S&P 500 Rises And Falls On Fed Stimulus, Fiscal Relief Speculation

We've reached an interesting juncture for the S&P 500. Thanks to some monumental stimulus from the U.S. Federal Reserve and other global central banks, along with the promise of trillions in fiscal relief for U.S. businesses from the U.S. government, stock prices rebounded over where they closed in the previous week.

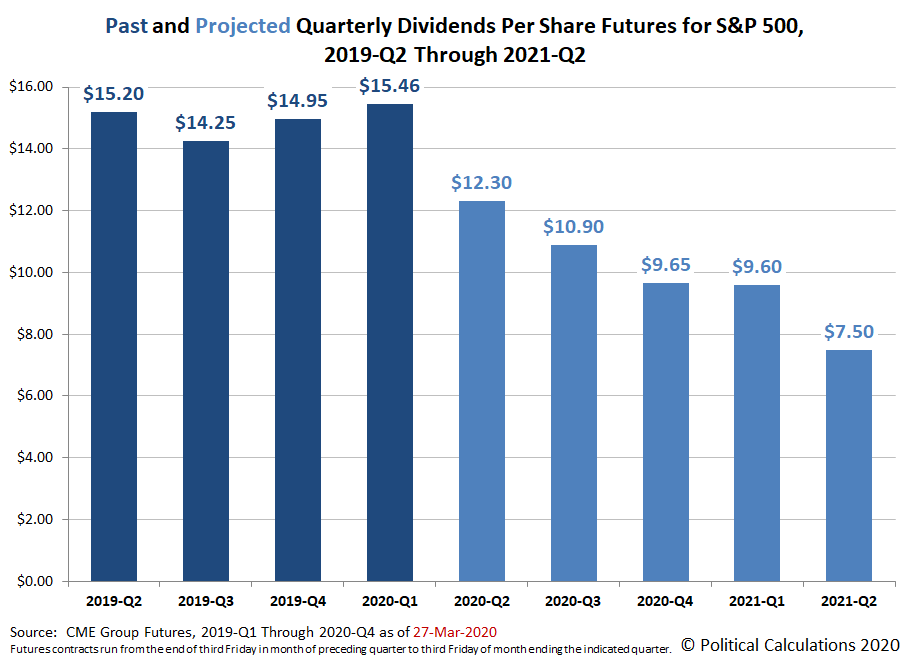

That's the good news. The bad news is both actions have come too late for U.S. firms to avoid having to cut their dividends, which saw continued deterioration over the past week. The following chart shows the level to which the expectations for future S&P 500 quarterly dividends per share deteriorated by the end of trading on Friday, 27 March 2020.

That makes the S&P 500's current level look quite a lot like a speculative bubble with respect to where the dividend futures-based model would set them based on the S&P 500's projected fundamentals.

As such, we see the S&P 500 as rising and falling based mostly on speculation, which suggests continued volatility coupled with downward momentum in the near future.

The flow of new information during the past week provides the context behind the market's various surges and retreats, where partisan politics emanating from the U.S. House of Representatives that needlessly delayed fiscal relief for American households and businesses negatively impacted by the numerous statewide economic shutdowns that were ordered during the past week to cope with the spreading coronavirus epidemic in the U.S.

Monday, 23 March 2020

- Crude extends fall as U.S. gasoline slumps 20% amid demand fears

- Democratic party leadership's partisan games derail $1 trillion fiscal relief bill:

- Emergency Economic Rescue Plan in Limbo as Democrats Block Action

- Mnuchin urges U.S. Congress to pass $2 trillion economic relief bill

- Bigger stimulus developing all over:

- World Bank could deploy $150 billion over 15 months in coronavirus battle

- Central banks deploy record sums to break financial logjam, but may need more

- Mnuchin says G20 set to coordinate globally as needed

- 'No limits' to euro zone's coronavirus response, Eurogroup chief says

- Fed aims 'bazooka' to backstop coronavirus-hit economy

- This is a big one - the Fed is now backing commercial paper and issuing loans to corporations for the first time in its history, which will contribute toward ending an underreported run on the bank....

- With latest moves, Fed becomes creditor in chief for U.S. business

- Fed, ECB minions confirm gloomy outlook for world economy:

- ECB's de Guindos says coronavirus will put Europe into a recession

- Fed's Bullard: Coronavirus shutdown not a recession but an investment in survival

- Historic Fed boost fails to stop Wall Street's coronavirus-driven sell-off

Tuesday, 24 March 2020

- Coronavirus impacts to major U.S. economic sectors:

- Oil little changed as falling demand offsets hopes of U.S. aid package

- U.S. new home sales fall in February, January revised up sharply

- Coronavirus crisis rocks airlines and planemakers

- Bigger trouble developing all over:

- Euro zone business activity collapses in March as coronavirus spreads

- Shipping industry urges G20 to keep freight flowing as virus hits supply chains

- Bigger stimulus developing in Washington D.C., China, Eurozone:

- Mnuchin: Negotiators 'very close' to deal on coronavirus stimulus

- Factbox: What's in the nearly $2 trillion U.S. Senate coronavirus stimulus?

- Chinese consumer finance firms rush to raise money via ABS amid coronavirus

- Germany: 750 billion euro aid package is just first step in tackling coronavirus

- Mnuchin: Negotiators 'very close' to deal on coronavirus stimulus

- Central banks restoring liquidity to cash-starved corporate debt/money markets:

- Companies rush to debt market as Fed eases funding logjam

- Fed's 'bazooka' soothes dollar funding squeeze

- Clearing the global dollar shortage: How the U.S. could intervene to weaken its surging dollar

- ECB intends to be major buyer in commercial player market

- ECB allots $4.12 billion in 7-day dollar swap

- German companies rush to banks for emergency coronavirus funds

- Positive speculation in absence of fiscal relief bill powers stock market upward:

- Dow soars over 11% in strongest one-day performance since 1933

Wednesday, 25 March 2020

- Good and bad for oil industry, consumers:

- Oil prices settle higher on stimulus package, fuel demand sinks

- Factbox: Global oil, gas producers cut spending after crude price crash

- Oil prices settle higher on stimulus package, fuel demand sinks

- Bigger trouble developing all over:

- German economy could shrink by 5-20% this year: Ifo economist

- Coronavirus lockdowns seen hitting Europe Inc earnings heavily

- Coronavirus sweeps across New York, California fears it could be next

- Bigger stimulus developing all over. Or not:

- Senators reach deal on $2 trillion stimulus bill aimed at coronavirus, bill will pass 'later today,' says McConnell

- Tempers rise as U.S. Senate awaits vote on $2 trillion coronavirus bill

- No action in House to consider bill

- Exclusive: ECB's Lagarde asked euro zone ministers to consider one-off 'coronabonds' issue

- Senators reach deal on $2 trillion stimulus bill aimed at coronavirus, bill will pass 'later today,' says McConnell

- Fed, ECB minions

- Bullard: $2 trillion package working through Congress 'scaled about right' for crisis

- Bullard: 46 million workers could be jobless in short-term

- Absorb shock now or face permanent destruction, Draghi warns

- Bullard: $2 trillion package working through Congress 'scaled about right' for crisis

- Stock prices

- S&P 500 rallies for second day as investors await $2 trillion aid package

- Big Oil may have to break dividend taboo as debt spirals

- S&P 500 rallies for second day as investors await $2 trillion aid package

Thursday, 26 March 2020

- Coronavirus pandemic continues roiling U.S. economy:

- U.S. braces for record surge in jobless claims amid coronavirus fallout

- Oil sheds more than $1 as weakening demand outweighs stimulus hopes

- Factbox: Trade restrictions on food exports due to coronavirus pandemic

- Bigger economic trouble developing all over:

- China's factories reopen, only to fire workers as virus shreds global trade

- Trade bellweather Singapore signals deep recession for world as virus batters economy

- Japan says virus has made economy's condition 'severe', worst view in seven years

- German economy could shrink by 10% this year due to coronavirus

- Italy PM sees Europe in 'hard, severe' recession post-coronavirus

- Euro zone faces 2% recession, 10% if lockdown lasts: S&P Global

- Bigger stimulus developing all over:

- U.S. Senate passes $2 trillion bill for 'strange and evil' coronavirus crisis

- Lackadaisical leadership in the House of Representatives: Pelosi expects bipartisan House vote for $2 trillion coronavirus bill Friday

- G20 leaders to inject $5 trillion into global economy to fight coronavirus

- IMF calls meeting of steering committee on pandemic response: source

- U.S. Senate passes $2 trillion bill for 'strange and evil' coronavirus crisis

- Fed actions to revive liquidity:

- Fed balance sheet tops $5 trillion for first time as it enters coronavirus war mode

- U.S. banks borrow at discount window after Fed offers stigma relief

- Wall Street powers stocks higher on $2 trillion stimulus; dollar takes a hit

Friday, 27 March 2020

- Global oil industry being hammered:

- Oil plunges posting fifth straight weekly loss despite stimulus efforts

- Russia calls for new enlarged OPEC deal to tackle oil demand collapse

- Global oil refiners shut down as coronavirus destroys demand

- Bigger trouble developing in Germany:

- Volkswagen burning through $2.2 billion a week as coronavirus halts production

- Around one in five German firms see themselves at risk of insolvency

- Bigger stimulus developing all over:

- Cash handouts and bond buying: $10 trillion-plus deployed against virus

- Japan plans huge stimulus package to cushion blow from coronavirus

- Bank of Canada slashes policy rate, to start purchase of government securities

- Historic $2.2 trillion coronavirus bill passes U.S. House, headed to Trump

- Cash handouts and bond buying: $10 trillion-plus deployed against virus

- Fed minion acknowledges U.S. recession:

- Fed working to bolster credit during 'self-mandated' recession

- Dividend cuts coming to Euro zone banks: ECB tells banks to be prudent on dividends, avoid capital hole later

- Wall Street tumbles as U.S. virus cases pass 85,000

Disclaimer: Materials that are published by Political Calculations can provide visitors with free information and insights regarding the incentives created by the laws and policies described. ...

more