S&P CoreLogic Case-Shiller 20 City Home Price Index January 2021 Year-Over-Year Growth Continues

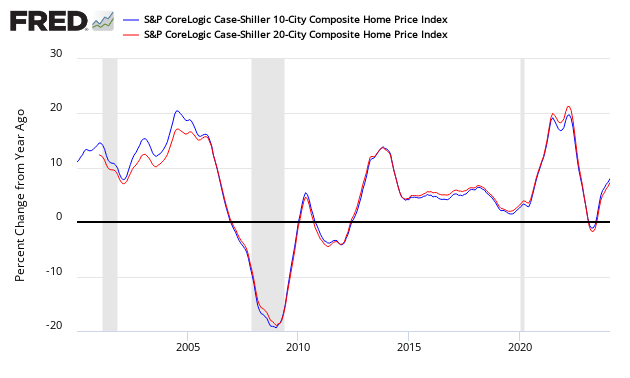

The non-seasonally adjusted S&P CoreLogic Case-Shiller home price index (20 cities) year-over-year rate of home price growth continues. The index authors stated, "January's performance is particularly impressive in historical context. The National Composite's 11.2% gain is the highest recorded since February 2006, just one month shy of 15 years ago.".

Analyst Opinion of Case-Shiller HPI

Please note from the authors:

Please note that transaction records for December 2020 for Wayne County, MI, are now available. Due to delays at the local recording office caused by the COVID-19 pandemic, S&P DJI and CoreLogic were previously unable to generate a valid December 2020 update for the Detroit S&P CoreLogic CaseShiller Indices.

All home price indices are now showing home price growth is continuing year-over-year. At this point, it looks like the pandemic has little affected home prices (or sales for that matter).

- 20 city unadjusted home price rate of growth accelerated by 1.0 % month-over-month. [Econintersect uses the change in year-over-year growth from month-to-month to calculate the change in the rate of growth]

- Note that the Case-Shiller index is an average of the last three months of data.

- The market expected from Econoday:

| Consensus Range | Consensus | Actual | |

| 20-city, SA - M/M | 0.6 % to 1.3 % | +1.2 % | +1.2 % |

| 20-city, NSA - M/M | 0.4 % to 0.8 % | +0.6 % | +0.9 % |

| 20-city, NSA - Yr/Yr | 9.7 % to 11.0 % | +10.7 % | +11.1 % |

S&P/Case-Shiller Home Price Indices Year-over-Year Change

Comparing the NAR and Case-Shiller home price indices, it needs to be understood each of the indices uses a unique methodology in compiling their index - and no index is perfect.

The way to understand the dynamics of home prices is to watch the direction of the rate of change. Here home price growth is now accelerating.

There are some differences between the indices on the rate of "recovery" of home prices.

A synopsis of Authors of the Leading Indices:

Case Shiller's Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices stated:

The strong price gains that we observed in the last half of 2020 continued into the f irst month of the new year. In January 2021, the National Composite Index rose by 11.2% compared to its year-ago levels. The trend of accelerating prices that began in June 2020 has now reached its eighth month and is also reflected in the 10- and 20-City Composites (up 10.9% and 11.1%, respectively). The market's strength is broadly-based: all 20 cities rose, and all 20 cities gained more in the 12 months ended in January 2021 than they had gained in the 12 months ended in December 2020. January's performance is particularly impressive in historical context. The National Composite's 11.2% gain is the highest recorded since February 2006, just one month shy of 15 years ago. In more than 30 years of S&P CoreLogic Case-Shiller data, January's year-over-year change is comfortably in the top decile. That strength is reflected across all 20 cities. January's price gains in every city are above that city's median level, and rank in the top quartile of all reports in 18 cities. "January's data remain consistent with the view that COVID has encouraged potential buyers to move from urban apartments to suburban homes. This demand may represent buyers who accelerated purchases that would have happened anyway over the next several years. Alternatively, there may have been a secular change in preferences, leading to a shift in the demand curve for housing. Future data will be required to analyze this question. "Phoenix's 15.8% increase led all cities for the 20th consecutive month, with Seattle (+14.3%) and San Diego (+14.2%) close behind. Although prices were strongest in the West (+11.7%), gains were impressive in every region.

CoreLogic believes home demand will remain firm moving forward (January 2021 Data). Per Dr. Frank Nothaft, chief economist at CoreLogic and Frank Martell, president and CEO of CoreLogic stated:

Record-low mortgage rates were a significant driving force behind last year's rebound in housing market activity. However, heavy competition for the few houses on the market drove home prices to historic highs, and mortgage rates are no longer enough to sway the affordability challenges for consumers. While new construction may help balance home prices towards the end of 2021, we may expect to see demand slow in the medium-term.

At the start of the pandemic, many braced for a Great Recession-era collapse of the housing market. However, market conditions leading into the crisis — namely low home supply, desire for more space and millennial demand — amplified the rapid acceleration of home prices

From the National Association of Realtors (February 2021 data):

Despite the drop in home sales for February - which I would attribute to historically-low inventory - the market is still outperforming pre-pandemic levels.

There may be a possible slowdown in growth in the coming months as higher prices and rising mortgage rates will cut into home affordability.

I still expect this year's sales to be ahead of last year's, and with more COVID-19 vaccinations being distributed and available to larger shares of the population, the nation is on the cusp of returning to a sense of normalcy. Many Americans have been saving money and there's a strong possibility that once the country fully reopens, those reserves will be unleashed on the economy.

Home affordability is weakening. Various stimulus packages are expected and they will indeed help, but an increase in inventory is the best way to address surging home costs.

The U.S. Federal Housing Finance Agency produces an All-Transactions House Price Index for the United States:

Econintersect publishes knowledgeable views of the housing market.

Caveats on the Use of Home Price Indices

The housing price decline seen since 2005 varies by zip code - and seems to have ended somewhere around the beginning of the 2Q2012. Every area of the country has differing characteristics. Since January 2006, the housing declines in Charlotte and Denver are well less than 10%, while Las Vegas home prices had declined by almost 60%.

Each home price index uses a different methodology - and this creates slightly different answers.

The most broadly based index is the US Federal Housing Finance Agency's House Price Index (HPI) - a quarterly broad measure of the movement of single-family house prices. This index is a weighted, repeat-sales index on the same properties in 363 metro centers, compared to the 20 cities Case-Shiller.

The US Federal Housing Finance Agency also has an index (HPIPONM226S) based on 6,000,000 same home sales - a much broader index than Case-Shiller. Also, there is a big difference between home prices and owner's equity (OEHRENWBSHNO) which has been included in the graph below.

Comparing Various Home Price Indices to Owner's Equity (blue line)

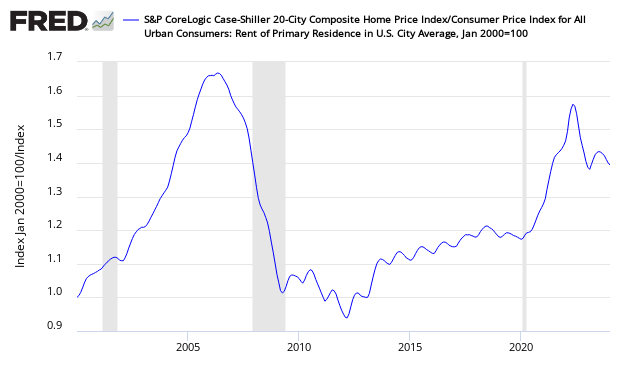

The affordability factor favors rental vs owning.

Price to Rent Ratio - Indexed on January 2000 - Based on Case-Shiller 20 cities index ratio to CPI Rent Index

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only.The reader is solely responsible for determining whether any investment, ...

more