S&P 500 Earnings And Market Update

The earnings per share (EPS) for all S&P 500 companies combined increased last week from $168.62 to $169.79.

About 13% of the S&P 500 have reported Q4 earnings now. 88% of those companies have beat estimates, by a combined rate of 23%. We still have a ways to go, but so far it's the 3rd straight quarter with an earnings beat rate above 80%.

In Q3, 84% of companies beat earnings expectations by a combined rate of 19.6%.

In Q2, 82.6% of companies beat earnings expectations by a combined rate of 22.9%. (I/B/E/S data from Refinitiv).

Not only are companies beating on earnings, but they are also raising forward guidance at a record pace.

The above chart shows annual earnings per share for all S&P 500 companies combined. While it took 4 years to recover from the 2007-2009 recession, it appears it will only take one year to recover from the 2020 COVID recession. Current earnings growth estimates are:

2021: +23.77%

2022: +16.12%

When we combine this against the backdrop of record low-interest rates, it shouldn’t come as a surprise that stocks are trading at all-time highs. With 117 companies reporting earnings next week (about 23% of the S&P 500), the heart of the earnings season is underway.

(Click on image to enlarge)

The S&P 500 increased 1.94% this week, another weekly closing high.

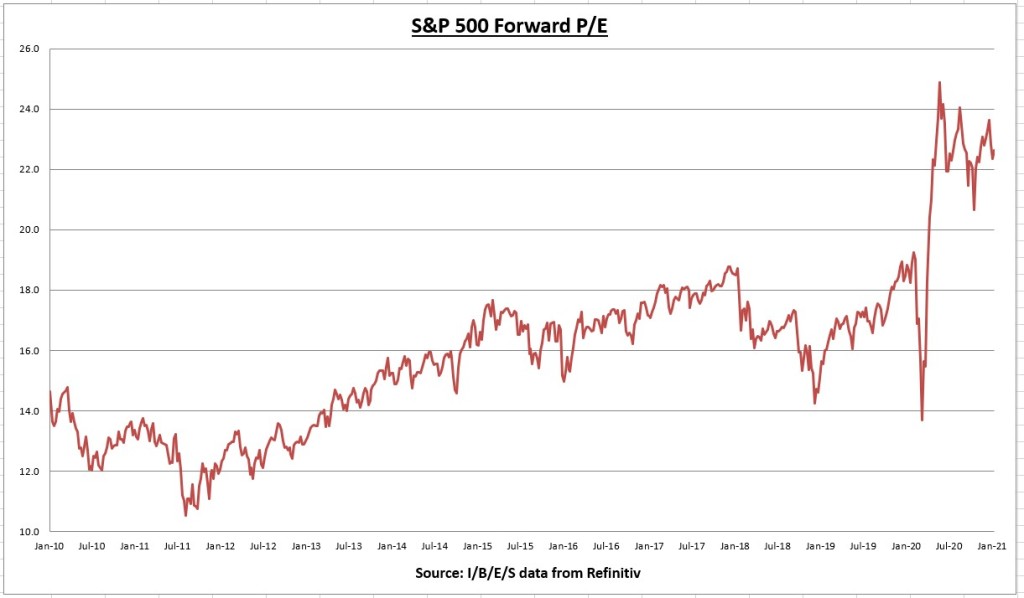

The index increased more than the EPS, causing the price to earnings (PE) ratio to tick up to 22.6x.

The S&P 500 earnings yield now stands at 4.42% (not to mention the 1.5% dividend yield) while the 10-year Treasury bond rate is 1.091%. The equity risk premium (earnings yield minus risk-free rate) is now 3.329%.

Economic Data review

No important data releases last week.

Key earnings reports

One key earnings report this week was from Netflix (NFLX). They actually missed on earnings (-8% y/y), but revenues beat and grew +22%. Subscriber numbers also beat expectations, Netflix now has over 200 million paid subscribers. Operating margins increased sharply from 8.46% to 14.4%

The company also issued positive guidance for Q1 2021. Expecting +23.6% revenue growth and operating margins increasing to 25.0%. Perhaps the biggest takeaway from this report is the company’s guidance on cash flow. Netflix is confident enough in its financial position that it plans to start returning cash back to shareholders, most likely in the form of buybacks.

(Click on image to enlarge)

The company generated over $25 billion in trailing revenue. A compounded annual growth rate of around 30% over the last 10 years.

While trailing operating income has gone from almost non-existent to over $4.5 billion.

Looking at those financial results helps explain the long-term outperformance of the stock since it IPO’d in 2002. The stock trades 60x forward earnings for a reason. As a result of the earnings report, the stock has gapped up above its prior trading range (roughly $460 to $570) its been in for the last 5 months. Assuming the price holds above $570, the next measure move target comes in around $660. Another stock I’ve owned for years, no intentions to sell anytime soon but won’t be buying anymore at these price levels either.

Market Internals

A quick look at the market internals show no bearish divergences developing. The S&P 500 advance-decline line continues making new all-time highs, showing broad level of participation.

91% of S&P 500 companies currently trade above their 200-day moving average. As we discussed last week, there are signs of the market being overbought in the short term. But I see no signs of weakness typically associated with the end of bull markets.

Japan’s stock market index continues to perform well, breaking out to 30-year highs.

While Germany is another international market making new all-time highs.

Summary: It’s all about earnings and interest rates. Earnings continue to smash expectations, while rates are nowhere near high enough to pose a valuation threat. 10-15% market corrections can happen anytime, and often without rhyme or reason, but its hard to imagine a sustainable bear market with an earnings beat rate consistently above 80% and rates at 1%. With about 23% of the S&P 500 index reporting earnings this week, we’ll get a clearer picture of how Q4 will turn out and how Q1 will look.

Along with a slew of earnings, we’ll have a ton of key economic data points such as consumer confidence, an FOMC statement and press conference, and new home sales. We’ll also get our first look at Q4 GDP. Current estimates are for a gain of +7.5%. This would make the second straight quarter the economy beats expectations.

Disclaimer: None.