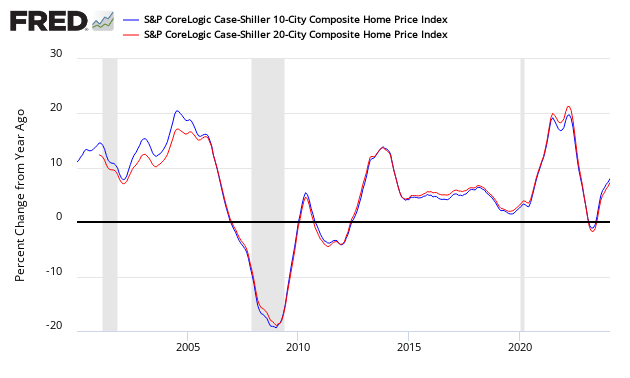

S&P CoreLogic Case-Shiller 20 City Home Price Index December 2019 Year-Over-Year Growth Now 2.9%

The non-seasonally adjusted S&P CoreLogic Case-Shiller home price index (20 cities) year-over-year rate of home price growth improved from 2.6 % to 2.9 %. The index authors stated, "At the national level, home prices are 59% above the trough reached in February 2012, and 15% above their pre-financial crisis peak".

Analyst Opinion of Case-Shiller HPI

All home price indices are now showing home price growth is accelerating year-over-year.

- 20 city unadjusted home price rate of growth accelerated by 0.3 % month-over-month. [Econintersect uses the change in year-over-year growth from month-to-month to calculate the change in the rate of growth]

- Note that the Case-Shiller index is an average of the last three months of data.

- The market expected from Econoday:

| Consensus Range | Consensus | Actual | |

| 20-city, SA - M/M | 0.5 % to 0.6 % | +0.5 % | +0.4 % |

| 20-city, NSA - M/M | +0.0 % | ||

| 20-city, NSA - Yr/Yr | 2.4 % to 3.0 % | +2.8 % | +2.9 % |

S&P/Case-Shiller Home Price Indices Year-over-Year Change

Comparing the NAR and Case-Shiller home price indices, it needs to be understood each of the indices uses a unique methodology in compiling their index - and no index is perfect.

The way to understand the dynamics of home prices is to watch the direction of the rate of change. Here home price growth generally appears to stabilize (rate of growth not rising or falling).

There are some differences between the indices on the rate of "recovery" of home prices.

When asked what today's release means for the housing market, Dr. Frank Nothaft, chief economist for CoreLogic said:

The drop in mortgage rates during the past week has improved payment affordability and will bring prospective buyers into the market. If rates stay low into the spring, we expect sales volume to be the highest in 13 years, and annual home price growth to quicken.

A synopsis of Authors of the Leading Indices:

Case Shiller's Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P Dow Jones Indices stated:

The U.S. housing market continued its trend of stable growth in December. December's results bring the National Composite Index to a 3.8% increase for calendar 2019. This marks eight consecutive years of increasing housing prices (an increase which is echoed in our 10- and 20-City Composites). At the national level, home prices are 59% above the trough reached in February 2012, and 15% above their pre-financial crisis peak. Results for 2019 were broad-based, with gains in every city in our 20-City Composite.

At a regional level, Phoenix retains the top spot for the seventh consecutive month, with a gain of 6.5% for December. Charlotte and Tampa rose by 5.3% and 5.2% respectively, leading the Southeast region. The Southeast has led all regions for the past year.

As was the case last month, after a long period of decelerating price increases, the National, 10-City, and 20-City Composites all rose at a faster rate in December than they had done in November; 12 of our 20 cities likewise saw accelerating prices. It is, of course, too soon to say whether this marks an end to the deceleration or is merely a pause in the longer-term trend.

CoreLogic believes affordability is now improving (December 2019 Data). Per Dr. Frank Nothaft, chief economist at CoreLogic and Frank Martell, president and CEO of CoreLogic stated:

Moderately priced homes are in high demand and short supply, pushing up values and eroding affordability for first-time buyers. Homes that sold for 25% or more below the local median price experienced a 5.9% price gain in 2019, compared with a 3.7% gain for homes that sold for 25% or more above the median

On a national level, home prices are on an upswing. Price growth is likely to accelerate in 2020. And while demand for homeownership has continued to increase for millennials, particularly those in their 30s, 74% admit they have had to make significant financial sacrifices to afford a home. This could become an even bigger factor as home prices reach new heights during 2020

The National Association of Realtors says (January 2020 data):

The outlook for 2020 home sales is promising despite the drop in January. Existing-home sales are off to a strong start at 5.46 million. The trend line for housing starts is increasing and showing steady improvement, which should ultimately lead to more home sales.

Mortgage rates have helped with affordability, but it is supply conditions that are driving price growth.

It is good to see first-time buyers slowly stepping into the market. The rise in the homeownership rate among the younger adults, under 35, and minority households means an increasing number of Americans can build wealth by owning real estate. Still, in order to further expand opportunities, significantly more inventory and home construction are needed at the affordable price points.

The U.S. Federal Housing Finance Agency produces an All-Transactions House Price Index for the United States:

Econintersect publishes knowledgeable views of the housing market.

Caveats on the Use of Home Price Indices

The housing price decline seen since 2005 varies by zip code - and seems to have ended somewhere around the beginning of the 2Q2012. Every area of the country has differing characteristics. Since January 2006, the housing declines in Charlotte and Denver are well less than 10%, while Las Vegas home prices had declined by almost 60%.

Each home price index uses a different methodology - and this creates slightly different answers.

The most broadly based index is the US Federal Housing Finance Agency's House Price Index (HPI) - a quarterly broad measure of the movement of single-family house prices. This index is a weighted, repeat-sales index on the same properties in 363 metro centers, compared to the 20 cities Case-Shiller.

The US Federal Housing Finance Agency also has an index (HPIPONM226S) based on 6,000,000 same home sales - a much broader index than Case-Shiller. Also, there is a big difference between home prices and owner's equity (OEHRENWBSHNO) which has been included in the graph below.

Comparing Various Home Price Indices to Owner's Equity (blue line)

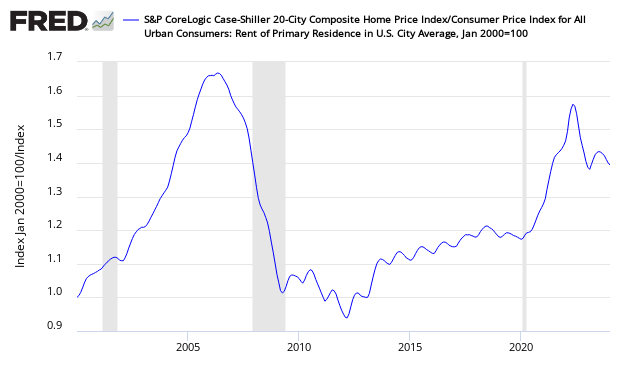

The affordability factor favors rental vs owning.

Price to Rent Ratio - Indexed on January 2000 - Based on Case-Shiller 20 cities index ratio to CPI Rent Index

Disclaimer: No content is to be construed as investment advise and all content is provided for informational purposes only.The reader is solely responsible for determining whether any investment, ...

more