S&P 500 Forecast: Continuing Finding Buyers On Dips

The S&P 500 has pulled back a bit during the trading session on Thursday, in a pattern that we have seen happen time and time again. The Asians in the European cell the S&P 500 E-mini contract in relation to their own problems, but at the end of the day when the real volume comes in as Chicago warms up, the market turned around completely as the Americans continue to focus on their own indexed assets, and don’t truly care about fears around the world. This is a perfect example as to why a lot of futures traders will completely ignore the Globex session, because it is not a “clean play” into the index itself.

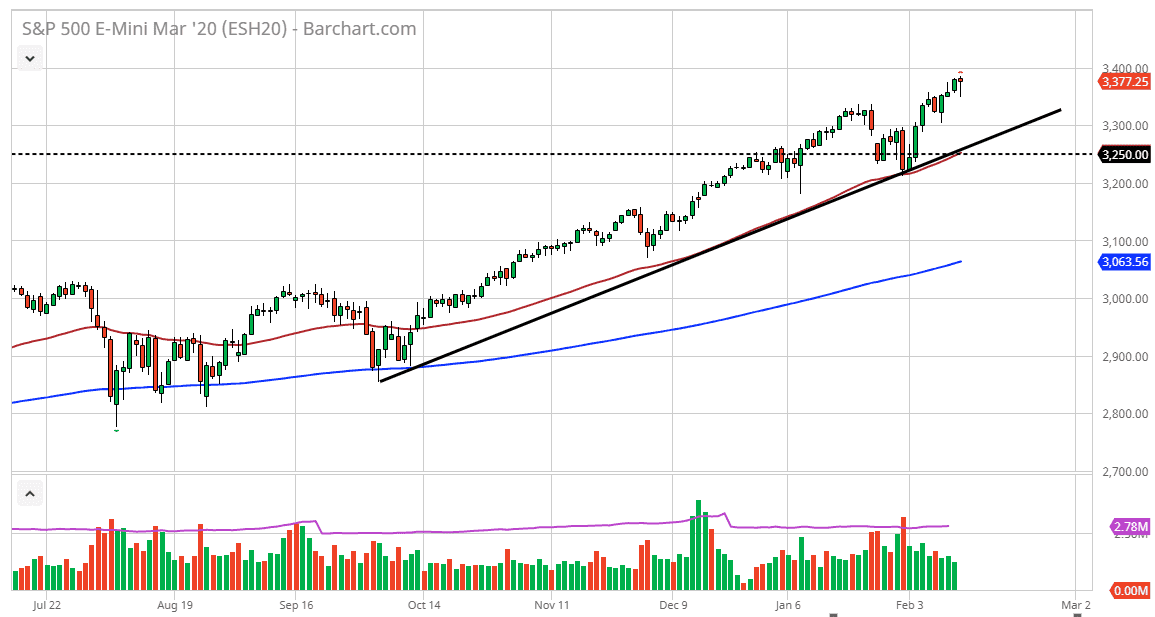

All of that being said, it offers opportunities for American traders or those who are willing to trade those hours. Looking at the 3300 level underneath I would anticipate seeing a lot of support, especially as there was a gap there previously and now it has been broken to the upside. Then shows that there was a lot of interest on both sides in that area, so ultimately, it’s likely that the buyers will jump in and support this market. The uptrend line sits just below there as well, and also has the 50 day EMA as offering even more support.

If the market was to break down below the 50 day EMA, then we could go looking towards the 3200 level underneath, which is horizontal support for the market. Breaking that then starts to question a lot of things and therefore it’s difficult to get excited at that point. Quite frankly, at that level then I would have to start looking for some type of support of candle at the 200 day EMA.

I would invite you to notice that I didn’t mention anything when it comes to selling. I have had numerous conversations with retail traders over the last couple of weeks who are looking to short this market because “coronavirus is going on”, which is not paying attention to the most obvious thing here: this is an uptrend. There is nothing on this chart that looks weak. Buying dips continue to be the best way to play this market, as it is obviously a very bullish and with the Federal Reserve willing to add liquidity as needed, this market doesn’t seem to be able to fall apart anytime soon. With that, you have to remain bullish, nothing else makes any sense.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more