S&P Dividend Yield Vs. 10-Year Treasury Yield

The big drop in Treasury yields seen for most of 2019 made equities more and more attractive from a dividend yield perspective. This is one of the reasons a sector like Utilities had been performing so well. Most Utilities stocks pay hefty dividends, which look pretty enticing when the 10-Year Treasury is yielding ~1.5%.

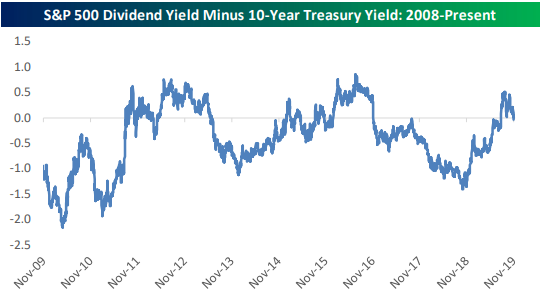

For a couple of months up until recently, the 10-Year yield got so low that the S&P 500’s dividend yield traded at a higher level. But the spread between the two flipped again last week as the 10-Year yield spiked back up to 1.94%. With the S&P 500’s dividend yield currently at 1.87%, Treasuries are back to being more attractive by 7 basis points. For reference, below is a chart of this spread over the last 10 years.

Disclaimer: Read our full disclaimer here.