday) to $35.49/barrel and Brent crude rose +0.57% on the week (+0.11% Friday) to $35.33/barrel.

As risk assets continue to rise and further stimulative policies were announced, credit spreads tightened on the week, albeit with the impact of month-end rebalancing. European HY cash spreads were -84bps tighter on the week, while European IG spreads tightened -18bps. US HY cash spreads were -52bps tighter, while IG tightened -10bps on the week.

Core sovereign bonds were mixed as US 10yr Treasury yields were mostly unchanged at -0.7bps (-3.7bps Friday) to finish at 0.653%, while 10yr Bund yields rose +4.0bps over the course of the week (-2.8bps Friday) to -0.45%. Peripheral debt tightened for the second week in a row as the proposal presented by the European Commission last week was larger than originally expected. Spanish 10yr yields tightened -10bps to Bunds over the 5 days, while Italian BTPs were -16bps tighter, Greek 10yr yields were -22bps tighter. Even French sovereign debt tightened -8bps.

Economic data on Friday showed that Euro Area inflation fell to just 0.1% in May, its lowest level in nearly four years, with lower energy prices a key contributor. Nevertheless, core inflation remained unchanged from the previous month at 0.9%. In Germany, data showed that retail sales fell by a smaller-than-expected 5.3% in April. In the US, MNI Chicago PMI came in at 32.3, down from last month’s 35.4 and far below consensus expectations of 40.0. University of Michigan consumer sentiment survey registered 72.3, slightly below consensus at 74.0. US Personal spending was down -13.2% (vs. -12.8% expected) in April versus -6.9% the month prior. Meanwhile personal income rose by 10.5% (well above -5.9% expected) and above last month’s -2.0% due primarily to stimulus payments from the CARES act.

Disclaimer: Copyright ©2009-2020 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more