S&P 500 Forecast: Ready To Offer Value

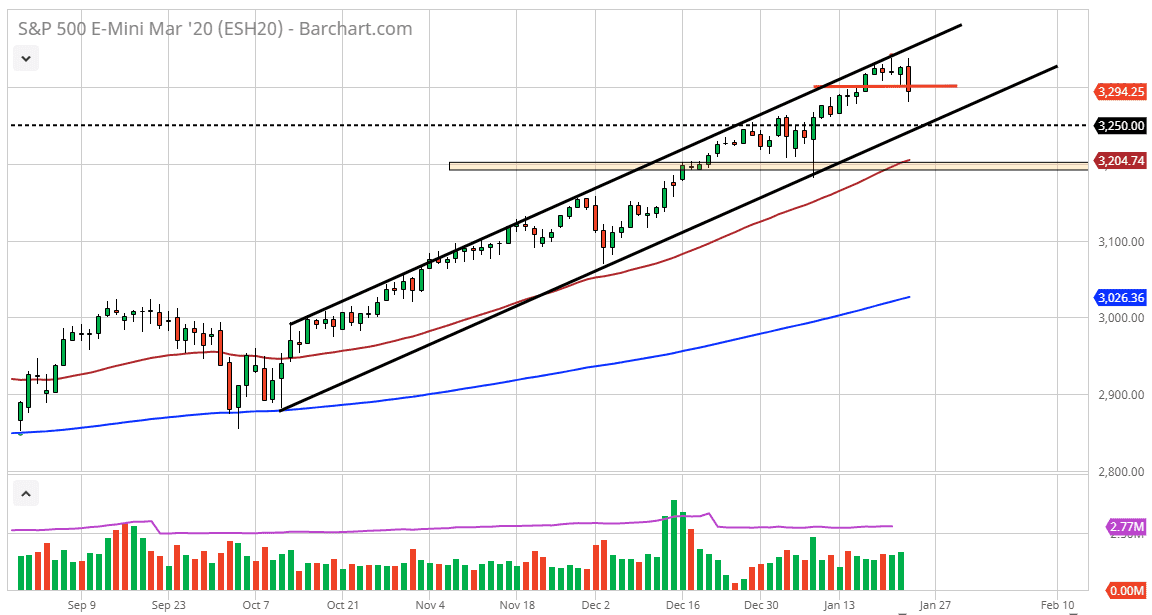

The S&P 500 has initially tried to rally during the trading session on Friday but gave back the gains in order to show signs of exhaustion. Quite frankly, this is a market that has been overdone for some time and people may be using the potential outbreak of more coronavirus as an excuse to take profit. That being said, I like the idea of 3250 offering support, not only because of the round “midcentury figure”, but the fact that it would coincide quite nicely with the uptrend line that is the bottom of the up trending channel. That being said, it’s a bit of a “perfect storm” for buyers to come in and offer support. Furthermore, depending on how long it takes for us to get down there we may much closer to the 50 day EMA at that point.

To the upside, if we were to break above the highs from the Friday session we could break out of the channel, but I don’t like those moves as although it shows a short-term buying opportunity because of the impulsivity of it, the reality is those moves tend to get broken right back down. As we are starting to close out the session, the very likely that selling is continuing and therefore there should be a bit of continuation going forward.

This is most certainly a market that is still very bullish, and therefore I look at a pullback as an opportunity to buy it “on the cheap.” I do not want to short this market, and therefore I’m simply looking for an opportunity to buy this market at lower levels. In fact, I have no interest in selling it until we break down below the 3200 level at the very least, and even then, I would have to be cautious about doing so.

To the upside, expect the 3500 level to be massive resistance so I think even if we do get some type of impulsive move, it is more than likely going to be an area where you will see a significant amount of profit-taking or selling. All things being equal, I believe that this market still looks very healthy, despite the fact that the Friday candlestick was less than bullish. Having said that, nothing has changed, and I still like the idea of these dips as offering opportunities for those who are looking to get involved.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more