S&P 500 Forecast: To Continue Finding Buyers

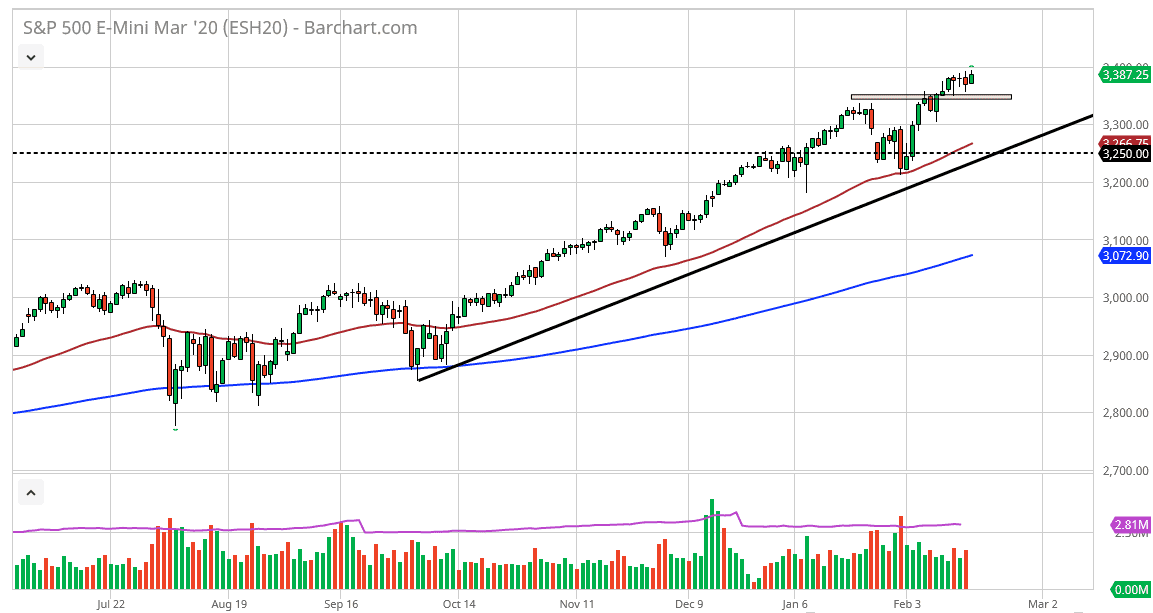

The S&P 500 rallied during the trading session on Wednesday again, as we continue to reach towards the 3400 level. That is a large, round, psychologically significant figure, and as a result, if we can break above that level it’s likely that the market goes looking towards the 3500 level. That is an area where I would anticipate seeing a lot of resistance, and it would probably coincide with a move to the 10,000 level in the NASDAQ 100.

That being said, I think that a pullback is probably going to be an opportunity and therefore if you look at the 3350 level, that is a short-term support level that could attract some attention. If we can break down below that level then the market probably goes looking towards the 3300 level, and then perhaps even the 50 day EMA which is reaching towards that level. We also have the uptrend line just below that should offer plenty of support and the 3250 level as well. I think there are plenty of reasons to think that there will be a bounce on some type of pullback unless of course, something significant happens.

Yes, I’m aware of the fact that stocks are overbought but quite frankly the only thing that people care about right now as the Federal Reserve stepping in and providing liquidity. They have shown that they are hand-in-hand with the lawsuit trading community, so it’s difficult to imagine that the Federal Reserve will allow this thing to collapse. Beyond that, the other parts of the world right now are struggling, and money is flowing out of places like Asia and into the United States, using the growth of the United States as a way to protect their money. There is no sign of that slowing down, so I do believe that we will continue to attract inflows.

Obviously, there can be some type of “black swan event” that comes in and wrecks the market, but quite frankly you would think that coronavirus would have been one. At this point, it’s all about the Federal Reserve and as long as they don’t jump out of the game of supporting stock markets, it’s difficult to imagine that something happens that changed the trend, until of course, something does happen. If you look at the history of stock markets over the last hundred years, we get these moves, and then a massive selloff. We are quite there yet but certainly, it’s something we need to think about.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more