S&P Futures Slide As Trade Pessimism Returns

It has been an overnight session of two different narratives, with Asian markets rising on Chinese economic data where despite the biggest annual drop in GDP since 1990 (which boosted hopes for more stimulus), Beijing goal seeked a slightly better than expected retail sales and industrial production December print...

... while European bourses and US equity futures dipped on a late Sunday report from Bloomberg pouring cold water on US-China trade talks, and according to which the two sides have so far made "little progress" on the issue any deal Trump strikes with China may ultimately be judged on: ending what the U.S. has dubbed as decades of state-coordinated Chinese theft of American intellectual property. BBG added that this stood in contrast to movement on other fronts that has lifted stocks in recent sessions, including a report on Friday that China offered a highly unrealistic path to reducing its trade surplus to zero by 2024.

As a result, emerging-market currencies weakened and stocks erased gains as traders assessed potential roadblocks in U.S.-China trade talks later this month. The yuan weakened as the U.S. and China negotiators were said to remain far apart over the key issue of intellectual property, with the next round of talks scheduled for Jan. 30-31, even as the Shanghai Composite rose 0.6% to close above 2,600, while the Nikkei was fractionally in the green, rising 0.3% to 20,719 and Australia was also green.

Chinese optimism did not carry over to Europe, however, where the Stoxx 600 index was on course for its first drop in five days, tracking S&P 500 futures lower in muted volumes due to the MLK market closure in the US. That said, European stocks trimmed early losses, with Stoxx 600 hitting session high, still down 0.2%, with telecom, utilities and banks shares leading declines, while airlines rallied.

European telecom companies were the first sector to give up 2019 gains, with the Stoxx 600 Telecommunications Index falling as much as 1.5%, making it Monday’s biggest sector decliner in Europe and erasing this year’s gains after slightly negative reports on several large carriers. The sector is now down 0.6% on the year, the first industry group (but certainly not the last) in negative territory for the period, with Deutsche Telekom leading declines with a 2.4% drop after a Berenberg downgrade; Orange, Vodafone, and Telecom Italia all dropped as well.

Earlier in the session, Germany report that PPI rose 2.7% Y/Y in Dec, missing expectations of 2.9% and far below November's 3.3% print as Europe's inflationary impulse appears to be fading.

S&P 500 futures dropped as much as 0.5% and hit a session low around 5 am, although they have since posted a modest rebound and were down 8.5 points last.

Monday's muted start was in stark contrast to last week's rally, when risk assets extended gains amid positive manufacturing numbers and signs the U.S. and China were closing in on a trade truce (even though many of these were officially denied). However, as Bloomberg notes, the "picture is complex", as reports on intellectual property paint a less optimistic view on the outlook for talks, while data on Monday confirmed China’s economy expanded at the slowest pace since the global financial crisis.

In FX, the pound erased a loss before Theresa May returns to Parliament to explain what she’s going to do next on Brexit. On Sunday, the U.K. prime minister ditched cross-party talks and was set to try to get her failed deal through Parliament with votes of Conservatives and her Northern Irish allies. Elsewhere, the dollar was steady, while bonds in Europe were mixed. The yen rose versus all its G-10 peers as global risks, including a lack of progress on the key U.S.-China trade issue of intellectual property, underpinned demand while Treasuries didn’t trade due to the MLK holiday.

Top Overnight News

- Theresa May briefed her Cabinet on Sunday evening that there was little prospect of cross-party Brexit talks yielding a workable alternative plan to the one that Parliament overwhelmingly rejected last week. Instead, according to two people who were on the conference call between May’s most senior ministers, she said she would seek changes to the Irish backstop section of the deal she’s negotiated with the European Union

- European Union governments disagree over how long they think the U.K. should delay Brexit, with some pushing for an extension of as much as a year, diplomats said

- China’s economy expanded at the slowest pace since the global financial crisis, as a domestic financial clean-up, weakening global demand and trade conflict with the U.S. all dampened momentum

- According to people close to the discussions, the U.S. and China have so far made little progress on the issue any deal Trump strikes with China may ultimately be judged on: ending what the U.S. has dubbed as decades of state- coordinated Chinese theft of American intellectual property

- The No. 3 House Democrat on Sunday offered a path for a deal to end the almost month-long partial government shutdown, focused on a permanent solution for so-called “Dreamers” rather than the three-year reprieve offered by President Donald Trump

- Administration officials are planning for President Donald Trump’s second summit with North Korean leader Kim Jong Un to take place in Vietnam, said people familiar with the plans

Asian equity markets began the week higher as the region followed suit to the optimism seen last Friday amongst the US majors after reports China is to offer concessions to eliminate the US trade imbalance, but with gains capped as participants digested a slew of Chinese data including 2018 GDP which was at the slowest growth in 28 years as expected. ASX 200 (+0.2%) and Nikkei 225 (+0.2%) were both positive from the open as they benefitted from the US-China trade optimism, but then pulled-back from their highs heading into the Chinese data and after US Trade Representative Lighthizer noted there was little progress made with China regarding intellectual property theft. Elsewhere, Hang Seng (+0.4%) and Shanghai Comp. (+0.4%) had a relatively tepid open on caution prior to the key data releases and after the PBoC skipped liquidity operations, although Chinese markets later breathed a sigh of relief from the inline GDP numbers, as well as better than expected Industrial Production and Retail Sales data.

Major European equities are mostly in the red [Euro Stoxx 50 -0.2%] as sentiment is dictated by China’s 2018 GDP printing, as expected, the slowest growth in 28 years. FTSE MIB (-0.6%) is the underperforming index, weighed on by Telecom Italia (-1.9%) after the Co’s proposal to confer all network assets into a separate company has been opposed by the communications regulator. Meanwhile, UK’s FTSE 100 (+0.3%) outperforms on currency effects and as the Pound awaits PM May’s Brexit “Plan B”. Sectors are similarly in the red, with underperformance seen in Telecom names; where the aforementioned Telecom Italia is amongst those weighing on the sector. Other notable movers include William Hill (-2.6%) after the Co. state their full-year operating profit for 2018 is expected to decrease from 2017’s level. Separately, Henkel (-5.3%) are towards the bottom of the Stoxx 600 after guiding FY19 EPS lower to mid-single digits.

In FX, the DXY is little changed and closer to the top of a 96.200-380 range following a relatively rangebound Asia-Pac session, with little reaction to the confirmation by USTR Lightihzer regarding little progress in intellectual property issues in US-Sino trade talks, while US President Trump dismissed the WSJ report about US mulling to lift China tariffs to move forward dialogue. Liquidity in the markets will likely be thin as US participants are away on MLK day, while State-side data remains scarce as the US government has been shut for almost a month.

- GBP, EUR – More angst for the Pound as PM May heads to the Commons later (around 15:30 GMT) to pitch her so-called “Plan B” with little expected in regard to a realistic strategy. Downing Street denied weekend reports that the Premier is looking to tweak the Good Friday agreement with Ireland to break the Brexit deadlock, while the Irish European Foreign Affairs Minister stated Ireland will not take part in bilateral talks and dialogue between EU and the UK, in turn pouring cold water on the Handelsblatt report from last week that the EU are ready to make further concessions on the backstop if the initiative comes from Ireland. Going back to May’s statement, there were reports over the weekend that MPs are to ambush the Premier with amendments aimed at stopping a no-deal scenario. Two amendments to be aware of are the Cooper and Grieve amendments, the former is aimed at giving parliament power to extend Article 50 while the latter gives parliament the power to hold “indicative votes” on Brexit options (such as a Norway or Canada-style). GBP/USD current resides nearer to the bottom of a 1.2831-1.2900 range, below its 100 DMA at 1.2891 and around its 200 HMA at 1.2844. Meanwhile, the EUR remains firmer, albeit marginally as EUR/USD straddles around its 50 DMA at 1.1379 and closer to the middle of a 1.1361-1.1400 range ahead of the ECB interest rate decision on Thursday, while EUR 1.2bln in option expiries rest at strike 1.1400 for today’s NY cut.

- JPY, CHF – Mixed trade for the “safe-haven” currencies with the Yen slightly firmer upon the release of Chinese GDP which printed the slowest annual growth in almost three-decades, though this was widely expected by analysts amid the ongoing US-China trade disputes. USD/JPY resides in the middle of a 109.50-80 range, while the absence of US participants will drain liquidity. Elsewhere, further suspicious activity in the weakening Franc as EUR/CHF stabilizes nearer to the top of a 1.1300-1.1350 range and similarly USD/CHF closer the top of the intraday range with speculation of potential SNB intervention taking place.

In commodities, Brent (-0.1%) and WTI (Unch%) recouped most of the initial losses, though prices remain below USD 63/bbl and USD 54/bbl; as the risk tone is directed by the slowest GDP growth in 28 years from China. Separately, China produced 3.86mln BPD for December which is a 2.85% increase Y/Y; however, 2018 domestic output decreased to 3.8mln BPD vs. Prev. 3.85mln BPD. Friday’s Baker Hughes Rig Count showed total decreased by 25 to 1050; with oil rigs decreasing by 21 to the lowest level since May 2018. Gold (-0.2%) is in the red but trading within a narrow USD 4/oz range, largely due to a lack of catalyst in the dollar as it is a US market holiday. Elsewhere, China’s primary aluminum output increased for the second month to a record in high in December of over 3mln tonnes; in contrast, China’s daily average steel output in December fell to the lowest level since March, due to weaker profit margins.

DB's Jim Reid concludes the overnight wrap

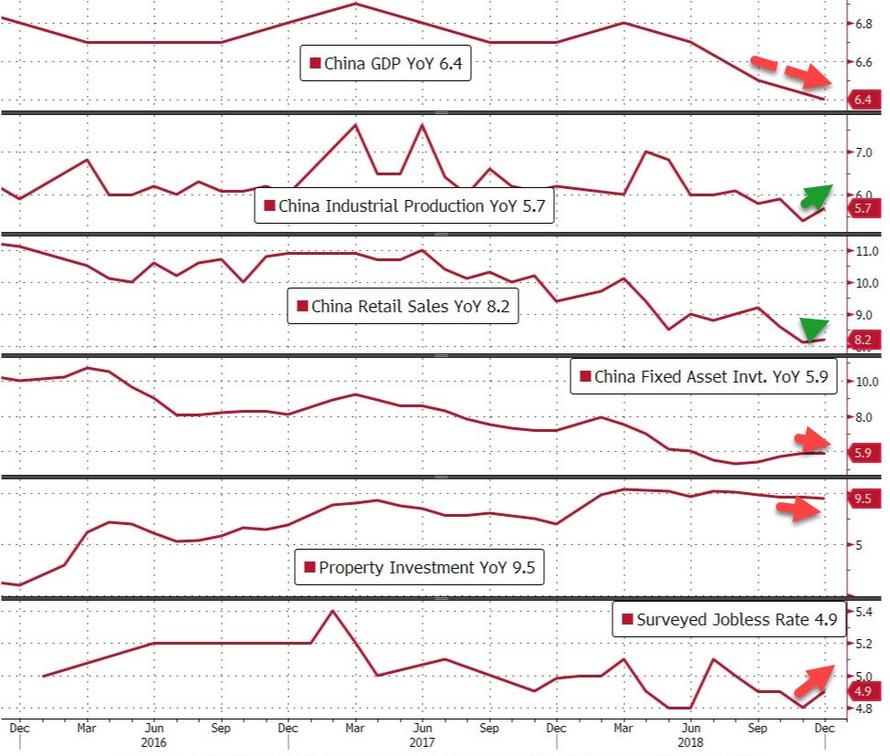

So far this year the market has shaken off its cast from December and is rehabilitating well. It’s a packed week though with lots to test the recovery and before we preview it we’ve already had the first test with China releasing all important data this morning. The good news is that there were no huge surprises with Q4 GDP printing in line with expectations at 6.4% (vs. 6.5% in Q3). That said, it confirms the lowest quarterly rate of growth in China since Q1 2009 (when it was also +6.4%) while the 2018 GDP growth rate of 6.6% is the lowest since 1991. Meanwhile the December activity indicators also out in China this morning were broadly in line. Retail sales printed at +8.2% yoy (vs. +8.1% expected) and fixed asset investment at +5.9% ytd yoy (vs. +6.0% expected) with industrial production (+5.7% yoy vs. +5.3% expected) the biggest positive surprise.

Markets in Asia are up across the board to kick off the week with Chinese bourses leading the way. The Shanghai Comp and CSI 300 are +0.68% and +0.69% respectively while the Hang Seng (+0.34%), Nikkei (+0.34%) and Kospi (+0.08%) have posted more modest gains. The CNY (-0.17%) is a touch weaker after that data along with most other EM currencies while US equity futures are down -0.30%. A Bloomberg story out early this morning suggesting that trade negotiations between the US and China – specifically over accusations of IP theft by China - are failing to make progress appears to be impacting sentiment this morning too. A reminder that China Vice Premier Liu He is traveling to the US on January 30th - 31st for trade negotiations. We should note that US equity and bond markets will be closed today on account of the Martin Luther King Jr. holiday. So it should quieten down as the day progresses.

Even after the China numbers, we have a busy week with the world’s most powerful and influential people (plus me) at Davos. So expect lots of headlines (hopefully not involving me). Outside of this, we see U.K. PM May present her alternative Brexit plan today, the ECB and BoJ policy meetings (Thursday and Wednesday), global flash PMIs (Thursday) and earnings season starting to get busier. The ongoing partial government shutdown (31 days and counting today) in the US should also be a talking point with certain US data releases continuing to be delayed as a result and more worries about what it might do to Q1 growth.

Going through these in a little more detail, in terms of Brexit it’s an important week (how many times have we said that) as PM May is due to present her Plan B to Parliament today ahead of a vote on January 29th. The latest is that there isn’t really any latest but lots of behind the scenes activity. TheTimes and various other media outlets last night reported after a cabinet meeting yesterday that May’s tactic seems to have moved from hopes of cross-party agreements to getting a deal that the Tories and the DUP can coalesce around. That really involves the backstop and further negotiations with the EU/Ireland. There’s no sign that this will be forthcoming and could be disappointing to the market.

However, the Sunday Times earlier reported that we could again be set for more unprecedented procedural dramas in the days ahead. Leaked emails they obtained show that “Dominic Grieve, the former attorney-general, has been in secret communications with Colin Lee, the clerk of bills, with the explicit intention of suspending Britain’s departure from the European Union”. So, while we’re no nearer to a breakthrough the odds of no Brexit might be edging ever so slightly higher from a low base. Related to this it seems likely that an amendment will be put to the next bill that asks for a second referendum. If so it will be interesting to see how the vote for such an amendment would go cross parties. An interesting 8 days lays ahead. Overall it feels like the U.K. Parliament will somehow ensure that a no-deal Brexit is unlikely but that the breakthrough continues to be as illusive as ever. We should add that Sterling has traded broadly flat overnight however Bloomberg is reporting that PM May briefed her Cabinet last night suggesting that cross party Brexit talks had yielded little. The story suggests that the PM will instead seek changes to the Irish backstop to secure enough support from the DUP and pro-Brexit Tory members.

Elsewhere, tomorrow sees the World Economic Forum in Davos officially get underway with the theme of this year's Forum being "Globalisation 4.0: Shaping a New Architecture in the Age of the Fourth Industrial Revolution". Please let me know if you or anyone from your office want to attend my slots on Wednesday (globalization) and Thursday (Will robots take your job?).

The flash PMIs on Thursday could be the most market moving event of the week. We'll get the manufacturing PMI for Japan, and manufacturing, services and composite readings in Europe and the US. For Europe, the composite Euro Area reading is expected to rise 0.3pts to 51.4 broken down by the manufacturing and services rising 0.1pts and 0.3pts respectively.

Any slight rise could be a big deal as the problem with the European PMIs is that their falls have now been long-standing and consistent (albeit from very high levels just over a year ago). For example, the Eurozone and German manufacturing PMIs have both been sequentially down 11 months out of the last 12. Equity and credit markets remain cheap to PMIs but the problem so far is that PMIs haven’t stabilized. This will be a big test. So, this is probably the highlight of the week.

Onto the ECB and there's fairly low expectations around the policy meeting on Thursday. The ECB is in a bit of a wait and see mode for now ahead of the next meeting in March when policymakers will then get the added benefit of new economic projections. Potentially important things to keep an eye on however include an acknowledgment of risks to the outlook tilting to the downside and comments around reassessing the impacts of TLTRO - both of which were acknowledged as talking points from the minutes of the December meeting. Also given Draghi’s hint last time out that the ECB are aware of the damage to the banking system of persistent negative rates it will be interesting if he now expands upon that. On this, it was interesting to read a piece by Mark Wall on Friday looking at net interest income of the four major economic sectors in Europe pre and post the GFC. Since the GFC, non-financial corporates and governments have seen theirs improve whereas households and financials have seen theirs deteriorate. It should be a zero-sum game at economy-wide level but perhaps it’s gone too far inter-sector wise. That partly explains the funk the European banking sector is in and may even be a small part of explaining why populism has grown. To restore balance, policy at some point might have to take from the government and corporates and give to consumers and the banks. Anyway, the report can be seen here.

Elsewhere in central bank world, the BoJ is also expected to be a bit of a non-event on Wednesday. Our Japanese economists expect the BoJ to vote to maintain its current policy stance and anticipate downward revisions to inflation forecasts for FY18 and FY19 in the outlook report by 0.1 and 0.2 percentage points respectively. In the view of our colleagues none of the conditions they deem necessary for monetary policy normalization – stable core inflation above 1%, stronger policy side effects, government declaration of end of deflation – have been realized at this point. In addition, the economic outlook is unlikely to be reduced to an extent that would demand further easing. In sum, our colleagues estimate the probability of further easing this year at around 10%.

Meanwhile, the ongoing partial government shutdown in the US continues to complicate the timing of economic data releases with a decent backlog now built up. Our US economists estimate that to date the impact on real GDP growth for Q1 is approximate -0.2 to -0.3 percentage points assuming the government reopens by the end of this week. However, if it lasts for the entire quarter, it could subtract around a full percentage point. Significantly the lack of timely data releases is increasing uncertainty for the Fed to get a better picture of how Q1 growth is tracking and this will continue until the BEA reopens. Friday's new home sales and durable goods orders fall under this category while the backlog includes retail sales, trade data, housing starts and building permits amongst others. However, we will get the Richmond Fed and Kansas Fed manufacturing reports on Wednesday and Thursday respectively which will be worth watching in light of other soft regional Fed surveys of late.

As for earnings, we're due to get quarterly reports from 59 S&P 500 companies this week including Johnson & Johnson and IBM on Tuesday, United Technologies, Proctor & Gamble and Ford on Wednesday, Starbucks, Intel and American Airlines on Thursday and AbbVie on Friday. UBS (Tuesday) and Ericsson (Friday) are the highlights in Europe. It's still early days in earnings season however for the US with about 10% of the S&P 500 having reported, 80% have beaten earnings expectations and 55% have beaten sales expectations. The full day by day week ahead is at the end as usual.

Turning to a recap of last week, the S&P 500 advanced +2.87% (+1.32% on Friday) on positive trade headlines and earnings reports. On the former, a Wall Street Journal article said that Treasury Secretary Mnuchin is arguing for removal of tariffs on China and a Bloomberg News article claimed that China has offered to buy additional US products in an effort to close the trade deficit. There were various denials from the White House but markets want to believe there is no smoke without fire. Equity gains were broad-based, with the DOW and NASDAQ also advancing +2.96% and +2.66% (+1.38% and +1.03% on Friday), respectively. Banks outperformed, as fourth-quarter results from major US banks showed declining FICC revenues but overall strength and a more positive Q1 outlook, with an index of bank stocks up +7.57% (+1.56% Friday). Banks in Europe also gained +2.83% (+2.11% Friday) while the STOXX 600 advanced +2.25% (+1.80%). In Asia, the Nikkei and Shanghai Composite rallied +1.50% and +1.65% (+1.29% and +1.42% Friday), respectively. The VIX index slid a bit more to 17.8 (-0.4pts on the week and -0.3pts Friday), closing at a six-week low.

The positive risk sentiment pushed Treasury yields a bit higher, with 10-year yields up +8.4bps to 2.784% (+3.4bps Friday), while bund yields rose +2.4bps (+2.0bps Friday). Peripheral spreads rallied, with Italian and Spanish spreads to bunds down -12.3bps and -9.8bps (-3.4bps and -1.7bps Friday), respectively. The dollar strengthened +0.70% (+0.28% Friday) as US economic data mostly steadied. Initial jobless claims fell, industrial production surprised to the upside, though regional Fed surveys were mixed and consumer sentiment deteriorated. Credit continued its strong start to the year, with US and EU HY cash spreads narrowing -22bps and -19bps (-10bps and -8bps Friday), respectively. The US side was helped by another strong week for oil, as WTI crude prices rose +4.28% (+3.32% Friday), which has supported the HY energy sector. US HY energy credit is -128bps tighter this year with the overall market -92bps tighter.

Disclosure: Copyright ©2009-2018 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every time ...

more