S&P 500 Forecast: Continuing Higher Longer-Term

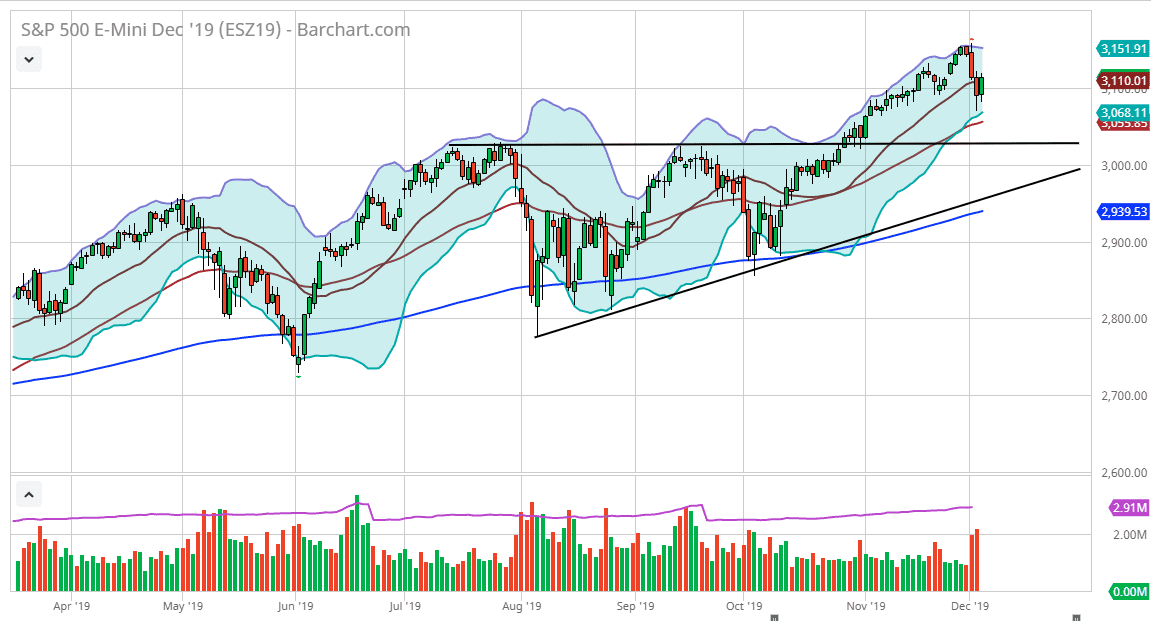

The S&P 500 recovered quite a bit during the trading session on Wednesday, after selling off drastically on Tuesday. Remember, that Donald Trump comment about the deal waiting until after the presidential election is what sent the market lower, and now that the algorithms have stopped trading that headline, cooler heads prevailed, and value hunters have stepped back into this market. Ultimately, this is a market that should continue to go higher, perhaps reaching towards the top of the Bollinger band that I have right now, and that, of course, the 3200 level which is based upon the measurement of the ascending triangle that we broke out of.

I recognize it Friday as the nonfarm payroll announcement, and that, of course, will have a massive influence on the market, but I think at this point people are willing to buy stocks unless of course there is some type of horrific figure coming out of that announcement. All things being equal, the market is likely to continue to go higher, and perhaps even enter a more bullish phase as the so-called “Santa Claus rally” is just about due. Beyond that, the Federal Reserve is on the sidelines and willing to loosen monetary policy if we do in fact see some type of massive selloff.

That being said, I like buying dips and I like the idea of reaching towards the 3200 level, and perhaps even higher than that. I think that we will see that in the next couple of weeks and the jobs report could be the major boost. The jobs report being poor probably causes a bit of a knee-jerk reaction to the downside on Friday, but that will more than likely be bought as well. All things being equal I do like the idea of buying the S&P 500 and won’t sell it as we are obviously very strong. I see the 3030 level underneath as the beginning of massive support that extends down to the 3000 level. It’s not until we break down below the 200 day EMA that I would start to short the market, and quite frankly we are miles away from that level and therefore if we were to get down there something major would have just changed overall. With this, I think you simply look for value or momentum to the upside and take advantage of it going forward.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more