S&P 500 Performance Following 1%+ Lower Opens

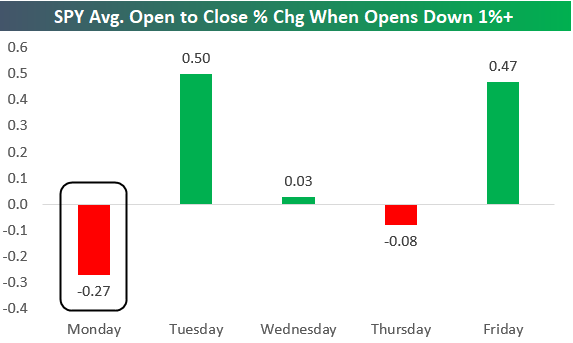

The S&P 500 SPY ETF opened lower by more than 1% this Monday morning after no progress was made between the US and China on trade. When SPY opens down 1% or more, how does the ETF typically perform during regular trading hours from the open to the close? Since 1993 when SPY began trading, the ETF has averaged a decline of 0.27% from the open to the close when it opens down 1%+ on a Monday morning. As shown in the chart below, Monday is the worst day of the week for a 1%+ open lower.

When SPY has opened down 1%+ on Tuesdays or Fridays, it has actually bounced back very nicely throughout the trading day with an average open to close change of ~0.50%. On Wednesdays and Thursdays, the open to close change is basically flat following a 1%+ gap down.

Based on historical price action, big opens lower on a Monday typically see continued selling throughout the trading day, while Tuesdays and Fridays see buyers step in.

Start a two-week free trial to Bespoke Institutional to access our thought-provoking investment research and all of ...

more