S&P 500 Forecast: Continue Testing Big Figure

The S&P 500 has gone back and forth during the trading session on Friday, essentially ignoring the loss of 701,000 jobs during the month of March, which isn’t a huge surprise when you think about all of the headlines that we have seen. The Initial Jobs Claims were horrific the day before, so none of this is news. With that being the case, it’s a matter of looking at whether or not we are going to pay attention to 2020. Most analysts are starting to throw the year out the window.

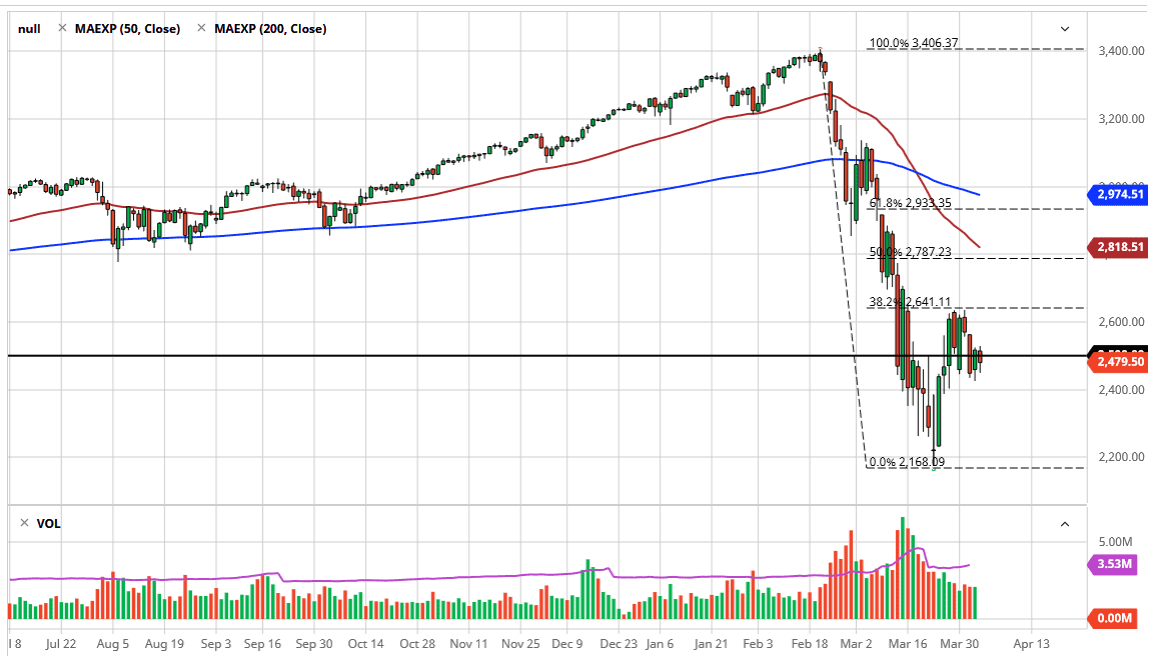

Analysts were bringing their numbers down for 2020 and 2021, even before the virus hit. That being the case, the market still may have further to go to the downside. That being said, I also can make an argument that the lows should hold unless something changes rather quickly. The breaking of the 2200 level to the downside opens up the door down to the 2000 level, which of course is a very large and round figure. Having said that, we could break down below the 2400 level and still stay above the 2200 level, which would be a nice bottoming process on a bounce. It’s this prism that I think a lot of people are looking at the market.

The alternate scenario is that we break above the highs from earlier in the week and that allows the market to go to the 2750 handle, and then the 2850 level. The 50 day EMA is sitting near the 2818 handle, so that’s an area that could cause some issues. Furthermore, it is also the 50% Fibonacci retracement level which attracts a lot of attention in and of itself. It is worth noting that we have pulled back from the 38.2% Fibonacci retracement level, so that, of course, plays well for technical traders as well. One thing is for sure, I think we are a long way from a huge bullish move, but I think the most likely scenario, barring some type of announcement over the weekend, it’s likely that we go back and forth in this general vicinity, chopping around and showing lots of noise. At this point, I think we have a lot of work to do and it’s not until we break below the 2400 level or the recent highs that clearly comes into play. I will keep you up-to-date here at Daily Forex.

(Click on image to enlarge)

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more