S&P 500 Industry Group Breadth Still Weak

Even with the S&P 500 up over 11% from its Christmas Eve lows just three weeks ago, it’s hard to believe that we’re still below the 50-DMA. That just goes to show you how steep the magnitude of the decline was leading up to this rally.

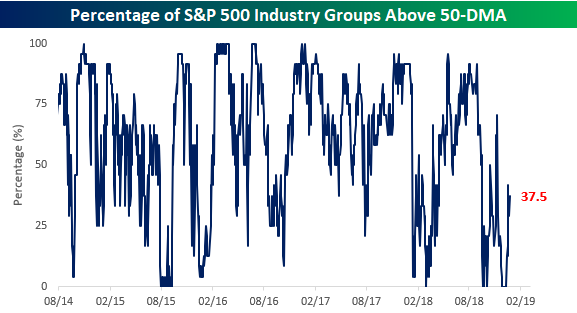

Not only is the S&P 500 still below its 50-DMA, but the majority of Industry Groups are still below their 50-DMAs as well. In fact, barely a third of them (9) finished the day yesterday above that level. While that’s significantly better than the 0% level it was at recently, this low reading confirms the fact that most sectors of the market still haven’t even recovered December’s losses, let alone the losses from the September highs.

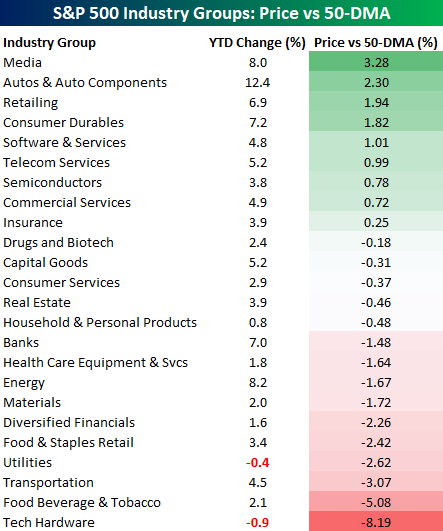

Looking on the positive side, while overall Industry Group breadth remains weak, many of them are right on the cusp of peeking above their 50-DMAs. As shown in the table below, five of them are currently within half of one percent of their 50-DMAs, which means just one more day like yesterday would likely put them over the top. Even the Banks group, which is more than 1% below its 50-DMA, could move above that level today following strong reports from Goldman Sachs (GS) and Bank of America (BAC). Way down the list, the four Industry Groups that are unlikely to trade above their 50-DMAs anytime soon are Tech Hardware (-8.2%), Food, Beverage & Tobacco (-5.1%), Transportation (-3.1%), and Utilities (-2.6%).

While most Industry Groups have yet to take out their 50-DMAs, the vast majority of them are trading in the black YTD. The only two that are in the red for the year are Tech Hardware (-0.9%) and Utilities (-0.4%). Leading the way higher so far this year (it’s still early) are Autos (+12.4%), Energy (8.2%), Consumer Durables (7.2%), and Banks (7.0%), which are all up over 7% on the year.

Disclaimer: To begin receiving both our technical and fundamental analysis of the natural gas market on a daily basis, and view our various models breaking down weather by natural gas demand ...

more