S&P 500: The Path To 5,000

Finally, it's Wednesday ("Fed-day"). Markets have been jittery for weeks now, and the S&P 500/SPX (SP500) gave up roughly 6% at its lowest point. Now, I've been discussing the current pullback since it began, and the 6% decline is roughly in line with my base case 5-10% pullback.

(Click on image to enlarge)

Source: stockcharts.com

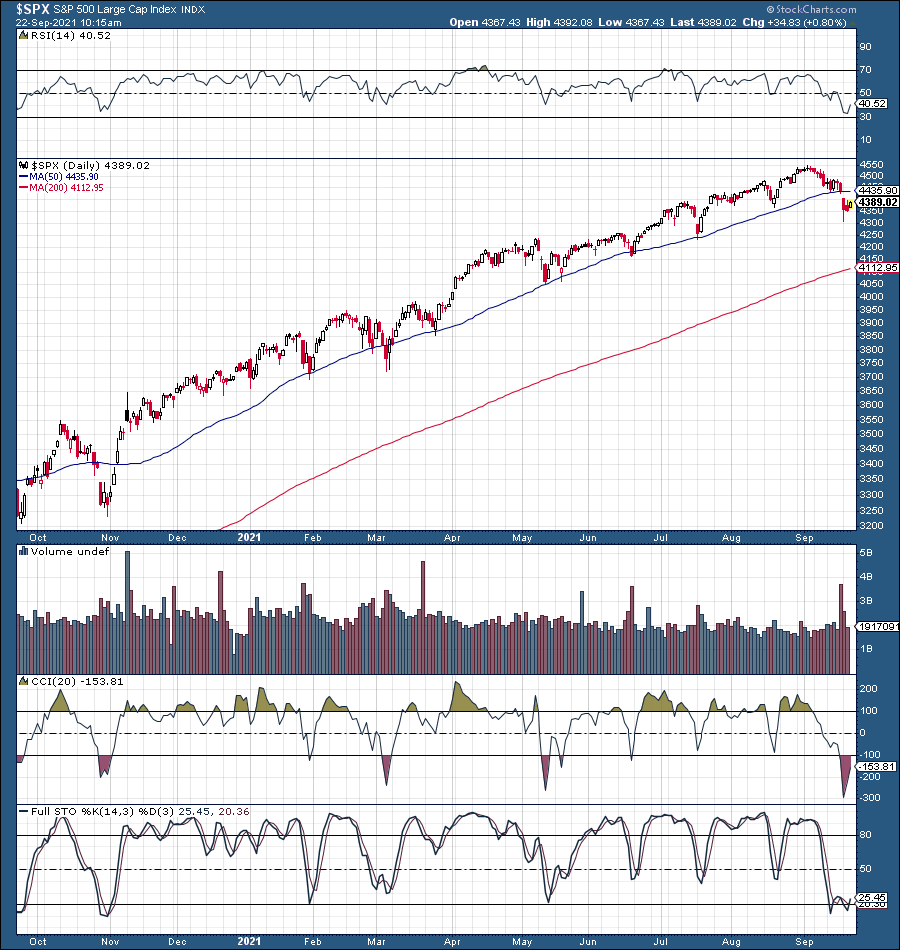

The market is in a critical spot right now. The SPX fell through its crucial 50-day moving average ("MA") support for the first time in months. Also, the relative strength index ("RSI") came down to about 30 for the first time since the last correction last fall. Other technical indicators like the CCI and the full stochastic also came down to levels not seen since the significant decline of last fall.

So, from a technical standpoint, I am satisfied here. The market delivered a 5-10% pullback, as I expected going into the Fed meeting. Also, most technical indicators came down to levels that imply that the market even got a little oversold. Did we get the great reset? No, of course not. However, we witnessed the most selling pressure since the last correction in the fall of 2020. Thus, the takeaway strictly from a technical standpoint here is that this may be an excellent opportunity to start to buy, increase positions, and decrease hedges in time for a probably year-end run higher. However, what about the fundamentals?

"Fed-Day" Is Here - What To Expect Next

It's easy to talk about technicals, but what about the fundamentals here? The Fed is about to wind down its QE program, rates could go up soon, valuations are still high, and other factors could impact the market. While these factors may be true, the most significant element is the Fed. How the Fed will discuss growth, markets, inflation, potential rate increase, and QT is crucial here. Market participants want to know that the Fed put is here and that it's not going away. The Fed knows this, and it is not likely going to disappoint. Therefore, I feel that the Fed will continue its cautionary, dovish tone with a relatively constructive outlook, and this dynamic should drive risk assets higher.

Also, please keep in mind that while monetary policy may be less loose in the future, it does not make monetary policy tight. There will still be plenty of cheap money in the system even when QE gets roped in a little bit. There is no reason to panic here. The market got what it needed (a 5-10% pullback), and now it will likely recover and move higher for now. We are still in a bull market, and risk appetite is about as strong as it has ever been. The SPX and other major market averages could move notably higher from here into year-end.

The Bottom Line: Factors to Keep in Mind

(Click on image to enlarge)

Source: thinkorswim

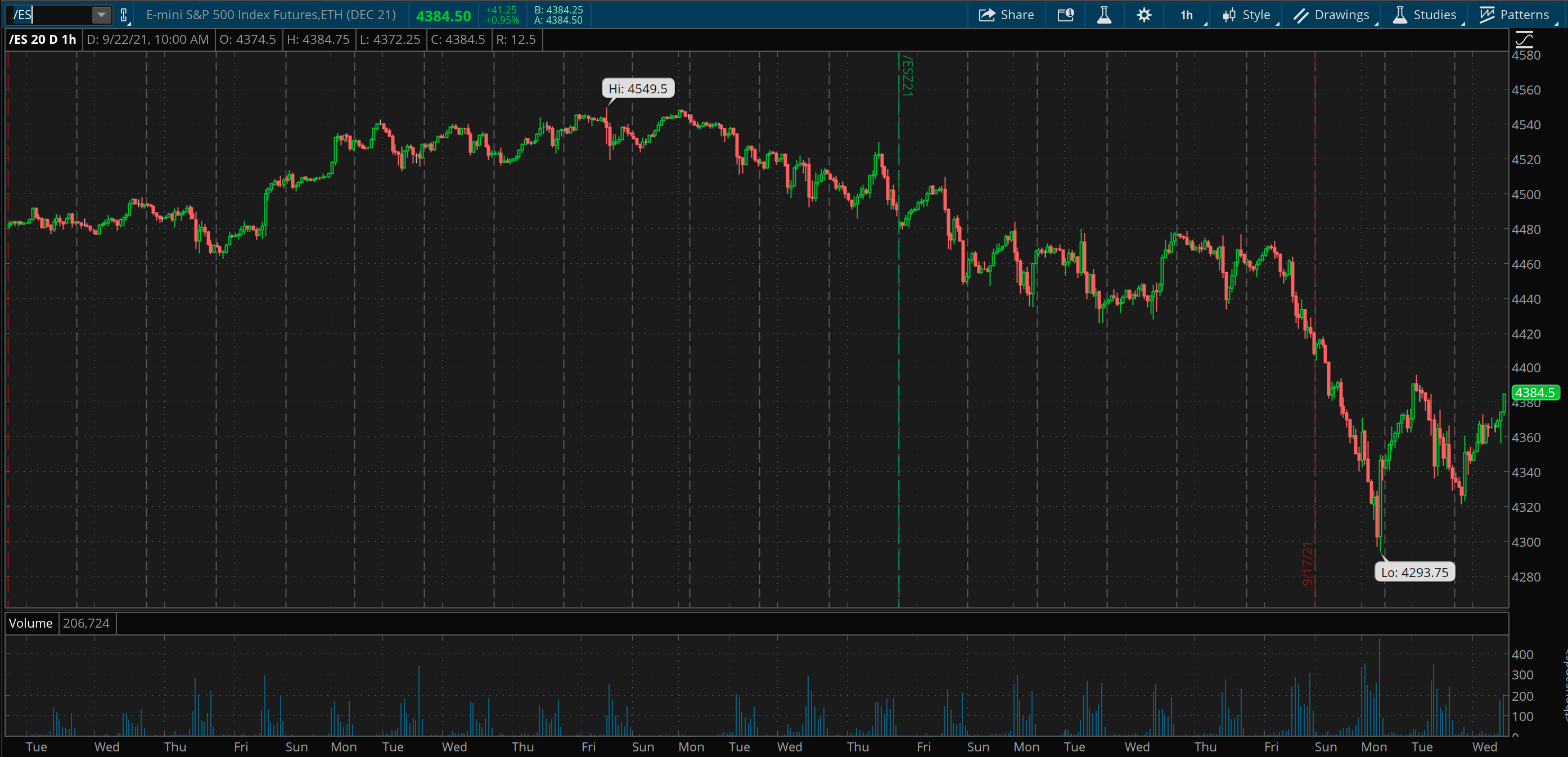

SPX futures are moving up towards crucial resistance at 4,380-4,400. Suppose the Fed doesn't put out any overly hawkish commentary, and its statements are well-received by the market. In that case, the SPX will likely move above this fundamental technical level. Once above 4,400, the SPX should move towards the next significant resistance at 4,480-4,500 and then to new ATHs.

However, if the Fed's tone is more hawkish than the market anticipates, or if the agency brings up anything detrimental that the market does not expect, we could see a breakdown of the critical 4,300-4,290 support level. If this technical area gets breached, equities could go substantially lower. In this bearish scenario, the following target range would be around 4,100-4,000, roughly a 10% decline from the SPX's recent ATH.

If the Fed does not surprise the market with any adverse developments, the SPX and stocks, in general, could move much higher into year-end. I expect that the S&P 500 could trade up to the 4,800-5,000 range in a bullish case scenario. This increase would be about 10-15% from current levels, not bad for a year-end rally.

Disclaimer: This article expresses solely my opinions, is produced for informational purposes only, and is not a recommendation to buy or sell any securities. Investing comes with risk to loss ...

more