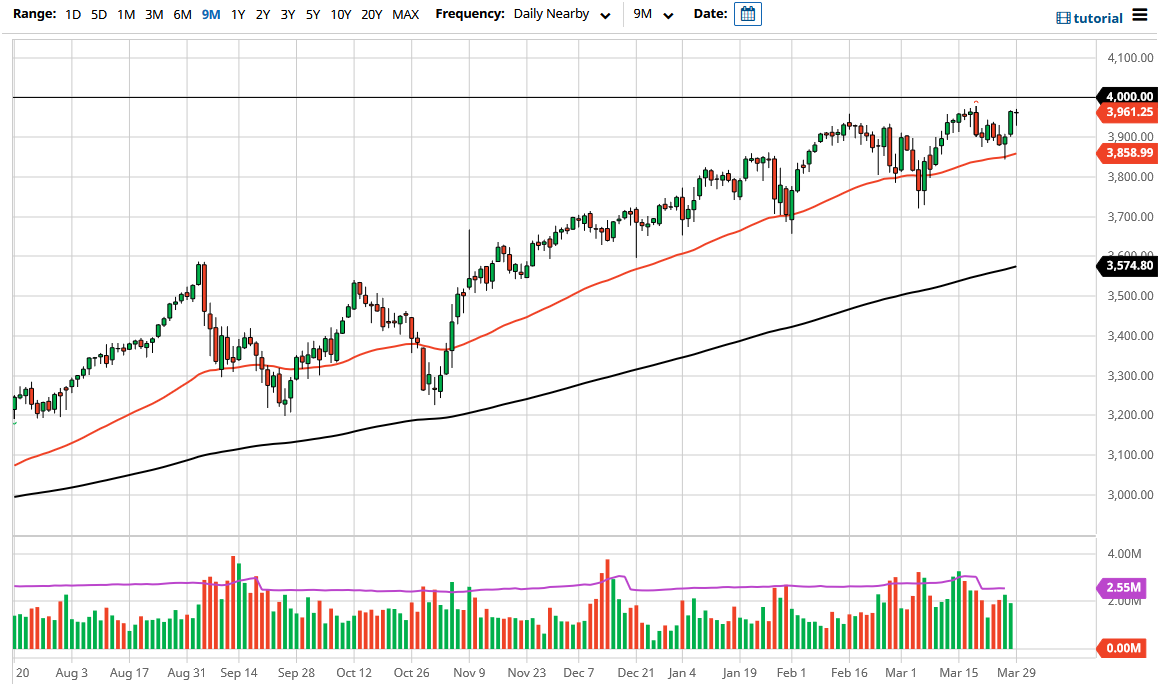

S&P 500 Forecast: Continues To Find Buyers On Dips

The S&P 500 initially pulled back during the trading session on Monday as people were worried about the fund that blew up on Friday. That being said, the market has turned around to show signs of life again and ended up forming a hammer at the end of the session. This tells me that the market is likely to continue to see a lot of volatility, but most certainly looks likely to favor a move to the upside. We have seen multiple times that traders have come back into the marketplace in order to pick up the market “on the cheap.”

The 3900 level underneath should offer support, and I think that any time we dip in that general direction we will probably see traders get aggressive. There has been a significant rotation in the markets, and as a result, you have seen a lot of volatility. Furthermore, there were some headlines across the wire that move things such as the ship in the Suez Canal finally breaking free, but at the same time, the Russians are looking to extend oil production cuts.

Just above, we have the crucial 4000 level offering resistance, and that of course is going to make moving higher a bit difficult, but I think given enough time we will probably see that happen. Most certainly, if we get a daily close above the 4000 level it is likely that the market will continue to go much higher. The S&P 500 is built to go higher, otherwise, it would be an equal-weighted index so that something that you should always keep in the back of your head when trading it.

The market will of course be supported by the Federal Reserve and the never-ending amount of money being thrown around the system with little in the way of cost, so at this point in time, a lot of money is being crammed into the stock market. I have no interest in shorting this market, but I would be willing to buy a put option if we were to break below the 3800 level. That obviously is quite some distance from where we are now so I would not think that is likely to happen in the near term as we have seen so much momentum to the upside every time we fall.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more